Overview

The best crowdfunding platforms for startups include Kickstarter, Indiegogo, SeedInvest, GoFundMe, and Crowdcube, each offering unique features and benefits tailored to different funding needs. The article underscores the importance of selecting the right platform based on specific business objectives and highlights how strategic platform choices can significantly influence fundraising success, as evidenced by successful campaigns and varying funding models available.

Introduction

The landscape of startup financing has undergone a transformative shift with the rise of crowdfunding, a method that empowers entrepreneurs to tap into the collective financial resources of individuals through online platforms. This approach not only reduces dependence on traditional funding avenues like banks and venture capital but also democratizes access to investment opportunities.

As the crowdfunding industry continues to evolve, it presents both significant opportunities and unique challenges for startups. Understanding the various types of crowdfunding, the key platforms available, and the common pitfalls to avoid is essential for entrepreneurs looking to navigate this dynamic environment effectively.

This article delves into the fundamentals of crowdfunding, offering insights that can help startups leverage this innovative financing method to fuel their growth and success.

Understanding Crowdfunding: A Primer for Startups

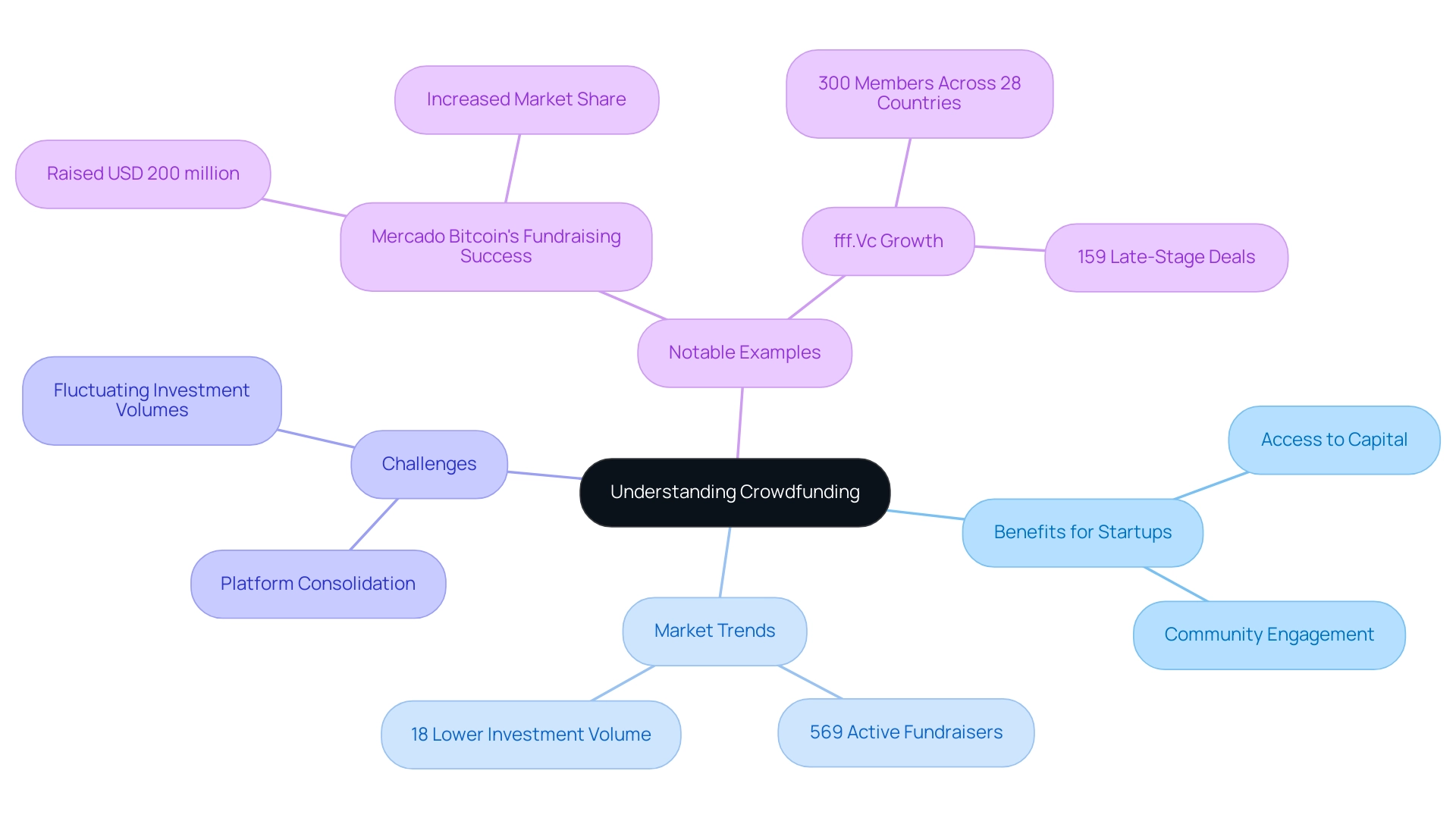

Crowdfunding represents a paradigm shift in capital raising, as it is one of the best crowdfunding platforms for startups to harness the collective financial power of numerous individuals through online platforms. This innovative approach diminishes reliance on traditional funding sources such as banks and venture capitalists, by utilizing the best crowdfunding platforms for startups, thus allowing for a more democratized investment landscape. In the technology sector, collective funding has gained remarkable traction, not only facilitating access to capital but also serving as a means to validate new ideas and foster community engagement.

As of December 2024, the industry experienced an unprecedented surge, with active equity fundraising raises reaching an all-time high of 569, surpassing the previous record set in March 2022. However, the total investment volume in 2024 was 18% lower than in 2023, indicating challenges within the market. This growth reflects the increasing acceptance and importance of crowdfunding as a viable financing method despite these obstacles.

Kingscrowd aptly noted, 'Despite challenges like consolidation of services and fluctuating investment volumes, the resilience and innovation within the industry are undeniable.' The strategic evolution of platforms like fff. Vc highlights how community investment is pivotal, particularly in tech sectors during uncertain times, and how they have adapted their focus towards late-stage and secondary deals to foster a diversified portfolio.

Notable investors such as Donatas Keras and Kristjan Tamla exemplify the successful integration of community-driven investment strategies in the Baltic region, further illustrating the vital role of collaboration and innovation in overcoming market challenges. For example, Mercado Bitcoin's successful fundraising effort, where it secured USD 200 million from the SoftBank Latin America Fund, illustrates how effective collective funding can greatly enhance market share and position new ventures advantageously within their industries. In its first two years, fff.

Vc grew to over 300 members across 28 countries and facilitated 159 late-stage deals, investing approximately 3 million euros. Community members can expect access to diverse opportunities in sectors such as Tech, Private Equity, and Real Estate. For new businesses navigating the intricacies of raising capital, a thorough comprehension of the best crowdfunding platforms for startups is crucial for effectively utilizing this trend.

Top Crowdfunding Platforms for Startups: Features and Benefits

A range of the best crowdfunding platforms for startups are specifically designed for new businesses, each marked by its distinctive features and advantages. The main venues consist of:

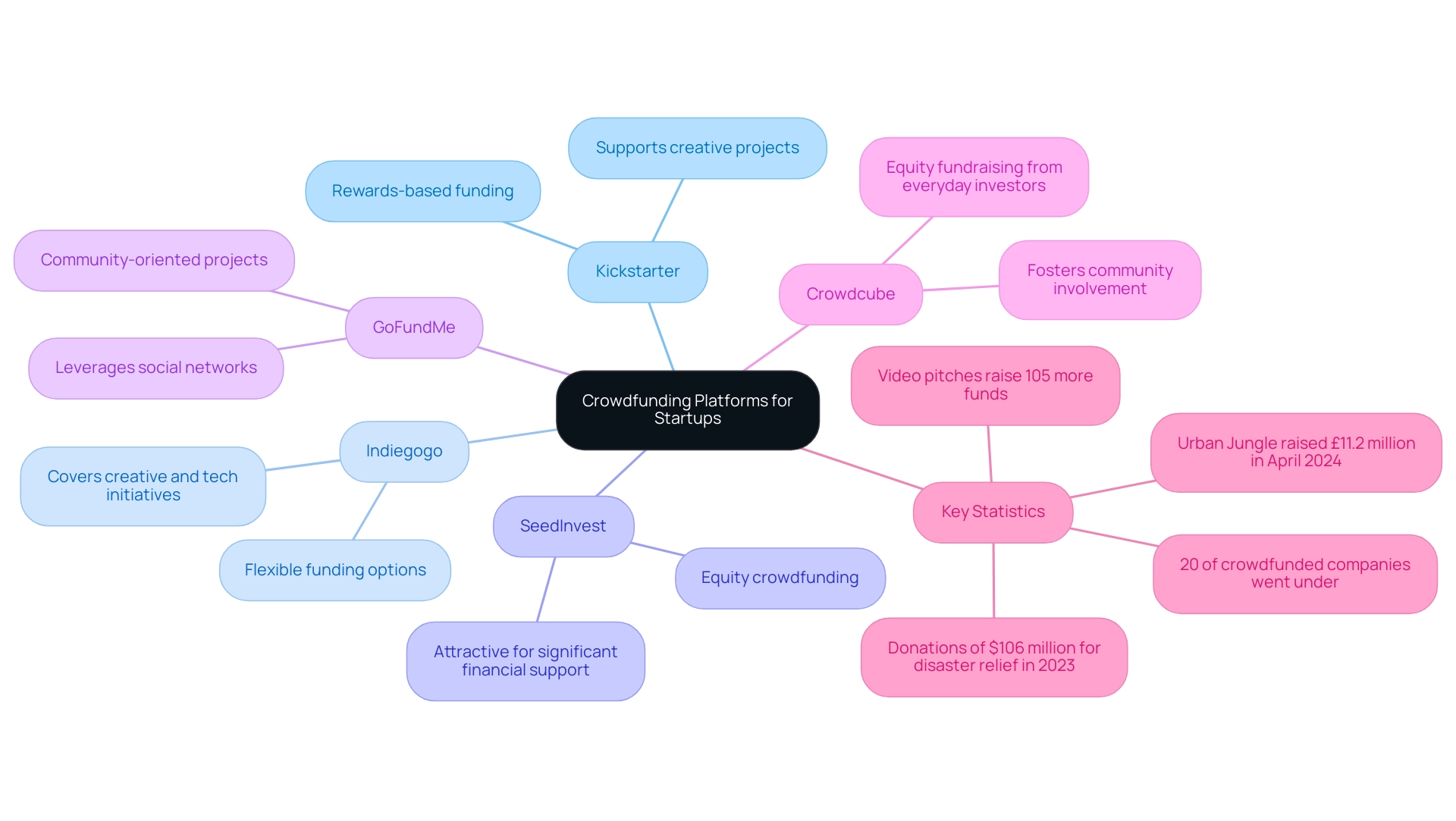

- Kickstarter: Renowned for supporting creative projects, Kickstarter enables new ventures to present their ideas while offering backers the incentive of rewards in exchange for their contributions.

- Indiegogo: This platform offers flexible funding options, enabling new ventures to retain the funds raised regardless of whether they meet their initial funding goal. It caters to both creative and technology-driven initiatives.

- SeedInvest: Focusing on equity crowdfunding, SeedInvest enables new ventures to offer shares in exchange for investments, which is especially attractive to those seeking significant financial support.

- GoFundMe: While primarily known for personal fundraising, GoFundMe can also assist new ventures engaged in community-oriented projects, leveraging social networks for support.

- Crowdcube: Based in the UK, Crowdcube facilitates equity fundraising from everyday investors, fostering community involvement and support for new ventures.

These services possess distinct rules, fee structures, and target demographics, making it crucial for startups to thoroughly assess the best crowdfunding platforms for startups in relation to their specific objectives and business models. For instance, a recent case study revealed that fundraising campaigns incorporating video pitches tend to raise 105% more funds than those without, highlighting the importance of storytelling and visual engagement in attracting backers. Furthermore, with the recent success of Urban Jungle, which secured £11.2 million in April 2024, it is evident that strategic platform selection can significantly impact fundraising outcomes.

However, investors should also be aware of the risks, as 20% of crowdfunded companies went under compared to 12% of venture-backed companies. Additionally, it's noteworthy that donations of $106 million were raised for natural disaster relief in 2023, illustrating the profound effect collective funding can have on various causes. Lastly, the share of design funding campaigns supported in Spain from 2014 to 2016 reflects the evolving market trends and performance of specific sectors within the funding landscape.

Evaluating the Pros and Cons of Popular Crowdfunding Platforms

Assessing funding sources necessitates a thorough examination of their individual benefits and difficulties. Here is a concise overview of notable platforms:

-

Kickstarter:

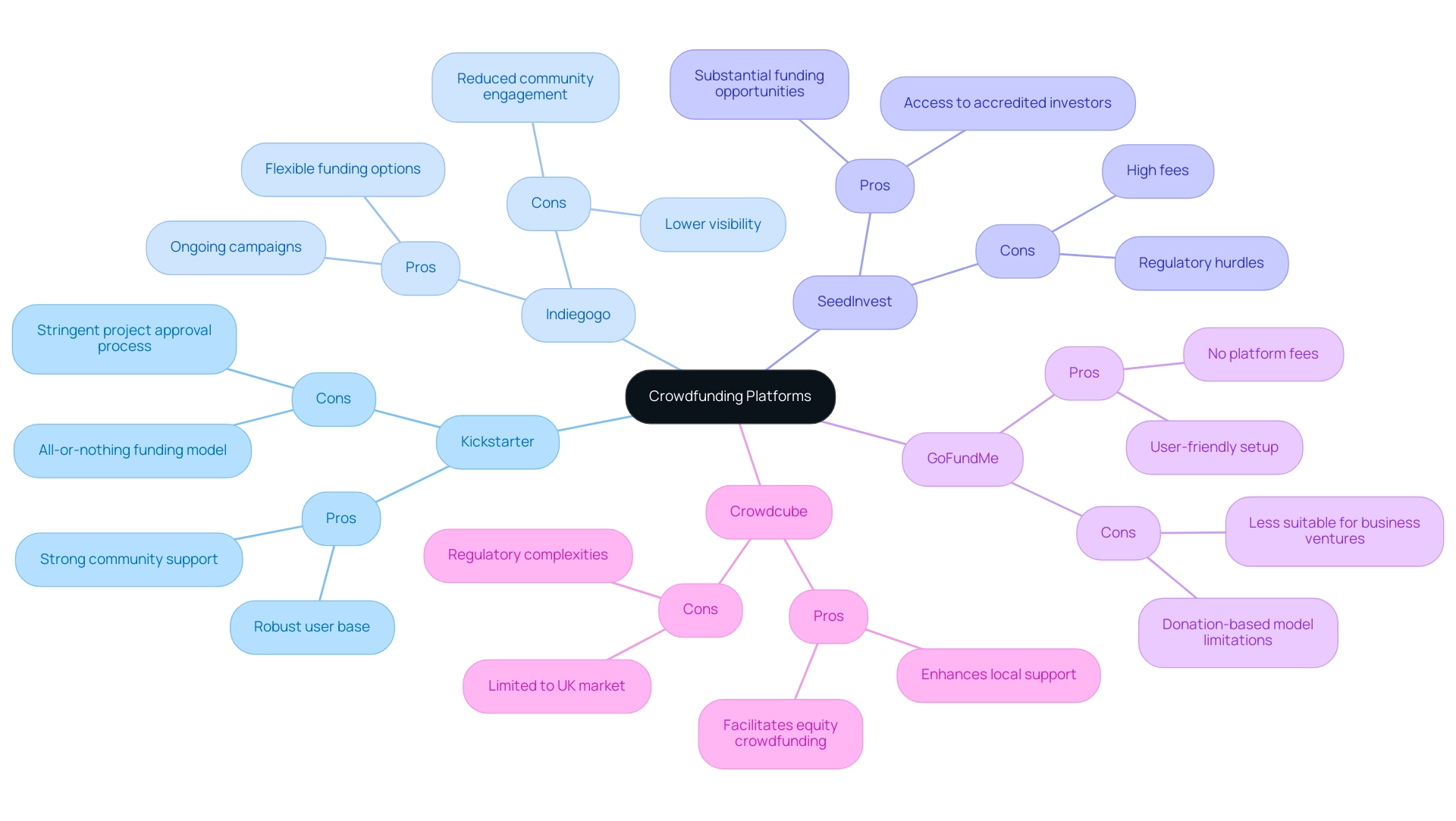

- Pros: With a robust user base and a strong community, Kickstarter excels in supporting creative projects, making it an appealing choice for entrepreneurs seeking visibility.

- Cons: However, the platform's all-or-nothing funding model can pose significant risks, coupled with a stringent project approval process that may deter some creators.

-

Indiegogo:

- Pros: Indiegogo offers flexible funding options and the opportunity for ongoing campaigns, catering to a diverse range of fundraising needs.

- Cons: Despite its advantages, Indiegogo generally suffers from lower visibility compared to Kickstarter, leading to reduced community engagement.

-

SeedInvest:

- Pros: By connecting startups with accredited investors, SeedInvest provides access to substantial funding opportunities, particularly for equity crowdfunding. Notably, equity crowdfunding raised a total of $2.5 billion, highlighting its potential.

- Cons: Nevertheless, startups must navigate high fees and regulatory hurdles, which can be a barrier for many seeking equity financing.

-

GoFundMe:

- Pros: Ideal for personal and charitable endeavors, GoFundMe has the benefit of no platform fees and a user-friendly setup process. For instance, the George Floyd Memorial Fund raised a remarkable $14.7 million, showcasing the platform's effectiveness in fundraising.

- Cons: However, its donation-based model is less suitable for business ventures, limiting its utility for startups.

-

Crowdcube:

- Pros: This platform facilitates equity crowdfunding, enabling significant community investment in UK-based startups, enhancing local support.

- Cons: Crowdcube does face regulatory complexities and is limited to the UK market, which can restrict its appeal to international startups.

By weighing these key factors, startups can choose a crowdfunding platform that best aligns with their funding strategies and overall business objectives. Notably, the landscape of financial support through collective funding has evolved, particularly during events like the COVID-19 pandemic, which saw a 736% increase in GoFundMe campaigns related to health crises in March 2020. This shift underscores the importance of selecting the right platform in a changing environment.

Moreover, as emphasized in the case study 'Key Takeaways on Fundraising,' entrepreneurs are encouraged to perform comprehensive research and consult experts prior to launching a fundraising initiative.

Exploring Different Types of Crowdfunding for Startups

Crowdfunding includes various unique types, each designed to meet specific funding requirements for new ventures:

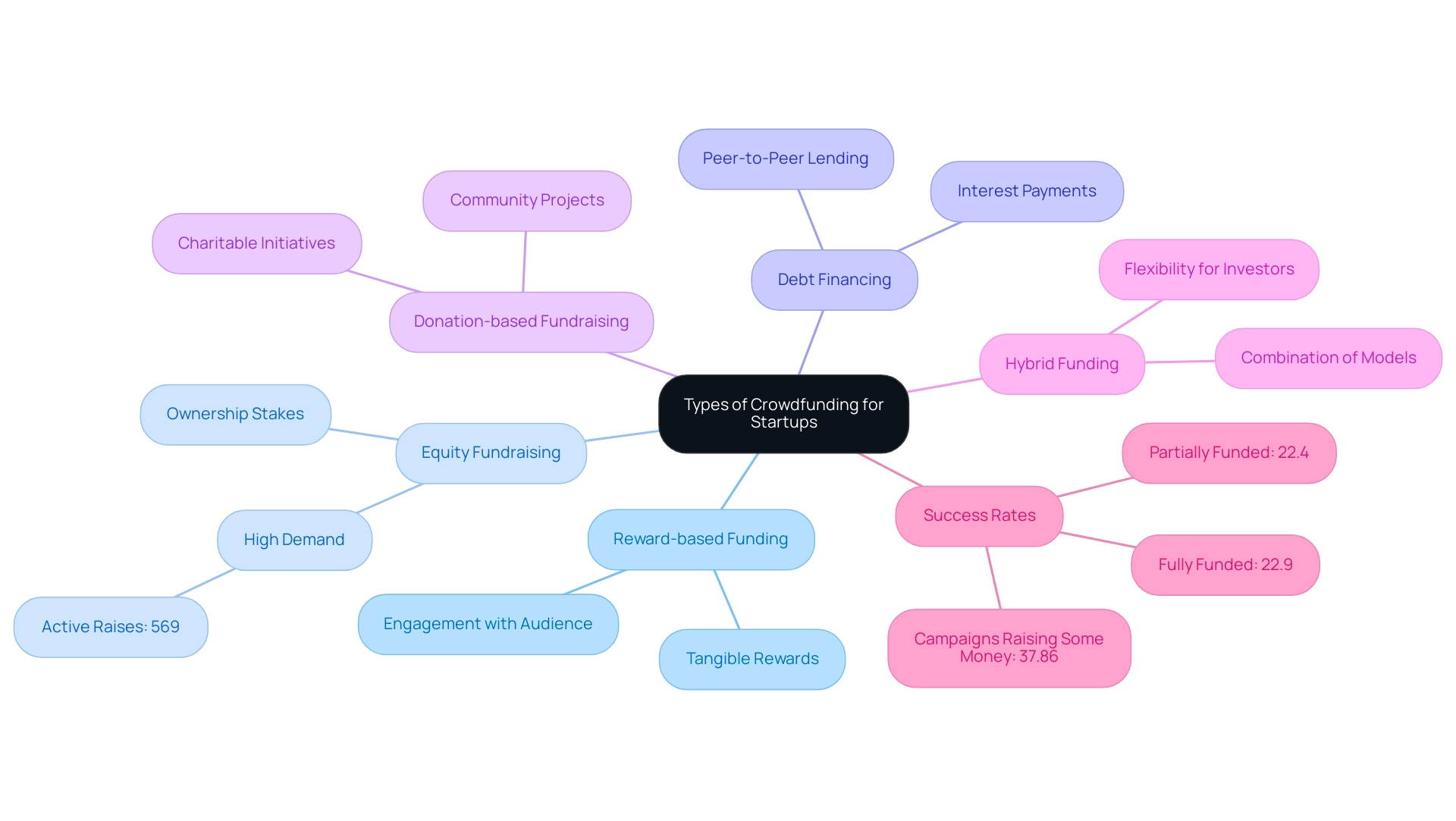

- Reward-based funding: In this model, backers contribute financial support in exchange for tangible rewards, such as products or services. This approach has gained significant traction among innovative businesses, allowing them to engage directly with their audience while generating funds.

- Equity fundraising: Investors in this category acquire shares in the company proportional to their investment. This model is particularly beneficial for new enterprises aiming to raise substantial capital while simultaneously sharing ownership stakes, thus aligning investor interests with business success. Notably, the number of active equity funding raises reached an all-time high of 569 in December 2024, underscoring its growing relevance in the fundraising landscape.

- Debt financing: Often known as peer-to-peer lending, this system enables new businesses to borrow funds from investors with a promise to return the principal along with interest. This option provides an alternative financing route, circumventing traditional banks and their associated constraints.

- Donation-based fundraising: Primarily utilized for charitable initiatives, this model involves backers donating funds without anticipation of any financial return. While not often utilized by new businesses, it can effectively support community-driven projects and social enterprises.

- Hybrid funding: Some innovative platforms combine elements from various models, allowing new ventures to provide rewards while simultaneously raising equity. This flexible approach caters to diverse investor preferences and broadens fundraising opportunities.

By comprehensively understanding these types of funding, startups can strategically tailor their fundraising efforts to align with their goals, investor expectations, and market dynamics using the best crowdfunding platforms for startups. However, it's important to note that only 22.9% of funding campaigns are fully funded, as highlighted in the case study on funding success rates, while 22.4% of all such campaigns achieve some level of success according to Zippia's statistics. These insights offer a realistic view on funding viability, further highlighting the importance of these models in contemporary fundraising.

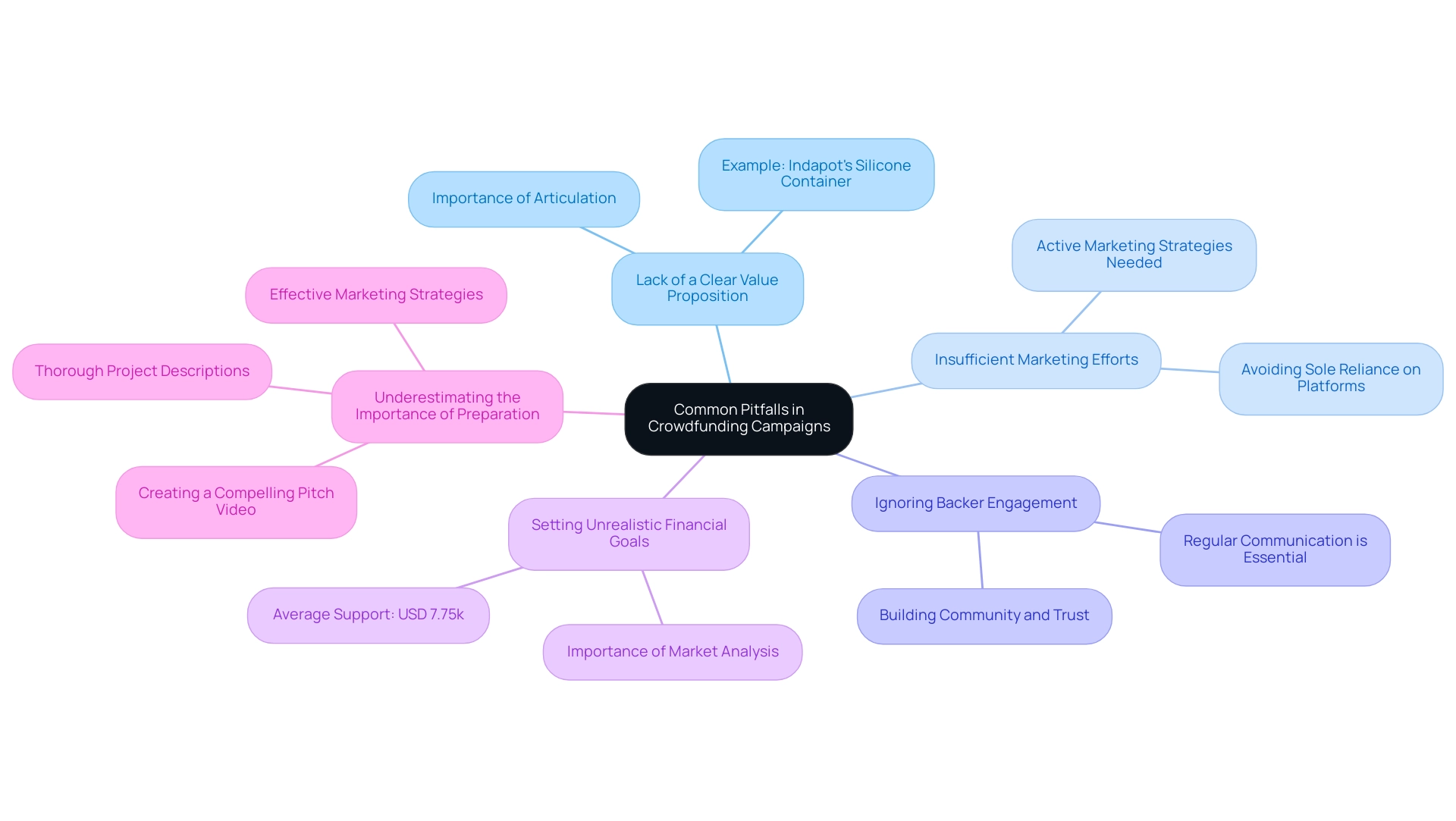

Common Pitfalls in Crowdfunding Campaigns: What Startups Should Avoid

Startups must navigate a variety of common pitfalls when embarking on funding campaigns to maximize their chances of success:

- Lack of a clear value proposition: Articulating a distinct value proposition is crucial; without it, potential backers may struggle to understand what sets the product or service apart, resulting in diminished interest. As Indapot states, 'By using a plant container made of silicone, you get the benefits of both flexibility and extreme rigidity,' illustrating how a well-defined value can attract attention.

- Insufficient marketing efforts: Relying solely on the funding platform for visibility is a significant misstep; active marketing strategies are vital for generating traffic and cultivating interest in the campaign.

- Ignoring backer engagement: Regular communication with backers is essential; neglecting to provide updates can erode support and trust. Consistent engagement fosters a sense of community and investment in the project.

- Setting unrealistic financial goals: Establishing overly ambitious monetary targets can lead to failure. With the average financial support per campaign around USD 7.75 thousand in 2023, new ventures should establish attainable objectives based on thorough market analysis to improve the chances of success.

- Underestimating the importance of preparation: A successful fundraising initiative requires meticulous planning, including the creation of a compelling pitch video, thorough project descriptions, and effective marketing strategies.

By proactively addressing these common pitfalls, new businesses can significantly enhance their prospects for executing a successful fundraising campaign on the best crowdfunding platforms for startups, securing the necessary funding to propel their growth. For instance, Crowdcube's equity crowdfunding model has successfully supported European startups in accessing necessary capital for growth, demonstrating the effectiveness of a well-prepared and strategically marketed campaign.

Conclusion

The rise of crowdfunding has transformed the startup financing landscape, providing entrepreneurs with innovative avenues to secure capital while reducing reliance on traditional funding sources. Understanding the various types of crowdfunding—such as reward-based, equity, debt, and donation-based—enables startups to tailor their fundraising strategies to align with their specific goals and market demands. Each crowdfunding platform offers unique features and benefits, making it essential for businesses to assess their options carefully based on their objectives.

While the opportunities presented by crowdfunding are significant, startups must also be aware of potential pitfalls that can hinder success. Clear communication of value propositions, effective marketing strategies, and active engagement with backers are crucial factors that contribute to a campaign's viability. Additionally, setting realistic funding goals and thorough preparation can make a substantial difference in outcomes.

In summary, navigating the crowdfunding landscape requires a strategic approach that balances the potential for growth with an awareness of inherent challenges. By leveraging the insights provided in this article, startups can effectively utilize crowdfunding as a powerful tool for financing and community engagement, ultimately positioning themselves for success in an increasingly competitive marketplace.