Overview

In today's ever-evolving real estate landscape, many investors find themselves navigating a complex array of options. We understand that identifying the right investment opportunities can be daunting, especially for those who are just starting their journey. The article focuses on the top real estate crowdfunding platforms to consider in 2025, shedding light on their unique offerings and advantages for investors like you.

Platforms such as Fundrise, EquityMultiple, and CrowdStreet stand out for their diverse investment opportunities, user-friendly experiences, and commitment to transparency. These platforms cater to both novice and experienced investors, providing the tools necessary to make informed decisions. As many of our members have experienced, having access to clear and supportive resources can significantly ease the stress of investing.

We recognize the importance of feeling confident in your choices, and these platforms aim to foster that confidence through their innovative approaches. By sharing relatable experiences and testimonials, we hope to create a sense of community among investors. Remember, you are not alone in this journey; many others are navigating similar paths and finding success along the way.

As you explore these platforms, take comfort in knowing that they are designed with your needs in mind. Together, we can foster a supportive environment where every investor feels valued and informed, ready to embrace the opportunities that lie ahead.

Introduction

In recent years, we understand that many individuals have faced challenges in accessing the lucrative world of real estate investment, often feeling deterred by the hefty financial barriers traditionally associated with property investments.

Real estate crowdfunding has emerged as a compassionate solution, offering a unique opportunity for individuals to engage in this exciting landscape. By pooling resources from multiple investors, this innovative model not only democratizes access to real estate but also allows a diverse range of participants to diversify their portfolios and explore high-potential projects.

As many of our members have experienced, with the U.S. commercial real estate market projected to remain strong and the global sector on a growth trajectory, understanding the intricacies of real estate crowdfunding—including its structures, benefits, and potential drawbacks—becomes essential for savvy investors.

We want to support you in navigating this evolving market, as platforms that facilitate collaborative investment strategies are poised to play a pivotal role in shaping the future of real estate investment.

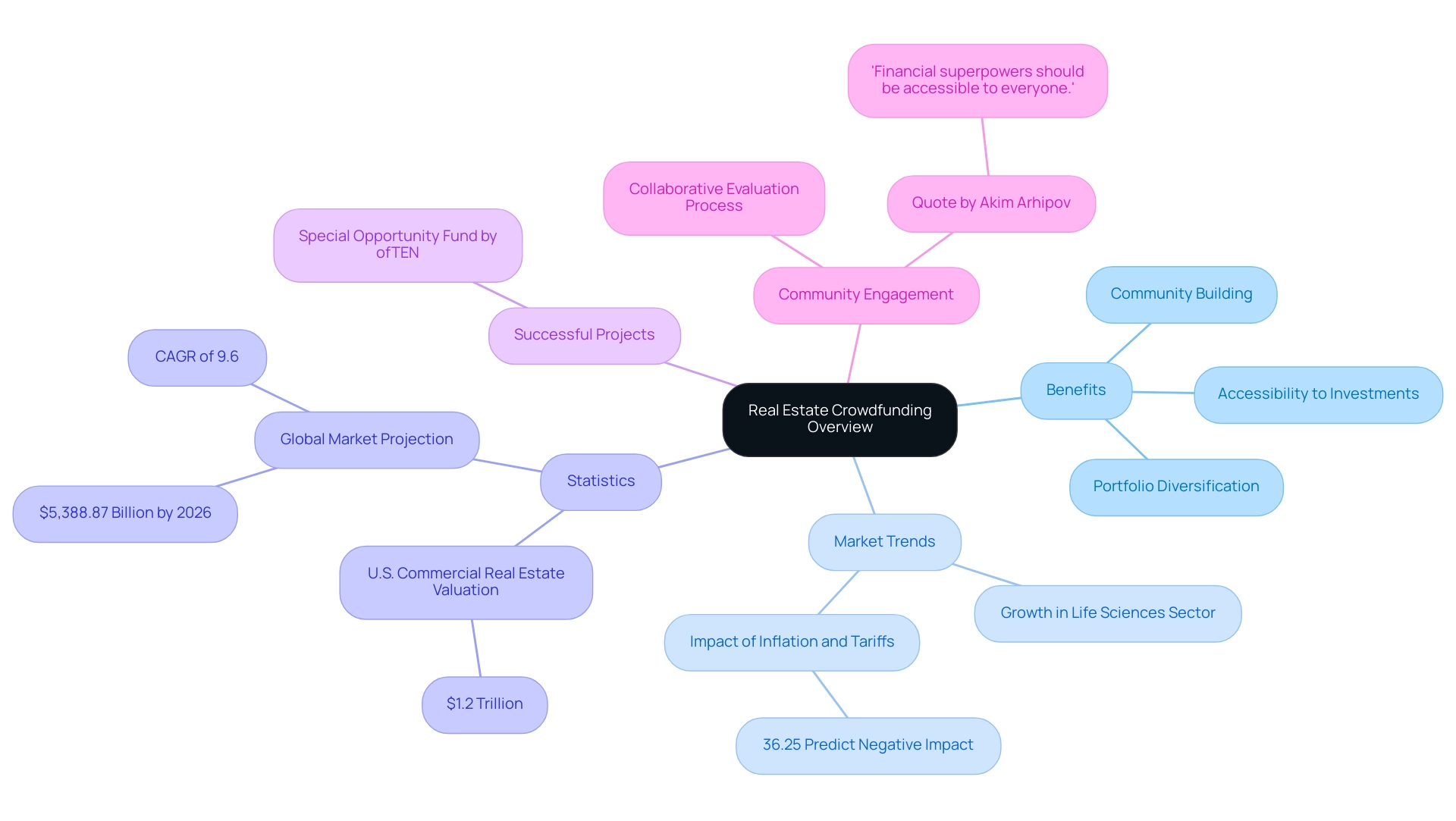

Understanding Real Estate Crowdfunding: An Overview

Real property collective funding represents a transformative approach to financing real estate initiatives by bringing together capital from diverse backers, making it more accessible and appealing to technology investors. Industry leaders, including Kristjan Tamla, Managing Director of ofTEN, emphasize the benefits of real property funds, which allow individuals to tap into lucrative opportunities that typically require significant financial resources. This innovative model democratizes access to financial possibilities, enabling investors to contribute smaller amounts and diversify their portfolios without the burdens of direct property ownership.

The allure of real property collective funding has grown significantly, fueled by its accessibility and the potential for attractive returns. As we look ahead to 2025, the U.S. commercial real estate market remains strong, valued at approximately $1.2 trillion and contributing nearly 17% to the U.S. GDP. This context underscores the increasing interest in collective funding as a practical investment strategy.

Current trends indicate a movement towards more specialized collective funding platforms, particularly in sectors like life sciences, which are expected to benefit from heightened government attention and funding through leading real estate crowdfunding platforms. As new lab spaces emerge, investors are presented with unique opportunities to capitalize on these developments.

Statistics reveal that the global property market is projected to reach $5,388.87 billion by 2026, growing at a compound annual growth rate (CAGR) of 9.6%. This upward trajectory highlights the resilience of the real estate sector, even in the face of challenges such as inflation and tariffs, which 36.25% of stakeholders anticipate will hinder market recovery in 2025.

Successful real estate crowdfunding projects in 2025 illustrate the effectiveness of top real estate crowdfunding platforms, with many reporting impressive returns for participants. For instance, the Special Opportunity Fund managed by ofTEN has achieved notable success, attracting a diverse group of backers and showcasing the potential of collaborative funding strategies. Industry leaders recognize the benefits of these platforms, noting that they not only provide access to profitable financial opportunities but also foster a sense of community among stakeholders.

By pooling resources, backers can engage in due diligence and co-investing, enhancing their overall financial strategies. As Akim Arhipov, founder of fff.club, expresses, 'Financial superpowers should be accessible to everyone,' reinforcing the importance of democratizing funding opportunities.

In summary, real property collective funding is set to continue its upward momentum in 2025, providing participants with an appealing avenue to diversify their portfolios and access high-potential projects in a vibrant market. The collaborative nature of the evaluation and due diligence process at fff.club further empowers stakeholders, ensuring they are well-equipped to make informed decisions.

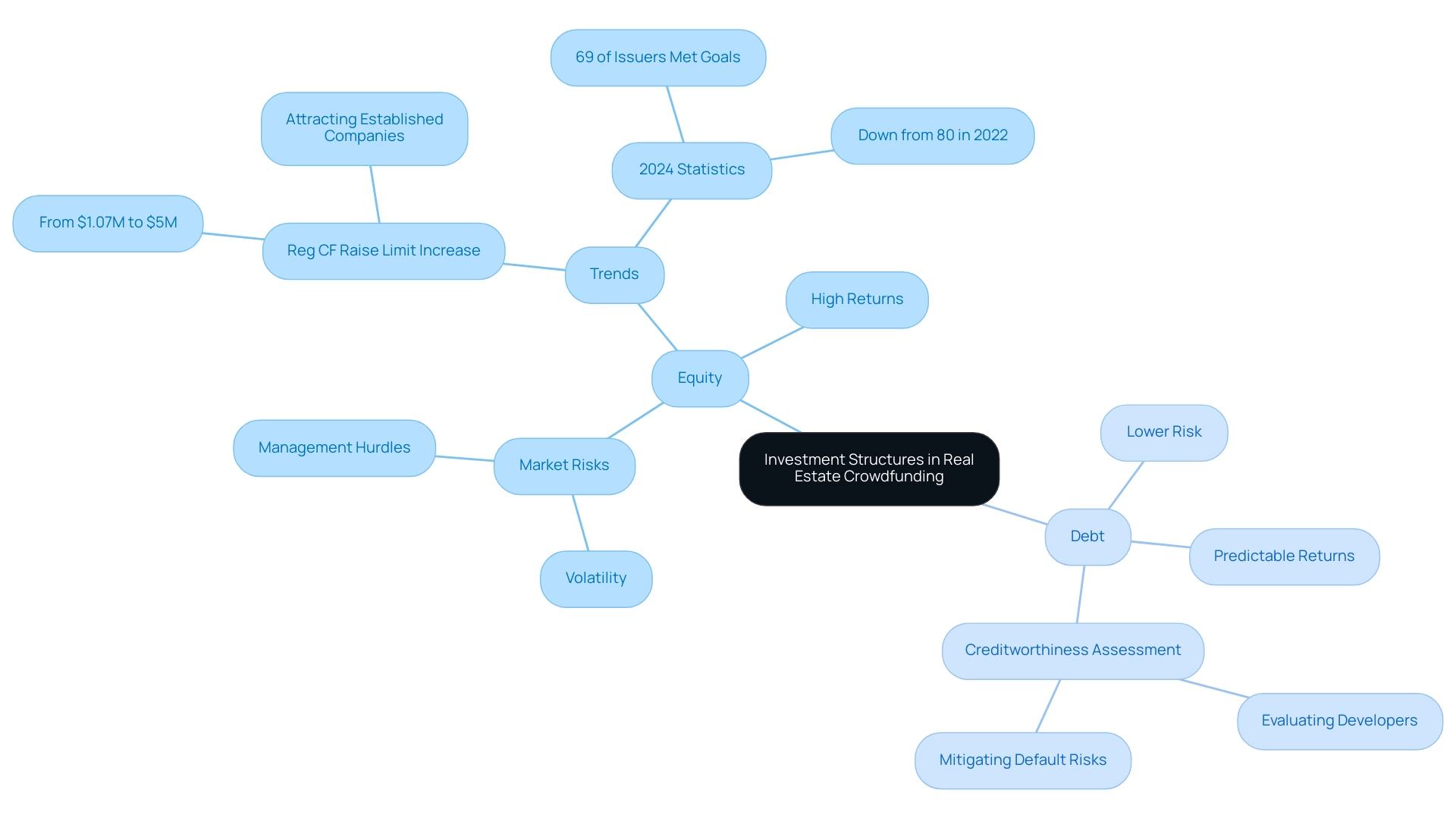

Exploring Investment Structures in Real Estate Crowdfunding

Real estate collective investment presents two main structures: equity and debt, each with its own unique opportunities and challenges. In equity raising, individuals acquire shares in a property, which entitles them to a portion of the rental income and any appreciation in property value. This model offers the potential for high returns, especially in thriving markets, yet it also brings the inherent risks tied to property ownership, such as market volatility and management hurdles.

Conversely, debt-based funding involves individuals lending money to property developers, who repay these loans with interest over a set period. This structure often provides more predictable returns, appealing to those in search of steady income with lower risk exposure. However, it is essential for investors to assess the creditworthiness of developers and the underlying projects to mitigate the risk of defaults.

As we look ahead to 2025, the realm of real property collective funding is transforming, with notable trends emerging. For instance, the average returns from equity fundraising in real estate are showing promising growth, reflecting the market's increasing maturity. Importantly, the rise in the Reg CF maximum raise limit from $1.07 million to $5 million has attracted more established companies, enhancing the viability of equity financing as a source of funding for capital-intensive startups.

Statistics reveal that in 2024, 69% of Reg CF issuers successfully met their minimum funding goals, a slight dip from 80% in 2022, indicating a competitive landscape that participants must navigate with care. Financial experts stress the importance of grasping these investment structures, emphasizing that the choice between equity and debt funding should align with individual financial aspirations and risk tolerance. Brian Belley, VP of Product, shares, "With the rise of broker-dealers, advancements in secondary markets, and increasing opportunities for non-traditional and underrepresented founders, 2025 holds exciting potential for growth and impact."

Additionally, recent updates indicate that distributions have surpassed capital calls for the first half of 2024, suggesting net positive cash flows for private equity LPs, even as industry-wide internal rates of return (IRR) have declined to around 3.8 percent. This context is vital for stakeholders as they assess the viability of funding alternatives in today's market.

Case studies highlight the real-world implications of these structures. For example, successful equity fundraising campaigns have empowered developers to launch innovative projects, while debt-based funding has been crucial in securing capital for renovations and expansions. As the property collective funding sector continues to evolve, we encourage backers to stay informed about emerging trends and to draw on the insights of industry experts to make well-informed decisions.

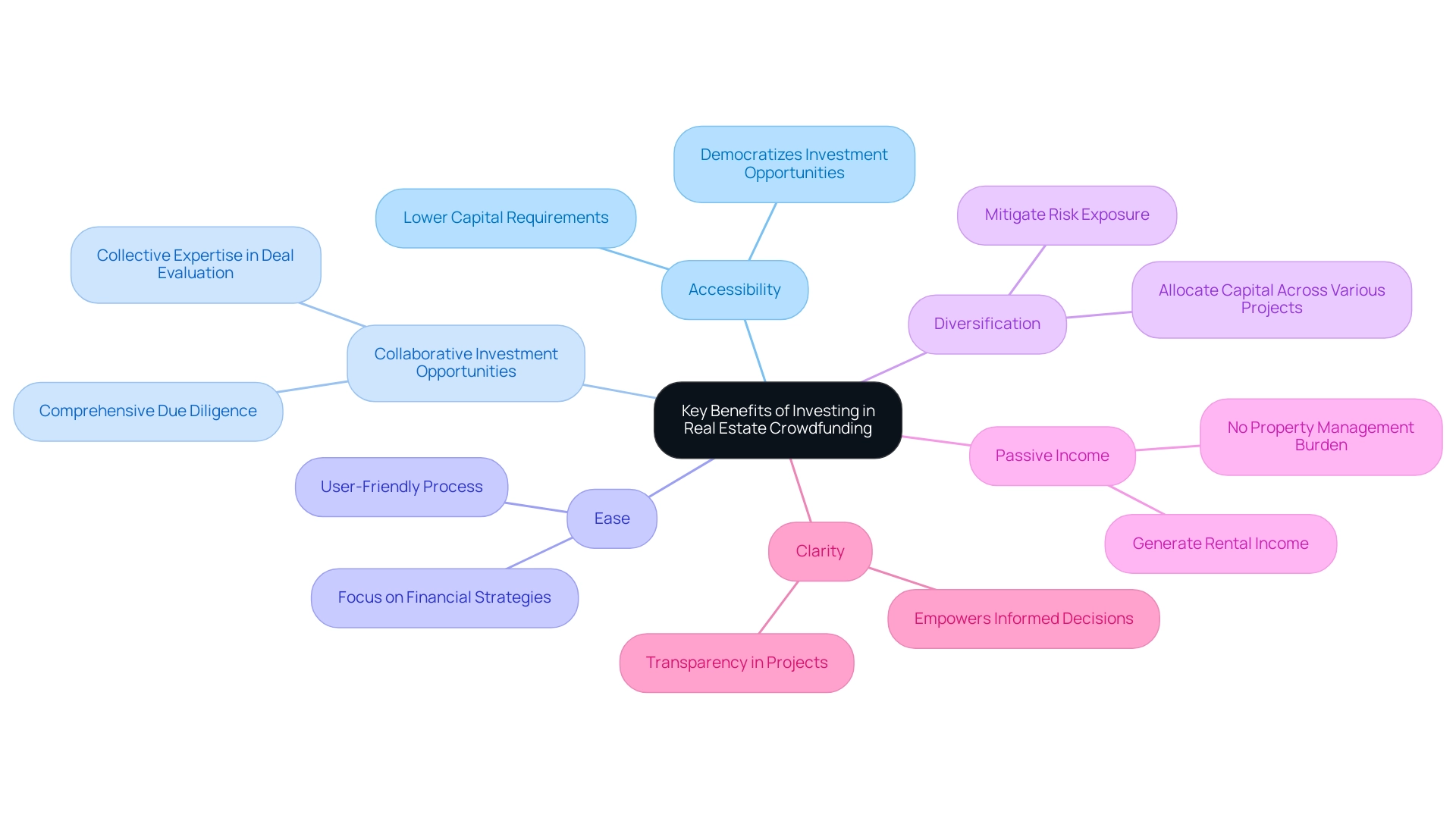

Key Benefits of Investing in Real Estate Crowdfunding

Investing in the top real estate crowdfunding platforms offers numerous benefits that resonate with both experienced investors and those just starting out. We understand that navigating the investment landscape can be daunting, but the advantages of real estate crowdfunding provide a supportive pathway forward.

-

Accessibility: With lower capital requirements, real estate crowdfunding democratizes investment opportunities, allowing a broader range of individuals to engage in real estate markets. This inclusivity is particularly significant in 2025, as the real estate market size is projected to reach USD 11.0 trillion, highlighting the potential for substantial returns. Many of our members have shared how this accessibility has opened doors they never thought possible.

-

Collaborative Investment Opportunities: The top real estate crowdfunding platforms, like fff.club, harness the power of collective expertise in deal evaluation. They filter top-notch opportunities and conduct comprehensive due diligence, ensuring that stakeholders benefit from the insights of over 300 experts assessing potential ventures. As one pleased contributor remarked, 'The collaborative method at fff. Club instilled confidence in my financial decisions.' This collaborative approach not only enhances the quality of available opportunities but also fosters a sense of community, allowing for informed decision-making.

-

Ease: We recognize that the funding process can often feel overwhelming. At fff. Club, the process is designed to be smooth and user-friendly for all parties involved, allowing backers to concentrate on their financial strategies without the usual complications of real estate transactions.

-

Diversification: Crowdfunding allows individuals to allocate their capital across various projects, effectively mitigating risk exposure. By diversifying their portfolios, investors can enhance their resilience against market fluctuations, a strategy endorsed by financial experts who advocate for a balanced approach to asset allocation. Real estate investing is considered reliable and attractive, making diversification even more crucial for solid investment portfolios. Many members have found that this approach has greatly improved their financial security.

-

Passive Income: Many of the top real estate crowdfunding platforms facilitate the generation of rental income without the burdens of property management. This passive income stream is appealing to individuals seeking to build wealth while maintaining their current lifestyle. We understand how important it is to find ways to grow your finances without added stress.

-

Clarity: Transparency is a cornerstone of trust in investing. Most of the top real estate crowdfunding platforms prioritize providing detailed insights into each project. This level of disclosure empowers individuals to make informed decisions, fostering trust and confidence in their investment choices.

However, it is essential to consider the regulatory environment surrounding property fundraising. Evolving legal frameworks, protection measures for financiers, and distinctions between accredited and non-accredited individuals present challenges that participants must navigate. We are here to support you through these complexities.

In 2025, the trend of using top real estate crowdfunding platforms for collective funding in real estate ventures continues to grow, with a significant percentage of investors acknowledging its advantages. Success stories are plentiful, demonstrating how individuals have successfully diversified their portfolios through strategic funding efforts. Furthermore, grasping the differences between equity fundraising and reward-based contributions, as emphasized in the case study titled 'A Short Guide to Crowdfunding,' improves awareness of the funding landscape.

As the landscape changes, understanding the subtleties of real property collective funding through top real estate crowdfunding platforms such as fff.club becomes crucial for enhancing financial potential. We are committed to walking alongside you on this journey, ensuring you feel supported and informed every step of the way.

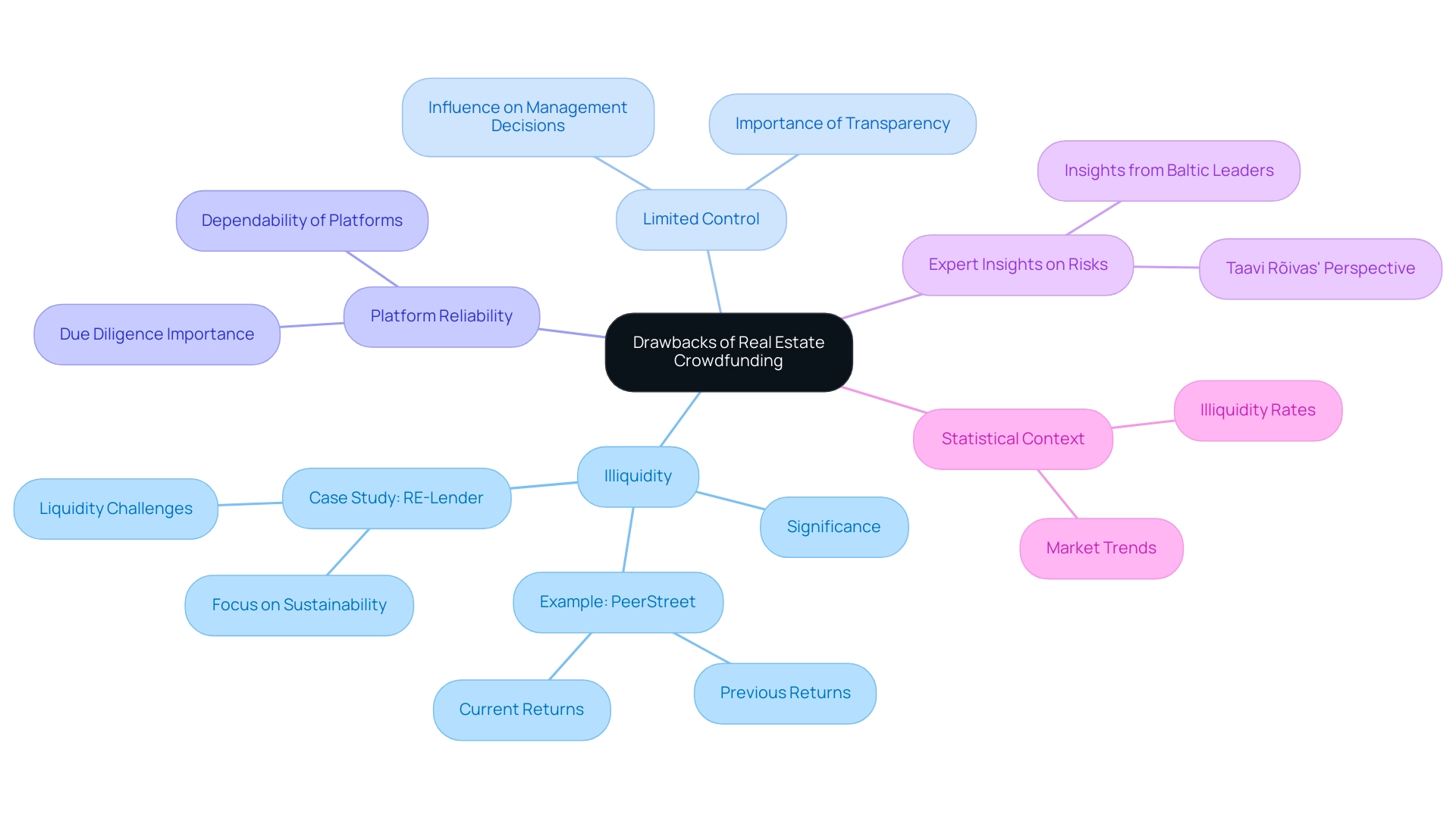

Understanding the Drawbacks of Real Estate Crowdfunding

While real estate collective funding offers various advantages, it’s important to recognize the inherent disadvantages that can impact participants in 2025.

-

Illiquidity: One of the most significant challenges is the illiquidity of investments. Unlike traditional stocks or bonds, which can be sold quickly, funds tied up in crowdfunding projects may be difficult to access promptly. This lack of liquidity can be particularly concerning during times of financial need or market volatility. As many of our members have experienced, understanding the liquidity profiles of different funds, such as the Special Opportunity Fund from efTEN, is crucial for managing expectations.

-

Limited Control: Many individuals find themselves with minimal influence over property management decisions. This lack of control can lead to outcomes that do not align with the expectations of financiers, especially if management decisions do not prioritize the interests of all stakeholders. Tamla's insights on effective fund management highlight the importance of selecting one of the top real estate crowdfunding platforms that prioritize investor communication and transparency. We understand that economic downturns can severely affect property values and rental income, posing substantial risks to investors. During economic contractions, the real estate market can experience significant declines, affecting returns on capital. Tamla emphasizes the importance of grasping these market dynamics, particularly in the Baltic region, where local economic elements can significantly affect fund performance.

-

Platform Reliability: The success of crowd-sourced financing heavily relies on the platform's dependability. If a platform encounters financial challenges or collapses entirely, stakeholders risk losing their capital. This platform risk underscores the importance of conducting thorough due diligence before committing funds, especially when investing in top real estate crowdfunding platforms, as highlighted by industry leaders. Tamla encourages individuals to evaluate platform backgrounds and management groups thoroughly prior to committing funds.

-

Expert Insights on Risks: Financial analysts have pointed out that while collective funding can broaden access to real property opportunities, it also presents distinct risks that individuals must manage. As Taavi Roivas, former Prime Minister of Estonia, emphasized, understanding these risks is crucial for making informed financial decisions in this evolving landscape. The insights shared by Kristjan Tamla and other Baltic investment leaders provide valuable perspectives on navigating these challenges.

-

Statistical Context: Recent statistics indicate that illiquidity rates in real estate collective funding investments have become a growing concern, with many stakeholders facing challenges in liquidating their positions. For instance, PeerStreet formerly provided returns of 12-14% on hard money loans, but this has now diminished to 6-9%, reflecting changing market conditions and their effect on expectations of those funding. This trend emphasizes the necessity for possible financiers to consider the advantages alongside the risks meticulously.

-

Case Studies on Illiquidity: A notable example is RE-Lender, an impact funding marketplace based in Milan. While it encourages sustainability by financing different reconversion initiatives, backers have reported challenges concerning the liquidity of their investments, highlighting the significance of comprehending the specific terms and conditions of each funding opportunity. This situation demonstrates the wider obstacles encountered by participants in funding platforms.

In conclusion, while property fundraising can offer profitable opportunities, it is essential for participants to recognize these disadvantages and perform comprehensive research to mitigate potential risks. Insights from Baltic leaders like Kristjan Tamla can assist individuals in making informed decisions in this complex landscape, particularly regarding the importance of understanding fund structures like the Special Opportunity Fund and the necessity of due diligence.

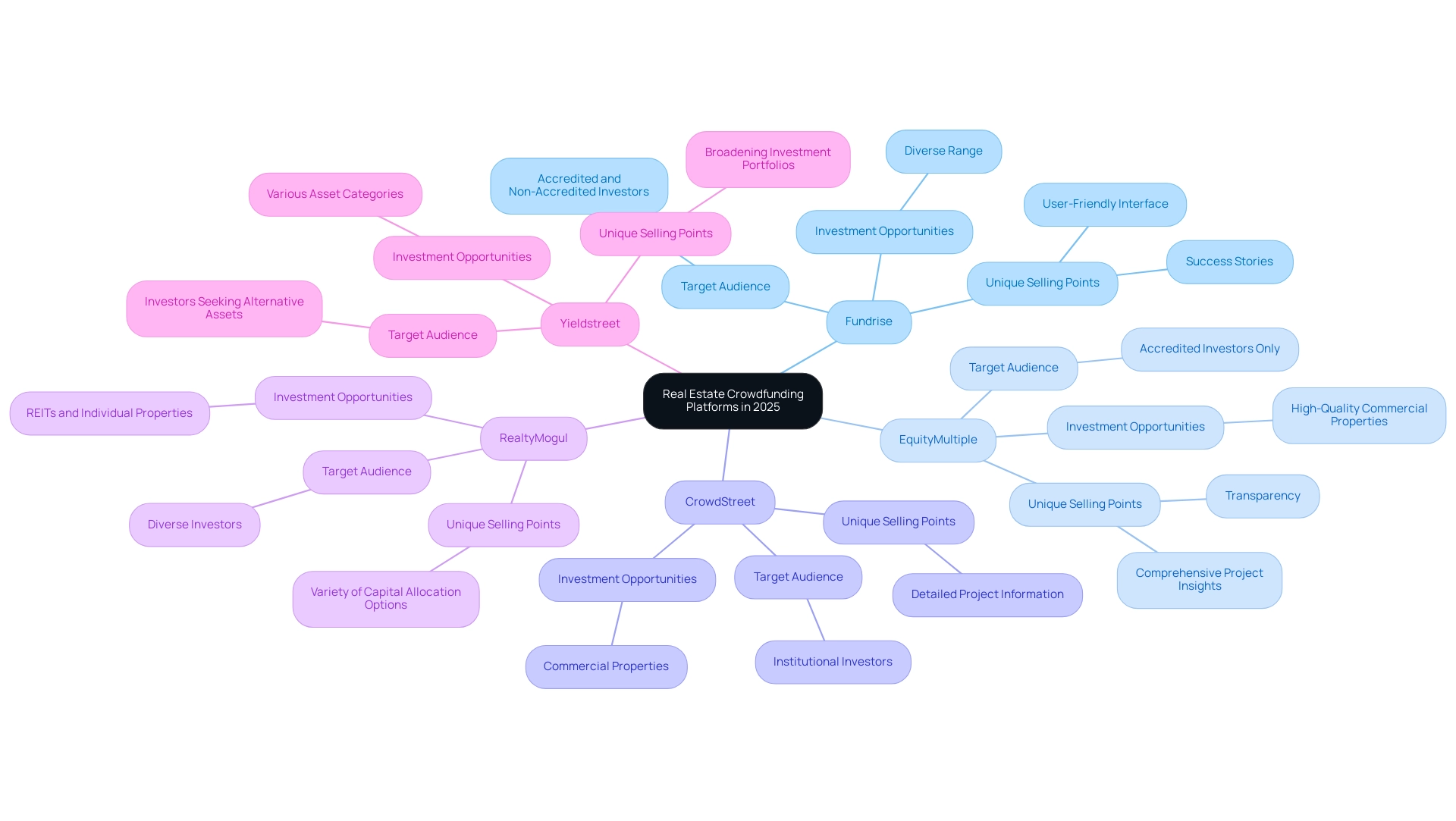

Top Real Estate Crowdfunding Platforms to Consider in 2025

As we look towards 2025, [several real estate crowdfunding platforms](https://blog.fff.club/what-are-examples-of-crowdfunding-platforms-a-comprehensive-overview) are emerging as beacons of innovation and robust offerings, each catering to the diverse needs of investors.

- Fundrise: Known for its user-friendly interface, Fundrise attracts both accredited and non-accredited investors with a diverse range of options. Many users have shared their success stories, reflecting the platform's potential for healthy returns and reinforcing its appeal to newcomers and seasoned individuals alike.

- EquityMultiple: Exclusively catering to accredited participants, EquityMultiple stands out by focusing on high-quality commercial real property opportunities. Its commitment to transparency and comprehensive project insights resonates with discerning stakeholders who value informed decision-making.

- CrowdStreet: With a focus on commercial properties, CrowdStreet opens doors to institutional-quality opportunities. Investors appreciate the detailed project information, which empowers them to make informed choices that align with their financial goals.

- RealtyMogul: This platform offers a variety of capital allocation options, including Real Estate Investment Trusts (REITs) and individual properties, catering to the diverse preferences and strategies of participants, thus fostering a sense of inclusivity.

- Yieldstreet: Recognized for its emphasis on alternative assets, Yieldstreet provides unique opportunities across various asset categories, appealing to investors eager to broaden their portfolios and explore new avenues.

In the residential sector, we anticipate it will lead revenue shares in 2025, facilitating easier market entry and being perceived as less risky. This trend underscores the growing interest in property crowdfunding as a viable financial strategy. Notably, 88% of top executives in the real estate industry express optimism for a positive year ahead, reflecting a hopeful market outlook.

Real Estate Crowdfunding is becoming a beloved approach for funding, granting ordinary individuals access to the financial sector while allowing professional stakeholders to diversify their portfolios. It is characterized by low expenses and ease of use, making it a versatile choice for both new and seasoned investors. As Albert Einstein wisely noted, "Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn’t, pays it." This profound insight resonates deeply within the realm of real estate crowdfunding, where informed financial choices can lead to significant growth.

Moreover, Philadelphia stands out as a vibrant city where history, culture, and opportunity converge, making it an attractive location for potential investments through these platforms. We understand that navigating this landscape can be daunting, but together, we can explore these opportunities and support one another in our investment journeys.

Conclusion

Real estate crowdfunding is transforming the investment landscape, offering accessible and collaborative opportunities for a diverse range of investors. This innovative approach allows individuals to pool their resources, democratizing access to lucrative real estate projects that were once the domain of those with substantial capital. As many of our members have experienced, the U.S. commercial real estate market is thriving, and global projections indicate continued growth. Thus, understanding the dynamics of crowdfunding is becoming increasingly vital.

The article highlights the distinct structures of equity and debt crowdfunding, each presenting unique risks and rewards. We understand that aligning your choices with your financial goals and risk tolerance is essential, while also recognizing the trends shaping this evolving market. The benefits of real estate crowdfunding—accessibility, convenience, and the potential for passive income—underscore how these platforms facilitate diversification and informed investment decisions, creating opportunities for everyone.

However, alongside these advantages, it is crucial for investors to remain vigilant about potential drawbacks, such as illiquidity and limited control over property management. A thorough understanding of these challenges, along with insights from industry leaders, can empower investors to navigate the complexities of real estate crowdfunding more effectively. As many of our members have shared, being informed is key to feeling confident in your investment journey.

In conclusion, as the real estate crowdfunding sector continues to mature, it presents an exciting opportunity for savvy investors. By leveraging the insights and strategies discussed, individuals can maximize their investment potential while participating in a collaborative community that fosters growth and innovation in real estate. Embracing this transformative model can pave the way for financial success in an increasingly competitive market, and we are here to support you every step of the way.