Overview

The article "Understanding Equity Startup: A Caring Guide for New Founders" thoughtfully addresses the essential elements of equity distribution and its profound significance for new startup founders. We recognize that navigating ownership shares can be daunting for many founders, as these shares deeply influence control, decision-making, and financial rewards. It is crucial to understand that equitable distribution not only motivates your team but also plays a vital role in attracting top talent. By fostering transparent agreements, we can help avoid potential conflicts and create a supportive environment where everyone feels valued. As many of our members have experienced, this understanding is fundamental to building a successful startup community.

Introduction

In the competitive realm of startups, we understand that grasping the concept of equity is not just an option; it's a necessity for founders, employees, and investors alike. Ownership stakes are pivotal as they define control, decision-making, and financial rewards. The nuances of equity distribution have become increasingly vital, especially in a landscape where fintech investments surged to an impressive $31.1 billion from 2022 to 2024.

This article invites you to explore the intricacies of startup equity, delving into its various types, distribution strategies, and the essential role of vesting schedules. By sharing expert insights and real-world examples, we aim to highlight how thoughtful equity management can foster collaboration, attract top talent, and ultimately drive a startup's success in an ever-evolving market.

Together, we can navigate these complexities with confidence and support.

What is Startup Equity and Why It Matters

Ownership shares represent the stake that creators, staff, and backers hold in a new venture, typically expressed as a percentage of the firm's total shares. For new founders, understanding ownership is vital, as it directly influences control, decision-making, and financial rewards. In 2025, the importance of fairness in distribution has become increasingly clear, especially as the equity startup sector within the FinTech industry saw an impressive $31.1 billion in investments from 2022 to 2024. This highlights the competitive landscape in which new ventures operate.

An equity startup not only serves as a powerful incentive for employees but also plays a crucial role in attracting top talent. By aligning employee interests with the company's success, shared ownership nurtures a culture of commitment and motivation. Moreover, the way ownership is shared can significantly impact future funding rounds and the overall valuation of the new venture.

Determining how much ownership to give up in an equity startup hinges on funding needs, investor stakes, and the strategic value they bring. For instance, shares should be allocated based on value generation, recognizing that different entrepreneurs contribute various skills and levels of dedication to the business.

Expert insights emphasize the necessity of equitable distribution. As Scott Dettmer, a Silicon Valley-based attorney, points out, the dynamics of ownership can create tension among founders during liquidity events, where disparities in ownership stakes may overshadow accomplishments. This underscores the need for transparent and fair agreements from the very beginning.

Real-world examples illustrate the impact of fairness on the success of an equity startup. In 2024, private capital limited partners (LPs) experienced net positive cash flows for the first time since 2015, suggesting that general partners (GPs) are effectively meeting LPs' liquidity demands, even as overall returns across sub-asset classes have decreased. This trend highlights the importance of strategic asset management in maintaining investor trust and support, further reinforcing the need for creators to approach ownership agreements thoughtfully.

In conclusion, grasping the nuances of ownership shares is essential for any new founder of an equity startup aiming to build a successful business in today's ever-changing market. The ability to navigate financial agreements and understand their implications can greatly enhance a new venture's potential for growth and sustainability.

Types of Startup Equity: Understanding Your Options

As founders navigate the often daunting startup landscape, it’s important to familiarize themselves with the various types of equity available, each serving distinct purposes and offering unique advantages. We understand that this can feel overwhelming, but knowing these options can empower you on your journey.

- Common Stock: This foundational type of ownership is typically granted to founders and employees. Common stockholders enjoy voting rights and may receive dividends, making it a vital component of the ownership structure. However, in liquidation scenarios, common stockholders are paid last, after creditors and preferred shareholders, which can add to their risk profile. Many of our members have shared their concerns about this risk, and it’s crucial to weigh these factors carefully.

- Preferred Stock: Commonly issued to investors, preferred stock offers significant benefits, including priority in dividend distributions and during liquidation events. In situations where a company is liquidated, preferred shareholders are compensated before common stockholders, highlighting the reduced risk associated with this type of ownership. As you consider investing in preferred stocks, we encourage you to assess credit risk and current interest rates to ensure stable returns.

- Stock Options: These options empower employees with the right to purchase shares at a predetermined price, effectively aligning their interests with the company’s growth trajectory. This incentivization can drive performance and commitment among team members, fostering a sense of shared purpose.

- Restricted Stock Units (RSUs): RSUs are shares granted to employees that vest over time, ensuring that their interests are closely tied to the company’s long-term success. This structure not only motivates employees but also fosters loyalty as they work towards the company's goals. Many founders have found that this approach nurtures a stronger connection between the team and the company’s vision.

- Advisory Shares: Allocated to advisors in exchange for their expertise, advisory shares are often structured similarly to common stock. This arrangement enables new businesses to leverage the knowledge and networks of seasoned professionals while compensating them appropriately, creating a supportive ecosystem for growth.

Comprehending these equity types is essential for entrepreneurs in an equity startup as they devise strategies for compensation and attracting investments. Current trends indicate a growing emphasis on stock options and RSUs within equity startups, reflecting a shift towards performance-based incentives. Additionally, as Schwab forecasts annual returns of 5.7% for U.S. investment-grade bonds and 3.6% for cash equivalents, it’s vital to consider the implications of credit risk and interest rates when evaluating preferred stock options.

As Gaviria observes, 'most of this stuff is a leverage game,' which underscores the significance of negotiation in ownership discussions. By understanding these concepts and taking into account expert insights, founders can make informed choices that enhance their venture’s appeal to both employees and investors. Moreover, insights from the case study titled 'Market Predictions for 2025 and Beyond' indicate that, although short-term market fluctuations may happen, specialists typically anticipate U.S. stocks to keep increasing in value over the long haul. This emphasizes the importance of strategic investment planning, reassuring you that with careful thought and community support, you can navigate these complexities successfully.

Equity Distribution: Splitting Shares Among Founders and Employees

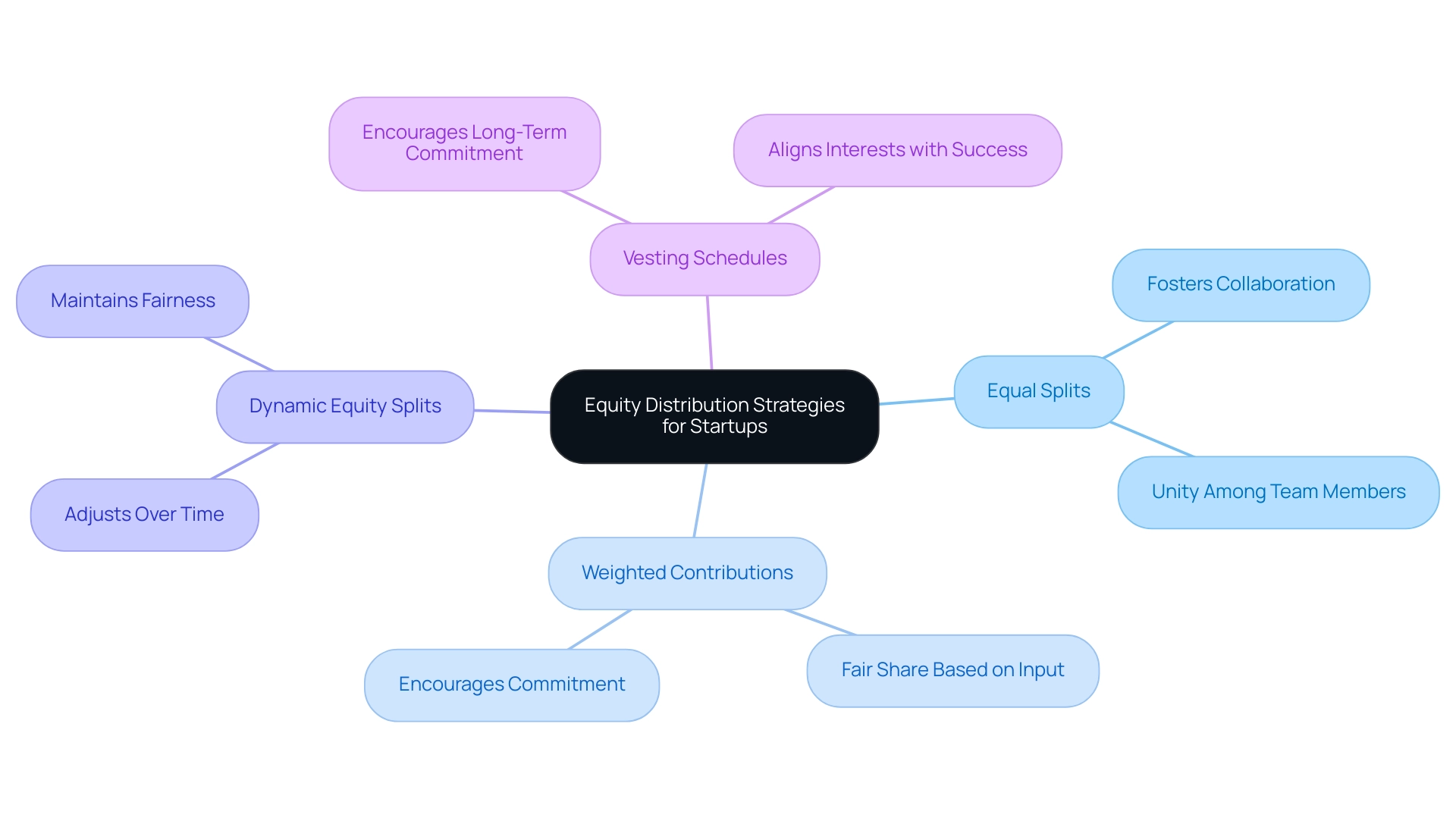

Equity distribution is a critical decision for any equity startup, influencing both team dynamics and long-term success. We understand that founders face various challenges when determining how to split shares, and it’s essential to navigate these thoughtfully:

- Equal Splits: Many entrepreneurs choose equal ownership divisions to foster a sense of collaboration and collective responsibility. This approach can cultivate unity among team members, which is vital during the early stages of a new venture.

- Weighted Contributions: Another common strategy involves distributing ownership based on each partner's contributions. This method considers factors such as time commitment, expertise, and financial investment, ensuring that those who contribute more significantly to the venture's growth receive a fairer share of equity.

- Dynamic Equity Splits: This innovative approach allows for adjustments over time, reflecting each founder's ongoing contributions. As the new venture evolves, this flexibility can help maintain fairness and motivation among the founding team.

- Vesting Schedules: Implementing vesting schedules is a best practice that encourages long-term commitment. Founders accumulate their shares progressively, aligning their interests with the venture's success and reducing the risk of early exits.

As we look toward 2025, the landscape of resource distribution continues to evolve, with a growing emphasis on transparency and fairness. Statistics suggest that equity startups utilizing fair and transparent resource distribution methods are more likely to align interests and drive growth effectively. As noted by Stripe, "fair and transparent ownership distribution helps align interests and drive the startup's growth effectively."

For example, companies that implement flexible ownership distributions often report greater levels of satisfaction among creators and staff alike. We recognize how vital it is for team members to feel valued and heard in their contributions.

Case studies, such as the commitment to inclusivity articulated by Akim Arhipov, highlight the importance of accessible financial structures. By enabling co-investing and fostering a collaborative learning environment, platforms like fff. Club enhance the investment experience, driving meaningful outcomes for all members.

Furthermore, insights from Finro's approach, which includes personalized attention and strategic insights, can help founders map out their growth trajectory while delivering precise valuations. We understand that personalized guidance can make a significant difference in navigating these complex decisions.

Ultimately, the chosen method of equity distribution in the equity startup should align with the values and goals of the founding team, fostering collaboration and motivation. Demonstrating founder-market alignment builds trust with investors regarding the venture's potential for success. As the entrepreneurial ecosystem continues to mature, we encourage founders to adopt best practices that not only reflect their unique circumstances but also contribute to a thriving, equitable workplace.

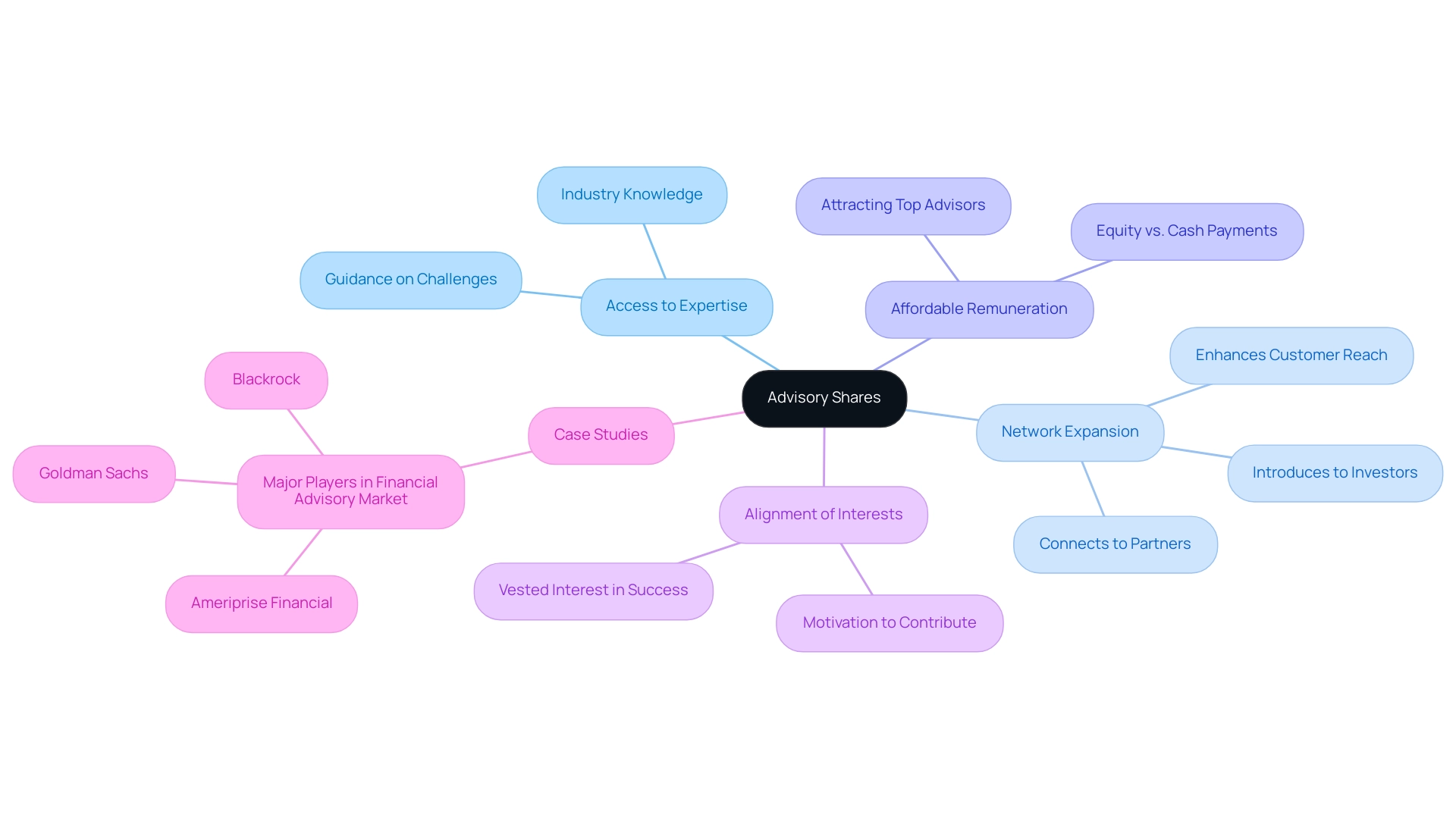

Advisory Shares: Engaging Experts for Your Startup's Success

Advisory shares represent a thoughtful form of ownership compensation given to advisors who generously share their expertise and guidance with emerging companies. These shares are often structured similarly to common stock and typically vest over a specified period, aligning the interests of both the company and its advisors. Engaging advisors through equity compensation offers several compelling advantages:

- Access to Expertise: Advisors provide invaluable industry knowledge and experience, enabling new ventures to navigate challenges effectively and capitalize on emerging opportunities.

- Network Expansion: With their extensive connections, advisors can introduce founders to potential investors, partners, and customers, significantly enhancing the company's growth trajectory.

- Affordable Remuneration: For new businesses working with limited budgets, providing shares serves as a practical substitute to cash payments, enabling them to draw in top-tier advisors without immediate financial pressure.

- Alignment of Interests: Providing shares ensures that advisors have a vested interest in the company's success, motivating them to contribute actively and meaningfully.

As many of our members have experienced, in 2025, equity startups in their early stages are particularly well-positioned to offer advisory shares, as they typically have more ownership available due to a smaller employee base. This trend highlights the significance of ownership compensation in attracting the right talent at a critical stage of development. Founders should consider offering advisors between 0.2% and 1% ownership, depending on the advisor's level of involvement and expertise.

This approach aligns with the wider framework of the financial consulting market, where equity startups frequently utilize advisory shares to improve their strategic direction and stakeholder relations.

The effectiveness of advisory shares is further illustrated by case studies highlighting successful equity startups that have utilized advisor ownership compensation to achieve significant milestones. For instance, companies that actively involve advisors through ownership compensation often report enhanced strategic direction and improved investor relations, leading to successful funding rounds and accelerated growth. Notably, major players in the financial advisory market, such as Ameriprise Financial and Goldman Sachs, have recognized the value of advisory shares in fostering successful partnerships and driving growth.

Insights from successful founders emphasize the value of engaging advisors through equity compensation. They observe that the appropriate advisors not only offer guidance but also act as champions for the venture, endorsing its vision and linking it with crucial resources. As Eli Oftedal, a Senior Researcher in Market Insights, points out, "Our deep relationships with top entrepreneurs and investors inform our insights and give us a vantage point unlike any other bank."

Moreover, engaging with the fff.club community allows new ventures to tap into exclusive deal flow and due diligence opportunities, enhancing their chances of securing funding and strategic partnerships. The weekly tech and economic updates provided by the community further equip entrepreneurs with the insights necessary to make informed decisions in a rapidly evolving market.

In summary, advisory shares are a powerful tool for startups looking to harness the expertise of seasoned advisors while aligning their interests for mutual success. By carefully organizing ownership compensation, creators can establish a cooperative setting that promotes significant results in the competitive tech arena, reflecting the relationships and understandings nurtured by the fff. Club community.

This network of elite tech investors enhances the investment experience through co-investing and lifelong learning, empowering tech investors to thrive.

The Importance of Vesting Schedules in Equity Agreements

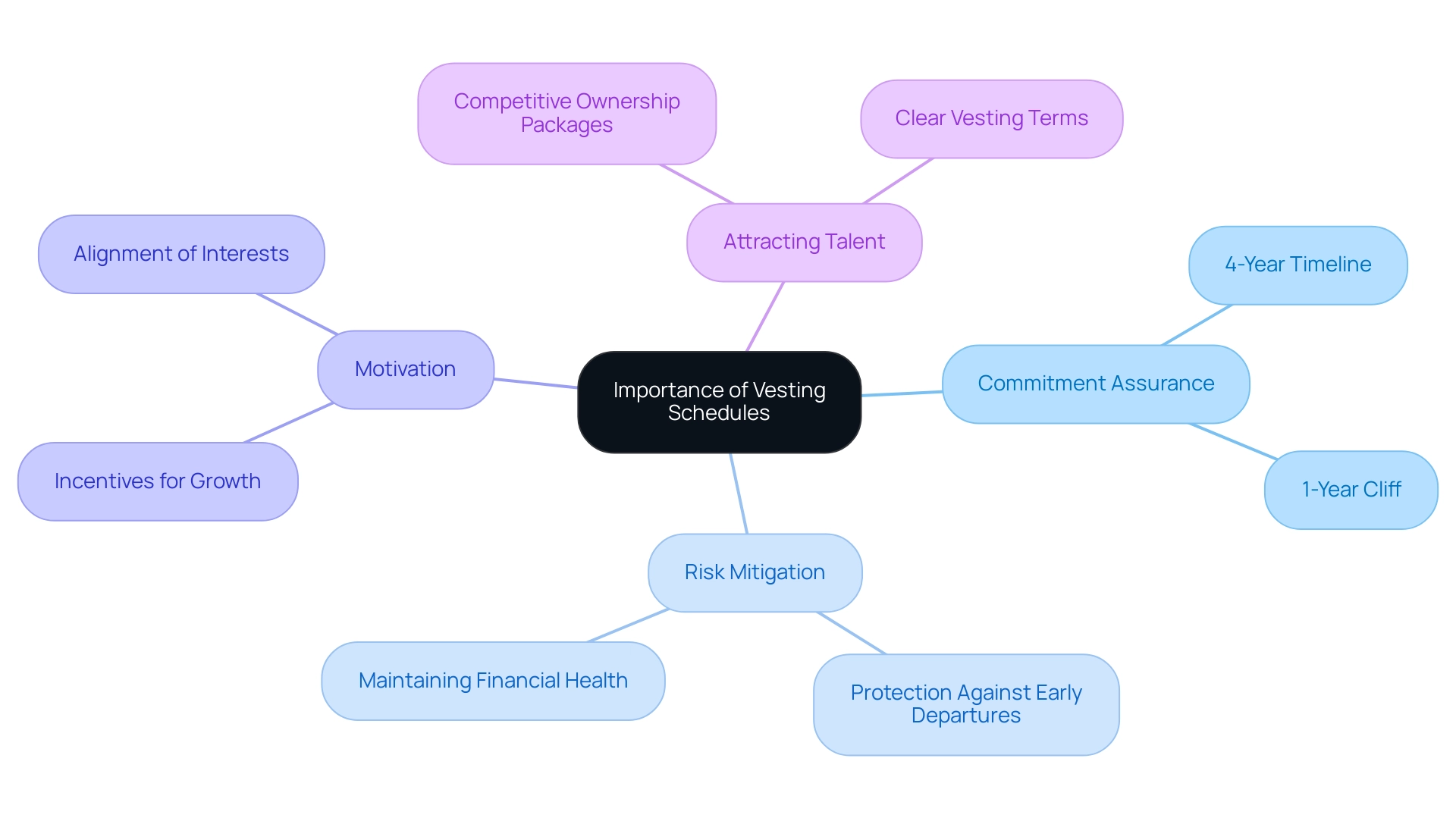

Vesting schedules are essential elements of ownership agreements, establishing the timeline and conditions under which creators and staff acquire their stake. We understand that navigating these complexities can be challenging, and here are several compelling reasons why these schedules are vital:

- Commitment Assurance: Vesting structures typically extend over four years with a one-year cliff, ensuring that co-founders and employees remain dedicated to the venture's long-term success. This commitment is crucial for fostering a stable and focused team, as many of our members have experienced firsthand.

- Risk Mitigation: When a co-founder leaves early, vesting schedules protect the remaining founders by preventing the departing individual from claiming an excessive portion of ownership. This safeguard is fundamental to maintaining the integrity and financial health of the equity startup, offering peace of mind to all involved.

- Motivation: A thoughtfully designed vesting schedule acts as a powerful incentive for employees, encouraging them to actively contribute to the company's growth. As the startup flourishes, the value of their ownership stakes increases, aligning their interests with the overall success of the business, which is something many have found motivating.

- Attracting Talent: Startups that implement appealing vesting schedules can enhance their attractiveness to potential hires. A competitive ownership compensation package, structured with clear vesting terms, can be a decisive factor in attracting top-tier talent in a competitive market, as shared by several entrepreneurs in our community.

The importance of clearly defining vesting terms in ownership agreements cannot be overstated. Doing so helps prevent misunderstandings and ensures that everyone is aligned in their goals and expectations.

Recent trends indicate that equity startup ownership grants increasingly embody these principles, with many emerging companies adopting innovative vesting structures. For instance, accelerated grant structures are becoming more common, featuring splits such as 40%/30%/30%/10% over four years or 50%/33%/17% over three years. This shift underscores a broader development in compensation practices, driven by the need for equity startups to remain competitive and retain talent.

Industry leaders emphasize that vesting schedules not only protect the interests of an equity startup but also cultivate a culture of accountability and shared success. Real-world examples illustrate how effective vesting arrangements have prevented ownership disputes, reinforcing the notion that thoughtful planning in ownership agreements is crucial for sustainable growth. By prioritizing vesting schedules, entrepreneurs can build a more resilient and motivated team, ultimately enhancing their venture's potential for success.

Moreover, public companies are becoming trendsetters in stock compensation programs, as highlighted in the case study titled "Following the Trends in New Hire Stock Compensation." This case study suggests that the decision to adopt these trends depends on a company's financial situation and strategic goals, providing a broader context for the discussion on vesting schedules.

To further assist entrepreneurs and emerging businesses, a series of free webinars are scheduled, covering topics such as understanding new digital and consumer laws, handling retail disputes, and attracting investors for new ventures. These educational opportunities can help founders navigate the complexities of ownership agreements and enhance their understanding of vesting schedules, fostering a supportive community where everyone can thrive.

Best Practices for Managing Startup Equity Over Time

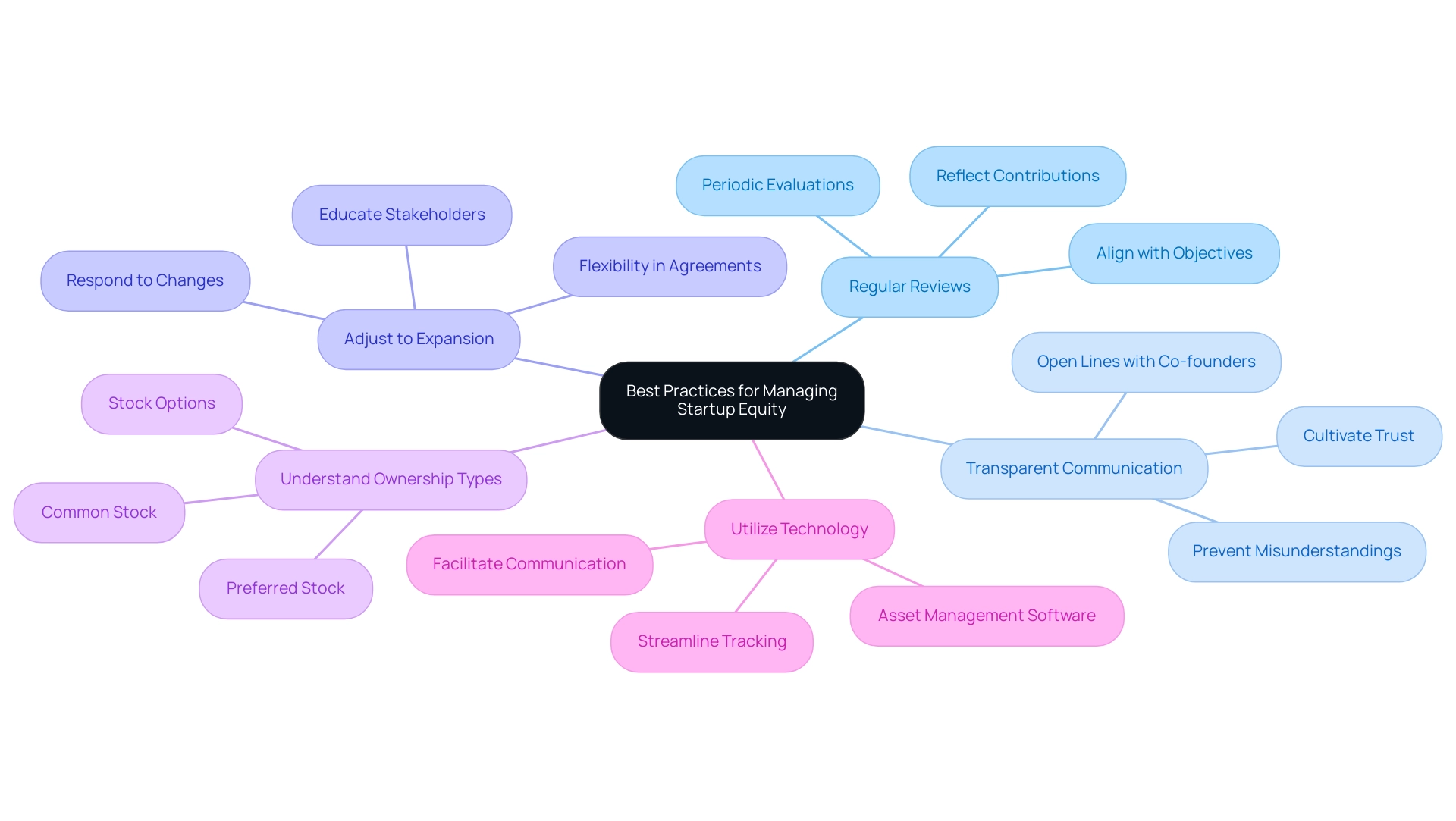

Effectively managing ownership interests in an equity startup is essential for fostering growth and ensuring alignment among stakeholders. At fff.club, we genuinely believe in empowering tech investors through inclusive financial education and community collaboration. We understand that navigating ownership can be challenging, and we want to share several best practices that can help you feel more secure in your journey.

- Regular Reviews: Conducting periodic evaluations of the ownership framework is crucial to ensure it aligns with your new venture's objectives and accurately reflects the contributions of each stakeholder. Many new businesses overlook this aspect, which can lead to misalignment and dissatisfaction. In fact, data shows that in 2017, startup investors participated in 87 agreements across North America, highlighting the competitive environment where effective ownership management is vital.

- Transparent Communication: Establishing and maintaining open lines of communication with co-founders and employees regarding ownership distribution and any changes that may arise is essential. As Silicon Valley-based attorney Scott Dettmer points out, misunderstandings can occur when founders disagree on ownership distribution, leaving some feeling undervalued. By fostering transparent communication about fairness, you can prevent such pitfalls and cultivate trust within your team.

- Adjust to Expansion: As your new venture develops, be prepared to adjust ownership agreements, especially during financing stages or significant changes in team composition. Flexibility in ownership management allows for effective responses to evolving circumstances, ensuring that all parties feel valued and fairly compensated. We encourage you to educate stakeholders about their rights and responsibilities, empowering them to engage in informed discussions about fairness changes.

Understanding the various forms of ownership distribution, including common stock, preferred stock, and stock options, is essential for aligning ownership allocation with your company's objectives.

- Utilize Technology: Leverage asset management software to streamline tracking and reporting processes. Such tools can simplify ownership management as your startup scales, making it easier to maintain accurate records and facilitate communication among stakeholders.

By implementing these best practices, you can cultivate a collaborative environment that not only supports the long-term success of your equity startup but also enhances the overall investment experience for everyone involved. Engaging with communities like fff.club, where over 400 tech financiers collaborate, provides valuable resources and insights, further aiding tech stakeholders in navigating the complexities of equity management and accessing private market opportunities.

Join us at fff.club to connect with top tech investors and empower your wealth management journey.

Conclusion

Navigating the complexities of startup equity can feel overwhelming for founders, employees, and investors. We understand that grasping the various types of equity—such as common stock, preferred stock, stock options, and advisory shares—equips you with the essential knowledge to make informed decisions that align with your startup's goals. Moreover, effective equity distribution strategies, whether through equal splits or dynamic adjustments, can foster a collaborative atmosphere that enhances team cohesion and drives growth.

The implementation of vesting schedules stands as a cornerstone for ensuring commitment and motivation among team members, safeguarding the startup's integrity against potential disruptions. These carefully structured timelines not only protect the interests of the company but also create incentives for employees to contribute actively to long-term success.

As the startup landscape continues to evolve, embracing best practices in equity management becomes increasingly vital. Regular reviews, transparent communication, and adaptability to change are key components that can significantly influence your startup's trajectory. By leveraging technology and fostering education among stakeholders, founders can cultivate a supportive environment that enhances the overall investment experience.

Ultimately, thoughtful equity management goes beyond mere ownership stakes; it is about building a culture of trust, collaboration, and shared success that drives sustainable growth in an ever-competitive market. By embracing these principles, you can empower your startup to thrive and attract the talent and investment necessary to realize your vision.