Overview

A business venture is defined as a new commercial initiative undertaken by individuals or groups aimed at generating profit, requiring a commitment of resources such as time, capital, and expertise. The article emphasizes that understanding key concepts like risk, innovation, and opportunity is crucial for entrepreneurs and investors, as these elements shape the dynamic nature of business ventures and inform strategic investment decisions.

Introduction

The landscape of business ventures is a dynamic and multifaceted arena where innovation meets opportunity. As aspiring entrepreneurs and seasoned investors navigate this complex environment, understanding the foundational concepts and terminology becomes essential.

From defining what constitutes a business venture to exploring the various types—such as startups, joint ventures, and franchises—this article delves into the critical elements that influence success and growth. It highlights the importance of market research in identifying trends and customer needs, examines diverse funding options available to entrepreneurs, and addresses the inherent risks and challenges that accompany any new initiative.

With insights from industry experts and current market data, this comprehensive overview aims to equip readers with the knowledge necessary to make informed decisions in their business endeavors.

Defining a Business Venture: Key Concepts and Terminology

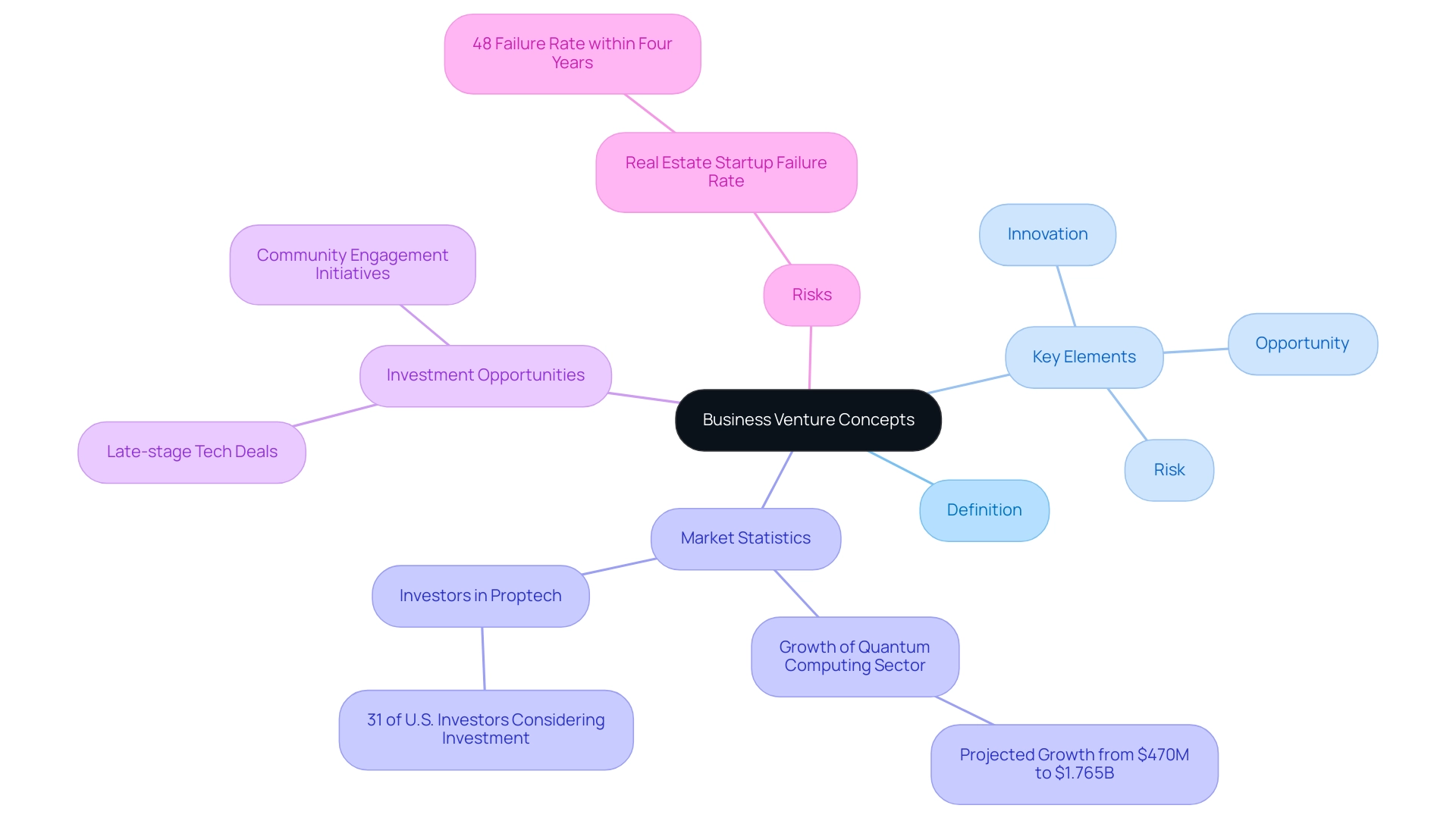

A business venture definition fundamentally describes a commercial endeavor as a new initiative undertaken by individuals or groups aimed at generating profit. This undertaking necessitates a commitment of resources—including time, capital, and expertise—focused on achieving a specific goal. Fundamental to the conversation about commercial projects are essential ideas such as risk, innovation, and opportunity.

Comprehending these elements is essential for both aspiring entrepreneurs and investors, as they encapsulate the dynamic nature of the business venture definition in terms of starting and managing an enterprise. In the present economic landscape, where the private sector has seen a 1.7% increase compared to the prior year, as mentioned by management specialist Shweta Jhajharia, understanding the business venture definition and its implications becomes essential for directing strategic investment choices and performing comprehensive risk evaluations. Notably, fff.

Vc has strategically shifted its focus toward late-stage and secondary tech deals, responding to the evolving landscape and fostering community investment in uncertain times. Over its first two years, fff. Vc grew to 300 members from 200+, representing 28 countries, worked through 159 late-stage deals, and invested approximately 3 million euros in notable companies like Inbank and Bolt.

The global quantum computing sector is projected to grow from $470 million in 2021 to $1,765 million in 2026, highlighting a considerable growth opportunity for tech investors. Moreover, roughly 31% of U.S. commercial investors are contemplating investments in proptech firms, highlighting a particular market opportunity within the wider field of enterprises. However, it is essential to recognize the inherent risks, as evidenced by the 48% failure rate of real estate ventures within four years.

These insights, along with the recent 1.2% rise in unicorn startups, emphasize the dynamic entrepreneurial ecosystem that is shaping the business venture definition landscape in 2024, making it essential for investors to remain informed and flexible. Furthermore, fff.vc's commitment to community engagement is demonstrated through workshops hosted with industry leaders like Blackstone and UBS, which not only enhance member knowledge but also strengthen networking opportunities.

Exploring Types of Business Ventures: From Startups to Joint Ventures

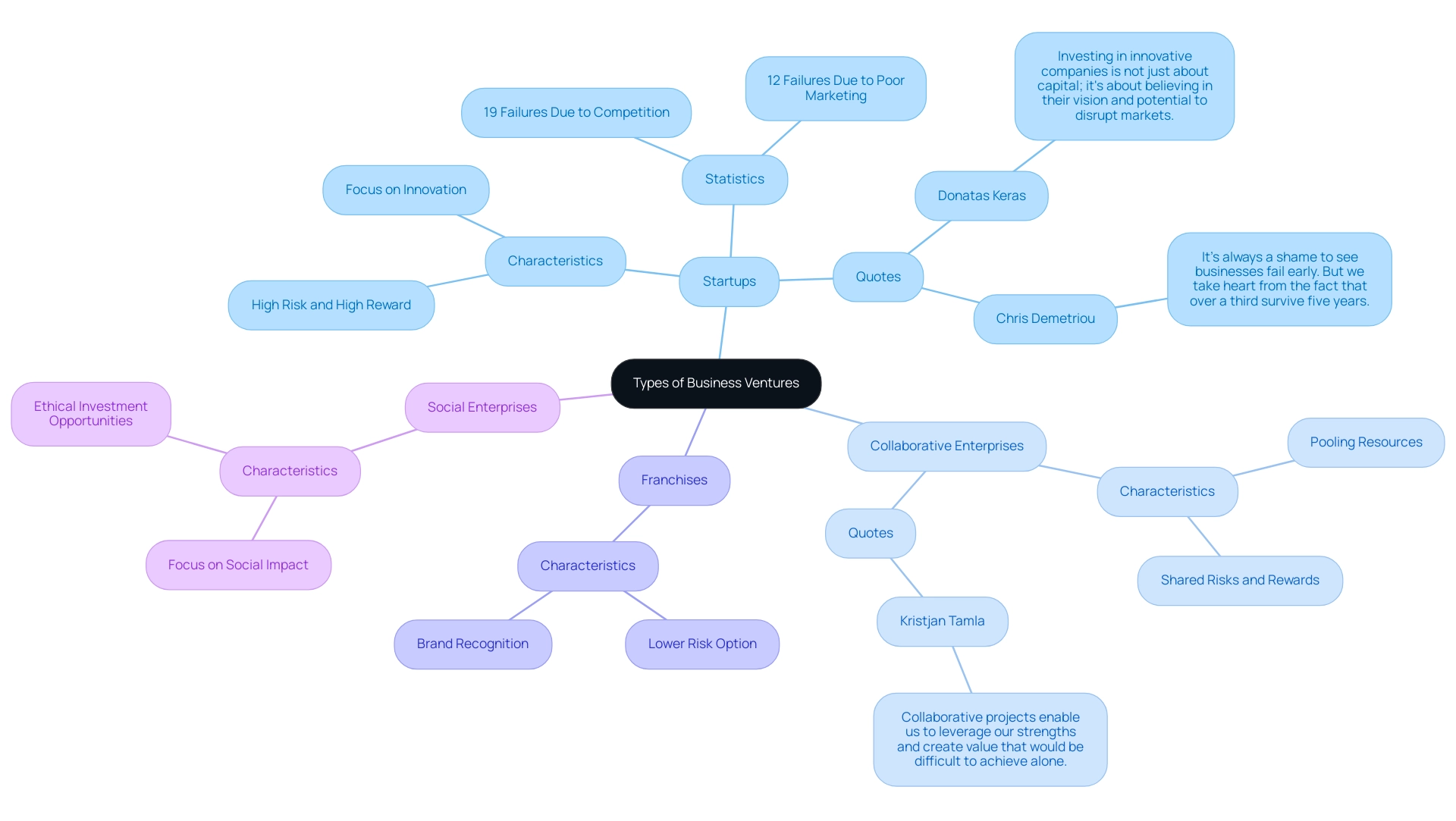

Business enterprises can be classified into several types, each with distinct characteristics and implications for investors. Understanding these categories is crucial for assessing risks and identifying suitable opportunities according to the business venture definition.

- Startups are newly established businesses that often prioritize innovation and growth. While they typically require significant initial investment and come with high risk—evidenced by the fact that 19% of failures stem from competition—they also present substantial potential for returns. As emphasized by Donatas Keras, a prominent figure in Baltic venture investment, successful companies like Montonio and TransferGo showcase the immense possibilities within this space. Keras emphasizes, "Investing in innovative companies is not just about capital; it's about believing in their vision and potential to disrupt markets." Chris Demetriou, Head of Business Advisory at Archimedia Accounts, notes, "It’s always a shame to see businesses fail early. But we take heart from the fact that over a third survive five years, which is no mean feat at all." As the customer success role evolves into a data engineering function, startups are increasingly leveraging data to enhance their strategies and outcomes.

- Collaborative enterprises involve two or more parties pooling resources to achieve a common objective while sharing risks and rewards. This collaborative structure is particularly useful for entering new markets or developing innovative products, allowing partners to mitigate individual risks. Kristjan Tamla's work with ofTEN illustrates how collaborations in real estate can leverage shared expertise and resources to optimize returns. Tamla states, "Collaborative projects enable us to leverage our strengths and create value that would be difficult to achieve alone."

- Franchises enable individuals to operate a business under an established brand, offering a lower-risk option for entrepreneurship. Franchisees benefit from brand recognition and support from the franchisor, which can significantly improve their chances of success.

- Social enterprises prioritize social impact alongside profit, attracting investors interested in ethical investment opportunities. These initiatives demonstrate that profitability and social responsibility can coexist, appealing to a growing demographic of conscious investors.

A case study on ineffective marketing highlights that 12% of startups fail due to poor marketing strategies, underscoring the importance of effective branding and promotion for reaching target audiences and ensuring market presence. By understanding these categories, investors and entrepreneurs can better align their goals with the suitable project type as per the business venture definition while assessing the associated risks and benefits. Significantly, as shown in 2022, investment into sectors like FinTech reached $81 billion, highlighting the ongoing growth and evolution of opportunities.

Insights from leaders such as Keras and Tamla underscore the vital role of community and collaboration in navigating these investment landscapes. Furthermore, Keras's Practica Capital has recently announced its fund III, ready to deploy another €80 million into future success stories in the Baltics, highlighting the continuous commitment to fostering innovation and growth in the region.

The Importance of Market Research in Business Ventures

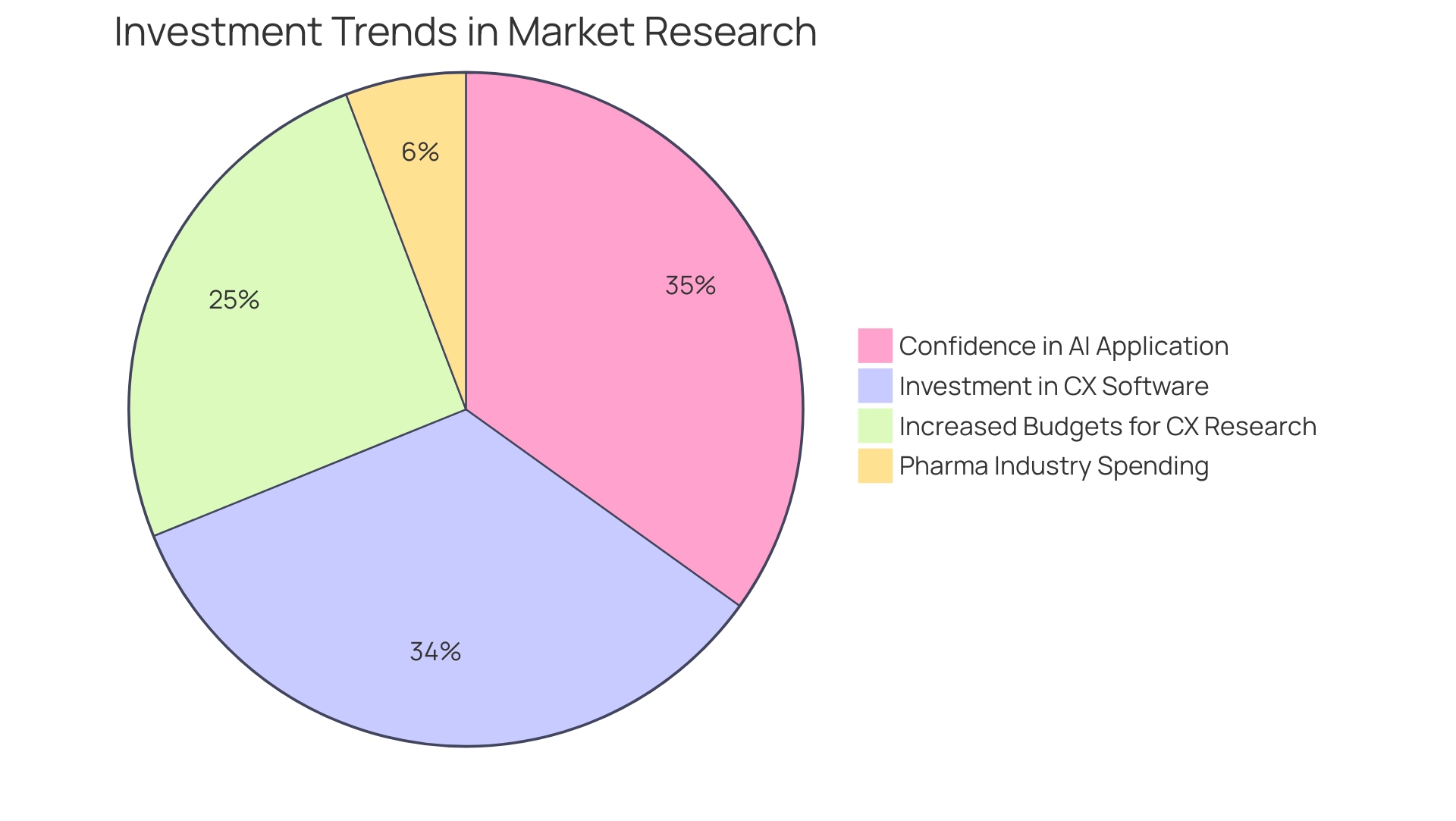

Comprehensive industry research is vital for any business venture definition, offering essential insights into trends, customer preferences, and competitive dynamics. Recent statistics reveal that 53% of researchers have increased their budgets for customer experience (CX) research, highlighting the growing recognition of its importance. This process entails examining data related to target demographics, scale, and potential obstacles to entry.

For example, a technology startup may utilize research to discover unmet needs within the industry, enabling them to customize their products effectively to satisfy specific consumer demands. Additionally, a significant 12.1% of global research spending comes from the Pharma industry, illustrating sector-specific investment trends. Grasping economic conditions equips entrepreneurs with the knowledge necessary to make informed decisions about pricing, marketing strategies, and distribution channels.

These strategic insights ultimately enhance the likelihood of success for ventures that align with the business venture definition. A case study from 2022 shows that 71% of researchers are now investing in customer experience software to derive valuable insights into customer interactions, which is expected to guide organizational strategies and boost overall customer satisfaction. Furthermore, a recent survey indicates that 73% of researchers worldwide feel 'very confident' or 'extremely confident' in their ability to apply AI to research activities, underscoring the latest trends shaping this critical field.

This confidence in AI application further emphasizes the importance of utilizing advanced research tools to enhance decision-making processes. As noted by sales professionals,

When people are exposed to brand messages on LinkedIn, they are six times more likely to convert.

This highlights the necessity for startups to leverage market research effectively to drive their success.

Funding Options for Business Ventures: Navigating Financial Resources

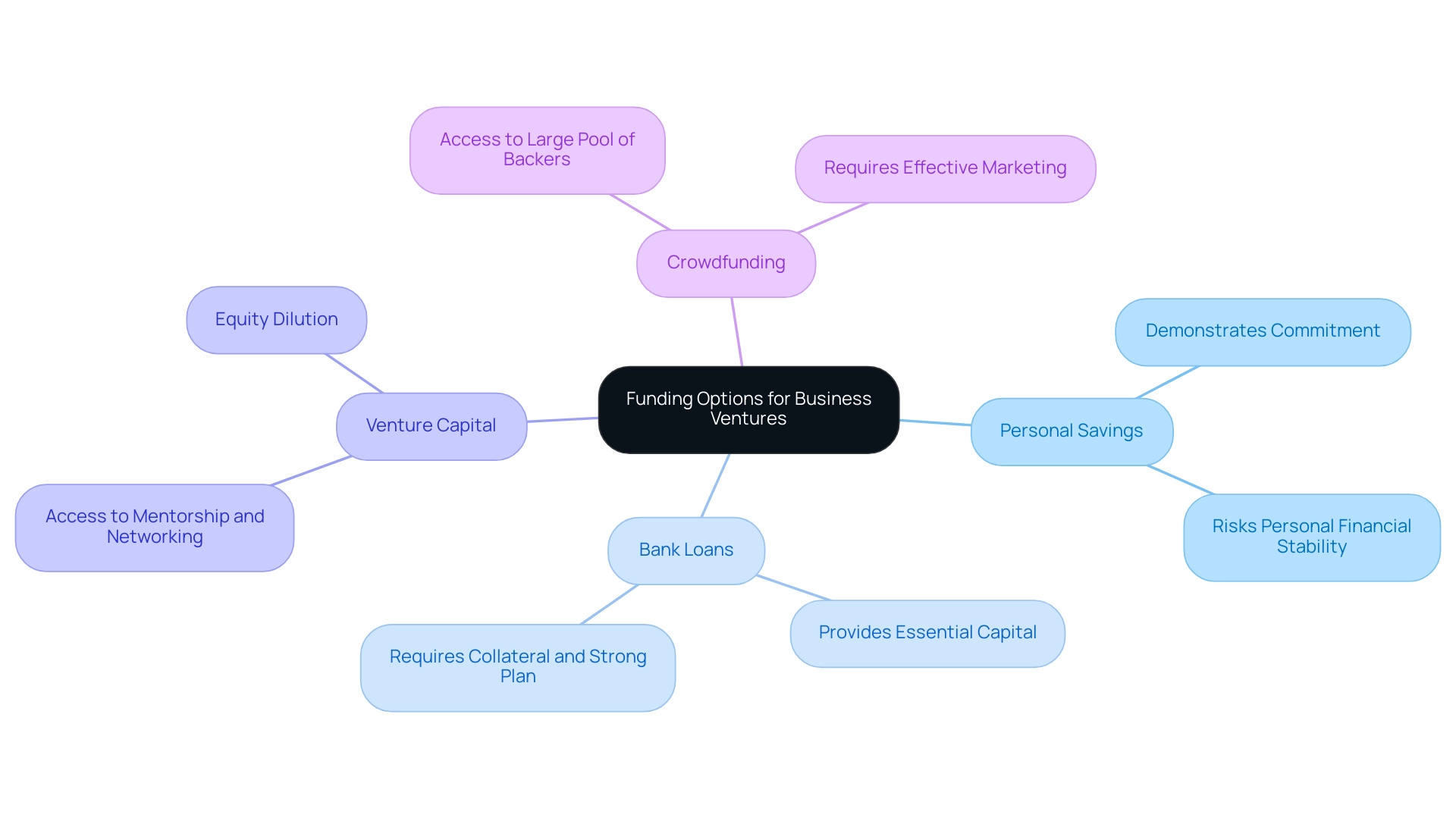

Acquiring capital is a crucial necessity for initiating and maintaining enterprises, and entrepreneurs have a range of financing alternatives to consider. Key sources of funding include:

- Personal savings: Many entrepreneurs begin their journey by investing personal funds, a move that often signals dedication and commitment, which can be appealing to potential investors.

- Bank loans: Traditional loans are a common option for financing, providing essential capital. However, these loans typically necessitate collateral and a strong plan to secure approval.

- Venture capital: High-growth potential companies may attract venture capitalists, who offer funding in exchange for equity. This not only provides necessary capital but also opens doors to invaluable mentorship and networking opportunities that can significantly enhance prospects.

- Crowdfunding: Platforms such as Kickstarter enable entrepreneurs to gather small contributions from a large pool of backers, often in return for early access to products or other rewards, making it a viable alternative for initial funding.

Each funding source presents distinct advantages and disadvantages. For instance, while personal savings demonstrate commitment, they also risk personal financial stability. Likewise, while bank loans can offer considerable capital, they come with strict requirements that can be difficult for new businesses. Understanding these nuances is essential for entrepreneurs to select the most appropriate funding path based on their business venture definition.

Recent trends suggest that the global quantum computing market, for instance, is expected to grow from $470 million in 2021 to $1,765 million by 2026, indicating profitable prospects for inventive companies. As Josh Howarth points out, 91% of working-age Saudis feel prepared to launch their own ventures, reflecting a growing entrepreneurial spirit that can further drive demand for diverse funding options. Moreover, it’s important to consider the risks associated with funding for new ventures, as information companies have the highest failure rate at 63%, followed by transportation and utilities at 55%. In light of the cash flow challenges that led to numerous company failures in 2023, understanding funding strategies is crucial for aspiring entrepreneurs.

Additionally, the case study of Black Founders in Y Combinator illustrates the strides made in diversity within the startup ecosystem, as startups with black founders now represent a growing segment of the market, indicating progress in funding accessibility.

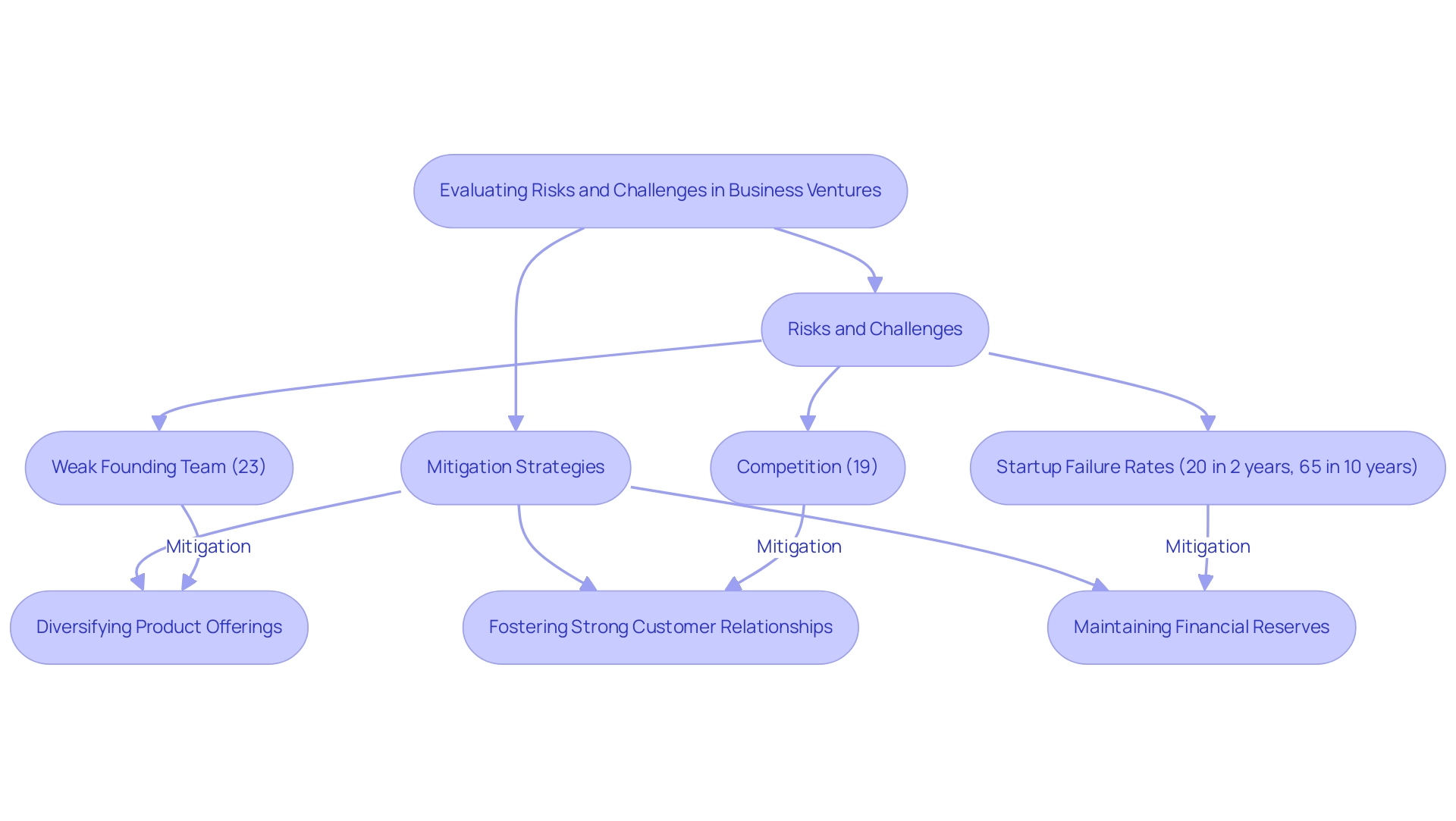

Evaluating Risks and Challenges in Business Ventures

Every business venture definition inherently carries a unique set of risks and challenges that can significantly influence outcomes. Current data reveals that approximately 20% of new businesses fail within their first two years, and this figure escalates to 65% within a decade, underscoring the critical nature of these challenges. In the United Kingdom, 60% of startups experience failure, pointing to specific difficulties within that market.

Notably, a weak founding team accounts for 23% of failures, while competition affects 19% of ventures, as highlighted by CBInsights. Startups often struggle with:

- Product development

- Customer acquisition

- Cash flow management

Areas that demand acute attention. To effectively navigate these risks, entrepreneurs should engage in comprehensive risk assessments and devise robust contingency plans.

Strategies such as:

- Diversifying product offerings

- Fostering strong customer relationships

- Maintaining sufficient financial reserves

Are vital in mitigating potential challenges. By remaining vigilant and prepared for these risks, entrepreneurs can bolster their resilience and adaptability, thus enhancing their prospects for success in an ever-evolving business landscape marked by volatility.

Conclusion

Understanding the intricacies of business ventures is essential for anyone looking to thrive in today’s competitive market. This article has explored the foundational concepts that define a business venture, emphasizing the crucial elements of risk, innovation, and market opportunity. By categorizing various types of ventures—such as startups, joint ventures, and franchises—investors and entrepreneurs can better assess their goals and align their strategies accordingly.

The significance of market research cannot be overstated. It serves as a vital tool for identifying customer needs, industry trends, and competitive dynamics, ultimately leading to informed decision-making. As demonstrated, effective market research enhances the likelihood of success by allowing entrepreneurs to tailor their offerings to meet specific demands.

Navigating the landscape of funding options is another critical aspect of launching and sustaining a business venture. From personal savings to venture capital, each source carries its own set of advantages and challenges, which must be carefully evaluated to ensure the best fit for the venture’s unique circumstances.

Finally, recognizing and managing the risks inherent in business ventures is paramount. With a considerable percentage of new businesses facing failure within their initial years, entrepreneurs must adopt proactive measures, including robust risk assessments and contingency planning, to increase their chances of success.

In summary, equipping oneself with a thorough understanding of business ventures, market research, funding options, and risk management strategies is imperative for aspiring entrepreneurs and seasoned investors alike. By embracing these principles, individuals can navigate the complexities of the business landscape with greater confidence and foresight, ultimately paving the way for sustainable success.