Overview

The article focuses on how sentiment analysis, particularly through platforms like StockTwits, can provide insights into investor attitudes toward Amarin stock, influencing trading behavior and stock performance. It outlines the methodologies used in sentiment analysis, such as natural language processing, and highlights the correlation between investor sentiment and stock price movements, emphasizing the need for a comprehensive approach that combines sentiment evaluation with traditional financial analysis to optimize investment strategies.

Introduction

In the realm of stock trading, understanding investor sentiment has emerged as a vital component in predicting market behavior. This article delves into the significance of sentiment analysis, particularly concerning Amarin stock, and its role in shaping investor perceptions and actions.

By examining social media platforms like StockTwits, the analysis reveals how collective emotions can influence stock performance, often leading to tangible market movements.

As the landscape of investing evolves, integrating advanced methodologies, such as natural language processing, becomes essential for accurately gauging sentiment. However, it is equally important to recognize the limitations of sentiment analysis, ensuring that it complements other analytical approaches for a comprehensive investment strategy.

Through this exploration, investors can gain insights into leveraging sentiment as a powerful tool in their decision-making processes.

Introduction to Sentiment Analysis for Amarin Stock

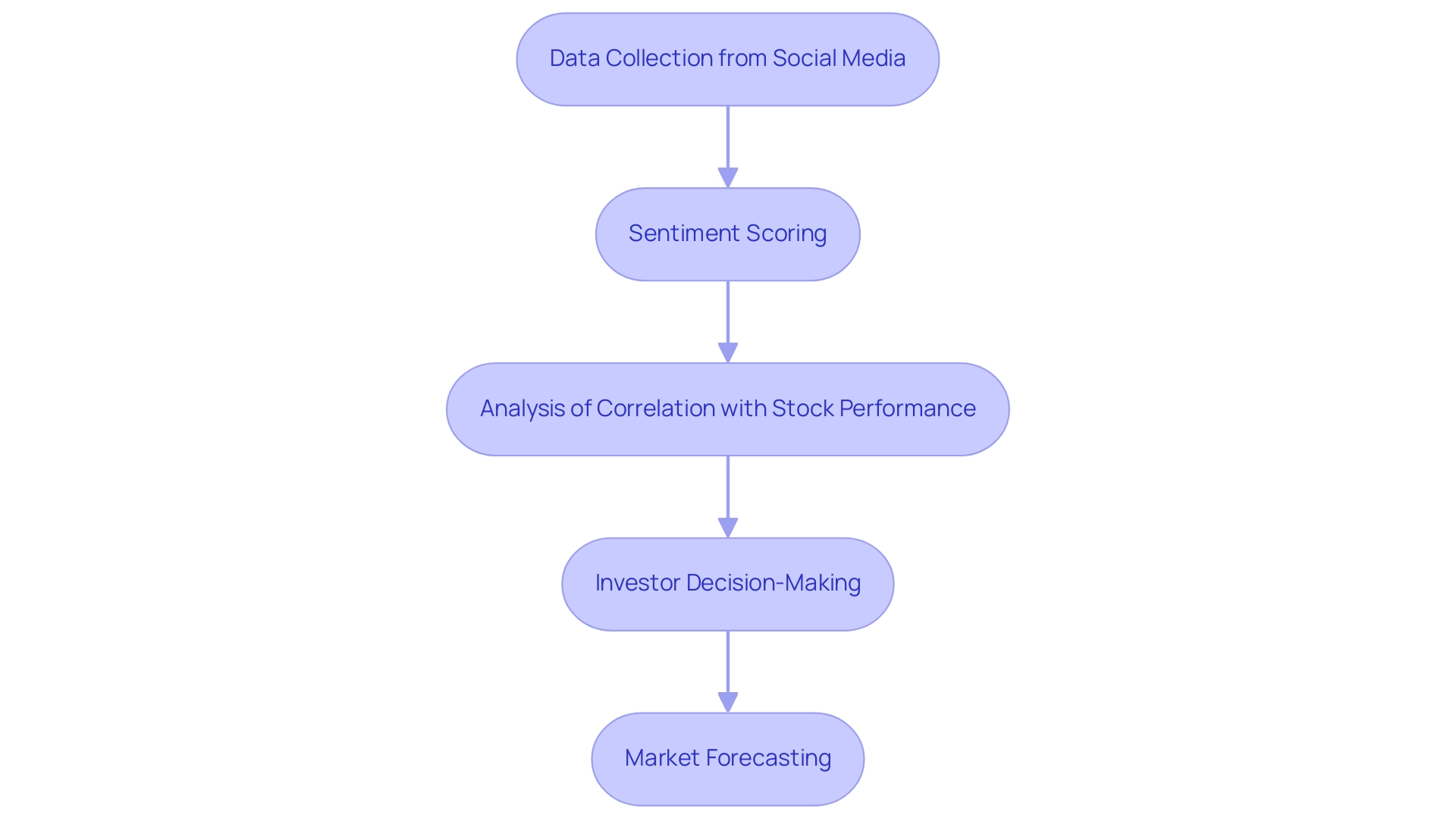

Sentiment analysis is an essential methodology that involves assessing the emotions and opinions expressed about a company across various platforms, particularly focusing on social media channels like amarin stocktwits. For Amarin shares, this process involves a comprehensive review of posts, comments, and discussions on amarin stocktwits to accurately assess investor feelings. A strong comprehension of this feeling is crucial, as it can act as a gauge for possible shifts in the economy, investor confidence, and overall performance of shares.

For example, on August 19, 2022, AMD's attitude score reached 0.66, correlating with a rise in the opening price that day, illustrating how opinion analysis can offer concrete insights into trading behavior. Recent research, including the case analysis titled 'Impact of Social Media on Investor Attitude,' has emphasized how social media feelings can substantially affect investor behavior and financial trends, noting a clear connection between expressed emotions and prices. This analytical approach allows investors to make informed decisions that reflect collective sentiments rather than relying solely on numerical data.

As we progress into 2024, the significance of emotional analysis—especially with the emergence of sophisticated natural language processing (NLP) models alongside conventional methods—continues to be a central theme for forecasting market performance, particularly in the context of amarin stocktwits. As Maryanti highlights, tackling important topics in sentiment evaluation for financial forecasting is vital for both researchers and practitioners.

The Role of StockTwits in Shaping Investor Sentiment

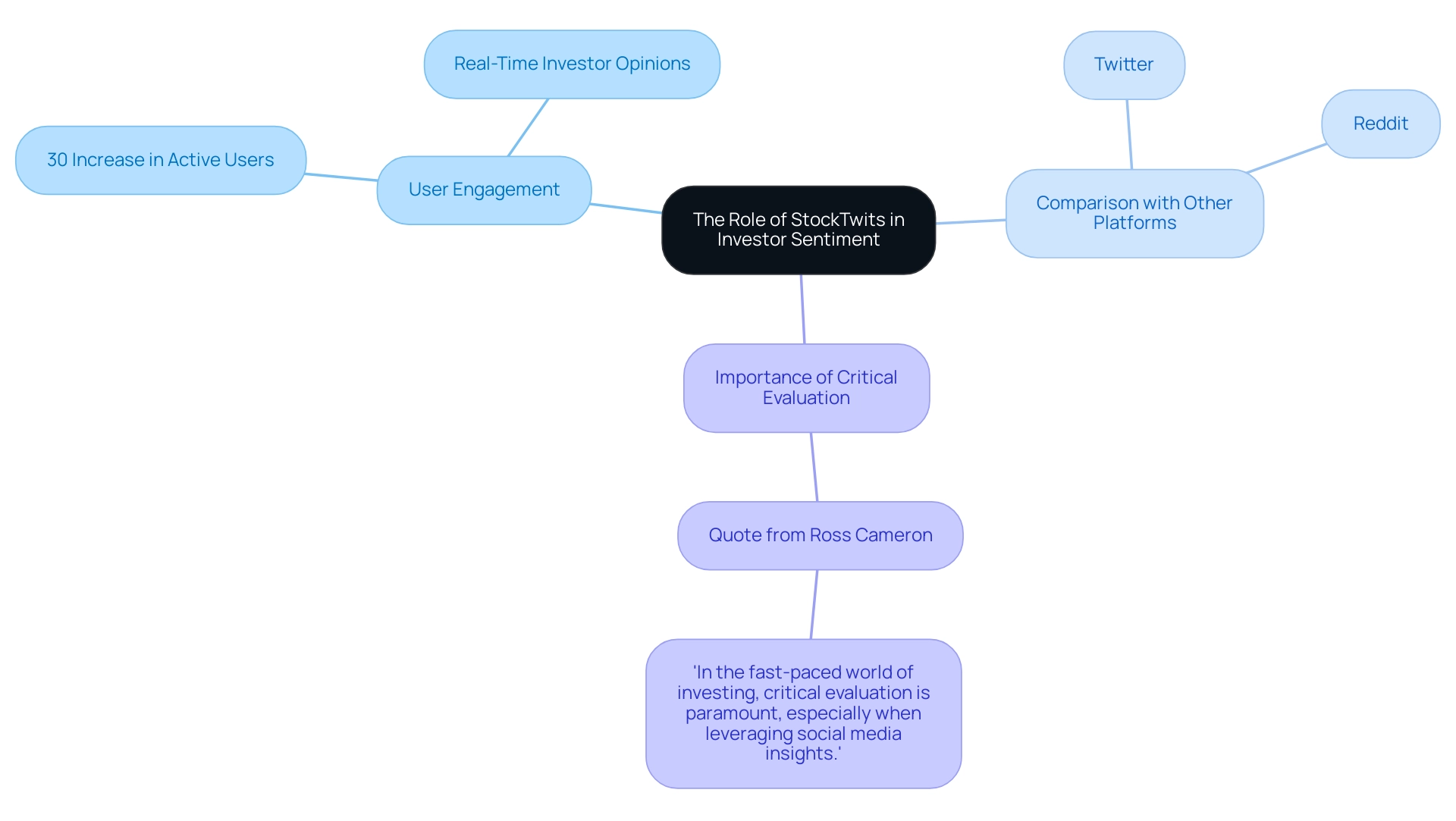

StockTwits serves as a dedicated social network for investors, facilitating the exchange of thoughts and analyses regarding specific stocks, such as Amarin. In contrast to platforms such as Twitter and Reddit, StockTwits distinctly emphasizes financial sectors and community-driven content, establishing it as a vital resource for investors. Its distinctive format prioritizes succinct communication, which is crucial for capturing real-time investor opinions.

Users can label stocks, creating a comprehensive overview of discussions and feelings related to Amarin, thereby enabling a more nuanced understanding of economic dynamics. In 2024, user engagement on StockTwits has demonstrated significant growth, with a reported increase of 30% in active users compared to the previous year. This underscores its relevance in contemporary investment discussions.

The aggregated data on StockTwits offers investors a valuable resource, illuminating market sentiment that may not be captured by traditional financial metrics. Furthermore, expert opinions highlight the necessity for users of platforms like AltIndex to independently verify information and consult financial advisors before making investment decisions. As Ross Cameron, Founder of Warrior Trading, emphasizes,

- 'In the fast-paced world of investing, critical evaluation is paramount, especially when leveraging social media insights.'

This emphasizes the significance of critical evaluation in the context of social media-driven insights.

Impact of Sentiment Analysis on Amarin Stock Performance

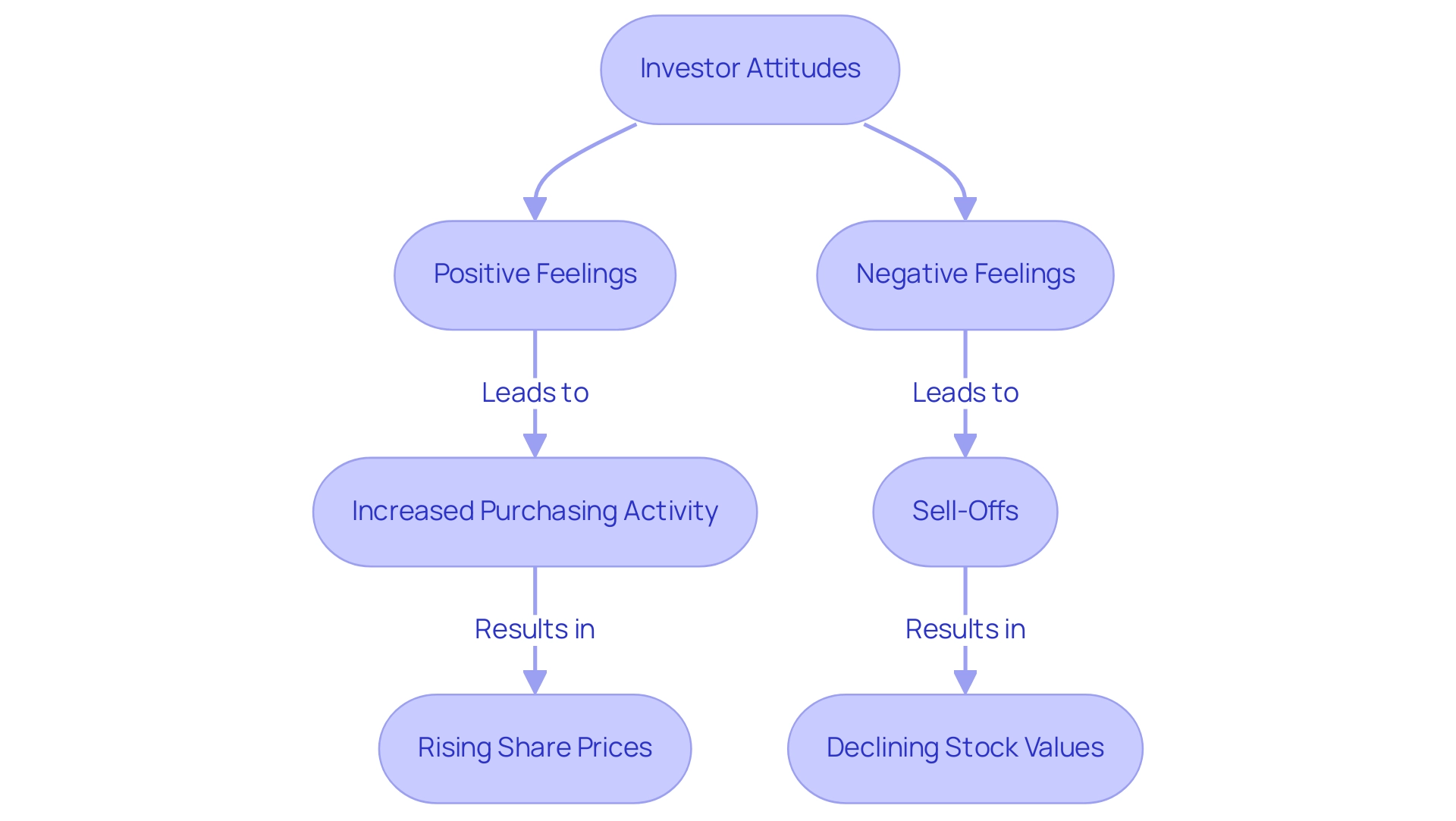

Investor attitudes play a crucial role in influencing the performance of Amarin's shares by affecting investor behavior and market dynamics. Empirical analysis indicates that favorable feelings often result in heightened purchasing activity, consequently pushing share prices upward. In contrast, negative feelings can trigger sell-offs, resulting in declining stock values.

Historical data shows a clear pattern where spikes in positive feelings on platforms like Amarin Stocktwits frequently precede price increases for Amarin. On the other hand, an increase in negative feelings often acts as a precursor to price declines. This correlation suggests that investor attitudes can serve as a major predictor of future market performance.

For example, recent case studies, including the Granger causality tests conducted on various indices, demonstrate that changes in investor mood can forecast equity returns, highlighting the significance of mood evaluation in market trends. As Benakovic and Posedel emphasize, macroeconomic factors are indeed linked to stock returns, indicating that investor mood should be a vital element of any thorough investment strategy. Considering recent discoveries, especially for 2024, investors are urged to incorporate emotional assessment into their decision-making processes, acknowledging its potential to improve trading results and guide strategic choices.

Methodologies for Analyzing StockTwits Sentiment

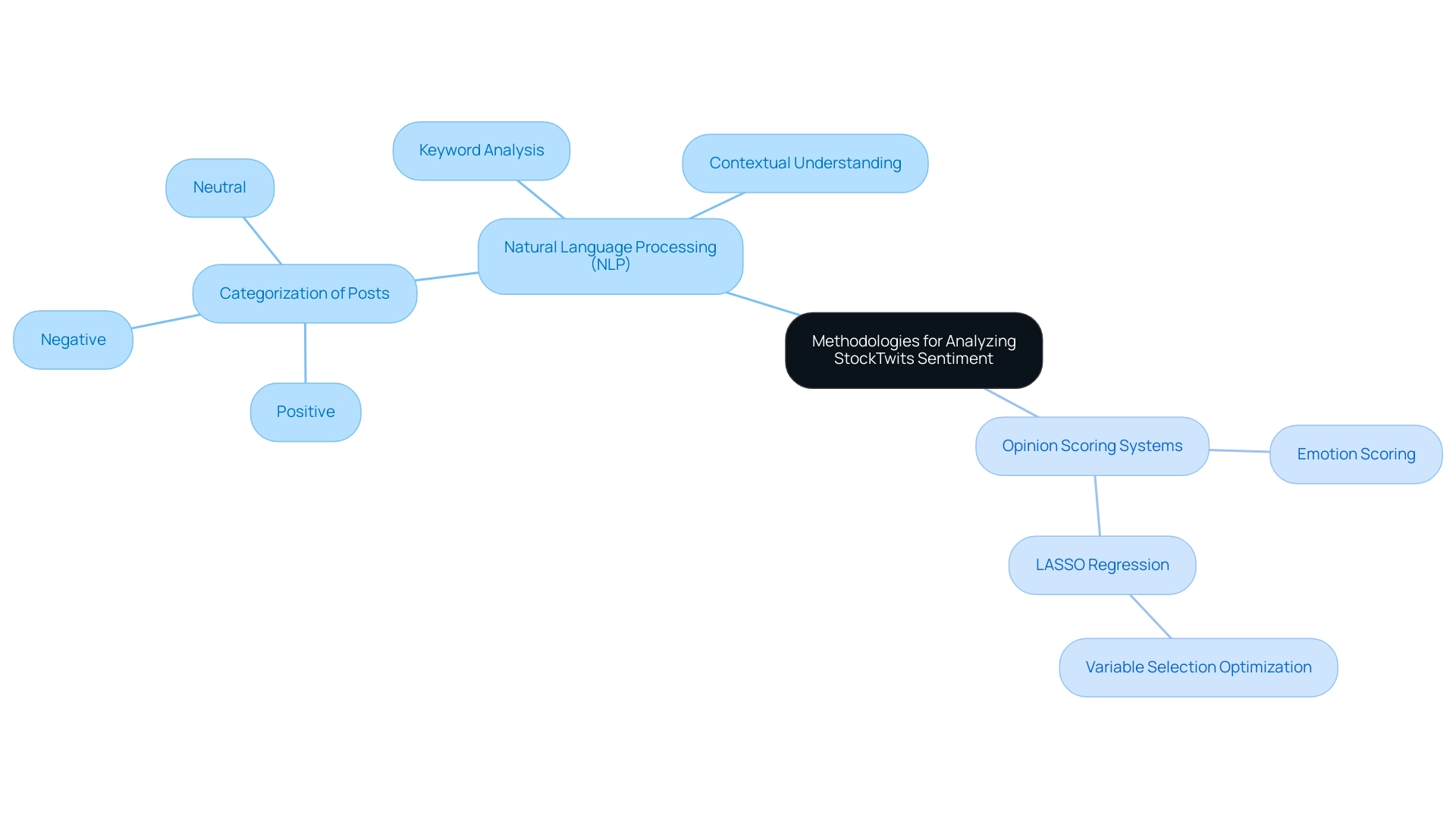

The examination of opinions on StockTwits utilizes various approaches, prominently showcasing natural language processing (NLP) and opinion scoring systems. Investors can leverage NLP techniques to categorize posts as positive, negative, or neutral, utilizing keyword analysis coupled with contextual understanding to enhance accuracy. Additionally, emotion scoring systems provide numerical values to posts, facilitating quantifiable assessments of feelings.

The integration of these methodologies establishes a robust framework for forecasting stock movements based on changes in opinion. As pointed out by Rudolf Eremyan, a specialist in emotional interpretation, the simplest method for handling negation in a sentence, which is employed in most advanced techniques, is marking as negated all the words from a negation cue to the next punctuation token. This highlights the necessity for advanced techniques in opinion evaluation, particularly in the financial domain where nuances can significantly affect interpretations.

Moreover, recent statistics indicate a low frequency of downtoners and adversatives, around 3% in a sample of 1.5 million documents, suggesting that effective evaluation can yield clearer insights. This statistic highlights the significance of improving emotion evaluation techniques, as the low occurrence of these linguistic features may boost the reliability of mood assessments. By employing LASSO regression, investors can optimize the selection of variables in their financial models, minimizing noise and improving the accuracy of predictions.

Furthermore, by compiling and examining emotional data, including the modeling methods for predicting price changes, investors can acquire valuable insights into possible trends related to Amarin stocktwits, thus improving their investment strategies.

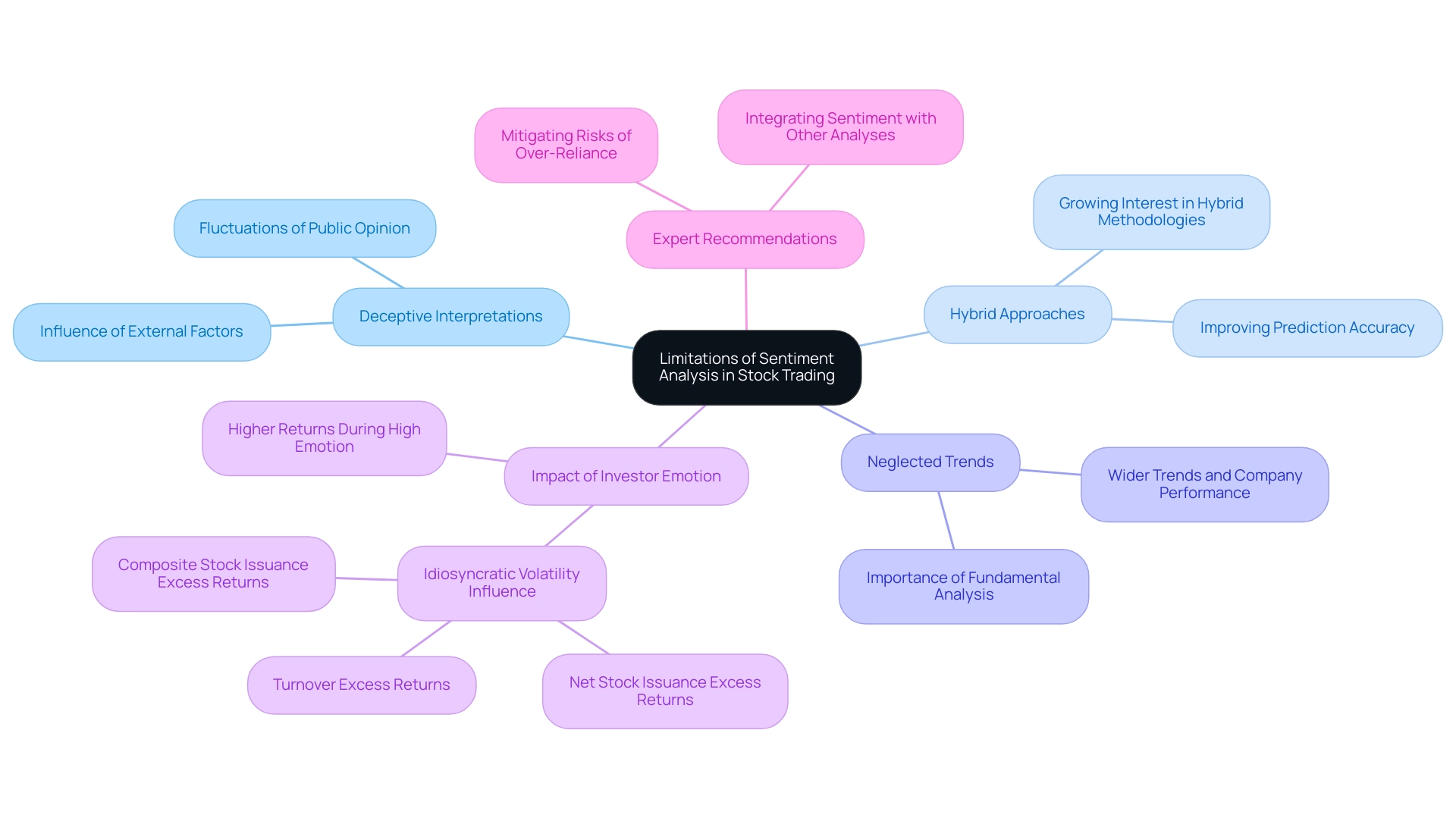

Understanding the Limitations of Sentiment Analysis in Stock Trading

Sentiment evaluation, while providing valuable insights, presents notable limitations that investors must recognize. The fluctuations of public opinion can result in deceptive interpretations, frequently influenced by external factors like economic news or geopolitical occurrences. A bibliometric examination has shown an increasing interest in hybrid approaches that improve financial prediction accuracy, highlighting the insufficiency of depending exclusively on feelings.

This trend underscores the necessity of integrating various analytical approaches for more informed trading decisions. Moreover, recent evaluations suggest that emotional assessment may neglect vital wider trends and fundamental company performance, both of which are important in affecting share prices.

In the context of equity anomalies, a study titled Impact of Investor Emotion on Anomalies Returns demonstrated that certain anomalies yield significantly higher returns during periods of increased emotion. However, this implies that dependence on feelings alone could result in overestimating potential returns. The examination discovered that idiosyncratic volatility significantly influenced the returns of market anomalies, with turnover, net stock issuance, and composite stock issuance producing statistically significant excess returns of 0.83%, 1.13%, and 0.60% per month, respectively, following high idiosyncratic volatility.

Experts, such as S. Paramati, chair professor of financial economics and climate change at the University of Dundee, assert that while feelings provide insights, they should be complemented by technical and fundamental evaluations to form a well-rounded investment strategy. He emphasizes that integrating sentiment analysis with other methods is crucial for mitigating the risks associated with an over-reliance on sentiment-driven investment strategies. Recognizing these limitations is essential for making informed trading decisions.

Conclusion

Investor sentiment plays a crucial role in the dynamics of stock trading, particularly for Amarin stock. As discussed, sentiment analysis offers a valuable lens through which investors can gauge market emotions and predict potential price movements. By utilizing platforms like StockTwits, investors can access real-time sentiment data that reflects collective opinions, which can significantly influence buying and selling behaviors. The correlation between positive sentiment and stock price increases, as well as negative sentiment and declines, underscores the importance of sentiment analysis in shaping investment strategies.

Moreover, the methodologies employed in sentiment analysis—such as natural language processing and sentiment scoring—enhance the accuracy of insights derived from social media discussions. However, it is vital to acknowledge the inherent limitations of relying solely on sentiment analysis. Market volatility, external influences, and the necessity for comprehensive analytical approaches highlight the need for a balanced investment strategy that incorporates both sentiment and fundamental analysis.

As the investment landscape continues to evolve, integrating sentiment analysis into decision-making processes can provide investors with a competitive edge. By recognizing the power of collective emotions while remaining mindful of its limitations, investors can make more informed decisions that align with market realities. Embracing a multi-faceted approach will ultimately lead to more successful trading outcomes and a deeper understanding of market mechanisms.