Overview

The article focuses on the meaning and significance of Special Purpose Vehicles (SPVs) in the context of technology investments. It explains that SPVs are separate legal entities created to manage financial risk and facilitate investment by pooling resources from various stakeholders, which enhances risk management, capital allocation, and adherence to regulatory standards, thereby making them increasingly popular among tech investors.

Introduction

The landscape of investment is continually evolving, and Special Purpose Vehicles (SPVs) have emerged as a pivotal tool in this dynamic environment. Designed to isolate financial risks and streamline investment strategies, SPVs offer a structured approach for investors looking to navigate complex markets. From facilitating startup funding to enhancing project financing and simplifying mergers and acquisitions, these vehicles serve a multitude of purposes across various sectors, particularly in technology.

As their popularity surges, understanding the intricacies of SPVs—including their types, advantages, and associated risks—becomes essential for investors aiming to maximize their returns while effectively managing potential pitfalls.

This article delves into the multifaceted world of SPVs, providing insights into their operational frameworks and real-world applications that highlight their significance in modern investment strategies.

What is a Special Purpose Vehicle (SPV)?

The term SPV meaning refers to a Special Purpose Vehicle, which is a separate legal entity created for a specific aim, mainly intended to isolate financial risk linked to certain assets. The spv meaning refers to special purpose vehicles that are often employed in financial contexts, where a group of stakeholders pools their resources to fund a particular asset or project. By effectively segregating these investments from the parent company or other personal assets of the investors, the spv meaning helps special purpose vehicles mitigate liability and shield investors from potential losses tied to the distinct investments executed via the special purpose vehicle.

In 2024, it is anticipated that the number of special purpose vehicles will keep growing each year, highlighting the spv meaning in different investment strategies. According to Table VEH0172, which contains 317 KB of data, the utilization of special purpose vehicles has shown significant growth, providing a quantitative basis for their rising popularity. Understanding the spv meaning is essential as the advantages of utilizing special purpose vehicles include:

- Enhanced risk management

- Improved capital allocation

- Adherence to evolving regulatory standards that support such structures

As mentioned by Alexander Ross, 'The remarkable story of a Highland architect,' demonstrates how specific projects can utilize special purpose vehicles to effectively handle monetary risks. Furthermore, the recent ACEA Commercial Vehicles Chairmanship, led by Christian Levin from Scania, is anticipated to affect commercial vehicle policies in Europe, showcasing the practical implications of special purpose vehicles in shaping financial landscapes.

Types of Special Purpose Vehicles and Their Uses

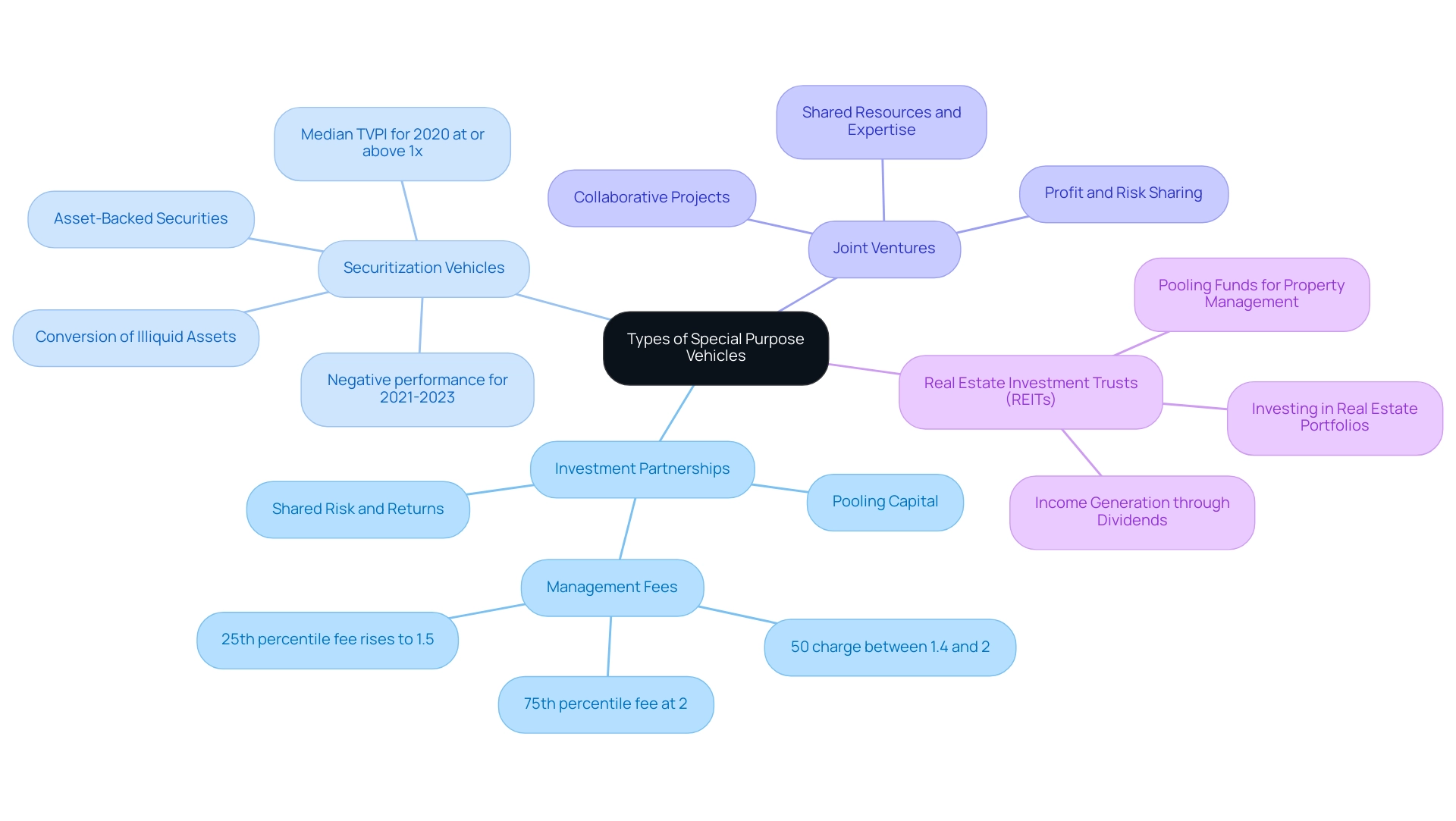

The spv meaning encompasses different kinds of Special Purpose Vehicles, each created to achieve particular financial strategies and goals. The following outlines the primary categories of SPVs:

-

Investment Partnerships: These structures are primarily established to pool capital from multiple contributors, facilitating collective investment in targeted assets.

They allow for shared risk and potential returns, making them an attractive option for investors looking for diversified exposure. Recent statistics indicate that the management fees for special purpose vehicles that charge them are consistent across sizes, with 50% of those formed in 2023 charging between 1.4% and 2%, reflecting typical fee structures.

-

Securitization Vehicles: Special Purpose Vehicles often serve as instruments to issue securities that are backed by a pool of underlying assets, such as mortgages or loans.

This process enables the conversion of illiquid assets into liquid securities, providing investors with an opportunity to invest in asset-backed securities while spreading risk. Notably, the median total value to paid-in (TVPI) for special purpose vehicles formed in 2020 was at or above 1x, contrasting with the negative performance of the 2021, 2022, and 2023 vintages, which underscores the financial significance of these vehicles.

-

Joint Ventures: In this arrangement, special purpose vehicles are created for collaborative projects between two or more parties.

Each participant contributes resources and expertise, sharing both profits and risks associated with the venture. This structure is particularly useful in large-scale projects that require significant capital and diversified skills.

-

Real Estate Investment Trusts (REITs): These SPVs allow individuals to invest in real estate portfolios without the necessity for direct property ownership.

By pooling funds to purchase and manage real estate assets, REITs provide access to the real estate market and the potential for income generation through dividends.

The spv meaning indicates that each type serves distinct purposes, allowing participants to tailor their strategies based on specific financial goals and risk appetites. As the landscape of funding partnerships continues to evolve, understanding these vehicles is crucial for making informed financial decisions. According to Michael Young, PhD, a senior data scientist at Carta, 'The development of special purpose vehicles illustrates the shifting dynamics of funding strategies, highlighting the necessity for stakeholders to remain knowledgeable about the most recent trends and frameworks in the market.

Advantages of Utilizing SPVs in Tech Investments

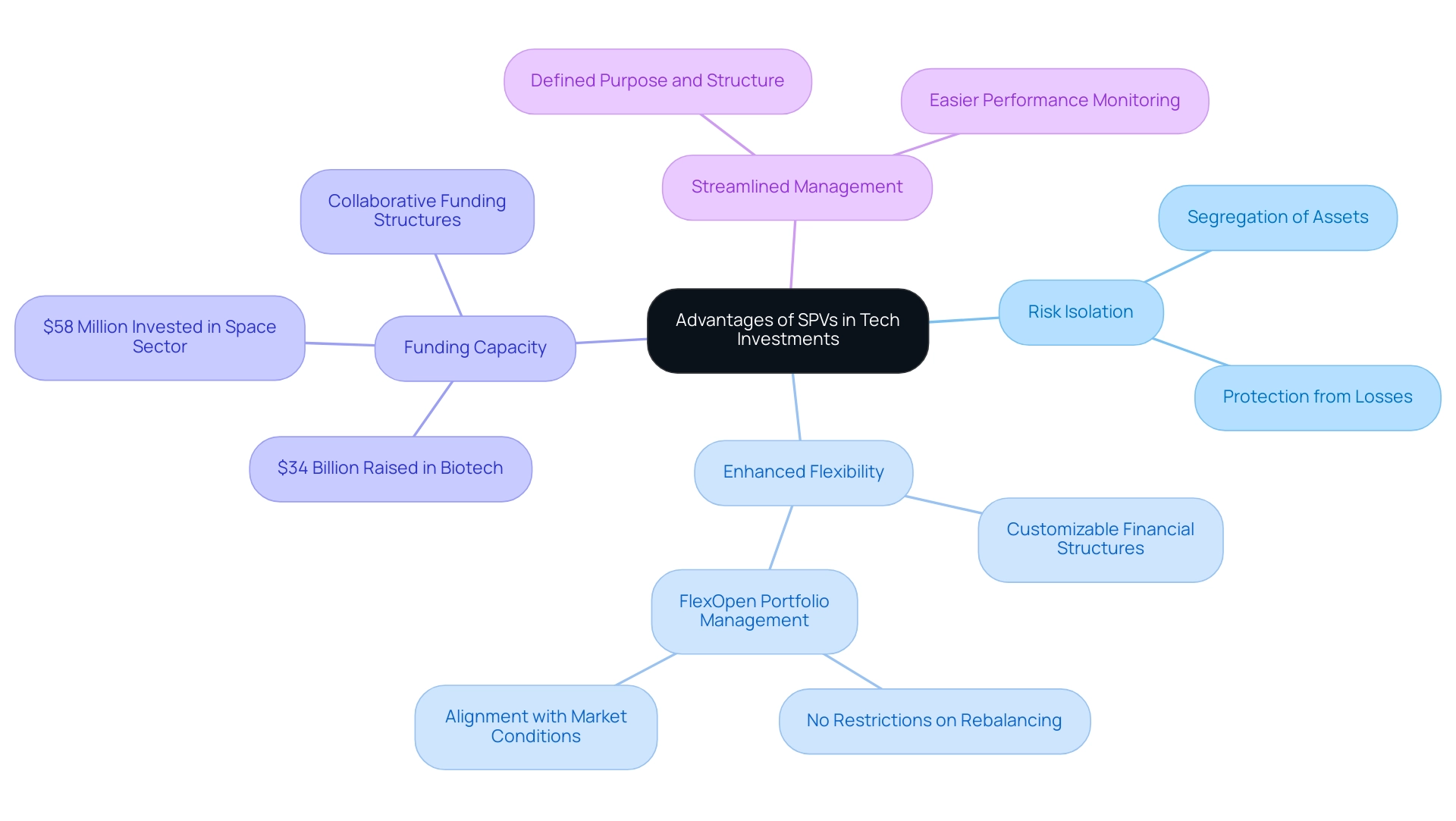

Employing Special Purpose Entities in technological ventures offers various benefits that highlight the spv meaning and can greatly improve a stakeholder's portfolio. One of the primary benefits is risk isolation; by segregating assets within an SPV, participants effectively shield their other holdings from potential losses incurred by underperforming ventures, highlighting the spv meaning in asset management. This strategic separation is crucial in a volatile sector, allowing for a more secure financial environment.

Moreover, the spv meaning indicates that special purpose vehicles offer enhanced flexibility in structuring financial contributions. They can be customized to achieve specific financial objectives and strategies, accommodating the unique requirements of each individual. The FlexOpen Portfolio exemplifies this adaptability, as it is actively managed with no restrictions on rebalancing or composition, ensuring that strategies remain aligned with market conditions.

Another significant advantage is the capacity of special purpose vehicles to draw funding, which illustrates the spv meaning in financial operations. By pooling resources from various investors, special purpose vehicles facilitate larger capital inflows into promising tech startups, thereby amplifying the potential for substantial returns. This collective approach is critical in sectors like biotechnology, where substantial funding is often necessary for innovation and growth.

For instance, from 2019 to 2022, venture capital funding in biotech startups surged, with over $34 billion raised, showcasing the appeal of collaborative funding structures. Significantly, pioneering firms like Volumetric Biotech and Ashvattha Therapeutics have gained from this surge of capital, emphasizing the spv meaning in the context of the biotech domain.

Moreover, clients have contributed a total of $58 million into the space sector via Allocations, demonstrating the financial importance of special purpose vehicles and their spv meaning in fostering funding for emerging technologies. As one pleased client mentioned, 'The collaborative method at fff.club, where over 300 minds are better than one, has changed our strategy and results.' This highlights fff.club's dedication to evaluating high-quality deals and conducting comprehensive due diligence, utilizing the knowledge of over 300 experts to guarantee each opportunity is carefully examined for its potential.

Lastly, the spv meaning highlights how SPVs streamline the management of funds. With their defined purpose and structure, they enable streamlined oversight, making it easier for stakeholders to monitor performance and manage their portfolios effectively. As the space economy continues to grow—reaching an impressive $469 billion, according to Elon Musk, Founder of SpaceX—investors are increasingly acknowledging the significance of these vehicles in navigating the complexities of technology financing while maximizing potential benefits.

Understanding the Risks Involved with SPVs

While Special Purpose Entities provide numerous advantages, understanding the SPV meaning is essential as they also involve considerable risks that stakeholders must carefully consider. These include:

-

Lack of Transparency: Many special purpose vehicles can fall short in providing comprehensive disclosures, which obscures the true nature of the investments and complicates accurate assessments for investors. This opacity can lead to misunderstandings about the actual financial health of the special purpose vehicle, highlighting the importance of understanding SPV meaning.

-

Regulatory Compliance: The regulatory landscape governing special purpose vehicles is often intricate, and understanding SPV meaning is essential as it varies from one jurisdiction to another. Non-compliance with legal and tax regulations can lead to serious consequences, as emphasized in the case study concerning the legal and tax risks associated with the spv meaning of special purpose vehicles. For instance, changes in tax laws can negate benefits and lead to unforeseen liabilities, making it crucial for companies to engage with experienced legal and tax advisors to grasp the spv meaning.

-

Market Risks: The spv meaning highlights that investments within special purpose vehicles are susceptible to market fluctuations, which can adversely impact returns. Investors must be aware of the underlying asset's volatility, as adverse market conditions can lead to substantial losses, and effective management is crucial for the success of any SPV, highlighting the importance of understanding spv meaning. Inadequate oversight can result in financial mismanagement, rendering the SPV vulnerable to losses, which underscores the spv meaning in the context of risk. Engaging skilled professionals in legal and tax advisory roles is essential to mitigate these risks, particularly as tax law changes can negate the anticipated benefits of special purpose vehicles, also known as spv meaning, and expose companies to unforeseen liabilities.

As Reena Aggarwal aptly states,

Project finance is an alternative to fund power projects, transport facilities, and other infrastructure around the world, particularly in emerging markets.

This viewpoint highlights the essential requirement for transparency and regulatory compliance in the functioning of special purpose vehicles, particularly in situations where the stakes are high, emphasizing the spv meaning. Enhancing transparency and compliance not only safeguards stakeholders but also improves the overall credibility of SPVs, highlighting the importance of understanding spv meaning in the financial landscape.

How to Set Up a Special Purpose Vehicle (SPV)

Establishing a Special Purpose Vehicle (SPV) requires a systematic approach that begins with understanding the SPV meaning, along with several critical steps.

- Define the Purpose: Begin by clearly articulating the investment objectives of the SPV. This foundational step is crucial as it guides subsequent decisions and structures.

- Choose a Legal Structure: Select an appropriate legal form for the SPV, which may include options such as a corporation or a limited liability company (LLC). The choice of structure can significantly influence operational flexibility and tax implications. Limited partnerships, for example, offer the same benefits and protections for investors as LLCs, along with additional advantages across international jurisdictions, as noted by the Carta Team.

- Draft the Operating Agreement: This essential document should comprehensively outline the governance framework, rights, and responsibilities of all stakeholders involved. It serves as a guiding blueprint for the SPV’s operations.

- Register the SPV: Complete the necessary registration by filing relevant paperwork with the appropriate regulatory authorities. This step is vital to ensure the SPV operates within legal parameters.

- Open a Bank Account: Establish a dedicated bank account specifically for the SPV, ensuring its transactions remain distinct from personal or other business accounts. This separation is important for clear fiscal management and reporting.

- Fund the SPV: Secure initial funding from investors to initiate operations. It is advisable to consult with financial professionals to navigate the complexities of funding, particularly in tax-neutral jurisdictions such as the British Virgin Islands (BVI), which do not impose corporation tax, income tax, capital gains tax, inheritance tax, or gift tax on companies.

In addition to these steps, it is recommended to seek professional advice to effectively navigate the intricate tax regulations and implications associated with special purpose vehicles, or SPV meaning. The application of special purpose vehicles by venture capitalists emphasizes their adaptability; they optimize for liquidity, asset diversification, or fund reputation when a deal does not align with their fund's financial strategy. This real-world application highlights the practical relevance of special purpose vehicles in the investment landscape.

As noted, limited partnerships offer significant advantages, reinforcing the importance of selecting the right legal structure to maximize the benefits of an SPV.

![]()

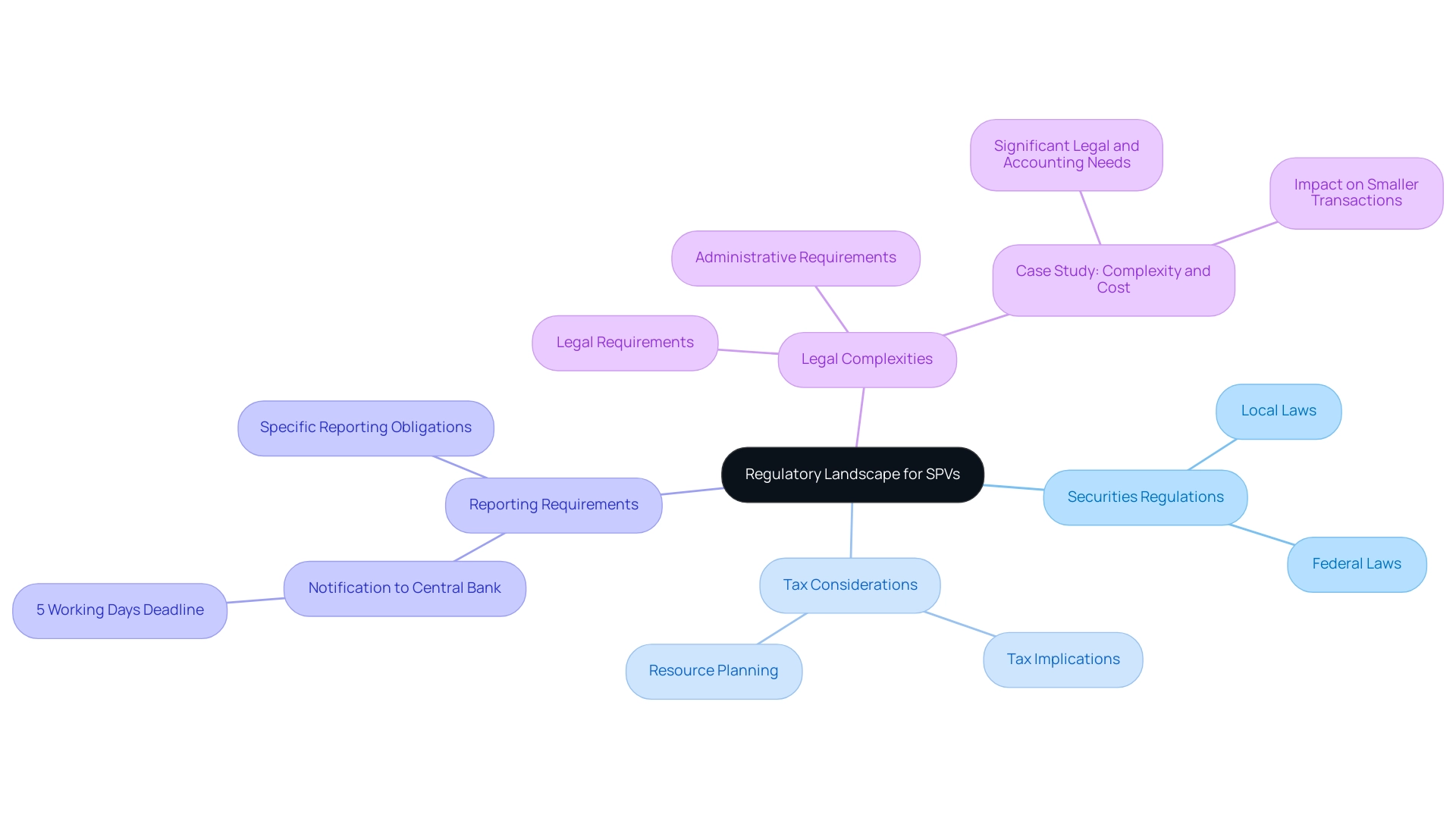

Navigating the Regulatory Landscape for SPVs

Investors must have a comprehensive understanding of the regulatory landscape surrounding Special Purpose Vehicles (SPVs), which encompasses several critical areas:

- Securities Regulations: Depending on the nature of their offerings, SPVs may be obligated to comply with a range of local and federal securities laws. This compliance can involve intricate requirements that vary significantly by jurisdiction, necessitating a nuanced understanding of the regulatory framework.

- Tax Considerations: It is imperative for investors to grasp the tax implications associated with the concept of spv meaning. This understanding is essential for effective resource planning and can significantly influence the overall economic outcome of utilizing an SPV, which is important to grasp the spv meaning.

- Reporting Requirements: The spv meaning includes the specific reporting obligations that Special Purpose Vehicles may face, which are imposed by regulatory authorities and vary based on the jurisdiction in which they operate. Notably, a notification email must be dispatched to the Central Bank within five working days following the SPV's first financial transactions.

Additionally, it is important to note that 220 special category (SCat) codes are defined as excluded from floorspace statistics, which can impact the regulatory considerations for special purpose vehicles. Engaging legal counsel or a compliance expert is strongly recommended to effectively navigate these complexities and understand spv meaning. As Michael Killourhy notes,

Ogier is a professional services firm with the knowledge and expertise to handle the most demanding and complex transactions and provide expert, efficient and cost-effective services to all our clients.

This insight emphasizes the significance of professional guidance in managing the complexities of special purpose vehicles.

Moreover, the SPV meaning is important to grasp, as setting up and maintaining an SPV involves significant legal, accounting, and administrative requirements, as illustrated in the case study titled "Complexity and Cost." These complexities and costs can diminish the financial benefits of using an SPV, particularly in smaller transactions. While special purpose vehicles provide advantages such as risk isolation and asset protection, careful management of these factors is crucial for maximizing their benefits.

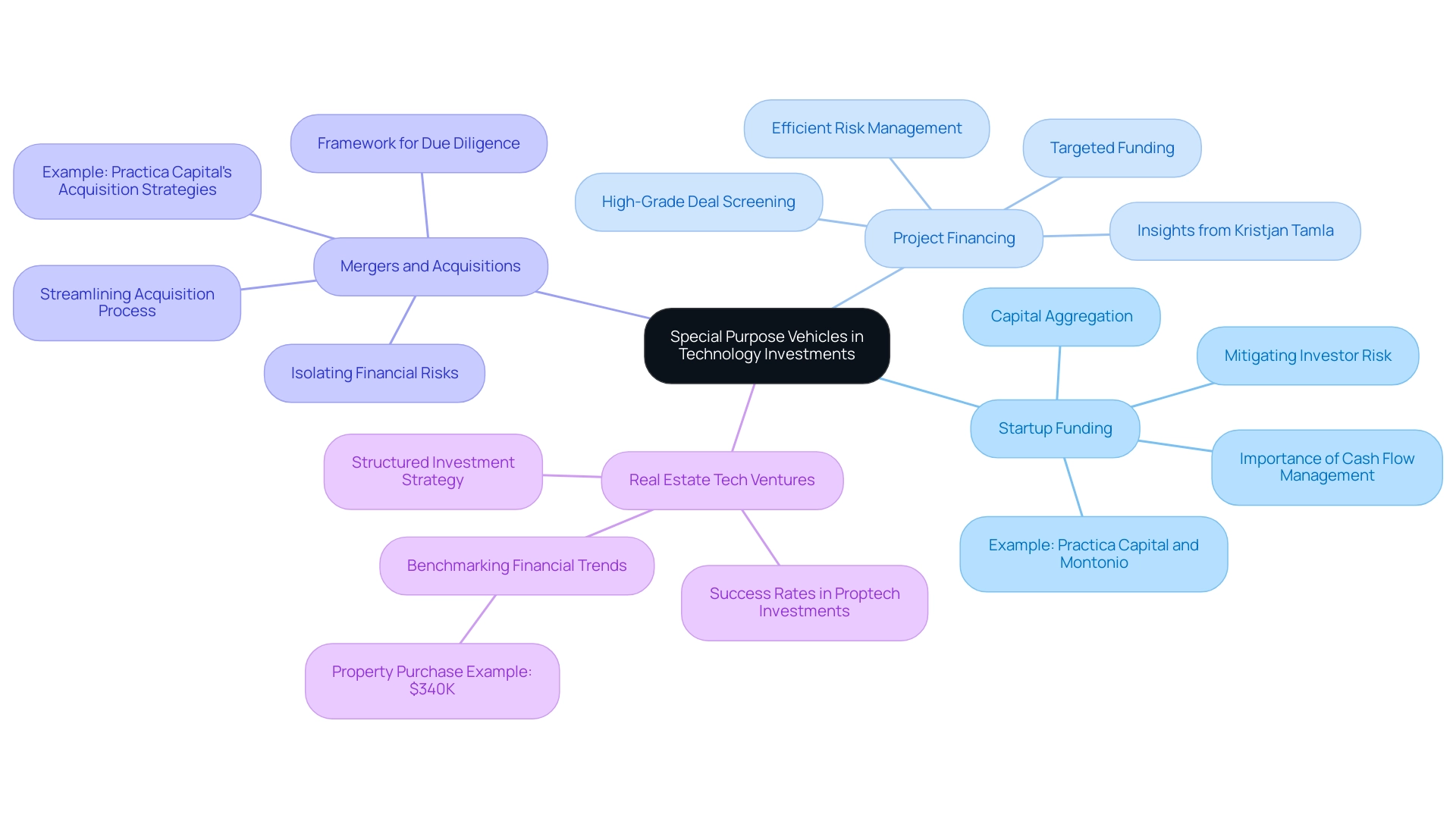

Real-World Applications of SPVs in Technology Investments

Real-world applications of Special Purpose Vehicles in technology financing demonstrate their versatility and strategic importance in various aspects of the tech landscape:

- Startup Funding: Tech startups frequently utilize these vehicles to aggregate capital from multiple investors, which not only diversifies funding sources but also mitigates individual investor risk. By pooling resources, startups can access larger amounts of capital, essential for their growth and innovation. This method has gained traction, particularly in recent years, as startups seek to navigate the competitive funding environment. As emphasized by Baltic funding leaders like Donatas Keras and Kristjan Tamla, effective capital management is crucial, particularly since numerous companies that collapsed in 2023 did so because of cash flow issues, highlighting the essential role that spv meaning plays in ensuring stability. For instance, Practica Capital's backing of Montonio showcases how SPVs can facilitate substantial funding for promising startups.

- Project Financing: SPVs can be specifically established for distinct projects, such as the development of advanced software applications. This structure enables targeted funding and efficient risk management, as investors can evaluate the viability and specific risks related to the project without exposing themselves to the broader financial liabilities of the parent company. Collaborative investment platforms like fff. Club emphasize the importance of high-grade deal screening and due diligence, enhancing the likelihood of successful outcomes in project financing. Kristjan Tamla’s insights on project financing emphasize the significance of comprehensive assessments in reducing risks.

- Mergers and Acquisitions: In the field of technology mergers and acquisitions, special purpose vehicles play a crucial role in streamlining the acquisition process. By isolating financial risks and liabilities associated with the target company, special purpose vehicles facilitate smoother transactions and provide a clearer framework for due diligence. This approach has been increasingly adopted as tech companies look to expand their capabilities through strategic acquisitions, which aligns with the spv meaning in their growth strategies. For example, the acquisition strategies employed by Practica Capital demonstrate how SPVs can be leveraged to navigate complex transactions effectively.

- Real Estate Tech Ventures: The intersection of real estate and technology, commonly referred to as proptech, has experienced substantial funding through SPVs. These vehicles enable individuals to participate in proptech startups with a structured and clear investment strategy. For example, a property purchased in 2019 for $340K can serve as a benchmark for evaluating the financial trends in this sector. As the proptech market continues to evolve, special purpose vehicles serve as a vital tool for investors looking to capitalize on this burgeoning sector. Testimonials from industry leaders further illustrate the success rates of such investments.

Overall, the application of SPVs in technology investments not only provides a framework for effective capital raising but also enhances strategic risk management, making them a vital component in the landscape of tech investment.

Conclusion

The exploration of Special Purpose Vehicles (SPVs) reveals their significant role in modern investment strategies. By isolating financial risks, SPVs enable investors to engage in diverse investment opportunities while protecting their broader financial interests. Various types of SPVs, including:

- Investment partnerships

- Securitization vehicles

- Joint ventures

cater to specific investment needs, illustrating their versatility in adapting to different financial goals.

The advantages of utilizing SPVs in technology investments are particularly noteworthy. They provide:

- Enhanced flexibility

- Attract larger capital inflows

- Simplify investment management

However, it is essential to remain cognizant of the potential risks associated with SPVs, such as:

- Lack of transparency

- Regulatory compliance challenges

A thorough understanding of these risks, along with careful planning and professional guidance, can help investors navigate the complexities involved.

Ultimately, the effective utilization of SPVs can lead to substantial benefits in technology investments, from startup funding to project financing and mergers and acquisitions. As investment landscapes continue to evolve, the strategic application of SPVs will likely remain a critical component for investors seeking to maximize returns while managing risks effectively. Understanding how to set up and operate SPVs, along with navigating the regulatory environment, is vital for anyone looking to leverage these vehicles in their investment strategies.