Overview

A 0 credit card cash advance can provide cardholders with quick access to funds against their credit limit, but we understand that it often comes with high fees and immediate interest accrual, making it a costly borrowing option. Many of our members have shared their experiences with this type of borrowing, highlighting the importance of recognizing the associated risks and costs. Withdrawal fees and elevated interest rates can lead to significant debt if not managed properly, and we want to ensure you feel informed and supported in navigating these challenges.

Introduction

In the intricate world of personal finance, cash advances can often feel like a double-edged sword. While they offer a quick fix for immediate cash needs, the hidden costs tied to these financial tools can lead to significant long-term consequences that many of us may not fully grasp. As credit card holders navigate the complexities of cash advances—facing high fees, steep interest rates, and potential impacts on credit scores—it becomes essential to understand their implications.

We recognize that many of our members have encountered these challenges, and this article delves into the mechanics of cash advances, highlighting the stark differences compared to traditional loans, and exploring practical scenarios where they might actually be beneficial. With insights from industry experts and a focus on financial literacy, we aim to equip both tech investors and consumers with the knowledge necessary to make informed financial decisions, fostering a sense of community and support along the way.

Defining Cash Advances: What You Need to Know

A monetary loan represents a temporary borrowing option provided by card issuers, allowing cardholders to access a 0 credit card cash advance against their available limit. This process, known as a 0 credit card cash advance, can be conveniently executed at ATMs or banks, with withdrawal amounts typically ranging from 20% to 60% of the total credit limit. However, unlike typical transactions, a 0 credit card cash advance is subject to immediate charges and often carries considerably higher interest rates, which can escalate quickly.

Understanding the nuances of monetary boosts is essential for technology investors navigating complex economic landscapes. As we look ahead to 2025, the average charges related to monetary withdrawals are projected to be around 5% of the transaction total, with interest rates that may exceed 25% per year. This financial burden highlights the importance of being well-informed about the terms and conditions of credit agreements, aligning with fff.club's commitment to empowering members through inclusive economic education and community collaboration.

Many industry leaders stress the significance of this knowledge. Mihkel Torim, a respected figure in the finance sector, notes that "the club's dedication to providing members with the essential knowledge and tools to make informed choices" is vital for navigating monetary offerings such as loans. This perspective reinforces the belief that monetary superpowers should be accessible to everyone, a core value of fff.club, which was founded by experienced professionals like Akim Arhipov, a wealth manager with two successful exits, and Tim Vaino, a lawyer who co-built Latitude59.

Moreover, recent statistics reveal a growing trend in monetary prepayment usage, with a notable increase in contactless transactions amounting to £25.7 billion in November 2024, reflecting a 5.3% growth from the previous year. This trend indicates that technology investors and consumers are increasingly relying on quick access to resources, making it crucial to understand the effects of monetary increases on overall economic well-being. The UK Finance Card Spending Update from November 2024 emphasizes a significant reliance on card-based transactions, with 2.3 billion debit card transactions totaling £66.2 billion spent.

In summary, while monetary loans can provide quick liquidity, utilizing a 0 credit card cash advance also carries inherent risks that can affect long-term economic stability. Therefore, tech investors must approach these options with care and a comprehensive understanding of the associated fees and interest rates. This ensures that their financial strategies are informed, aligned with their investment goals, and supported by the resources available at fff.club, such as educational materials and community discussions designed to enhance financial literacy.

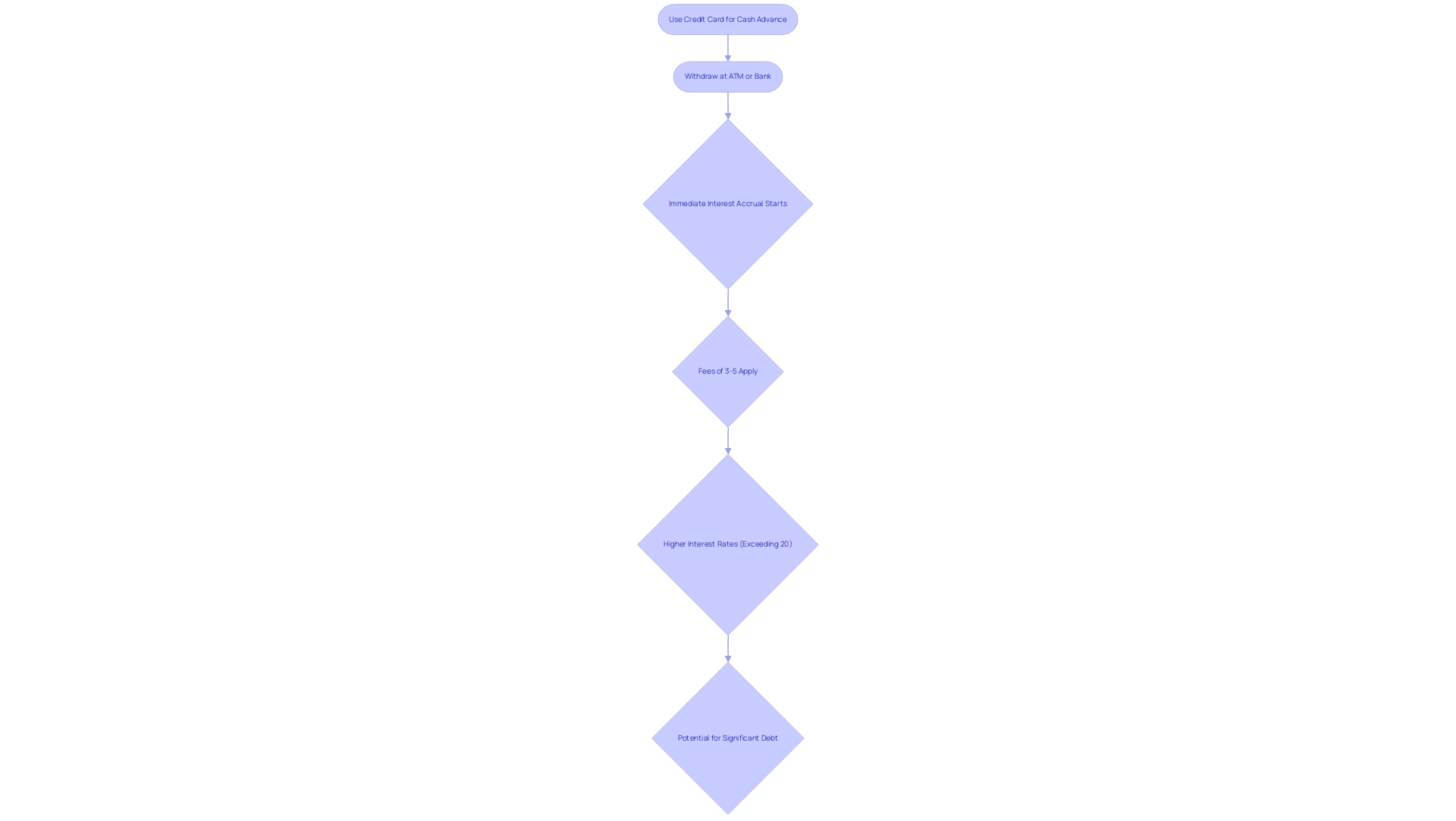

How Cash Advances Work: The Mechanics Explained

To start a monetary withdrawal, cardholders can conveniently use their credit card for a 0 credit card cash advance at an ATM or request funds directly at a bank. While this option may seem appealing, we understand that it comes with unique drawbacks that can be concerning. Unlike standard purchases, making a 0 credit card cash advance does not benefit from a grace period; interest starts accruing immediately upon withdrawal, which can be quite alarming.

Charges linked to monetary withdrawals usually vary from 3% to 5% of the sum taken out, and these fees can accumulate rapidly. Moreover, the interest rates for monetary loans are often significantly higher than those for regular purchases, frequently exceeding 20%. In contrast, the interest rate on overnight deposits from households remains largely unchanged at 0.34%, highlighting the stark difference and potential burden of monetary loans.

This combination of instant interest accumulation and high charges makes obtaining a 0 credit card cash advance a costly choice for acquiring funds quickly. Financial specialists caution that while these loans can provide rapid liquidity, they should be approached with care. As many of our members have experienced, the potential for significant debt looms if these loans are not managed appropriately. Furthermore, as Michael J. Hsu pointed out, some banks may 'feel like hostages' to their legacy technology, which can impact the fees and procedures related to monetary withdrawals.

Looking forward, we are hopeful that developments in generative AI may aid in enhancing these legacy systems, possibly leading to improved financial options or reduced fees in the future. For tech investors, understanding these dynamics is crucial. The experiences shared within the fff. Club community illustrate the importance of informed decision-making in navigating financial strategies, fostering a sense of support and shared knowledge among members.

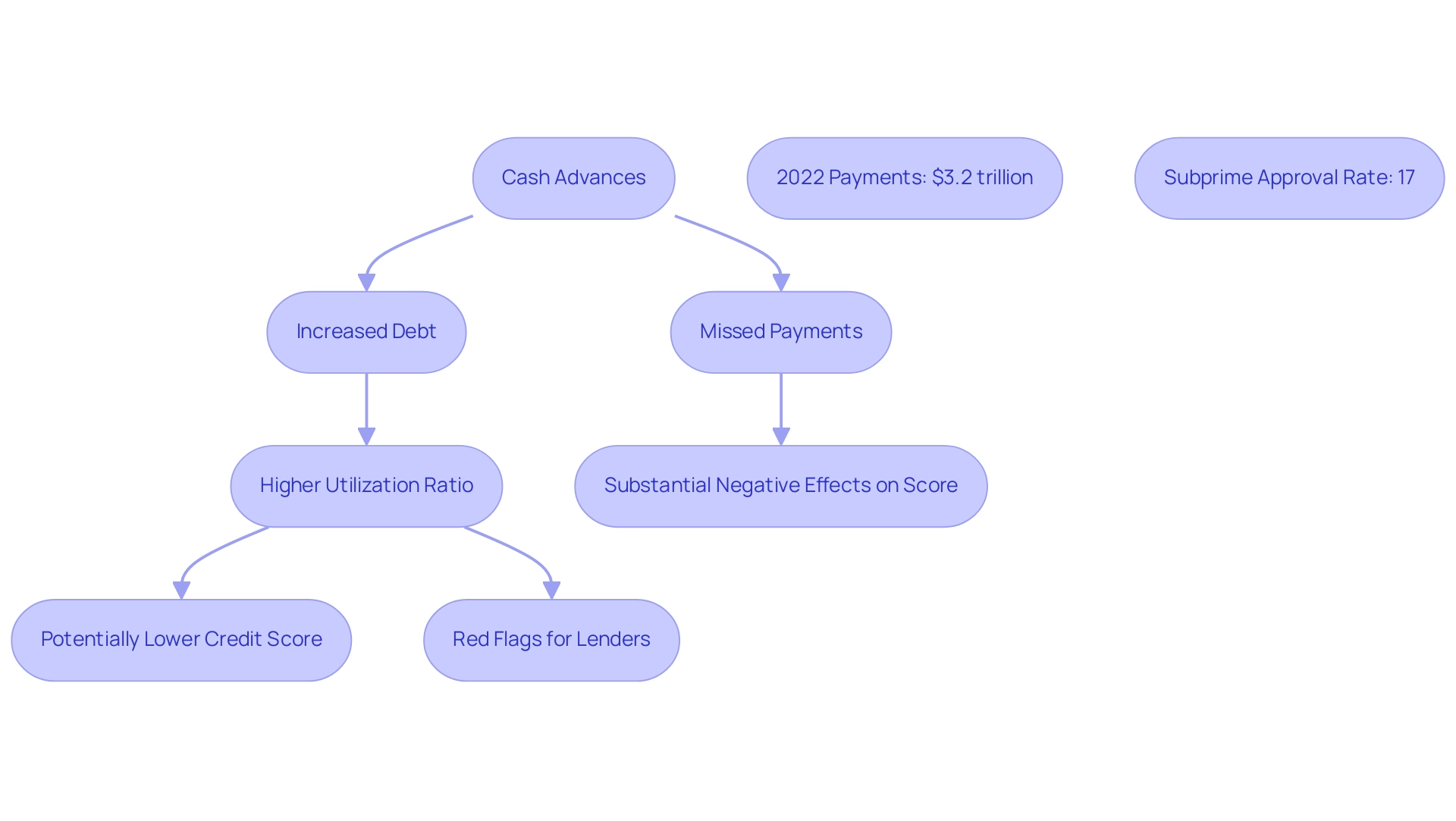

The Impact of Cash Advances on Your Credit Score

While a monetary increase itself does not directly reduce your score, it can significantly impact your utilization ratio, a key element in scoring. We understand that utilization is calculated by comparing your total card balances to your limits, and it is generally recommended to keep this ratio below 30% for optimal financial health. A sudden increase in debt from a monetary loan can raise red flags for lenders, indicating that you may be over-leveraged.

This perception can understandably hinder your chances of obtaining future financing. Furthermore, if cash advances lead to missed payments, the negative effects on your score can be substantial. In 2022, cardholders paid approximately $3.2 trillion toward card debt, with 44% of those payments aimed at covering full balances, reflecting a growing trend towards responsible usage.

This trend is particularly significant considering that the approval rate for subprime applicants was only 17% in 2022, emphasizing the importance of maintaining a strong financial profile. Financial analysts stress that keeping a low borrowing utilization ratio is crucial for maintaining a good score, especially for individuals who use loans. As Virginia C. McGuire observes, "credit cards are convenient and secure; they assist in establishing a financial profile, they simplify budgeting, and they earn rewards."

Therefore, understanding the implications of cash advances on your credit utilization is crucial for making informed monetary decisions. Additionally, platforms like fff. Club enhance the investment experience by promoting co-investing and learning, which can lead to improved monetary outcomes.

With advancements in technology, such as generative AI enhancing banking systems, tech investors can utilize these tools for better management of resources.

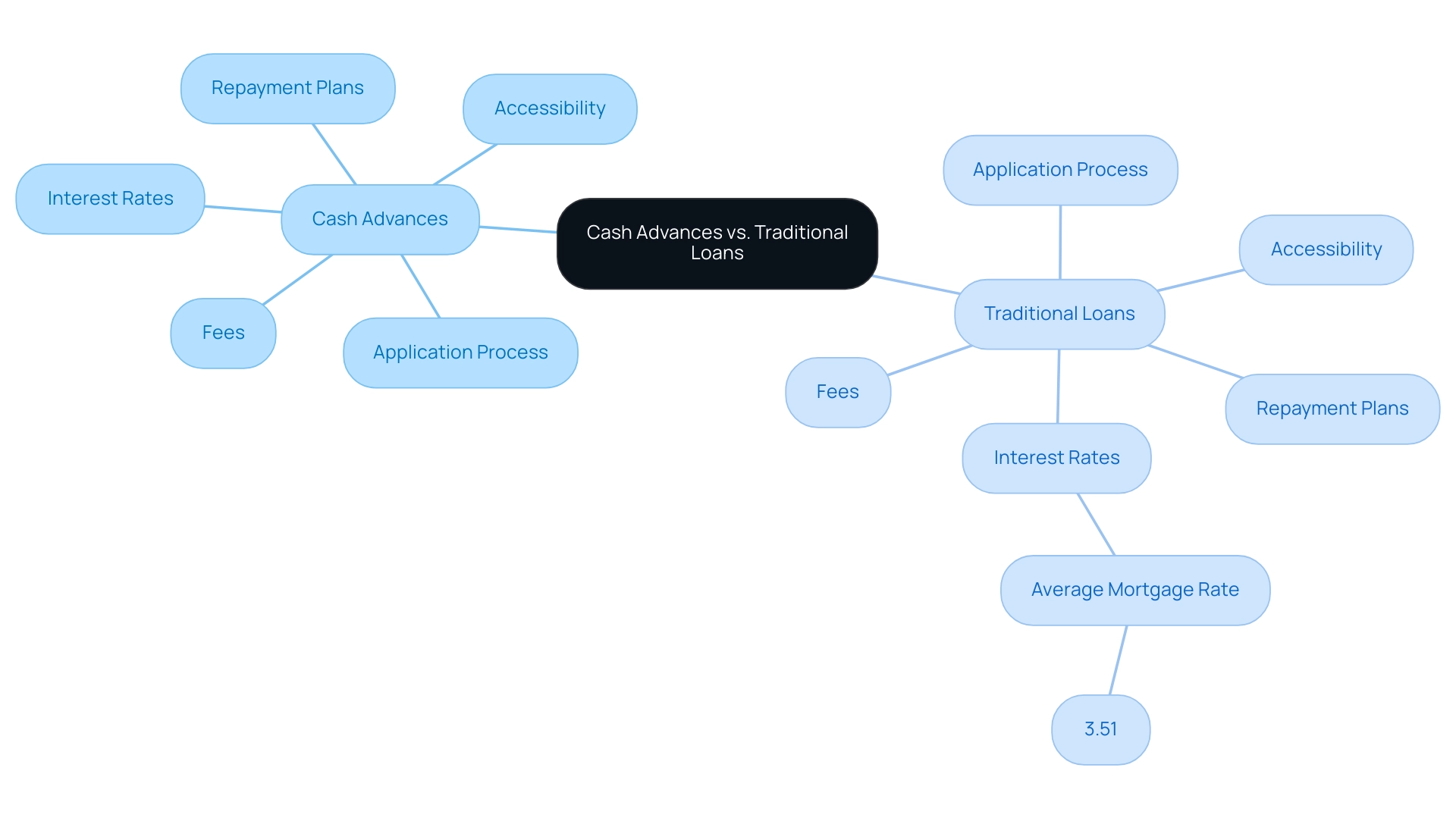

Cash Advances vs. Traditional Loans: Key Differences

Cash loans and conventional borrowing cater to different financial needs and come with distinct terms that are essential for borrowers to understand. Cash loans are typically more accessible and quicker to secure, often requiring minimal documentation and providing immediate access to funds. However, they usually carry high fees and interest rates, which can significantly impact the overall cost of borrowing.

In contrast, traditional loans, such as personal loans or mortgages, often feature lower interest rates and structured repayment plans, making them a more cost-effective option in the long run. These loans, however, necessitate a more thorough application process and may involve longer approval times. In 2025, the average mortgage interest rate stood at 3.51%, resulting in an average of £5,290 in mortgage-related interest paid over the year. This statistic highlights the monetary consequences of selecting between loans that provide immediate funds and conventional borrowing.

As many of our members have experienced, understanding these differences is crucial for tech investors, as it enables them to make informed decisions tailored to their economic circumstances. For instance, in situations where immediate liquidity is essential, opting for a credit card cash advance might be preferable despite its higher costs. Conversely, for larger, planned expenses, a traditional loan could offer a more sustainable monetary solution.

By carefully weighing these options, investors can optimize their strategies and enhance their overall investment experience. Moreover, the challenges faced by tech investors in navigating monetary decisions underscore the importance of community engagement and education. As highlighted by fff.club, which is dedicated to empowering its members through inclusive economic education and community collaboration, fostering connections and facilitating informed investment decisions becomes essential. This collective approach assists investors in aligning their choices with their monetary goals while fostering a collaborative atmosphere among over 400 tech investors involved with fff.club.

Founders Akim Arhipov, with his wealth management expertise and experience from two successful exits, and Tim Vaino, a lawyer who co-built Latitude59, bring invaluable insights to the community, enhancing the support available to members. Additionally, the Government's fiscal targets, which require public sector net debt to fall and net borrowing not to exceed 3% of GDP by 2028-29, provide a broader economic context for understanding the implications of borrowing choices. Furthermore, recent news suggesting that misrepresentation of employment was the most frequent form of mortgage fraud in the UK serves as a cautionary tale for investors contemplating loans, reminding them to approach their monetary choices with due diligence.

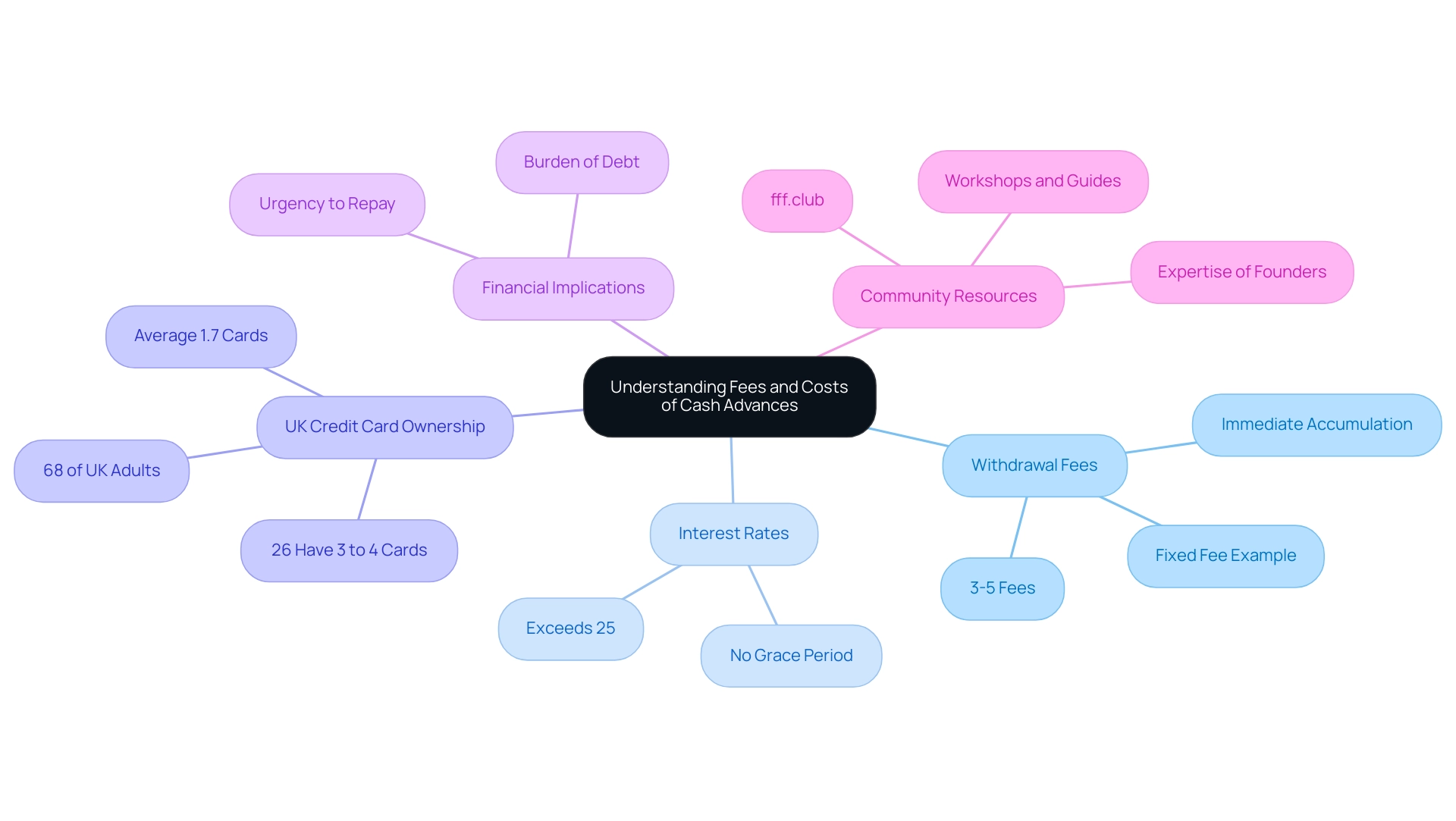

Understanding Fees and Costs of Cash Advances

Cash loans can quickly become a burdensome financial choice, often laden with various fees that can catch many off guard. Most credit card providers impose a withdrawal fee that typically ranges from 3% to 5% of the amount withdrawn, or a fixed fee, whichever is higher. For example, withdrawing $1,000 might incur a fee of around $30, which can feel overwhelming.

Furthermore, monetary loans generally have higher interest rates compared to standard purchases, frequently exceeding 25%. Unlike regular purchases, interest on these withdrawals begins to accumulate immediately, leaving no grace period to ease the financial strain. This means that if the monetary loan isn't repaid swiftly, the costs can escalate rapidly, creating a sense of urgency that many of our members have experienced.

An estimated 68% of UK adults possess at least one credit card, underscoring the widespread use of credit cards and the potential pitfalls of cash advances that often go unnoticed. For tech investors, it's vital to grasp these financial implications to make informed decisions that resonate with their investment strategies. As industry leaders like Mihkel Torim highlight, insights from communities such as Finance, Freedom, Fellows (fff.club) empower members to navigate these monetary decisions with confidence.

By connecting with over 400 technology investors and utilizing the educational resources available through fff.club—including workshops and guides on funding options—members can gain a clearer understanding of the fees and interest rates associated with funding. This knowledge is crucial in avoiding unnecessary debt and enhancing overall money management. The founders of fff.club, Akim Arhipov and Tim Vaino, bring a wealth of expertise in wealth management and legal frameworks, respectively, further enriching the community's resources and support for its members.

When to Consider a Cash Advance: Practical Scenarios

In certain situations, cash options, such as a 0 credit card cash advance, can be a vital financial resource, especially when unexpected expenses arise, like emergency medical bills, urgent home repairs, or last-minute travel costs. We understand that when an unexpected medical crisis occurs and prompt funds are needed, a monetary prepayment can offer a quick resolution when conventional alternatives, such as personal loans, might feel too slow or cumbersome to obtain.

As we look ahead to 2025, projections indicate that card debt in the U.S. will reach approximately $905 billion, highlighting the growing reliance on borrowing to manage unforeseen expenses. This trend underscores the importance of knowing when to effectively utilize a 0 credit card cash advance. Financial specialists note that while credit quality is expected to stabilize, there may be a rise in 2025, influencing choices regarding monetary loans.

Financial advisors often recommend considering a monetary loan only in true emergencies, particularly when other funding alternatives, like a 0 credit card cash advance, are not viable. For instance, many individuals have turned to a 0 credit card cash advance to tackle urgent car repairs that simply could not wait, or to manage unexpected travel expenses stemming from family emergencies. As the financial services landscape evolves, with 30% of cross-border transactions for micro businesses now conducted through nonbank providers, the availability of funds is likely to increase.

This shift may lead to more individuals relying on credit cards for urgent financial needs, especially among demographic groups such as Asian Americans (92%) and Caucasian Americans (87%), who are among the most likely to hold credit cards.

Moreover, the case study titled "Trends Defining the Future of Payments" reveals a significant increase in the market capitalization of specialist payments companies, which could influence how financial transactions are processed and managed. Ultimately, while a 0 credit card cash advance can provide immediate assistance during challenging financial times, it is crucial to approach it with care and a clear repayment plan to avoid potential pitfalls.

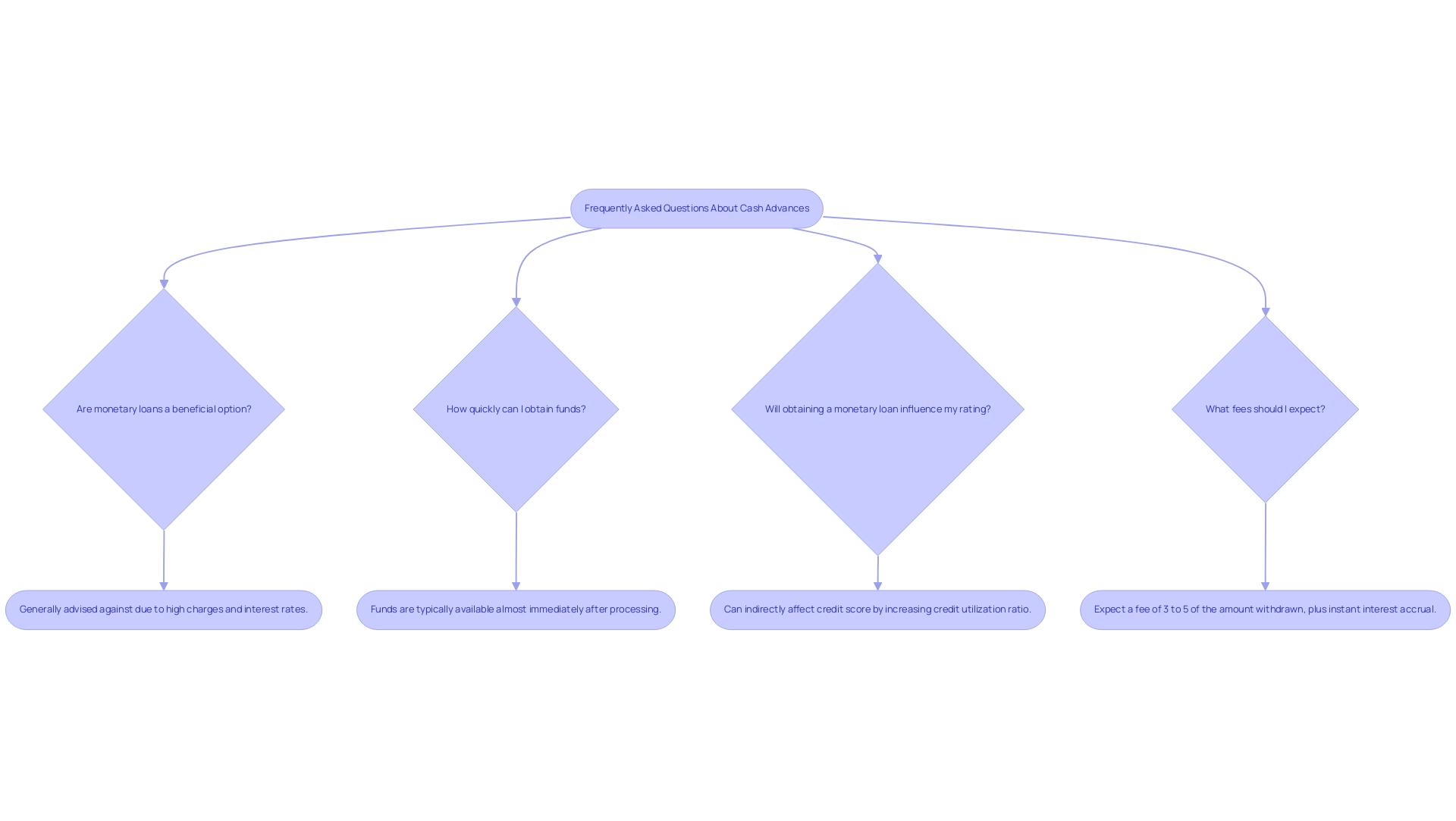

Frequently Asked Questions About Cash Advances

Frequent inquiries about monetary loans often arise among consumers seeking immediate liquidity. It’s essential to consider a few key points:

-

Are monetary loans a beneficial option? Generally, financial specialists advise against withdrawing funds, such as a 0 credit card cash advance, due to their high charges and interest rates. Vikram Bhat, Vice Chair and US Financial Services Industry Leader at Deloitte, highlights, "Understanding the financial implications before proceeding with such options is crucial." This underscores the importance of thoughtful consideration before opting for a 0 credit card cash advance.

-

How quickly can I obtain funds? One of the appealing aspects of a 0 credit card cash advance is the swift access to funds; they are typically available almost immediately after the transaction is processed, providing a quick solution for urgent financial needs.

-

Will obtaining a monetary loan influence my rating? While a monetary withdrawal itself does not directly impact your credit score, it can indirectly affect it by increasing your credit utilization ratio, a key factor in credit scoring.

-

What fees should I expect? It’s important for consumers to anticipate a monetary withdrawal fee ranging from 3% to 5% of the amount withdrawn, along with instant interest accrual with a 0 credit card cash advance. This can significantly elevate the overall cost of borrowing.

In 2024, a survey revealed that 71% of consumers could consistently use their preferred payment method, yet 24% of euro area consumers noted that their desired payment method was not always available. This highlights the importance of being aware of available options, especially when considering financial decisions. Additionally, insights from the case study titled 'Conclusions from SPACE 2024' indicate changing payment behaviors, which are relevant for tech investors exploring financial extensions.

By addressing these common questions, we hope to empower consumers to make informed decisions about cash advances, particularly 0 credit card cash advances, and their financial strategies, reinforcing the belief that financial superpowers should be accessible to everyone.

Conclusion

Navigating the world of personal finance can be daunting, and understanding cash advances is crucial for making informed decisions. While they offer immediate liquidity, the high fees and interest rates associated with them present significant risks that can lead to long-term financial strain. We recognize that cash advances may seem like a viable option in emergencies, but it's essential to weigh their costs against other financial solutions, such as traditional loans, which typically offer lower rates and structured repayment plans.

The impact of cash advances on credit scores is another vital consideration. Although they do not directly lower credit scores, the potential increase in credit utilization can raise concerns for lenders and affect future credit opportunities. We understand that maintaining a low credit utilization ratio is essential for financial health, especially when resorting to cash advances.

Ultimately, financial literacy and community support play a significant role in empowering consumers and tech investors alike. Resources like fff.club provide valuable insights and educational materials that can enhance understanding of cash advances and their implications. As many of our members have experienced, fostering a culture of informed decision-making allows individuals to navigate their financial journeys with greater confidence. By making choices that align with their long-term goals, they can avoid unnecessary pitfalls and feel supported along the way.