Overview

A qualified purchaser is someone who, whether an individual or an entity, has at least $5 million in investments. This financial threshold opens doors to exclusive opportunities, especially in private markets. However, we understand that becoming a qualified purchaser is not just about meeting these financial requirements; it also demands a profound grasp of market dynamics and the ability to navigate intricate financial landscapes.

Many of our members have shared their experiences, highlighting how this knowledge empowers them to engage in higher-risk investments with fewer regulatory constraints. It's a journey that can feel daunting, but with the right support and understanding, it becomes a pathway to greater financial engagement.

Introduction

In the intricate world of investments, we understand that distinguishing between qualified purchasers and accredited investors can be daunting for those seeking to navigate the private market landscape. Qualified purchasers, defined by their significant investment holdings, gain access to exclusive opportunities that may feel out of reach for their accredited counterparts.

As we look ahead to 2025, grasping the criteria and characteristics that define qualified purchasers becomes increasingly essential. This article will explore the key aspects of being a qualified purchaser, from eligibility requirements and regulatory frameworks to the numerous advantages that come with this esteemed status.

By examining these elements, we hope to empower investors to position themselves to seize unique investment opportunities that promise substantial returns while skillfully navigating the complex web of compliance and market dynamics.

Together, we can foster a supportive community where every investor feels equipped to thrive.

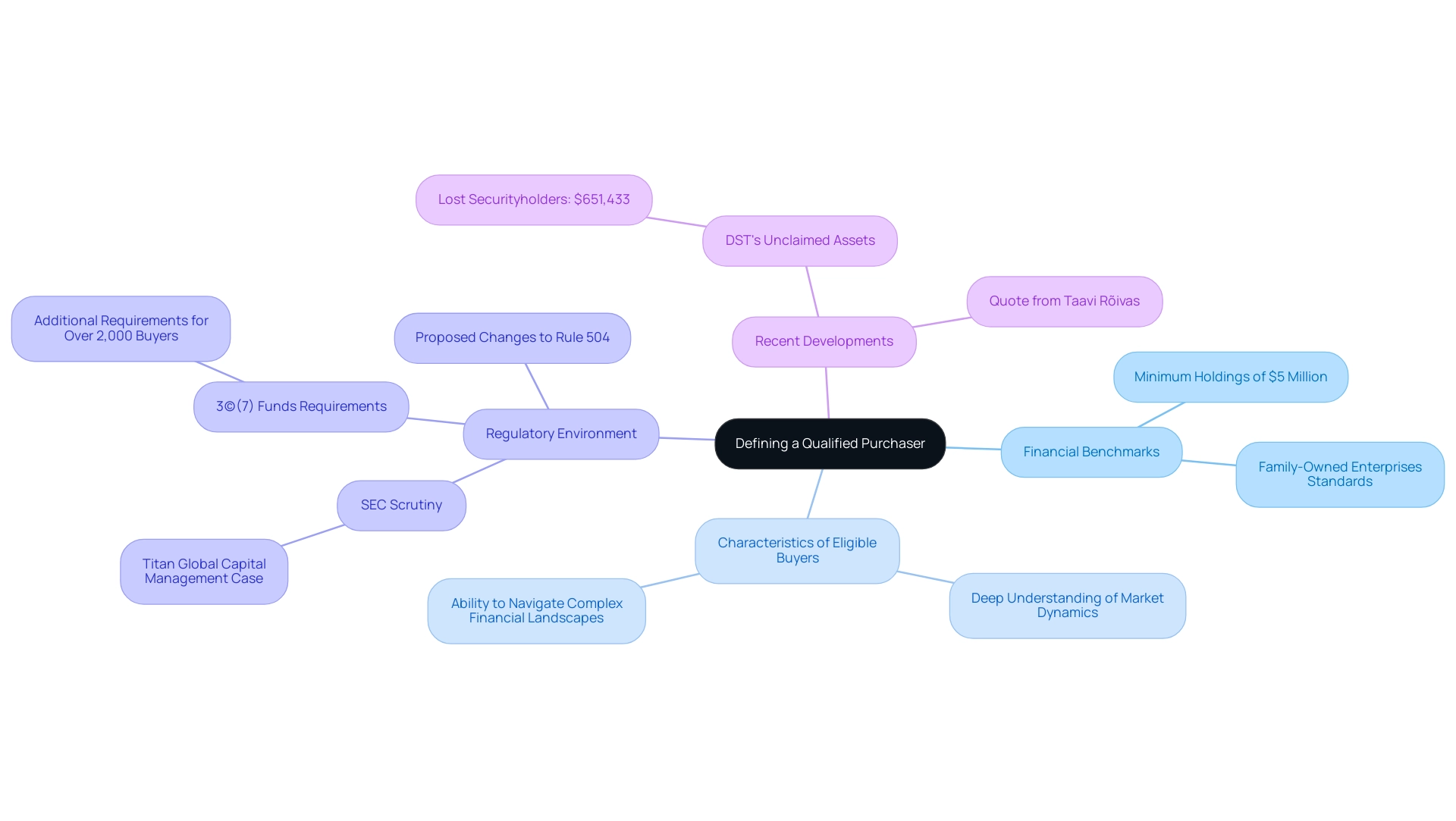

Defining a Qualified Purchaser: Key Characteristics and Criteria

A certified buyer, as outlined by the Investment Company Act of 1940, is a person or organization that meets specific financial benchmarks, typically involving individuals with a minimum of $5 million in holdings or family-owned enterprises that meet similar standards. This classification is vital, as it grants eligible buyers access to a wider array of financial opportunities, particularly in private markets that are often limited to those who meet these financial criteria.

As we approach 2025, the landscape of eligible buyers is evolving, with a notable increase in the number of individuals falling under this classification. Recent data reveals that the count of eligible buyers has risen significantly, reflecting a growing interest in private market opportunities. This trend underscores the importance of understanding the criteria for eligible buyers, which not only includes financial thresholds but also the ability to engage in advanced financial strategies.

The characteristics of an eligible buyer extend beyond mere financial capability; they often encompass a deep understanding of market dynamics and the capacity to navigate complex financial landscapes. For instance, 3(c)(7) funds, which cater to eligible buyers, face additional regulatory requirements if they exceed 2,000 eligible buyers, highlighting the regulatory environment governing these assets.

Recent developments, such as the SEC's scrutiny of financial firms for misrepresentations, further emphasize the need for eligible buyers to remain informed and vigilant. The SEC's actions, including a recent case where Titan Global Capital Management faced charges for misrepresenting performance, serve as a poignant reminder of the importance of transparency and due diligence in private market opportunities. Additionally, the statistic regarding DST's struggle to locate 78 lost securityholders, resulting in $651,433 of unclaimed assets, illustrates the financial repercussions of maintaining accurate records for investors. Notable figures like Taavi Roivas, former Prime Minister of Estonia, highlight the significance of informed decision-making in this domain.

Understanding what defines a qualified purchaser and the standards for eligible buyers is essential for individuals seeking to navigate the complexities of private market investments effectively. By meeting these criteria, individuals not only gain access to exclusive opportunities but also position themselves to make informed decisions that can profoundly affect their financial success.

Moreover, the SEC is contemplating changes to Rule 504, which offers an exemption for public offerings up to $1 million, to address concerns about the impact of preempting state regulations on small businesses. These proposed modifications aim to preserve small enterprises' ability to raise funds while ensuring that safeguards for investors are not compromised, further highlighting the shifting regulatory landscape affecting qualified buyers.

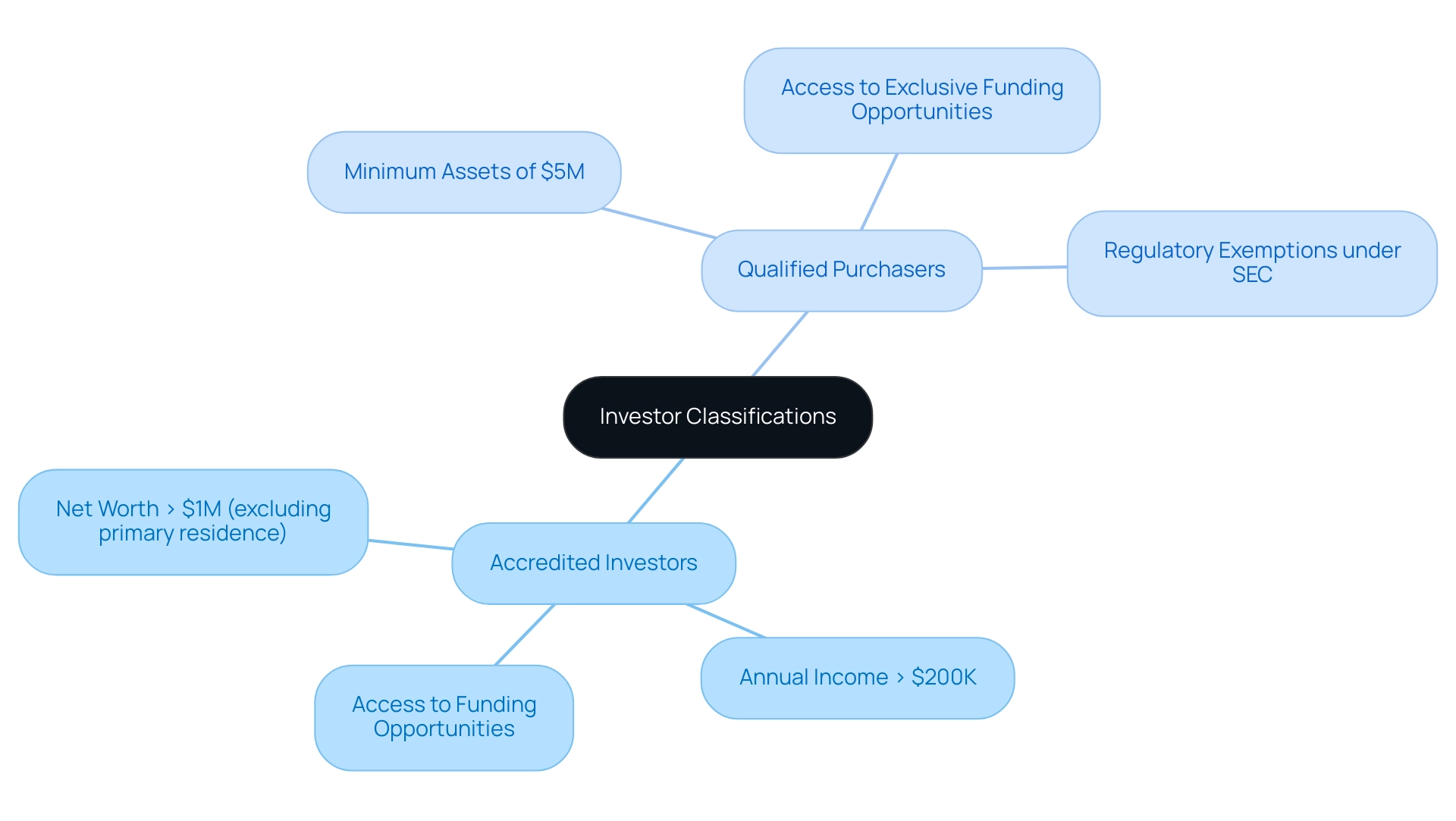

Distinguishing Between Qualified Purchasers and Accredited Investors

Qualified buyers and accredited individuals both have the opportunity to engage in unregistered securities, yet they face different financial thresholds and varying opportunities. Accredited investors are defined by specific criteria based on income or net worth, such as having a net worth exceeding $1 million (excluding their primary residence) or an annual income surpassing $200,000. In contrast, a qualified purchaser is defined by their asset holdings, requiring a minimum of $5 million in assets.

This distinction is crucial, as it directly influences the range of funding opportunities accessible to each group. We understand that navigating these classifications can be challenging, and it’s important to note that qualified buyers typically gain access to more exclusive funding opportunities, including certain private equity funds that may not be available to accredited investors. The case study titled "Investment Company Act of 1940 and Eligible Buyers" emphasizes how this act categorizes eligible buyers and the implications for asset management firms.

Funds that exclusively sell to qualified buyers enjoy exemptions under the SEC regulations established by this act, allowing them to operate with fewer regulatory constraints. This flexibility can enhance their ability to offer diverse financial products, which is something many investors seek.

At Finance, Freedom, Fellows, we are dedicated to empowering tech investors by providing access to educational resources and exclusive funding opportunities. Recent trends indicate that founding teams are increasingly opting to distribute equity more fairly, which may shift the dynamics of funding opportunities. As Mihkel Torim, a leader in the field at LHV, pointed out, 'The club's dedication to providing members with the essential insights and resources to make informed choices' underscores the importance of understanding these classifications for effective decision-making.

As we look ahead to 2025, it becomes clear that understanding what is a qualified purchaser reveals that the financial limits for these eligible buyers remain considerably higher than those for accredited investors. This reinforces the exclusivity of the former group. This difference in criteria not only shapes the financial landscape but also emphasizes what is a qualified purchaser for effective decision-making. Real-world examples illustrate that eligible buyers often have access to unique opportunities that can yield substantial returns, further highlighting the advantages of meeting these financial thresholds.

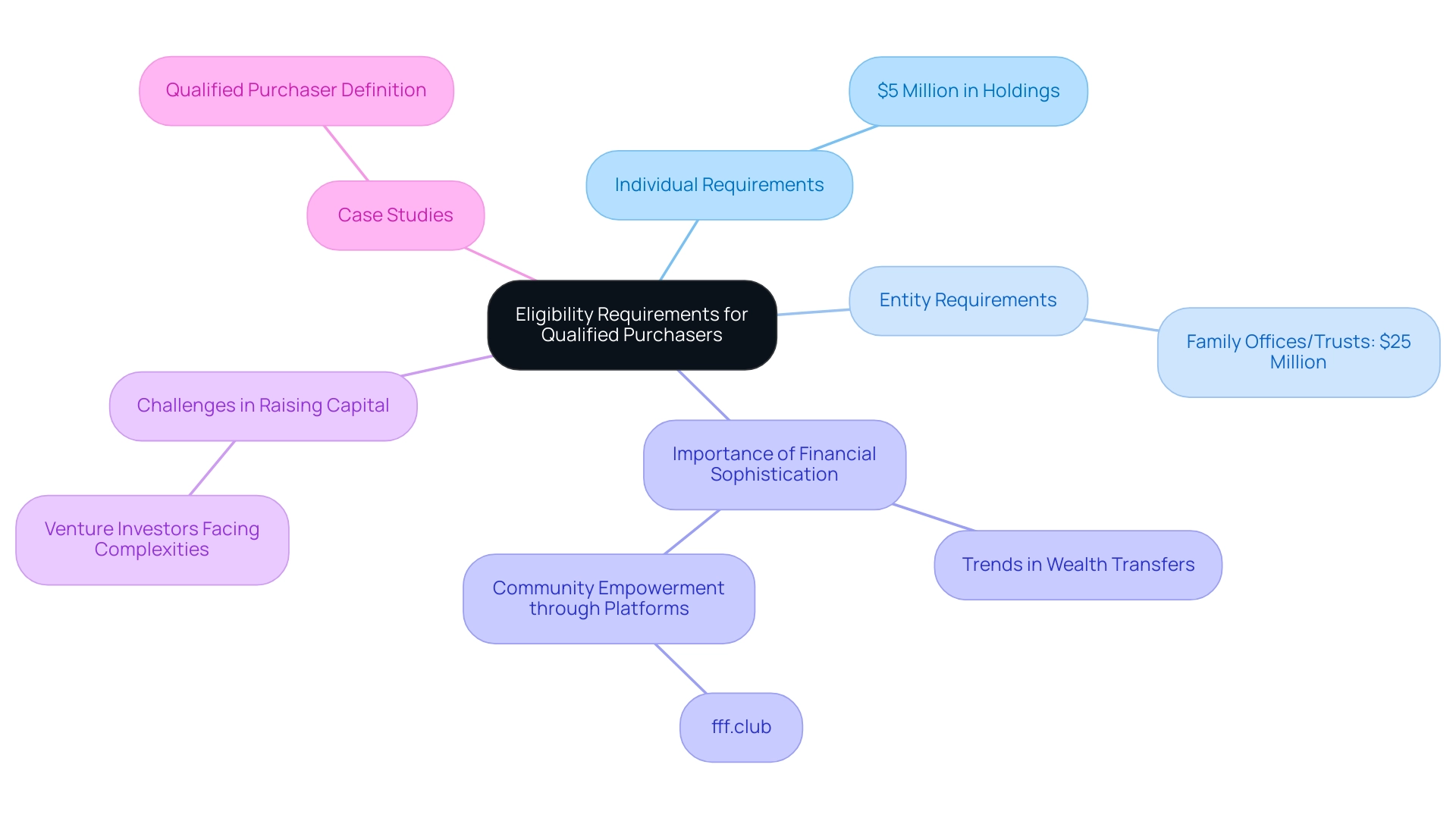

Eligibility Requirements for Becoming a Qualified Purchaser

To be considered an eligible buyer, one typically needs to possess at least $5 million in holdings, which can encompass a range of assets including stocks, bonds, and real estate. For entities like family offices or trusts, the threshold is generally set at $25 million in assets. This framework not only includes individuals who act on behalf of other eligible buyers but also fosters a collaborative spirit among seasoned financiers, particularly concerning private market opportunities such as venture capital, private credit, and real estate.

The eligibility standards for buyers are designed to ensure that only those with significant financial acumen can access certain high-risk opportunities. This distinction is vital, as it safeguards less experienced individuals from potential pitfalls associated with unregistered securities. Unlike accredited investors, whose classification hinges on income or net worth, a qualified purchaser is defined by the amount of assets held, granting them access to a wider array of opportunities, including exclusive deals facilitated by platforms like fff.club.

As we look ahead to 2025, the landscape for family offices and trusts regarding what constitutes a qualified purchaser is evolving. Current statistics reveal a notable increase in the number of family offices qualifying under these thresholds, reflecting a growing trend in wealth transfers and allocations in private securities. Financial experts emphasize the importance of understanding what it means to be a qualified purchaser, as this knowledge not only opens doors to exclusive opportunities but also underscores the need for financial sophistication in navigating complex markets.

For instance, the Series 65 license examination lasts for 3 hours, requiring a passing score of 94 out of 130 questions. This highlights the rigorous standards expected of advanced investors.

To become an eligible buyer, both individuals and entities must meet specific financial thresholds and demonstrate a level of financial expertise. This includes an understanding of the risks tied to private market ventures and the ability to conduct thorough due diligence. As the funding landscape becomes more intricate, particularly for venture capitalists and venture-supported entrepreneurs facing fundraising challenges, the role of accredited buyers becomes increasingly crucial.

Mihkel Torim, a leader in the field, observes the club's commitment to equipping members with the essential knowledge and tools to make informed decisions, reflecting the experiences of individuals like Donatas Keras and Kristjan Tamla, who have adeptly navigated these situations.

Case studies illustrate what it means to be a qualified purchaser by outlining the eligibility criteria for approved buyers in 2025, showcasing how various family offices have successfully met these standards. By nurturing a community of informed investors, platforms like fff.club empower members to refine their financial strategies and make thoughtful decisions in the ever-evolving tech landscape.

The growth of private securities and wealth transfers is likely to lead to more trusts investing in these asset classes, further emphasizing the importance of understanding what it means to be a qualified purchaser and the criteria surrounding qualified buyers.

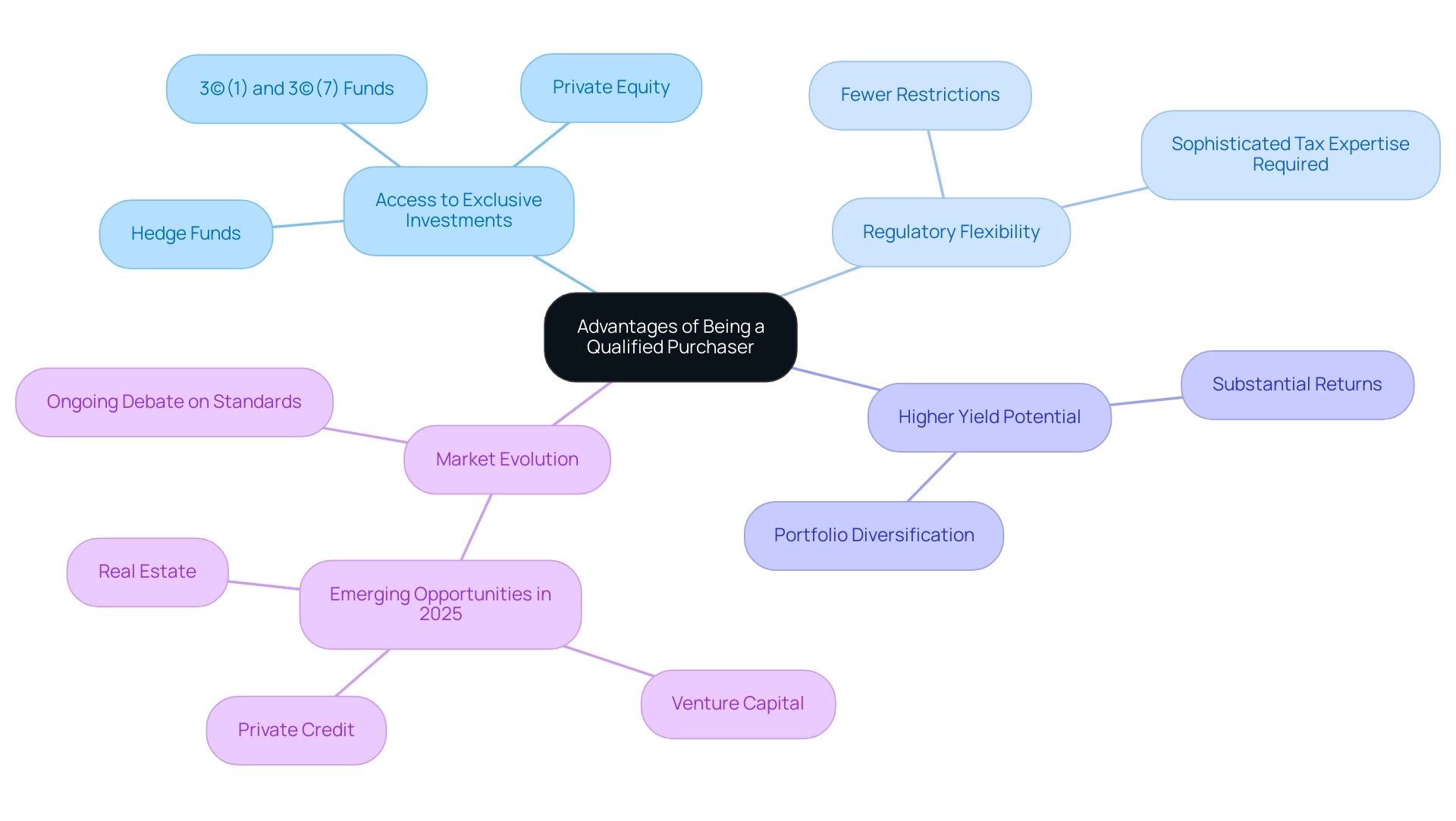

Advantages of Being a Qualified Purchaser in Investment Markets

In the financial markets, understanding what it means to be a qualified purchaser is essential for many. Qualified buyers enjoy a unique advantage, as they have access to a broader range of opportunities, including those offered through fff.club. This elite status opens doors to investments in both 3(c)(1) and 3(c)(7) funds, typically reserved for more seasoned participants. Consequently, eligible buyers can engage in private equity, hedge funds, and other exclusive financial vehicles that remain out of reach for accredited investors.

As we look toward 2025, the landscape for eligible buyers continues to evolve, with numerous financial opportunities emerging, particularly in venture capital, private credit, and real estate. These innovative private equity funds and hedge funds offer unique strategies and the potential for substantial returns, which can be accessed through the collaborative network of over 400 technology supporters at fff.club. This ability to navigate exclusive avenues not only enhances portfolio diversification but also positions eligible buyers to seize higher yield potentials.

Moreover, eligible buyers often experience fewer regulatory restrictions, granting them the flexibility to make investment choices that align with their financial goals. This flexibility is crucial in a market where regulatory and tax considerations can be intricate, often necessitating sophisticated tax expertise and a careful assessment of risk tolerance. We understand that the ongoing debate about relaxing standards to allow more individuals to invest in high-risk opportunities highlights the inequities in the current system. Many argue that these qualifications limit access to diversification and higher yield opportunities for those who may not already be wealthy.

Expert opinions underscore the importance of this status. Lincoln Olson, a financial backer and finance writer, shares that the current qualifications can feel inequitable, restricting access to diversification and higher yield opportunities for those who are not already affluent. This sentiment reflects a broader discussion about what constitutes a qualified purchaser and the necessity to ease standards to allow more individuals to engage in high-risk investments. The advantages of being a qualified purchaser extend beyond mere access; they also encompass the potential for improved financial outcomes. For instance, case studies highlight the SEC's role in safeguarding small investors from high-risk financial opportunities, underscoring the importance of experience and financial capability.

While these regulations aim to protect the general public from risky opportunities, they simultaneously restrict access to potentially lucrative ventures for those who do not meet stringent criteria. Notably, Qualified Institutional Buyers (QIBs) must manage a minimum of $100 million in securities to meet the criteria, illustrating the elevated standards set for access to funding.

In conclusion, the designation of a certified participant not only grants access to exclusive financial opportunities but also fosters a more dynamic and potentially rewarding financial experience. As the market continues to change, the benefits associated with this classification will likely remain a focal point for serious individuals seeking to maximize their financial growth, particularly through community-driven investment opportunities at fff.club, founded by Akim Arhipov and Tim Vaino, who are dedicated to inclusive financial education and collaborative wealth management.

Understanding the Regulatory Landscape for Qualified Purchasers

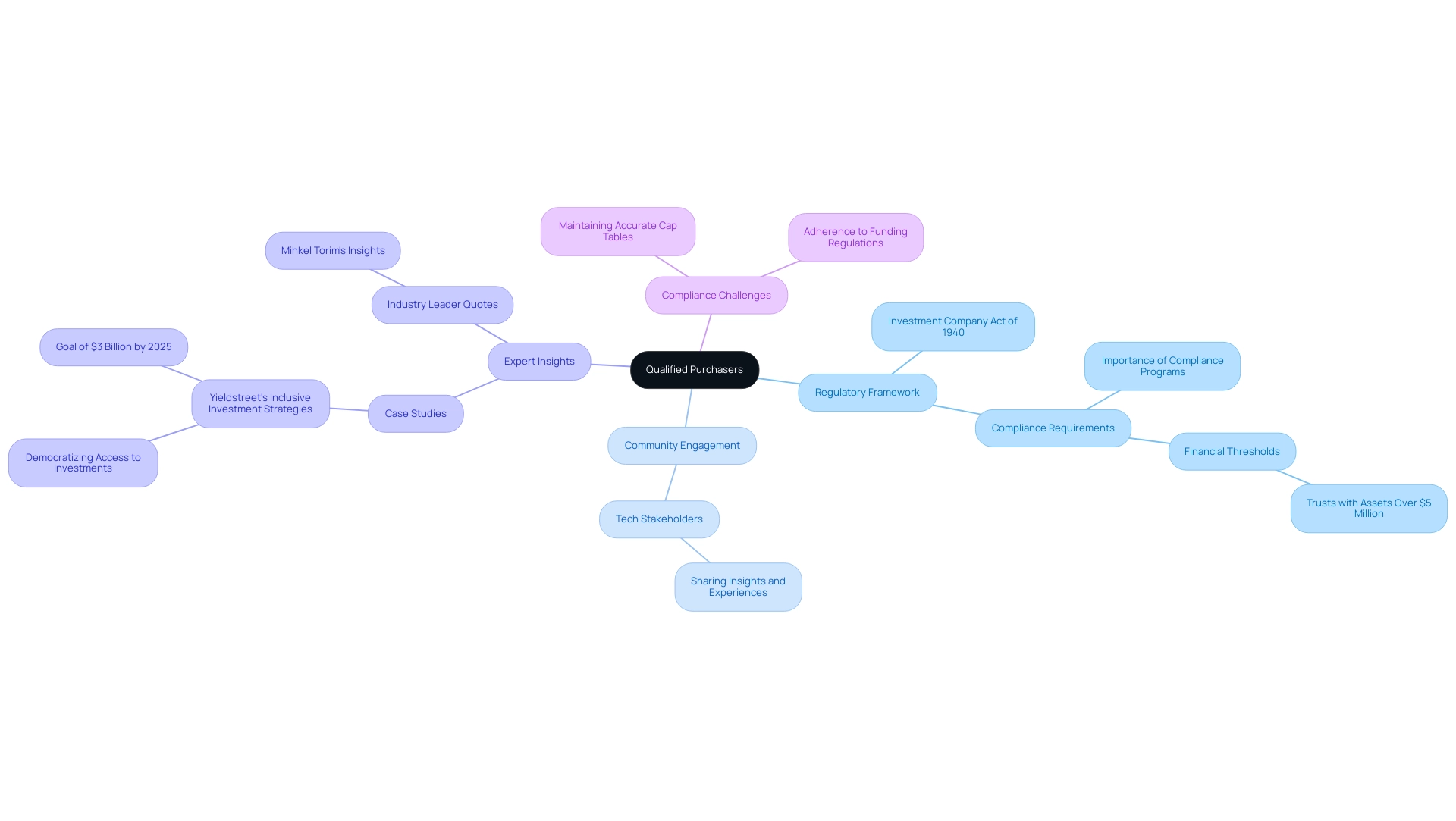

The regulatory environment for eligible buyers is fundamentally shaped by the Investment Company Act of 1940, which outlines the criteria for this classification. So, what is a qualified purchaser? Qualified buyers benefit from exemptions from specific regulations that restrict other categories of participants, allowing them to invest in private funds without the constraints placed on accredited individuals. This regulatory framework is designed to promote investment in high-risk opportunities while ensuring that only individuals and entities that understand what is a qualified purchaser can participate.

As we move into 2025, adherence to these regulations remains paramount for eligible purchasers. We understand that navigating these rules can be daunting, and the SEC emphasizes the necessity of strong compliance programs to prevent violations and protect the interests of those involved. For instance, a trust can be recognized as an accredited entity if it possesses assets surpassing $5 million, underscoring the financial limits that characterize eligible purchasers.

At fff.club, the community of tech stakeholders plays a vital role in navigating these complexities. By engaging with fellow members, investors can share insights and experiences that enhance their due diligence processes and deal flow. The strength of community in private market ventures cannot be overstated; it encourages collaboration and informed decision-making among participants who understand what is a qualified purchaser.

Expert opinions in 2025 highlight what is a qualified purchaser regarding the changing nature of compliance requirements for eligible buyers, especially considering recent regulatory updates. We recognize that the landscape is further complicated by challenges such as maintaining accurate cap tables and ensuring adherence to funding regulations. Firms like Qapita focus on equity management, helping eligible buyers understand what is a qualified purchaser while handling cap tables, remaining compliant, and enhancing funding strategies.

Case studies, such as Yieldstreet's inclusive funding approaches, illustrate the practical effects of these regulations. Yieldstreet seeks to democratize access to alternative opportunities, previously reserved for institutional investors and the ultra-wealthy, with a goal of achieving $3 billion in funding by 2025. This initiative reflects a broader trend towards inclusivity in financial products, aligning with the regulatory intent to empower individuals who understand what is a qualified purchaser.

Mihkel Torim, an industry leader at LHV, emphasizes the club's commitment to equipping members with the necessary insights and resources to make informed decisions, which is crucial in navigating the compliance landscape. By leveraging the collective knowledge and experience of the Finance, Freedom, Fellows community, qualified purchasers can enhance their investment strategies and ensure compliance. This raises the important question of what is a qualified purchaser, ultimately leading to more informed and successful investment decisions.

Conclusion

For qualified purchasers, the investment landscape offers significant advantages that truly set them apart from accredited investors. By meeting the substantial financial threshold of $5 million in investments for individuals or $25 million for entities, they unlock exclusive opportunities in private equity, hedge funds, and other high-potential assets that can transform their financial journeys.

Understanding the distinctions between qualified purchasers and accredited investors is essential for navigating the private market effectively. Many of our members have experienced the benefits of fewer regulatory constraints, which allows for greater flexibility in investment decisions and the potential for enhanced financial outcomes. As regulations continue to evolve, we understand that staying informed about eligibility requirements and the associated benefits is more important than ever.

Moreover, the regulatory environment highlights the necessity of compliance and due diligence. Engaging with communities like fff.club fosters collaboration among investors, enabling them to share insights and strategies that enhance decision-making. This sense of community is invaluable, as it creates a supportive network where members can learn from one another's experiences.

In summary, attaining the status of a qualified purchaser opens doors to a broader range of investment opportunities and positions investors for substantial returns. As the market evolves, understanding and leveraging this classification will be essential for those seeking to maximize financial growth and navigate the complexities of private market investments effectively. Together, we can embrace these opportunities and support one another in our investment journeys.