Overview

The article focuses on identifying the top crowdfunding platforms and their unique features, which cater to various fundraising needs. It provides a detailed analysis of key platforms like Kickstarter, Indiegogo, and GoFundMe, highlighting their funding models, target audiences, and success metrics, thereby guiding potential users in selecting the most suitable platform for their crowdfunding campaigns.

Introduction

Crowdfunding has revolutionized the way entrepreneurs and creators access capital, transforming the fundraising landscape into a more inclusive and dynamic space. By tapping into the collective power of individuals through online platforms, startups and innovative projects can bypass traditional funding hurdles and engage a diverse pool of investors. Recent trends indicate a remarkable growth in this sector, with average contributions rising significantly, reflecting a shift in investor confidence and interest.

As more individuals from younger demographics participate, the implications for both funding and community engagement are profound. This article delves into the various aspects of crowdfunding, including:

- Understanding its core principles

- Exploring leading platforms

- Evaluating the types of crowdfunding available

- Assessing the pros and cons associated with this modern financing method

Understanding Crowdfunding: An Overview

Crowdfunding has emerged as a prominent method for raising capital, harnessing the collective contributions of numerous individuals typically through a list of crowdfunding platforms. This innovative financing approach has gained traction among startups, small businesses, and creative projects, which are often featured in a list of crowdfunding platforms, enabling entrepreneurs to bypass traditional funding barriers. Recent statistics indicate that the average check size for crowdfunding has increased by 26% since 2023, now averaging $1,190, reflecting growing confidence in this model.

By leveraging social media and extensive online networks, entrepreneurs can effectively engage potential backers who are keen to support initiatives aligned with their interests. This democratization of funding not only facilitates access to capital but also fosters a sense of community among supporters and creators, enhancing shared purpose and collaboration. Furthermore, according to the Q3-2024 PitchBook Venture Monitor, the median valuation for Seed deals has reached $13 million, underscoring the increasing importance of collective funding in the investment landscape.

For tech investors, platforms like fff. Club amplify these benefits by offering a vibrant community where they can build valuable connections, gain investment insights, and participate in exclusive events. Members of the fff. Club community benefit from weekly tech and economic updates, as well as unique opportunities for deal flow and due diligence across various investment avenues. However, it is important to note that the average success rate for fundraising initiatives is approximately 22.4% to 23.7%, indicating that fewer than a quarter of efforts reach their funding objectives. Campaigns achieving at least 30% of their funding goal within the first week are more likely to succeed, highlighting the importance of outreach and marketing strategies in driving campaign success.

Additionally, the leading fundraising platforms in the UK, which are part of a list of crowdfunding platforms based on the amount of money raised in 2016, include notable names such as Kickstarter and Indiegogo, paving the way for future fundraising endeavors. Overall, collective funding presents numerous benefits for startups, offering an alternative financing option that encourages innovation and community-driven investment. Insights into the demographics of crowdfunding investors in 2024 reveal a diverse group, with increasing participation from younger generations, further indicating a shift in the investment landscape.

Exploring the Top Crowdfunding Platforms: A Comparative Analysis

- Kickstarter: Renowned for its focus on creative projects, Kickstarter operates on an all-or-nothing funding model, motivating backers to contribute. This model not only fosters a sense of urgency but has also been shown to enhance visibility and success rates on the list of crowdfunding platforms, with a noteworthy average success rate of approximately 22.4% to 23.7%. Furthermore, initiatives that feature a video pitch tend to raise 105% more funds than those lacking it, emphasizing the significance of captivating presentations. According to a 2024 survey of 1,660 respondents, the median offering valuation on Kickstarter was $15.0 million, with an average valuation of $36.5 million.

- Indiegogo: Offering flexible funding options, Indiegogo allows campaigners to retain the funds raised even if they do not meet their initial goal. This medium is especially favored for tech innovations, catering to a wide audience and providing a less restrictive environment for project creators. The success rate of initiatives on Indiegogo varies, but its flexibility can lead to favorable outcomes in certain cases, highlighting its position in the list of crowdfunding platforms. The same 2024 survey indicated that projects on Indiegogo generally attract diverse funding levels, contributing to a dynamic funding environment.

- GoFundMe: Primarily aimed at personal causes and charitable initiatives, GoFundMe features a straightforward approach that enables individuals to easily solicit support for emergencies or community projects. Its user-friendly interface has positioned it as a leading medium for fundraising in personal contexts, with many campaigns achieving significant backing.

- SeedInvest: Specializing in equity crowdfunding, SeedInvest connects startups with accredited individuals who are interested in exchanging capital for equity stakes. This system is especially advantageous for tech startups aiming to expand, as it offers access to a network of possible funders concentrated on innovative enterprises. The average valuation of startups on SeedInvest often aligns with industry standards, reflecting the growing interest in tech investments.

- Crowdcube: Located in the UK, Crowdcube enables individuals to buy shares in startups and small enterprises in return for their funding. This equity crowdfunding service is included in the list of crowdfunding platforms that attract a diverse range of investors looking to support early-stage companies while potentially benefiting from their growth. The system's structure is designed to facilitate a transparent investment process.

- Patreon: A unique model for creators, Patreon enables individuals to earn recurring revenue through subscription-based support from fans. This platform is especially effective for artists and content creators, providing a stable income stream and fostering community engagement.

- Fundable: Catering to a variety of campaigns, Fundable offers both rewards and equity crowdfunding options. This versatility makes it an attractive choice for entrepreneurs seeking different funding types, allowing them to tailor their approach based on their project's needs, as it is part of a larger list of crowdfunding platforms.

- WeFunder: Created to democratize investment, WeFunder enables everyday individuals to support startups in exchange for equity. This platform breaks down traditional investment barriers, making it accessible to a broader audience and promoting a more inclusive investment landscape.

- NextSeed: Concentrated on small enterprises, NextSeed offers a debt-based funding model where lenders provide capital to businesses in exchange for interest payments. This approach can yield steady returns for stakeholders while supporting local entrepreneurship.

- StartEngine: Focusing on equity crowdfunding, StartEngine provides startups a means to raise capital while enabling stakeholders to obtain shares in developing companies. This platform is particularly popular among tech startups, providing a robust environment for capital raising and engagement with financiers. Through

fff.club, tech stakeholders can further enhance their investment potential by accessing community insights, educational resources, and exclusive investment opportunities tailored for their needs. Additionally,fff.clubprovides essential advantages such as deal flow, due diligence, and co-investing opportunities, empowering individuals to make informed decisions. Weekly tech and economic updates provide further insights, ensuring that members stay ahead in the fast-paced investment landscape.

Types of Crowdfunding: Equity, Rewards, and More

- Equity Crowdfunding: This model enables individuals to acquire shares in a company, thereby allowing them to participate in its growth and financial success. It is particularly advantageous for startups seeking capital, as it not only provides funding but also aligns investors with the company's long-term objectives. According to recent analyses, Europe is expected to experience a steady growth rate in this sector, driven by evolving guidelines that support the collective funding model. Furthermore, 30% of Horizon Databook's revenue comes from working with investment firms to identify viable opportunity areas, highlighting the financial potential within this space.

- Reward-Based Crowdfunding: In this approach, backers receive non-monetary rewards in return for their financial support, often in the form of products or services. This model is prevalent on platforms such as Kickstarter and has been shown to enhance market validation for projects. Notably, Zippia reports that 22.4% of all crowdfunding efforts achieve success, underscoring the effectiveness of reward-based initiatives and adding credibility to this model.

- Debt Crowdfunding: Also referred to as peer-to-peer lending, this type allows individuals to lend money to businesses or projects in exchange for interest payments. It serves as an alternative funding source for startups and small enterprises, bypassing traditional financing avenues, thereby facilitating access to capital.

- Donation-Based Crowdfunding: This model involves individuals donating to a cause or project without any expectation of financial returns. It is commonly utilized in charitable campaigns and personal fundraising efforts, fostering community engagement and support for various initiatives.

- Royalty-Based Crowdfunding: Investors in this model receive a percentage of the revenue generated by the project or business over time, which provides a potential income stream without necessitating equity ownership. This option is particularly appealing to individuals seeking a return on investment that is tied directly to the success of the venture.

Overall, the list of crowdfunding platforms provides businesses alternative financial sources and acts as a tool for market validation, enhancing credibility and attracting additional investors. A case study indicates that collective funding has significant impacts on startups and small enterprises, providing them with essential capital while fostering community engagement and customer loyalty.

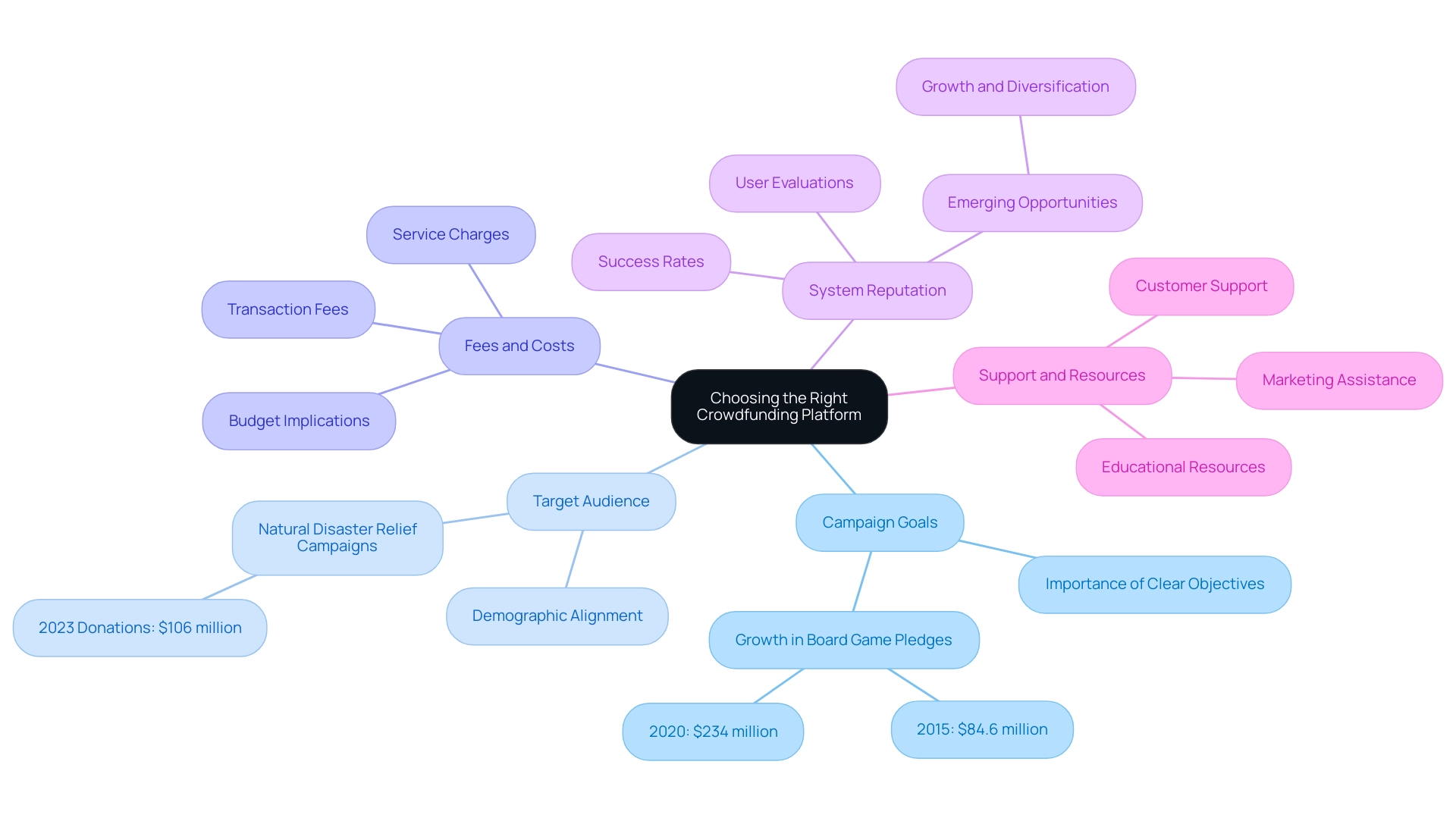

Choosing the Right Crowdfunding Platform: Key Considerations

-

Campaign Goals: It is crucial to clearly articulate your fundraising objectives before selecting a crowdfunding site. Comprehending how various systems address particular kinds of initiatives can greatly influence your success with a list of crowdfunding platforms. A well-defined goal not only directs your strategy but also aids in recognizing which avenues align best with your vision. For instance, the crowdfunding industry has shown tremendous growth, with pledges for board games increasing from $84.6 million in 2015 to $234 million in 2020, highlighting the potential for successful campaigns when goals are clearly defined.

-

Target Audience: Evaluating the demographics of a service's user base is essential. Ensure that the platform attracts supporters who match the profile of your intended audience. This alignment can enhance the chances of garnering the necessary support for your initiative. In 2023, crowdfunding efforts raised $106 million for natural disaster relief, showcasing how targeted campaigns can resonate with the right audience.

-

Fees and Costs: A thorough evaluation of the fee structures across various services is vital. This includes understanding transaction fees, service charges, and any additional costs that may arise during the fundraising process. Making an informed decision regarding fees can help you gauge the financial implications on your overall budget, especially when evaluating a list of crowdfunding platforms.

-

System Reputation: Investigating a system's track record is important for understanding its reliability and effectiveness. User evaluations and success rates offer important insights into the effectiveness of past campaigns, which can affect your selection of service. The case study 'Emerging Opportunities in the Crowdfunding Industry' illustrates how the industry is diversifying and growing, which can inform your assessment of the service reputations of the list of crowdfunding platforms.

-

Support and Resources: Choose funding platforms that provide educational resources, customer support, and marketing assistance. These tools can significantly enhance your campaign's visibility and overall success, equipping you with the necessary knowledge to navigate the complexities of fundraising.

The Pros and Cons of Crowdfunding: Weighing Your Options

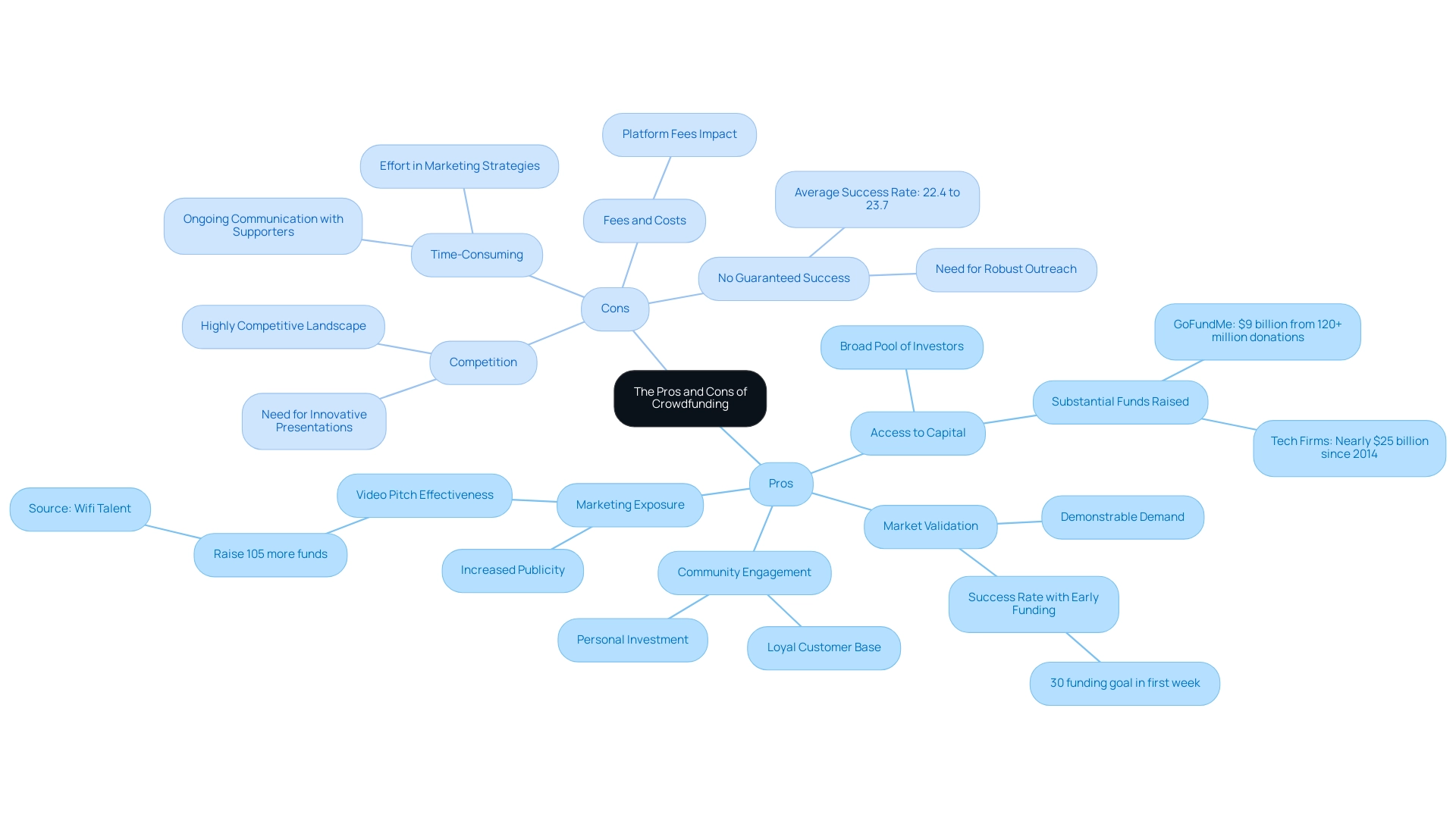

Pros:

-

Access to Capital: Crowdfunding offers entrepreneurs access to a list of crowdfunding platforms that allow them to raise substantial funds from a broad pool of investors, often eliminating the need for traditional financing avenues, which can be restrictive and time-consuming. Notably, GoFundMe has raised more than $9 billion from over 120 million donations worldwide, showcasing the significant potential for innovation-driven investments.

Moreover, technology firms have effectively generated almost $25 billion through a list of crowdfunding platforms since 2014.

-

Market Validation: Securing funding through a crowdfunding effort serves as a powerful validation of the business idea.

It signals to potential investors that there is demonstrable demand and interest in the product or service, which can enhance credibility. For instance, initiatives that reach at least 30% of their funding goal within the first week exhibit a higher likelihood of overall success, emphasizing the importance of early outreach and marketing strategies.

-

Community Engagement: Crowdfunding cultivates a sense of community among backers, allowing them to feel personally invested in the project’s success. This engagement can lead to a loyal customer base and sustained support beyond the initial funding phase.

-

Marketing Exposure: Successful initiatives often generate considerable publicity, elevating awareness of the project and attracting additional investment opportunities. The inclusion of a video pitch can significantly improve fundraising initiatives; according to Wifi Talent, efforts that employ this strategy raise 105% more funds than those that do not. This emphasizes the essential function of effective marketing in fundraising success.

Cons:

-

Competition: The landscape of collective funding, including the list of crowdfunding platforms, is highly competitive, making it increasingly difficult for initiatives to distinguish themselves and capture the attention of potential supporters. Entrepreneurs must develop innovative and compelling presentations to break through the noise.

-

Fees and Costs: Various fundraising platforms impose fees that can significantly reduce the total funds raised. This financial consideration is crucial for entrepreneurs, as it affects the overall viability of their initiatives.

-

Time-Consuming: Conducting a successful fundraising initiative demands considerable time and effort, particularly regarding marketing strategies and ongoing communication with supporters. Entrepreneurs must be prepared to invest the necessary resources to maintain engagement throughout the initiative.

-

No Guaranteed Success: There is no guarantee that a crowdfunding campaign will meet its funding goal. With an average success rate of only 22.4% to 23.7%, many projects fall short, which can be disheartening for creators.

This underscores the need for robust outreach and marketing strategies to maximize the chances of success.

Conclusion

Crowdfunding has emerged as a transformative force in the capital-raising landscape, enabling entrepreneurs and creators to access funding in unprecedented ways. This article has explored the core principles of crowdfunding, highlighting its ability to democratize investment and foster community engagement. With platforms like Kickstarter and Indiegogo leading the charge, the growth of crowdfunding reflects a significant shift in investor behavior, particularly among younger demographics who are increasingly participating in this modern financing method.

The comparative analysis of leading crowdfunding platforms reveals unique features and advantages, allowing creators to select the best fit for their specific needs. From equity crowdfunding to reward-based models, there is a diverse range of options available that cater to various project types and funding goals. However, it is essential to consider the potential drawbacks, including competition, fees, and the time commitment required for successful campaigns.

Ultimately, crowdfunding represents a powerful tool for innovation and entrepreneurship, offering access to capital while validating market demand. As this financing model continues to evolve, it is crucial for creators to develop effective outreach and marketing strategies to enhance their chances of success. Embracing the opportunities provided by crowdfunding can lead to not only financial backing but also a supportive community invested in the project's success.