Overview

Chief Operating Officers (COOs) in the United States typically earn between $150,000 and $300,000 annually, with a median salary around $200,000, influenced by factors such as industry, company size, and geographic location. The article highlights that tech industry COOs often earn above average due to high demand, while additional compensation through bonuses and equity stakes further enhances their overall remuneration, reflecting the strategic significance of their roles in driving organizational success.

Introduction

In the competitive landscape of executive leadership, the role of the Chief Operating Officer (COO) stands out, particularly in terms of compensation. As organizations strive to adapt to rapidly changing market dynamics, understanding the factors that influence COO salaries is essential for both aspiring executives and industry stakeholders.

In 2024, COOs in the United States can expect salaries that vary widely based on:

- Industry

- Company size

- Geographic location

with averages ranging from $150,000 to $300,000. This article delves into the intricacies of COO compensation, exploring the elements that shape salary structures, the benefits and bonuses commonly offered, and the regional differences that impact earnings.

It also highlights emerging trends that are likely to influence future compensation packages, providing a comprehensive overview for those navigating the evolving expectations of this pivotal role.

Overview of Chief Operating Officer Salaries

Chief Operating Officer (COO) compensation exhibits a significant range influenced by various factors, including industry demand, company size, and geographic location. As of 2024, many are curious about how much do chief operating officers make, with average compensation in the United States estimated to fall between $150,000 and $300,000 annually, and a median income around $200,000. Significantly, the tech industry provides competitive remuneration, where talented executives can demand earnings surpassing the average, especially within thriving startups or well-established companies.

Furthermore, it's important to mention that nearly 100% of Chief Operating Officer professionals express satisfaction with their earnings, indicating a favorable perspective on remuneration in this position. For instance, recent data indicates that early-career Chief Operating Officers with 1-4 years of experience earn an average total compensation of approximately $106,647. In addition to base compensation, bonuses, stock options, and other incentives contribute to how much do chief operating officers make, significantly enhancing their overall financial package.

In the startup environment, it's common for chief operating officers to negotiate lower compensation in exchange for higher equity stakes, typically ranging from 1% to 5% for non-cofounders, which vest over several years. This remuneration approach aligns the interests of Chief Operating Officers with the long-term success of the organization. Furthermore, as highlighted by Sifted, for cofounder COOs in seed-stage firms, average salaries hover around £71,000 ($96,000 USD), while those in Series B ventures can expect figures closer to £125,000 ($169,000 USD).

Significantly, the highest-paying organization for Chief Operating Officers in Aerospace & Defense is the US Department of Defense, demonstrating the differences in remuneration across various sectors. Such variations highlight the influence of company stage and industry on COO salary packages.

Factors Influencing COO Compensation

The compensation of Chief Operating Officers is influenced by several significant factors:

- Industry Variations: The remuneration for COOs differs significantly across various sectors. Sectors such as technology and finance typically provide higher compensation ranges, leading to inquiries about how much do chief operating officers make compared to non-profit organizations or traditional retail establishments, reflecting the financial dynamics and operational complexities inherent in these fields.

- Organization Size: The scale of an organization plays a crucial role in determining COO compensation. Larger firms tend to offer more significant compensation, which leads to inquiries about how much do chief operating officers make, given the intricate operations and heightened responsibilities that COOs must manage. On the other hand, startups may offer lower base compensation; however, they often make up for it with equity stakes, attracting individuals willing to invest in the company's future growth.

- Geographical Differences: Location significantly impacts COO compensation. In major metropolitan areas such as San Francisco or New York, many wonder how much do chief operating officers make, as they frequently earn higher compensation due to the elevated cost of living and a competitive job market. This trend is especially noticeable in high-demand sectors.

- Experience and Education: The level of experience and educational background also influences compensation levels. The salaries of Chief Operating Officers who possess extensive experience or advanced degrees, such as an MBA, can be quite high, which leads to the question of how much do chief operating officers make. Their proven track record in previous roles can considerably enhance their earning potential.

- Performance-Based Incentives: A considerable number of COOs receive bonuses tied to the company's performance, which aligns their interests with those of shareholders. This performance-based payment model can lead to notable income fluctuations depending on the success of the organization.

These factors are particularly relevant in 2024, especially considering the recent methodological improvements in the Annual Survey of Hours and Earnings (ASHE). These enhancements have resulted in more precise representations of earnings, particularly for high earners, which is essential for understanding compensation dynamics. Notably, the average bonus of £94,235 for Chief Operating Officers in London raises the question of how much do chief operating officers make, underscoring the lucrative potential within this role.

Furthermore, as industry experts highlight,

In many businesses, a Chief Operations Officer is a higher position than a Director of Operations,

reflecting the strategic significance of the COO role in driving organizational success. This context is crucial for tech investors to consider when assessing salary expectations for Chief Operating Officers in the upcoming year.

Typical Benefits and Bonuses for COOs

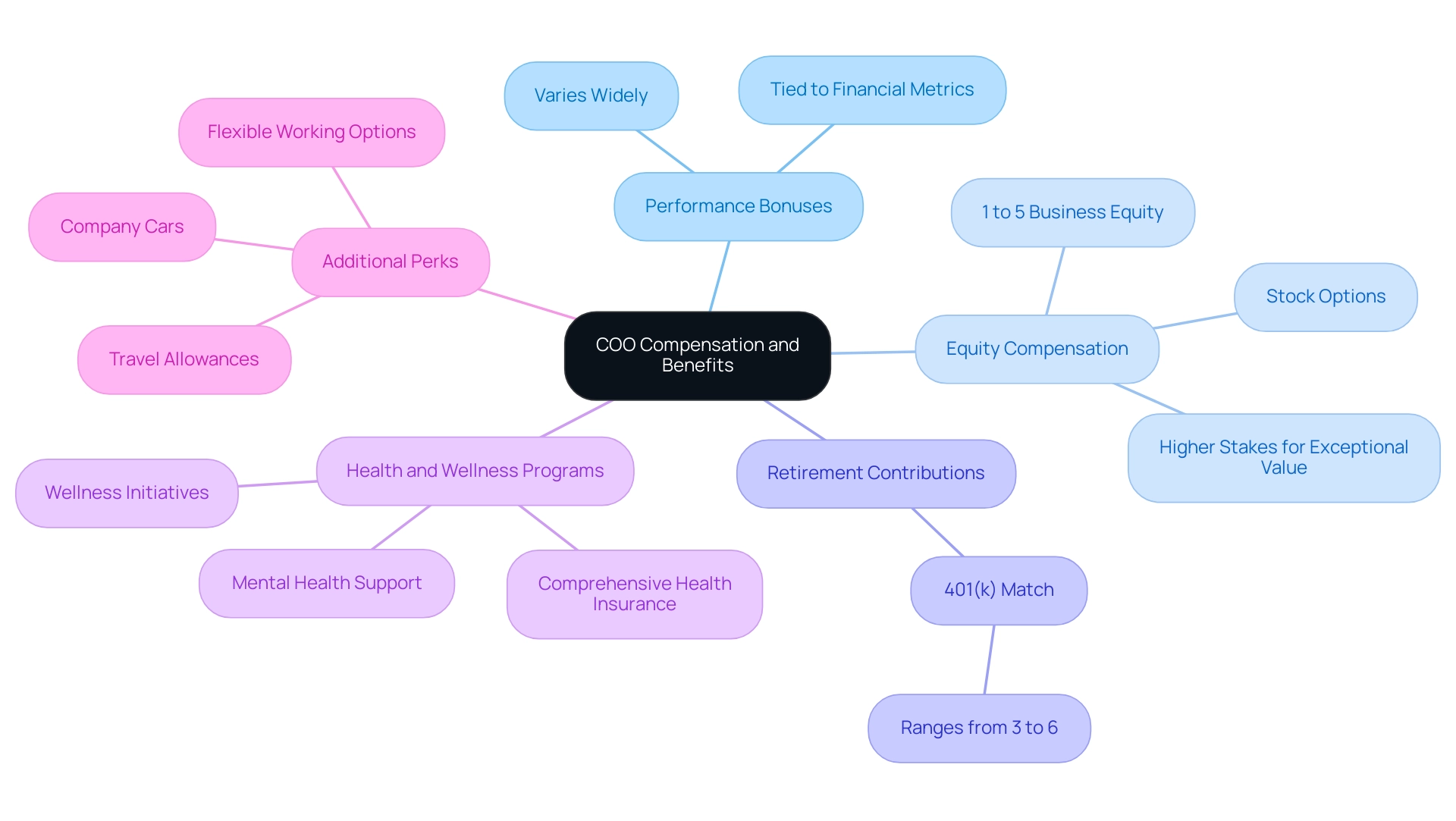

Beyond their base pay, the total compensation and benefits that significantly elevate how much do chief operating officers make in 2024 include a diverse array of bonuses. Key components include:

- Performance Bonuses: A substantial percentage of COOs receive performance-based bonuses tied to the company’s financial metrics, underscoring their role in driving organizational success. These bonuses can vary widely, often constituting a noteworthy addition to their base salary.

- Equity Compensation: Stock options are frequently offered, allowing Chief Operating Officers to partake in the financial growth and success of the company. Non-co-founder COOs typically receive between 1% and 5% in business equity, with higher stakes reserved for those demonstrating exceptional value. This aspect of remuneration is increasingly significant, as highlighted in the case study titled "Future Trends in COO Remuneration," which discusses how equity rewards are evolving in response to market demands and skill requirements.

- Retirement Contributions: A standard employer match for 401(k) plans ranges from 3% to 6% of salary, providing a robust incentive for long-term financial planning.

- Health and Wellness Programs: Comprehensive health insurance, alongside mental health support and wellness initiatives, are integral to COO benefits, reflecting a growing emphasis on employee well-being.

- Additional Perks: These may encompass company cars, travel allowances, and flexible working options, which can significantly enhance the overall appeal of the remuneration package.

Judy Canavan, Managing Director of Global Employer Services, emphasizes the importance of these offerings:

Understanding executive remuneration is vital for health insurers to attract top talent.

This sentiment resonates across industries, especially as aspiring COOs prepare to navigate the changing environment of executive remuneration. With future economic growth anticipated to enhance by mid-2024, it is vital for individuals in this role to stay alert to the changing trends regarding how much do chief operating officers make, as these elements will affect their capacity to negotiate competitive packages successfully.

Regional Salary Differences for COOs

The geographic position of a company plays a vital role in determining how much do chief operating officers make, as major metropolitan areas typically provide higher remuneration packages due to increased living expenses and competitive job markets. The following outlines the pay ranges for COOs in key cities as of 2024:

- San Francisco: COOs can command earnings between $250,000 and $400,000, driven by the high demand for executive talent in the tech sector.

- New York City: When considering how much do chief operating officers make, earnings range from $220,000 to $350,000, with substantial bonuses that reflect the intense competition within the financial services industry.

- Chicago: Here, you can find out how much do chief operating officers make, as they earn between $180,000 and $300,000, with variations largely influenced by the specific industry.

- Austin: The city's burgeoning tech scene has influenced how much do chief operating officers make, with earnings between $200,000 and $300,000, as it emerges as a significant market.

- Rural Areas: In less populated regions, the question of how much do chief operating officers make often leads to expectations of lower earnings, typically ranging from $150,000 to $250,000, reflecting local market conditions and the cost of living.

Additionally, how much do chief operating officers make in healthcare and education typically ranges between $150,000 and $250,000, illustrating how sector-specific factors also impact pay. This regional examination highlights the significance of location in influencing executive remuneration, raising the question of how much do chief operating officers make, as higher payments in urban centers are frequently a direct reaction to the elevated cost of living and the demand for skilled professionals. Furthermore, as Healy Jones, VP of Financial Planning & Analysis for Kruse, observes, the idea of ‘ramen profitability’ encourages startup founders to reduce compensation to keep expenses low and attract investors.

Finally, studies indicate that male employees with over 10 years of experience often report higher earnings than their female counterparts in similar roles, highlighting the influence of gender and experience on compensation disparities.

Future Trends in COO Compensation

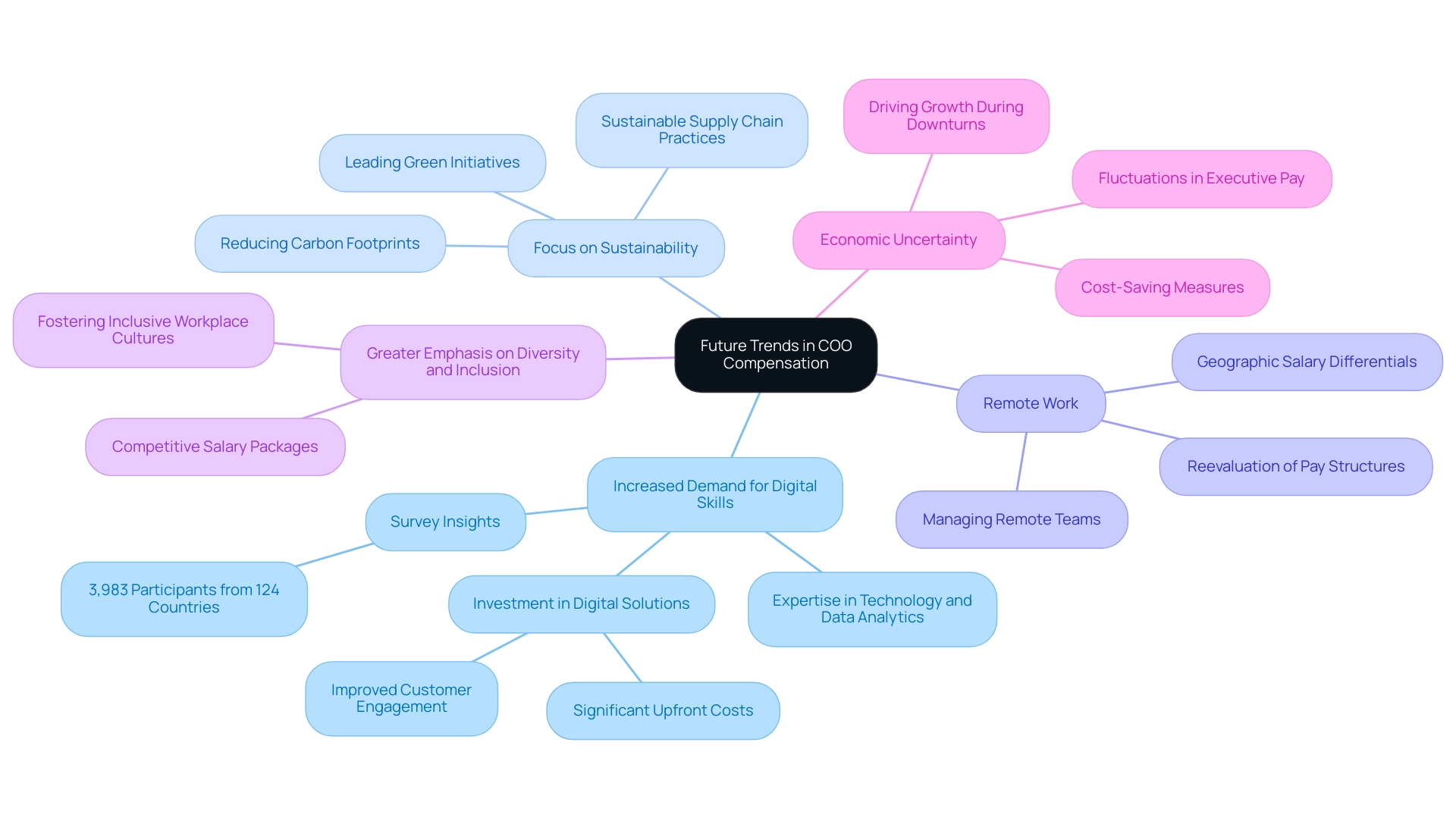

As the business environment keeps changing, several trends are expected to influence executive pay in the near future:

-

Increased Demand for Digital Skills: With organizations progressively adopting digital transformation, chief operating officers possessing expertise in technology and data analytics are likely to command higher salaries. Joe Fitzgerald, Chief Financial Officer at Domestic & General, underscores the necessity of such expertise, stating,

Developing a world-class digital solution requires a lot of up-front investment.

The organization's journey in creating the MyAccount digital service platform highlights how significant user adoption can reflect the value of these digital skills. Currently, approximately 50% of UK customers utilize this platform, showcasing the effectiveness of their digital engagement strategy. A recent survey conducted in October 2023, which included responses from 3,983 participants across 124 countries, further emphasizes this trend, revealing that organizations are increasingly prioritizing digital expertise in their remuneration structures.

-

Focus on Sustainability: Organizations are prioritizing sustainability, and Chief Operating Officers who successfully lead initiatives in this area may find that how much do chief operating officers make is positively impacted by their increased value. For instance, chief operating officers leading green initiatives, such as reducing carbon footprints or implementing sustainable supply chain practices, are likely to be acknowledged for their contributions, prompting inquiries about how much do chief operating officers make in competitive salary packages.

-

Remote Work: The rise of remote work is prompting a reevaluation of pay structures, as companies may want to consider geographic salary differentials to attract top talent. Chief Operating Officers who can effectively manage remote teams and maintain productivity in a virtual environment will be highly valued.

-

Greater Emphasis on Diversity and Inclusion: Executives who excel in fostering inclusive workplace cultures are likely to be rewarded with competitive salary packages, reflecting the growing importance of these values in corporate governance.

-

Economic Uncertainty: Global economic shifts could lead to fluctuations in executive pay. Companies may tighten budgets during downturns while offering more competitive packages during growth periods. COOs who can navigate these challenges by implementing cost-saving measures while still driving growth will be essential to their organizations' success, prompting inquiries about how much do chief operating officers make as their compensation may reflect this critical role.

Conclusion

The landscape of Chief Operating Officer (COO) compensation is shaped by multiple factors, including:

- Industry

- Company size

- Geographic location

- Experience

- Performance-based incentives

As outlined, COOs in the United States can expect salaries ranging from $150,000 to $300,000 in 2024, with industry-specific variations highlighting the tech and finance sectors as particularly lucrative. The interplay between company size and compensation reveals that larger firms often offer higher salaries, while startups may provide lower base pay supplemented by equity stakes, aligning the interests of COOs with long-term company success.

Benefits and bonuses further enhance COO compensation packages, with performance-based incentives and equity compensation playing critical roles in attracting top talent. The analysis of regional salary differences underscores the significance of geographic location, with major metropolitan areas offering higher salaries due to elevated living costs and competitive job markets. As the business environment evolves, emerging trends such as the demand for digital skills, a focus on sustainability, and the implications of remote work are anticipated to influence future compensation structures.

In summary, understanding the intricacies of COO compensation is essential for both aspiring executives and industry stakeholders. As organizations adapt to changing market dynamics, staying informed about these factors will be crucial for navigating the complexities of executive compensation and maximizing potential earnings in this pivotal role.