Overview

The article focuses on the various funding types available to entrepreneurs, emphasizing the importance of understanding these options to enhance business success. It details funding methods such as bootstrapping, angel investing, venture capital, crowdfunding, and more, while highlighting the critical factors entrepreneurs should consider—like business stage, industry, financial goals, and control—when selecting the most suitable funding type for their specific needs.

Introduction

In the competitive landscape of entrepreneurship, securing adequate funding is often a decisive factor in a startup's success or failure. With a staggering 90% of startups failing due to mismanagement of funds or market demands, understanding the diverse funding options available is essential.

From bootstrapping and angel investors to venture capital and crowdfunding, each funding avenue presents unique advantages and challenges that can significantly influence a business's trajectory. As the market evolves, particularly in regions like the Baltics and Nordics, entrepreneurs must navigate these options with a strategic mindset, aligning their funding choices with their specific business needs and growth ambitions.

This article delves into the various funding types, factors to consider when selecting the right option, and the critical steps for preparing a compelling funding proposal, equipping entrepreneurs with the knowledge needed to thrive in today's dynamic environment.

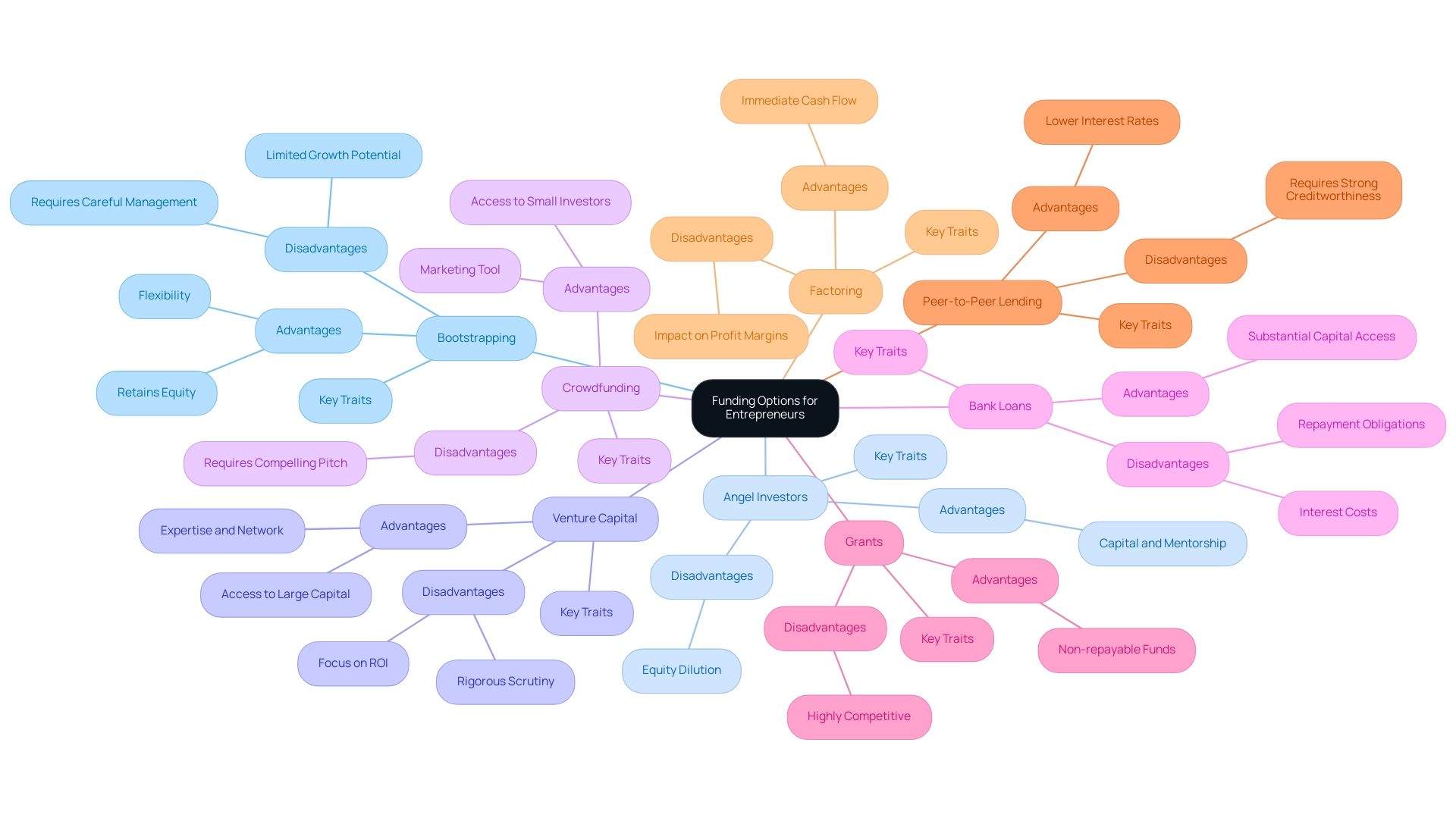

Exploring Diverse Funding Options for Entrepreneurs

Entrepreneurs today have various financial choices available, each with distinct traits that can considerably impact outcomes. Grasping these choices is essential for maneuvering through the present environment efficiently, particularly given that around 90% of startups fail due to misinterpreting market demand or exhausting their resources. Recent data shows that 82% of businesses that failed did so due to cash flow issues, emphasizing the significance of effective cash flow management in financial decisions.

As recent venture capital updates demonstrate, there is a dynamic market for investments and innovations, particularly in the Baltics and Nordics, where financial highlights reflect the evolving landscape. For instance, Plural's recent €4.6M investment in Moon and the acquisition of Hisa by Startup Wise Guys exemplify the active financial environment in these regions. Here is an overview of some prevalent funding type options:

- Bootstrapping: This method involves using personal savings or revenue generated from the business itself to finance operations. While it grants founders complete control over their ventures, it may restrict growth potential if funds become inadequate. The advantages of bootstrapping include retaining equity and flexibility, though it demands careful financial management.

- Angel Investors: Typically affluent individuals, angel investors provide capital in exchange for equity and often offer valuable mentorship. Their support can be instrumental for startups looking to establish a foothold in competitive markets.

- Venture Capital: Professional investors in this category concentrate on high-growth sectors, providing support to startups in exchange for equity. This approach usually entails rigorous scrutiny of the business model and a strong emphasis on return on investment (ROI), making it vital for entrepreneurs to prepare thoroughly for potential investor inquiries. Recent reports of substantial investments, such as Plural's €4.6M in Milton or Pocketlaw’s support for AI-driven legal tech, highlight the ongoing interest in innovative startups in the Baltics and Nordics.

- Crowdfunding: Entrepreneurs can raise small amounts of money from a large audience, often via online platforms. This method not only serves as a funding source but also acts as a marketing tool, provided the pitch is compelling enough to attract backers.

- Bank Loans: Conventional financing from banks necessitates a robust plan and collateral, enabling entrepreneurs to obtain substantial amounts of capital. However, the repayment obligations and interest can pose challenges, especially for new businesses.

- Grants: These are non-repayable funds awarded by government bodies or organizations, typically requiring applicants to meet specific criteria. Although competitive, grants can provide a substantial boost to startups without the burden of repayment.

- Peer-to-Peer Lending: This method involves borrowing from individual lenders through online platforms, effectively bypassing traditional banking systems. It often features lower interest rates compared to credit cards, though it may necessitate strong creditworthiness.

- Factoring: By selling accounts receivable to a third party at a discount, companies can raise immediate cash to address urgent cash flow needs. While this can be advantageous for sustaining liquidity, it may negatively impact profit margins.

A thorough comprehension of these financial options enables entrepreneurs to evaluate which funding type aligns best with their business model and growth strategy. As noted by industry experts, recognizing potential pitfalls early on can significantly improve a startup's chances of success in an increasingly competitive environment. Furthermore, with the global quantum computing market size projected to grow from $470 million in 2021 to $1,765 million in 2026, entrepreneurs should stay informed and adaptable to utilize emerging financial opportunities in this sector.

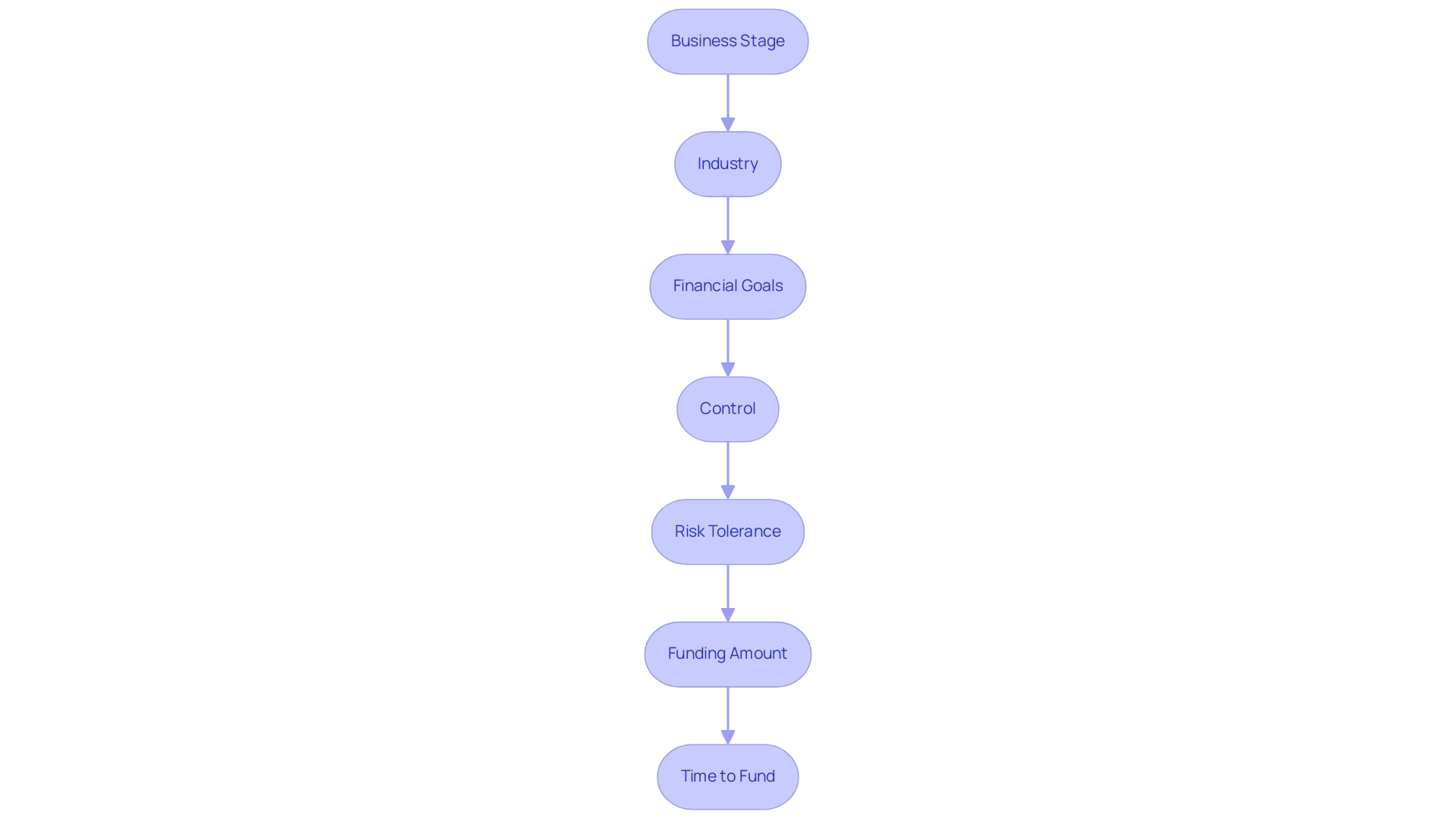

Choosing the Right Funding Type for Your Business Needs

Selecting the appropriate financial type for a startup necessitates a thorough evaluation of several vital factors:

- Business Stage: The stage of a startup significantly influences funding options. Early-stage ventures may find angel investors or crowdfunding more beneficial, while established businesses often prefer bank loans or venture funding to facilitate expansion.

- Industry: Different sectors attract distinct investor types. For instance, tech startups usually pursue venture funding due to their potential for rapid growth and innovation. Recent data suggests that approximately 31% of commercial real estate investors are intending to invest in proptech companies, highlighting the industry-specific trends in financial support. This aligns with the growing interest in technology-driven solutions across various sectors, including real estate.

- Financial Goals: It is crucial to clarify whether immediate capital is required for operational costs or if long-term investments for growth are needed. This distinction can determine which funding type to pursue, whether it is equity or debt financing.

- Control: Entrepreneurs must consider their willingness to relinquish control. Equity financing often entails sharing decision-making authority, whereas debt financing allows for complete control, but requires timely repayment.

- Risk Tolerance: Evaluating one’s risk tolerance is crucial when exploring various funding types. Venture funding, while potentially lucrative, brings significant performance pressure and expectations. A staggering 29% of startup failures can be traced to situations where a new business runs out of personal money and funding, underscoring the critical need for adequate financial backing.

- Funding Amount: Identifying the necessary resources is critical. Some sources, such as crowdfunding, may not yield substantial sums, while venture capital can provide significant investments necessary for robust growth.

- Time to Fund: Entrepreneurs should evaluate their urgency for funds. While traditional bank loans may involve lengthy approval processes, crowdfunding can produce quicker results if the pitch resonates with potential backers.

Additionally, considering the broader market context, the global quantum computing market is forecasted to expand from $470 million in 2021 to $1,765 million in 2026, highlighting the potential for substantial returns in tech investments. By thoroughly evaluating these elements, entrepreneurs can align their investment decisions with their objectives and monetary strategies, enhancing their likelihood of success in the competitive startup landscape.

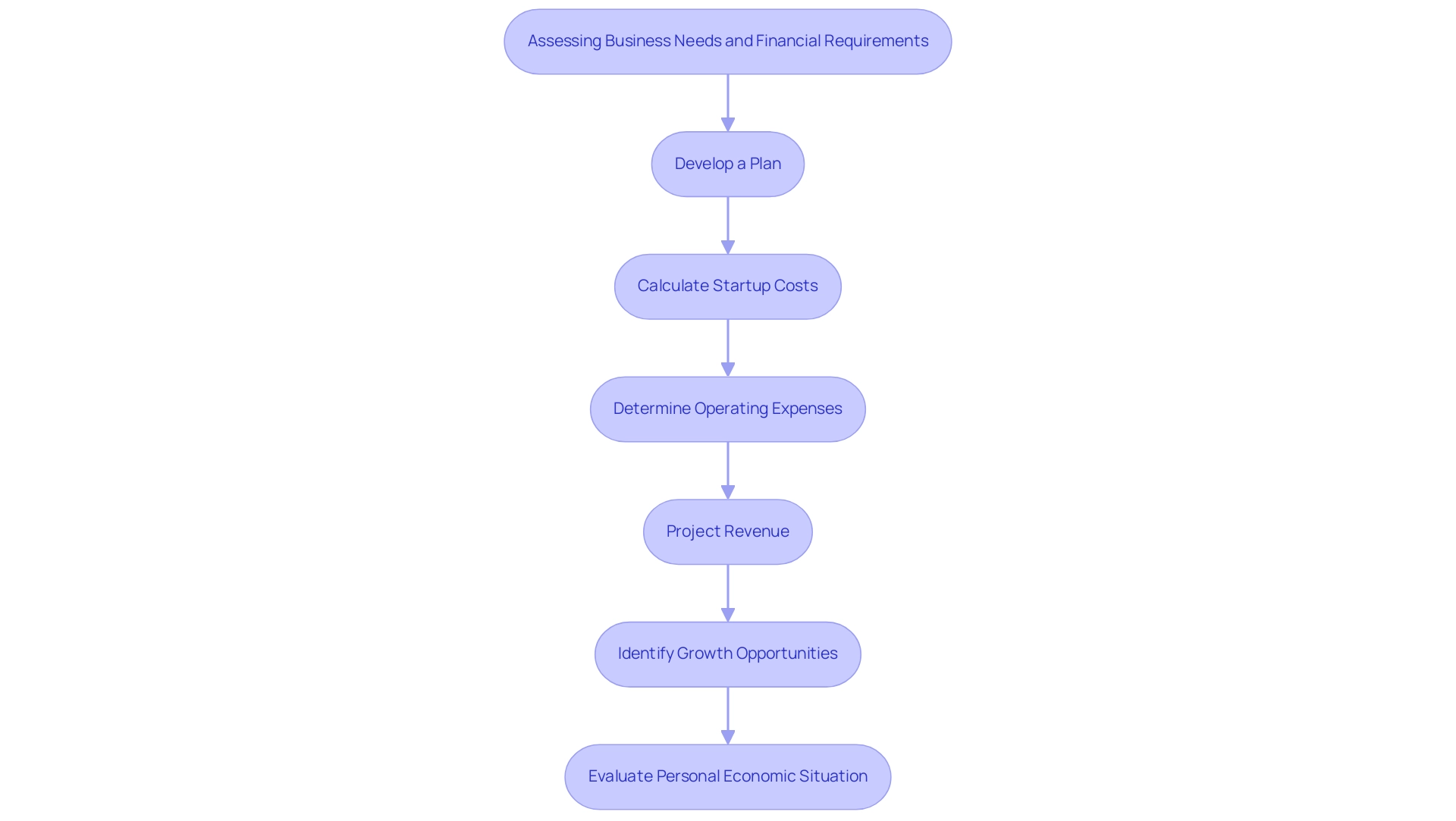

Assessing Your Business Needs and Financial Requirements

Prior to seeking resources, entrepreneurs should perform a thorough evaluation of their operational needs and monetary requirements. This process is critical for aligning funding options with the specific demands of the business and can be broken down into several key steps:

- Develop a Plan: A well-structured plan articulates your goals, strategies, and financial forecasts. This document is not only essential for securing funding but also for clarifying your overall vision and funding type needs.

- Calculate Startup Costs: It is vital to identify all potential expenses associated with launching and maintaining your business. These costs include equipment, marketing initiatives, and operational expenditures, offering a foundational understanding of your economic landscape.

- Determine Operating Expenses: Understanding ongoing expenses—such as salaries, rent, and utilities—is crucial for assessing the capital required to sustain daily operations. This insight helps in forecasting financial needs over the short and long term.

- Project Revenue: Estimating potential revenue streams and timelines for achieving profitability allows entrepreneurs to assess their financial needs accurately. This projection can guide the amount of capital needed and the timing of financial requests.

- Identify Growth Opportunities: Entrepreneurs should also consider future expansion plans that may require additional resources. Identifying these opportunities early can greatly impact financing strategies and options sought.

- Evaluate Personal Economic Situation: Assessing your own economic readiness is essential. This involves assessing your capacity to contribute personal resources if needed and comprehending how your financial well-being may influence your financing choices.

By performing this comprehensive evaluation, entrepreneurs can gain clarity on their financial requirements, ensuring they are strategically aligned with the most appropriate funding type for their resources. In an environment where 14% of owners cite lack of capital as a hindrance to growth, this proactive approach is imperative for enhancing the likelihood of securing funding and fostering success. As Chris, Head of Business Advisory at Archimedia Accounts, notes, 'We expect to see more and more enterprises founded each year...'

However, it’s an increasingly tough landscape for businesses to compete in... So we wouldn’t expect to see an improvement in the startup survival rates any time soon. This emphasizes the significance of comprehending monetary needs in a competitive market.

Additionally, the real estate sector saw a turnover growth of 12.5%, while manufacturing grew by 10.4% in 2023, illustrating the varying economic landscapes across industries. Such insights highlight the necessity for startups to thoroughly assess their financial needs and align their financing strategies accordingly.

Preparing a Compelling Funding Proposal

To secure funding, entrepreneurs must craft a compelling funding proposal that encompasses several critical components:

- Executive Summary: This section should provide a succinct overview of the organization, encapsulating its mission and outlining the funding request in a clear manner.

- Company Description: Provide detailed insights into the model, including the products and services available, and articulate the market need that the company aims to fulfill.

- Market Analysis: Present a thorough examination of the target market, competitive landscape, and prevailing industry trends that underscore the entity's potential for growth.

- Funding Requirements: Clearly state the amount of funding needed and specify its intended use—whether for equipment purchases, marketing initiatives, or staffing needs.

- Economic Projections: Include realistic and thoroughly researched economic forecasts, which should cover revenue expectations, expenses, and a break-even analysis to demonstrate the viability of the venture. As Fundera emphasizes, "In 2023, 82% of companies that failed did so due to cash flow issues," highlighting the essential requirement for a strong financial strategy.

- Management Team: Emphasize the knowledge and experience of the management team, demonstrating their capability to successfully implement the plan and handle obstacles. This is increasingly important as roles evolve, such as the shift towards data engineering in customer success roles, which reflects the growing importance of data-driven strategies.

- Appendices: Attach any supplementary materials that bolster your proposal, such as charts, graphs, and relevant documentation that provide further context or evidence.

A well-organized proposal is crucial in improving an entrepreneur's chances of securing the necessary funding type for financial support. By clearly communicating the business's value proposition and its potential for success, entrepreneurs can better attract investors. Additionally, with AI technology projected to enhance profits by 71% for the construction sector, highlighting technological benefits can further reinforce proposal submissions.

This combination of a robust monetary plan and an understanding of market trends can significantly enhance the chances of obtaining investment.

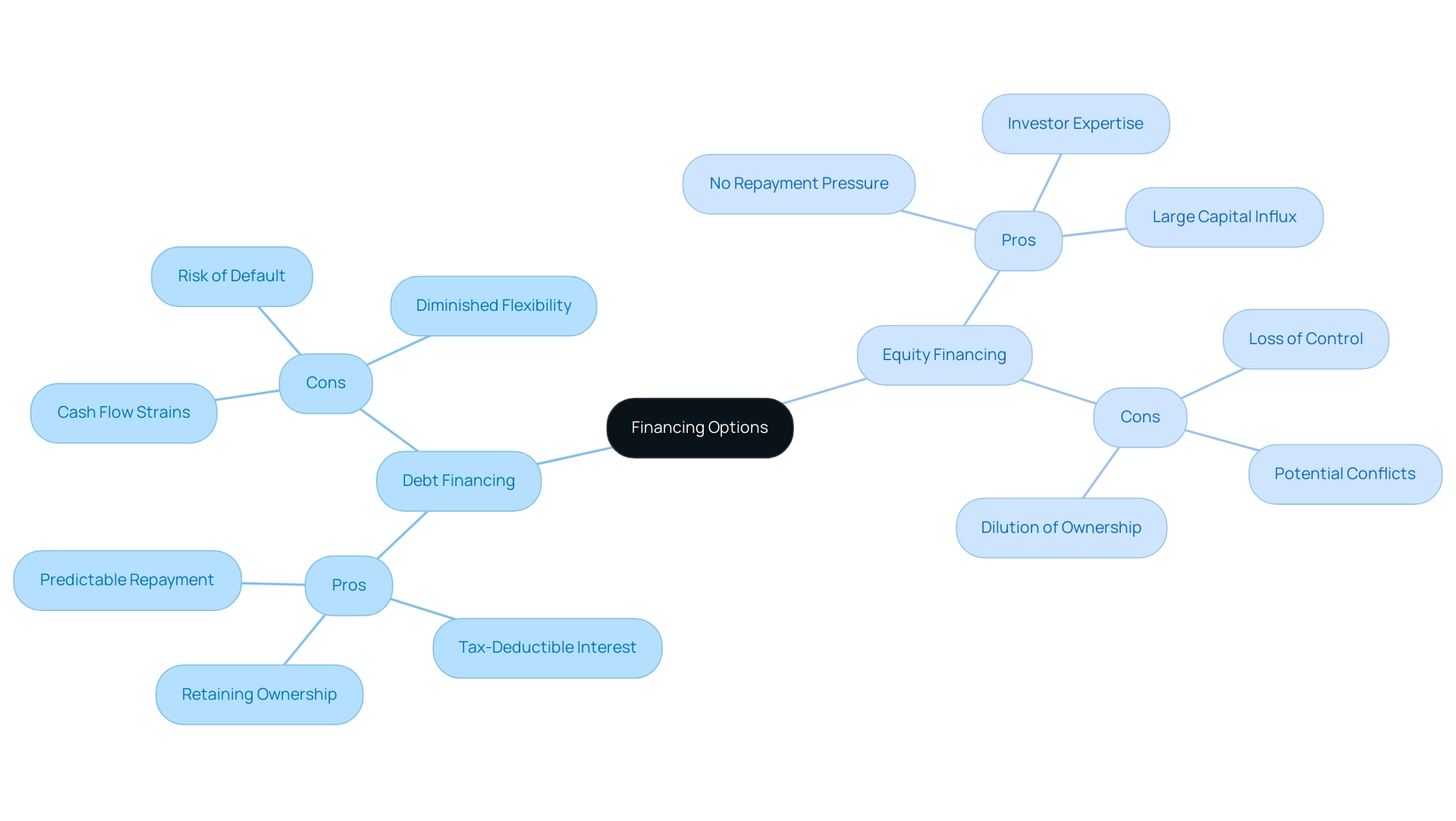

Understanding the Implications of Debt vs. Equity Financing

When considering funding type options, entrepreneurs must carefully navigate the implications of debt versus equity financing, particularly in the context of current market dynamics. The public sector's net financial worth has recently decreased by £169.0 billion, leading to a deficit of £2,362.2 billion, which underscores the importance of understanding the financial landscape when seeking funding.

-

Debt Financing: This approach involves borrowing funds that must be repaid with interest.

While it enables entrepreneurs to maintain control over their venture, it introduces an obligation to repay irrespective of performance. Recent insights indicate that a significant percentage of startups are leaning towards debt financing, reflecting a trend in 2024 where preferences for debt versus equity financing are clearly defined. The FPC has reiterated its view that rates based on the secured overnight financing rate (SOFR) provide more robust alternatives than USD credit sensitive rates, highlighting the evolving nature of financing options available to entrepreneurs.

- Pros: Entrepreneurs can retain full ownership of their business, benefit from tax-deductible interest, and enjoy a predictable repayment schedule.

- Cons: However, this method can lead to potential cash flow strains, increased risk of default, and diminished financial flexibility. Notably, the share of private equity-backed companies at a higher risk of default has been larger than that of UK corporates since 2017, although this trend has shown signs of improvement recently.

-

Equity Financing: This involves selling a stake in the business in return for funds.

While this method reduces ownership, it can provide substantial financial support without immediate repayment obligations.

- Pros: Entrepreneurs benefit from no repayment pressure, access to invaluable investor expertise, and the potential for a large influx of capital.

- Cons: Conversely, it can lead to loss of control, potential conflicts with investors, and dilution of ownership.

Financial analysts emphasize that these factors must be weighed carefully, as the implications of equity financing can significantly affect long-term corporate strategies.

Additionally, the Bank's new lending facility for Non-Bank Financial Institutions (NBFIs) aims to provide liquidity during system-wide liquidity stress in the gilt market, focusing on maintaining market stability. This initiative demonstrates a real-world application of funding strategies that can assist entrepreneurs in managing current monetary challenges.

By thoroughly assessing these implications, entrepreneurs can make informed choices regarding which funding type best aligns with their strategy and aspirations. As debt financing trends evolve, particularly for small businesses, understanding its impact on cash flow and overall financial health becomes increasingly crucial.

Conclusion

Understanding the various funding options available is paramount for entrepreneurs navigating today's competitive landscape. Each funding avenue—whether bootstrapping, angel investing, venture capital, or crowdfunding—offers distinct benefits and challenges that can shape the future of a startup. The critical evaluation of factors such as business stage, industry, financial goals, and risk tolerance is essential for aligning funding choices with specific business needs.

A thorough assessment of financial requirements is equally important. Entrepreneurs must create comprehensive business plans, calculate startup costs, and project revenue to identify the necessary capital and inform their funding strategies. This proactive approach can significantly enhance their chances of securing the right funding and fostering long-term success.

Moreover, preparing a compelling funding proposal that effectively communicates the business's value proposition is crucial. By articulating a clear vision and demonstrating market potential, entrepreneurs can attract the interest of potential investors. Understanding the implications of debt versus equity financing further empowers entrepreneurs to make informed decisions, ultimately supporting their growth ambitions.

In conclusion, the landscape of startup funding is multifaceted and dynamic. By strategically navigating these options and preparing thoroughly, entrepreneurs can position themselves for success, mitigating the risks that contribute to the high failure rates of startups. Embracing a well-informed approach to funding not only enhances business viability but also paves the way for sustainable growth in an ever-evolving market.