Overview

Series E funding is a critical phase in a startup's financial journey, aimed at scaling operations and preparing for an IPO, which highlights the company's maturity and proven business model. The article elaborates on the significance of this funding round by detailing the substantial investments from institutional backers, the importance of clear financial metrics, and the need for startups to effectively communicate their growth strategies and market positioning to attract potential investors.

Introduction

In the evolving landscape of startup financing, Series E funding emerges as a critical phase for companies poised for significant growth. Following the earlier rounds of investment, this stage not only reflects a startup's maturity but also its readiness to scale operations and enhance market presence. As venture capitalists and institutional investors increasingly back these ventures, understanding the nuances of Series E funding becomes essential for startups aiming for a successful trajectory, including preparations for potential public offerings.

This article delves into the intricacies of Series E funding, exploring:

- Its importance

- The distinctions from previous funding rounds

- Key considerations for startups

- Strategies for navigating the challenges that arise during this pivotal phase

With insights from industry experts and real-world examples, it offers a comprehensive guide for startups looking to leverage this funding to secure their future in a competitive market.

What is Series E Funding and Why is it Important?

Round E financing acts as a crucial milestone in a new venture's financial development, taking place after a company has effectively managed prior stages—A through D. This phase is marked by new enterprises aiming to greatly expand their operations, increase their market presence, or strategically prepare for an initial public offering (IPO). As new businesses reach this level of maturity, they often attract substantial investments from venture capitalists and private equity firms, signaling a viable business model with promising return potential. A significant instance is Airtable, which obtained an impressive $735 million in its Series F round in December 2021, emphasizing the strong investment activity in the emerging business environment.

According to projections for 2024, the IPO market is expected to witness nearly 150 new listings, an increase from 108 in 2023, reflecting a growing interest in established companies. However, this does not necessarily correlate to a rise in mergers and acquisitions (M&A) activity. Furthermore, Healy Jones, VP of Financial Strategy, emphasizes the significance of various factors in determining a company's value during investment rounds, stating,

Of course, things like revenue and revenue momentum can help change a company’s value at a fund raise - although not as much as a charismatic CEO or hot market, in my experience.

Moreover, FinTech companies encounter considerable obstacles related to customer acquisition expenses, which can influence their financing approaches. As new enterprises consider their growth path and investment needs at this pivotal moment, understanding the intricacies of series E financing becomes essential for sustaining upward momentum.

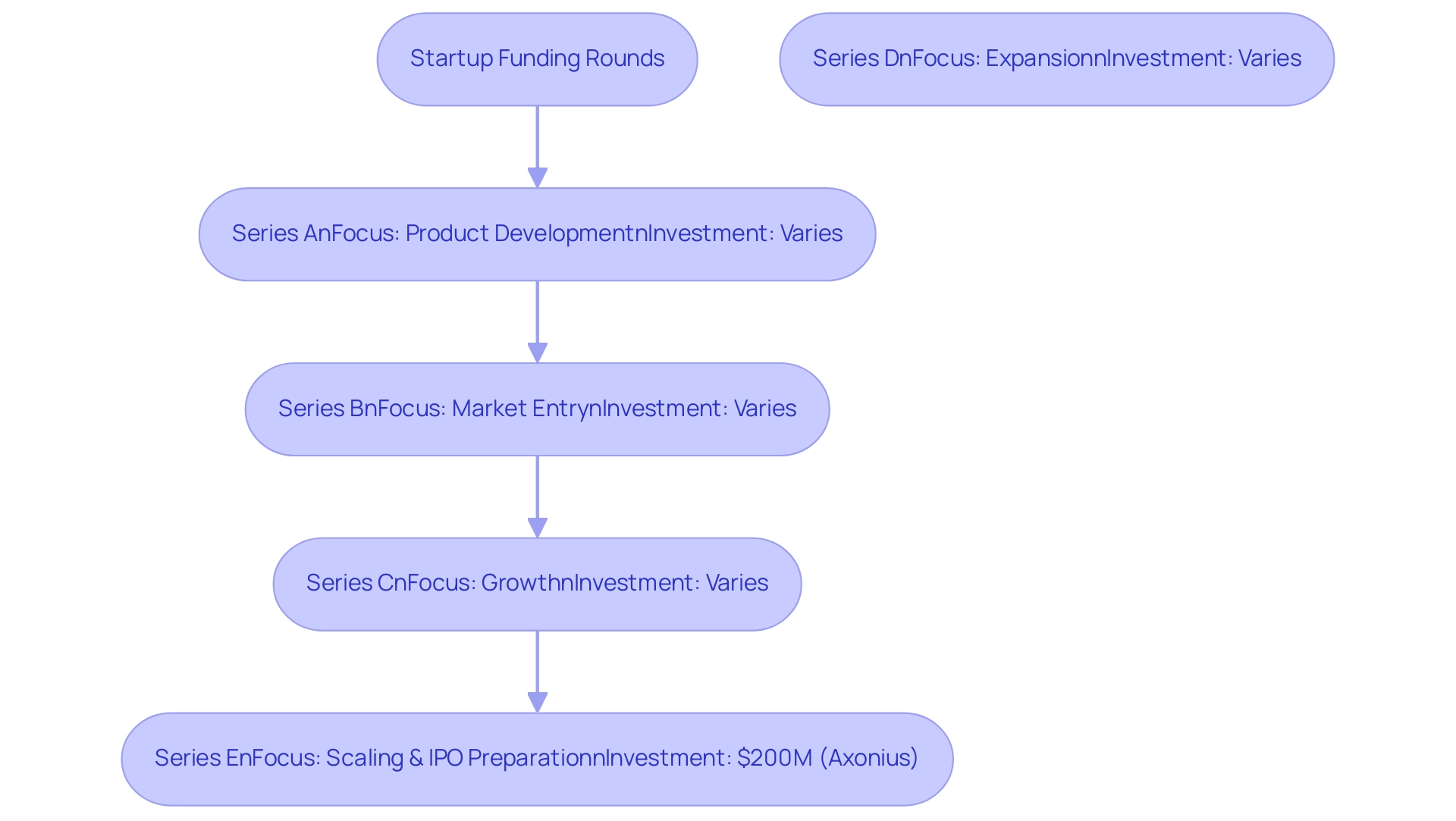

Understanding the Distinctions of Series E Funding

E round capital signifies a major advancement in the financing environment for new businesses, characterized by greater investment sums, frequently obtained from institutional backers rather than private angel investors. This shift highlights the maturity of the company, as these later rounds are typically characterized by substantial financial backing. Whereas Series A through D funding rounds primarily focus on product development and market entry, the objective of Series E is to scale operations and enhance the market presence of the company.

At this stage, startups generally command higher valuations, reflecting their proven business models and established customer bases. For instance, a $2 million investment at a $10 million post-money valuation translates to a 20% ownership stake, exemplifying the financial dynamics at play and highlighting the increased confidence from investors compared to earlier rounds. Moreover, the purpose of raising a round E often includes securing additional capital for enhancing product offerings, entering new markets, hiring personnel, or preparing for a public offering.

A notable example is the Series E investment, specifically the Series E extension round for Axonius, a cybersecurity asset inventory platform, which successfully raised $200 million, matching the size of its previous Series E investment. This consistency in funding size suggests stability and sustained interest from backers, with Axonius likely utilizing this capital for market expansion and product enhancement. As Schroter aptly noted, investors are increasingly focused on putting massive sums of money into companies that are already winning to secure their leadership positions.

Additionally, it is essential to recognize that new business founders, particularly those with ADHD, may face unique challenges in navigating the complexities of fundraising and scaling their enterprises. Thus, Series E investment is not only pivotal for operational readiness but also critical for companies contemplating an IPO, as it strengthens their financial foundation in preparation for the heightened scrutiny of public markets.

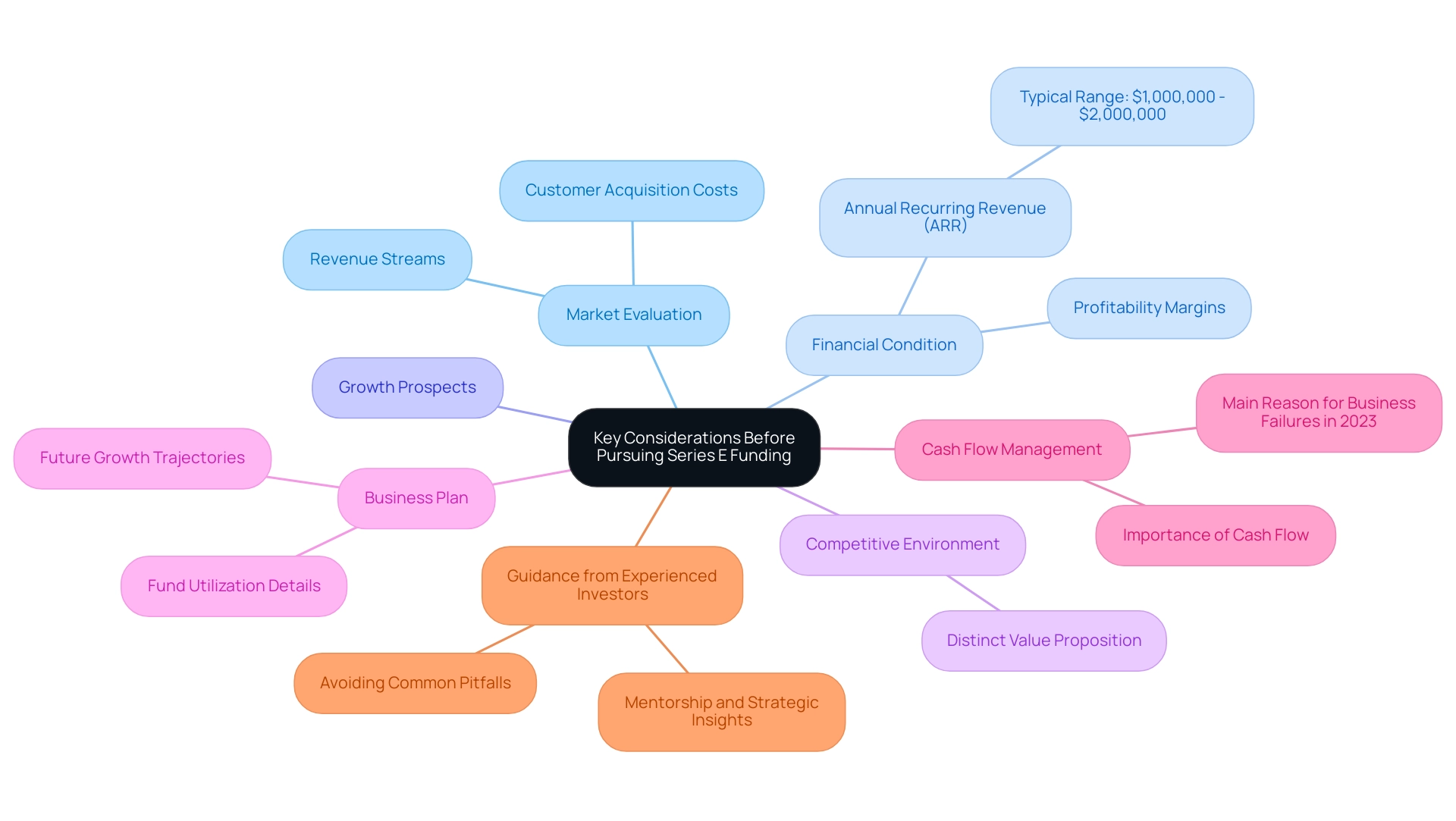

Key Considerations Before Pursuing Series E Funding

Before initiating round E investment, companies must perform a thorough evaluation of their market standing, financial condition, and growth prospects. It is vital to evaluate existing revenue streams, customer acquisition costs, and profitability margins. A benchmark to consider is that a Series A company's Annual Recurring Revenue (ARR) typically falls between $1,000,000 and $2,000,000, which helps in understanding financial health in the context of Series E.

Comprehending the competitive environment is just as crucial; new ventures must express their distinct value proposition clearly to draw in possible backers. A robust business plan that outlines future growth trajectories and details on fund utilization is essential for garnering interest from institutional backers. Furthermore, new ventures should stay keenly aware of the timing of their funding round, as market conditions greatly affect backer sentiment and the probability of funding success.

According to Nadia Basaraba, a Marketing Specialist at Coupler.io, "I’m passionate about content creation and data-driven marketing," emphasizing the importance of data-driven strategies in effectively assessing market position. Additionally, a focus on cash flow management is critical, as cash flow problems were identified as the primary reason for business failures in 2023. Effective approaches for new ventures also encompass utilizing guidance from veteran investors, as emphasized in the case study 'Guidance from Experienced Investors,' where seasoned financiers involved in series E provide priceless mentorship and strategic insights.

This guidance assists new ventures in avoiding common pitfalls during the pre-IPO stage, ultimately enhancing their chances of a successful public launch through fine-tuned business models and optimized market strategies.

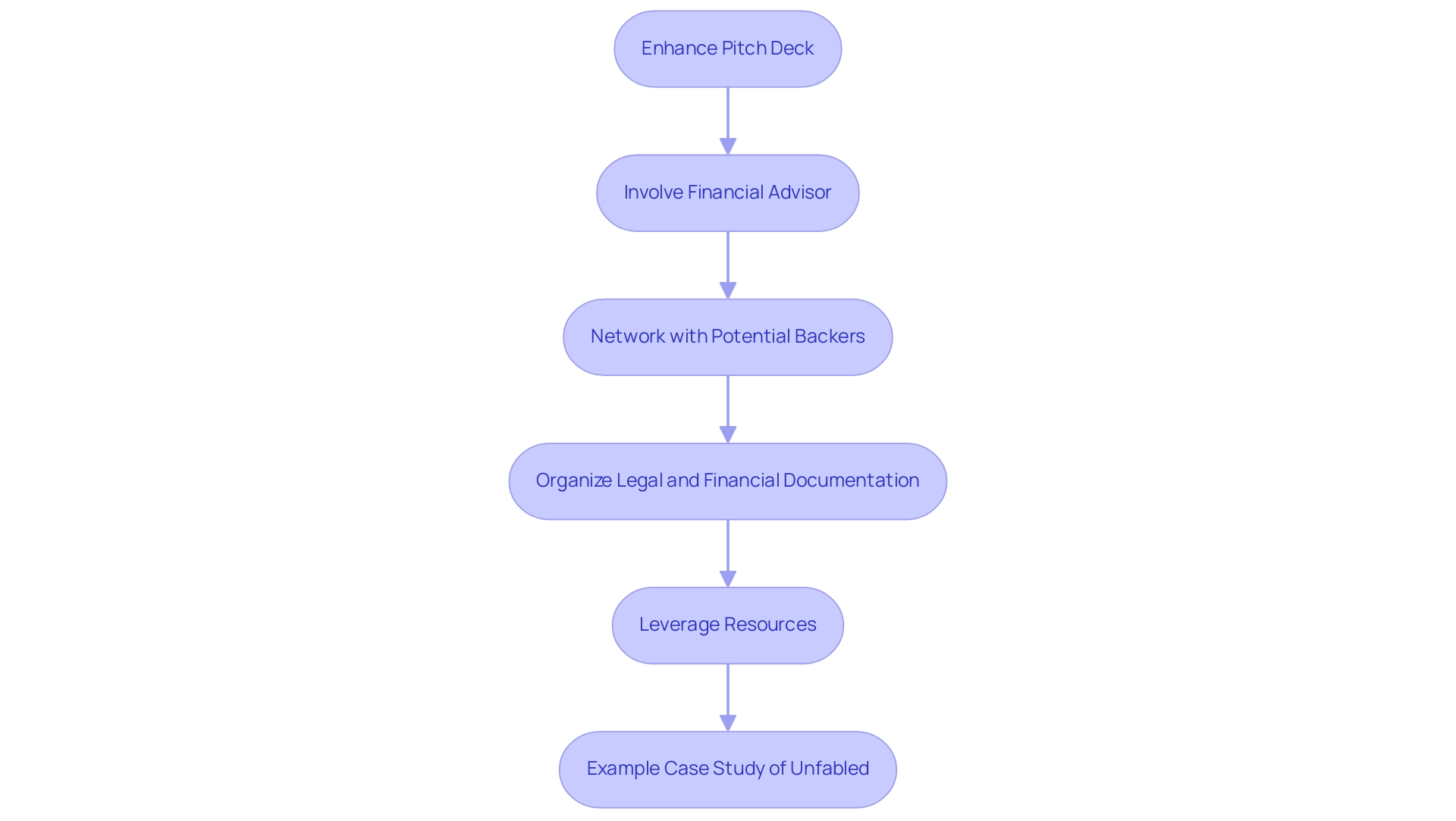

How to Prepare for a Successful Series E Funding Round

To successfully navigate a Series E investment round, companies must prioritize enhancing their pitch deck to effectively convey their business model, growth metrics, and strategic plans for utilizing the newly acquired capital. Essential elements of a successful pitch deck include clear financial performance metrics, such as revenue growth, user engagement statistics, and market share analysis. Notably, research indicates that subscription businesses expand five times quicker than traditional one-time purchase models, underscoring the significance of demonstrating a sustainable growth trajectory.

Involving a financial advisor or consultant can be invaluable in developing a persuasive narrative that emphasizes the venture's unique value proposition and growth story. Furthermore, proactive networking with potential backers before the funding round can provide significant advantages. This involvement enables new businesses to assess financial backer interest and obtain valuable feedback on their proposals, which can be crucial in enhancing their strategy.

Legal and financial documentation must also be meticulously organized, as this preparation will streamline the due diligence process and facilitate smoother discussions with stakeholders. This organization is essential, and leveraging available resources and platforms can significantly aid founders in developing effective pitch decks.

A relevant example is Unfabled, a company that successfully raised $1.6 million by tackling important women's health issues. They effectively utilized social media to demonstrate demand, showcasing the power of a well-structured pitch deck and a concise narrative in attracting potential backers. As new ventures approach their Series E round of financing in 2024, incorporating these strategies will be essential for improving their likelihood of success.

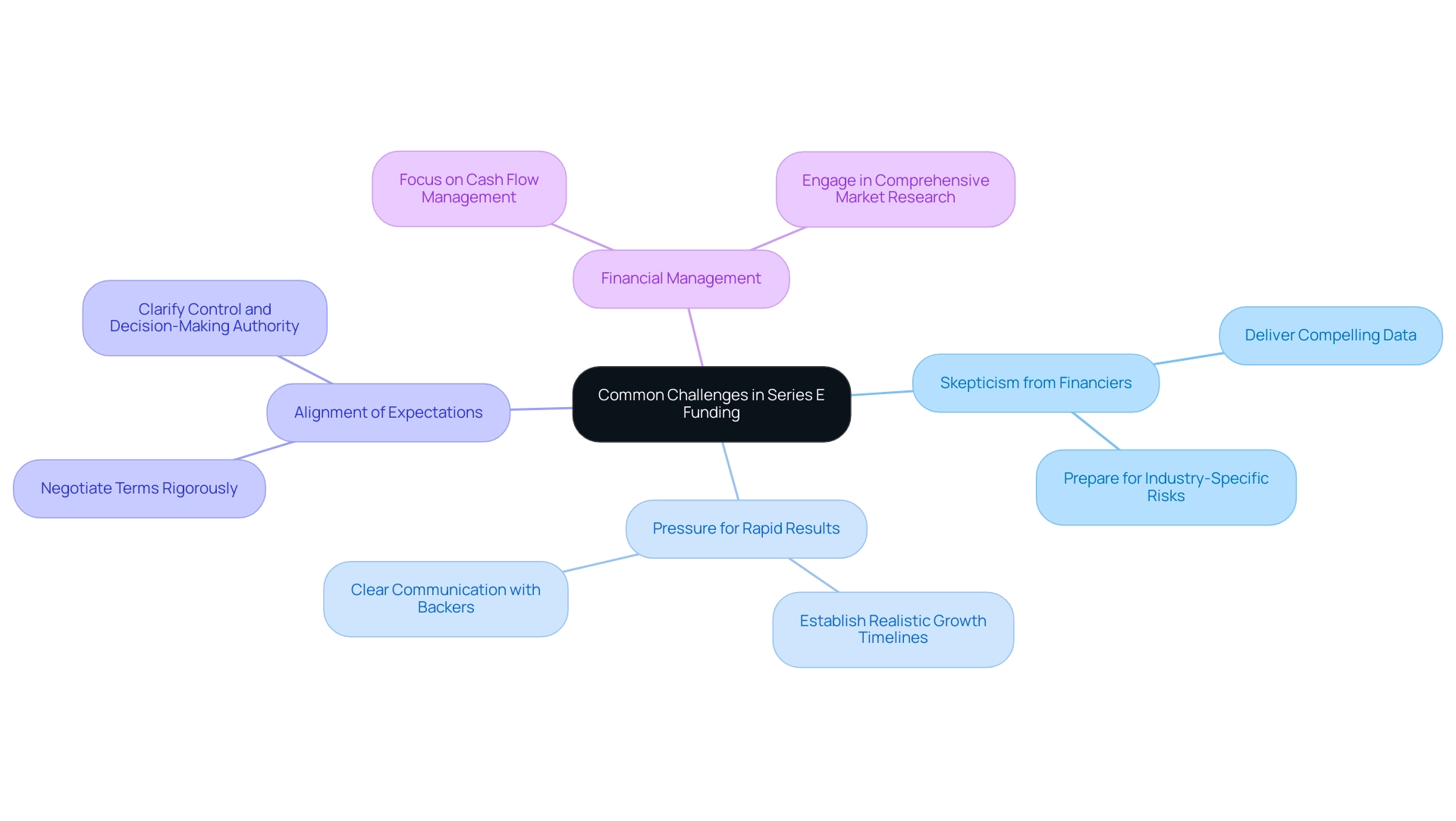

Common Challenges in Series E Funding

Navigating Series E financing presents significant challenges for new ventures, notably heightened skepticism from financiers regarding valuation and growth potential. In this critical stage, as companies pursue elevated valuations, they must deliver compelling data to substantiate their claims. This is especially vital considering that many financiers remain wary; reports suggest that doubt among capital providers has increased, particularly regarding new ventures' preparedness to handle industry-specific risks.

In 2024, M&A activity involving VC-supported companies has increased, reflecting a changing environment that backers are closely observing. Aligning expectations between founders and investors can also prove difficult, particularly regarding control and decision-making authority post-funding. Furthermore, new ventures face immense pressure to demonstrate rapid results, a pressure that can be overwhelming and detrimental to strategic planning.

Indeed, in 2023, numerous companies that collapsed pointed to cash flow issues as a main reason, highlighting the significance of financial management during series E investment. To effectively tackle these challenges, new businesses should prioritize clear communication with prospective backers, prepare to negotiate terms rigorously, and establish realistic growth timelines. Additionally, engaging in comprehensive market research can yield valuable insights, enhancing their position during negotiations and enabling them to counter skepticism effectively.

The achievements of FinTech companies, which secured an impressive $31.1 billion in capital between 2022 and 2024, demonstrate that with effective strategies, managing the intricacies of series E financing can enhance confidence among backers.

Post-Series E Funding: What to Expect

Upon successfully securing Series E, new ventures should prioritize the execution of their growth strategies as outlined in their funding proposals. This phase typically involves:

- Scaling operations

- Recruiting skilled talent—including those adept in data engineering, reflecting the evolving nature of customer success roles

- Amplifying marketing initiatives to expand market share

Creating a strong communication strategy with stakeholders is crucial; new ventures must offer regular updates on their progress and significant milestones.

Furthermore, maintaining financial discipline is crucial, as effective allocation of funds is necessary to foster sustainable growth. Startups must also be prepared for heightened scrutiny from investors, who will expect transparency and accountability regarding fund utilization and overall performance. Gaining insight from the shortcomings of other enterprises is crucial; as emphasized by CBInsights, nearly 29% of new business failures arise from depleting resources, highlighting the significance of strategic financial management.

Furthermore, comprehending the competitive environment is crucial, as shown by the global VC investment distribution, where North America leads with just over 50% of the total. Effectively leveraging the advantages of series E funding can significantly enhance a startup's competitive positioning, paving the way for substantial success in an increasingly challenging market landscape.

Conclusion

Series E funding represents a critical juncture for startups ready to scale and enhance their market presence. This funding phase not only indicates a company's maturity but also its potential for substantial growth, often leading to preparations for an initial public offering. As highlighted, Series E funding differs significantly from earlier rounds, characterized by larger investments from institutional investors, which reflects increased confidence in the startup’s business model and operational stability.

Startups must carefully assess their market position, financial health, and growth trajectories before pursuing Series E funding. A well-structured pitch deck, proactive networking with investors, and meticulous organization of legal and financial documents are pivotal steps in the preparation process. Understanding the challenges that come with this funding stage, such as investor skepticism and the pressure for rapid results, is equally crucial. By addressing these challenges head-on and maintaining transparent communication, startups can enhance their chances of securing the necessary capital.

Ultimately, successfully navigating Series E funding lays the groundwork for future growth and expansion. The ability to execute well-defined strategies, maintain financial discipline, and engage effectively with investors will be essential for startups as they leverage this vital funding to solidify their position in a competitive market. With the right approach, Series E funding can serve as a powerful catalyst for achieving long-term success.