Overview

The article titled "Top 10 Best Equity Crowdfunding Platforms You Should Consider" focuses on identifying and evaluating the leading equity crowdfunding platforms available for investors. It provides a comprehensive overview of each platform's unique features, benefits, and suitability for different types of investors, demonstrating how these platforms facilitate access to investment opportunities while highlighting their potential for returns and community engagement.

Introduction

Equity crowdfunding has emerged as a transformative force in the investment landscape, allowing businesses to raise capital by offering shares to a diverse pool of investors through online platforms. This method not only democratizes access to investment opportunities, previously reserved for accredited investors, but also empowers entrepreneurs to secure essential funding for their ventures.

As the popularity of equity crowdfunding continues to grow, with a record number of active campaigns, understanding its nuances becomes crucial for potential investors. This article delves into the mechanics of equity crowdfunding, highlights prominent platforms, discusses the benefits and risks associated with this investment model, and provides guidance on selecting the right platform to maximize investment potential.

By exploring these facets, investors can navigate the evolving landscape of equity crowdfunding with greater confidence and insight.

Understanding Equity Crowdfunding: A Comprehensive Overview

Equity crowdfunding is considered one of the best equity crowdfunding platforms for capital raising, enabling companies to offer shares to a vast pool of funds via online platforms. This innovative approach significantly democratizes investment opportunities, granting access to individuals who wish to invest in startups and small businesses that were once limited to accredited participants. The model not only provides entrepreneurs with essential funding but also enables stakeholders to engage in the growth trajectories of pioneering companies.

As of December 2024, the landscape of equity crowdfunding has seen remarkable growth, with the number of active raises reaching an all-time high of 569, surpassing the previous record of 561 in March 2022. For technology financiers, platforms like fff. Club provide extensive resources, including weekly tech and economic updates, to establish valuable connections, acquire financial insights, and engage in exclusive events.

Additionally, fff. Club provides opportunities for deal flow, due diligence, and co-investing, ensuring that participants are well-equipped to make informed decisions. Comprehending the complexities of equity financing, including the funding mechanics and possible returns, is essential for anyone contemplating this option.

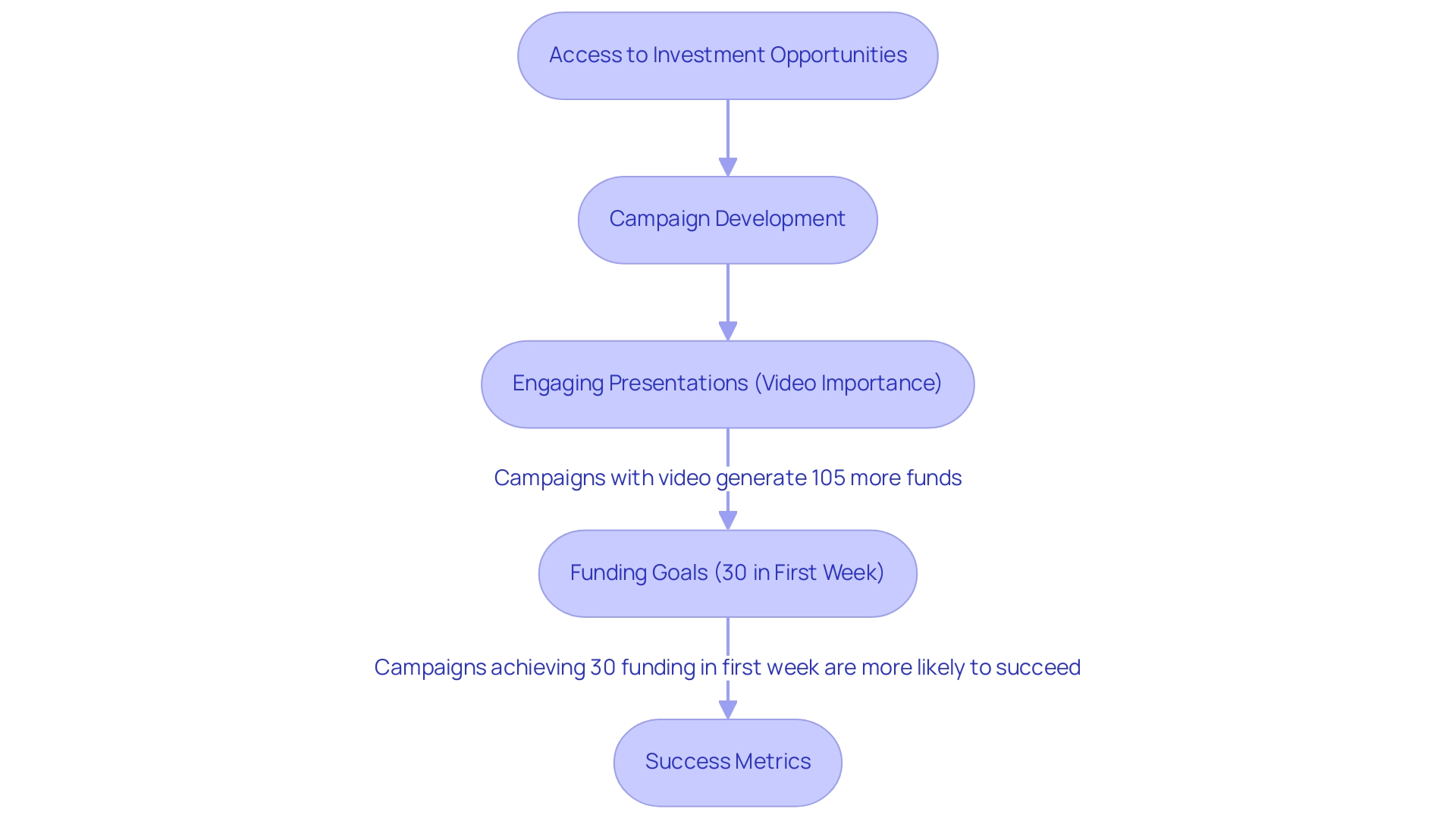

Significantly, campaigns that include video presentations generate 105% more funds than those lacking them, highlighting the essential function of engaging narratives and visual involvement in drawing in backers. Furthermore, campaigns that achieve at least 30% of their funding goal within the first week are more likely to succeed overall, as noted by Fit Small Business. As equity crowdfunding continues to evolve, recognizing its role in fostering innovation and expanding access to funding through the best equity crowdfunding platforms is essential, particularly in the context of stabilizing VC valuations, which fell significantly from 2021 to 2023 but showed signs of recovery in 2024.

By leveraging the community engagement and educational resources available at fff.club, including insights on market trends and funding strategies, tech investors can navigate the current financial landscape more effectively.

Top Equity Crowdfunding Platforms to Consider in 2025

- SeedInvest - Renowned for its rigorous vetting process, SeedInvest presents high-quality investment opportunities in startups. Investors gain access to a curated selection of companies, ensuring a level of security and reliability that is pivotal in the crowdfunding landscape. This dedication to quality is demonstrated in the system's successful history of funded projects, making it a preferred option for discerning backers.

- CrowdCube - A leading platform in the UK, CrowdCube empowers investors to acquire shares in startups and burgeoning businesses. It boasts a diverse range of financial opportunities, coupled with a user-friendly interface that enhances the investing experience. Success stories from UK startups on CrowdCube highlight its effectiveness in facilitating capital raises, further establishing its reputation in the equity crowdfunding space.

- Wefunder - Focusing on enabling small businesses to secure funding from the general public, Wefunder fosters a robust community aspect. This system motivates supporters to participate actively with the businesses they back, creating a vibrant financial atmosphere that not only enables funding but also fosters connections between entrepreneurs and sponsors.

- Republic - With a wide range of funding options including startups, real estate, and gaming, Republic is created to be approachable and captivating for all kinds of participants. The platform's diverse offerings cater to a wide array of interests and financial strategies, making it a popular choice among tech-savvy individuals seeking varied opportunities.

- StartEngine - StartEngine distinguishes itself by providing both equity raising and tokenized securities, enabling participants to explore various investment types. This versatility is especially attractive in the current market environment, where individuals are increasingly seeking innovative methods to diversify their portfolios.

- Fundable - Merging rewards-based and equity crowdfunding, Fundable provides entrepreneurs with flexibility in their fundraising approaches. This dual model enables businesses to choose the fundraising strategy that best aligns with their goals, thereby enhancing their chances of success.

- NextSeed - Focusing on revenue-based financing, NextSeed allows individuals to fund small businesses and obtain returns based on the company’s revenue. This model aligns stakeholder interests with business performance, promoting a collaborative growth environment that benefits both parties.

- EquityNet - EquityNet provides an extensive database of funding opportunities, streamlining the search process for capital providers. With its extensive listings, individuals can easily identify suitable startups that align with their financial criteria, thereby streamlining their decision-making process.

- MicroVentures - Catering to both accredited and non-accredited individuals, MicroVentures provides access to a diverse range of startups and growth companies. This inclusive method expands the financial landscape, enabling more individuals to engage in equity crowdfunding.

- Honeycomb Credit - Focused on helping local enterprises gather capital through community support, Honeycomb Credit links funders directly with businesses in their area. This localized approach not only fosters community engagement but also enhances the likelihood of investment success, as investors can support ventures they are passionate about.

Case Study: Crowdfundr - Crowdfundr is a fundraising service that assists individuals and companies in obtaining capital for creative endeavors, such as books, comics, and art. The service provides tools for campaign management and a straightforward application process, making it accessible for creators to showcase their ideas. As mentioned by Imed Bouchrika, Co-Founder and Chief Data Scientist, "The realm of collective funding is flourishing, providing a diverse array of options to assist individuals and enterprises in gathering resources for their initiatives and causes."

This highlights the diverse opportunities available in the funding space.

Traffic Insights - Furthermore, comprehending traffic sources can offer valuable insight into effectiveness. For instance, direct searches accounted for 45.13% of traffic to Crowdfund, indicating a strong brand presence, while social searches contributed 9.77%. Such statistics can assist stakeholders in assessing the popularity and reliability of different funding platforms.

Benefits and Risks of Equity Crowdfunding: What You Need to Know

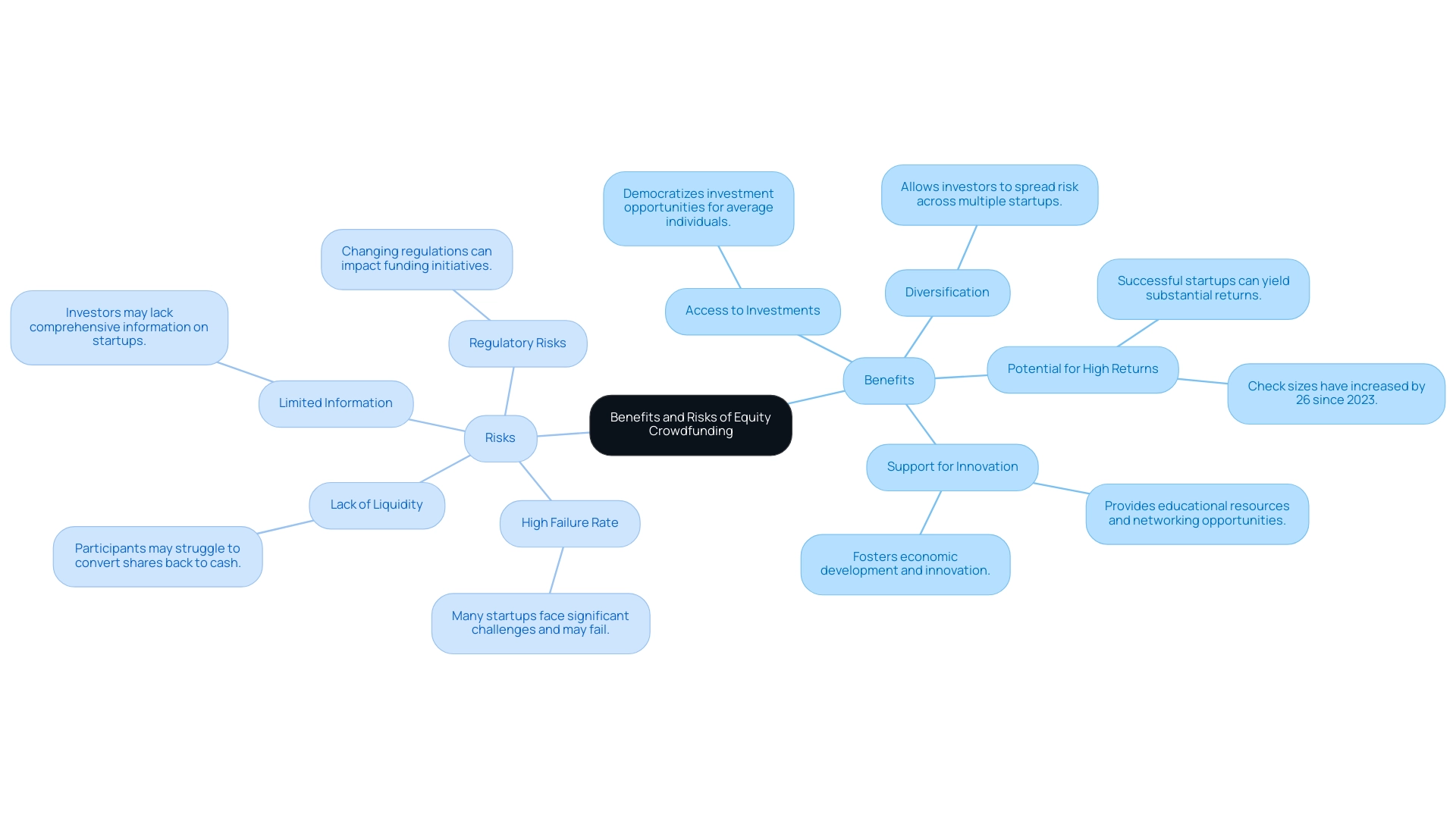

Benefits:

- Access to early-stage investments is enhanced by the best equity crowdfunding platforms, which democratize investment opportunities and enable average individuals to participate in financing startups that were previously out of reach. This shift not only broadens the investor base but also enhances the potential for community-driven innovation, as exemplified by the active engagement of over 400 members in the best equity crowdfunding platforms like the fff.club community.

- Potential for High Returns - The upside of equity crowdfunding is notable, especially for successful startups. Rapid growth in these companies can lead to substantial returns, outpacing conventional financial options. This is emphasized by recent statistics indicating that check sizes have risen by 26% since 2023, reflecting a growing confidence in this funding approach and the potential for higher returns.

- Diversification - Investors can strategically diversify their portfolios by allocating funds to multiple startups across various sectors. This spread can mitigate risks and enhance the potential for overall returns, making the community insights and resources at fff.club invaluable.

- Support for Innovation - By backing startups, financiers play a crucial role in fostering innovation and economic development. The fff.club platform empowers tech stakeholders through educational resources—such as webinars, investment guides, and market analysis—and exclusive investment opportunities, ensuring members are well-informed and capable of making impactful investment decisions. Additionally, members can participate in various events designed to facilitate networking and knowledge sharing. As mentioned by Kingscrowd, "We remain dedicated to creating the tools and services that democratize access to capital and enable both funders and entrepreneurs to prosper in this dynamic ecosystem." This statement emphasizes the wider influence of equity financing on fostering entrepreneurial efforts and innovation.

Risks:

- High Failure Rate - It is well-documented that startups face a significant challenge, with many ultimately failing. This reality presents a significant threat for stakeholders, who may encounter complete loss of their capital.

- Lack of Liquidity - Equity-based funding endeavors often prove to be illiquid, indicating that participants may face challenges in selling or converting their shares back into cash. This lack of liquidity can be a critical consideration for those needing access to their funds.

- Limited Information - Unlike traditional investors, those participating in equity fundraising may not have access to comprehensive information regarding the startups they are considering. This information asymmetry can complicate the assessment of potential funding opportunities.

- Regulatory Risks - The changing regulatory environment can present challenges to funding initiatives and their related investments. Changes in regulations may affect the operational viability of these platforms, potentially influencing the interests of those involved.

Broader Trends:

Additionally, the rise of peer-to-peer payments in countries like Canada and Chile in 2023 indicates a significant shift in the crowdfunding landscape, further emphasizing the growing acceptance and integration of innovative financial solutions within equity crowdfunding.

Market Presence:

With 2.5 years on the market, fff.club has established a solid reputation among tech investors, continuously adapting to the evolving landscape of crowdfunding and investment opportunities.

How to Choose the Right Equity Crowdfunding Platform for Your Needs

When selecting the ideal equity crowdfunding platform, investors should meticulously evaluate the following criteria:

-

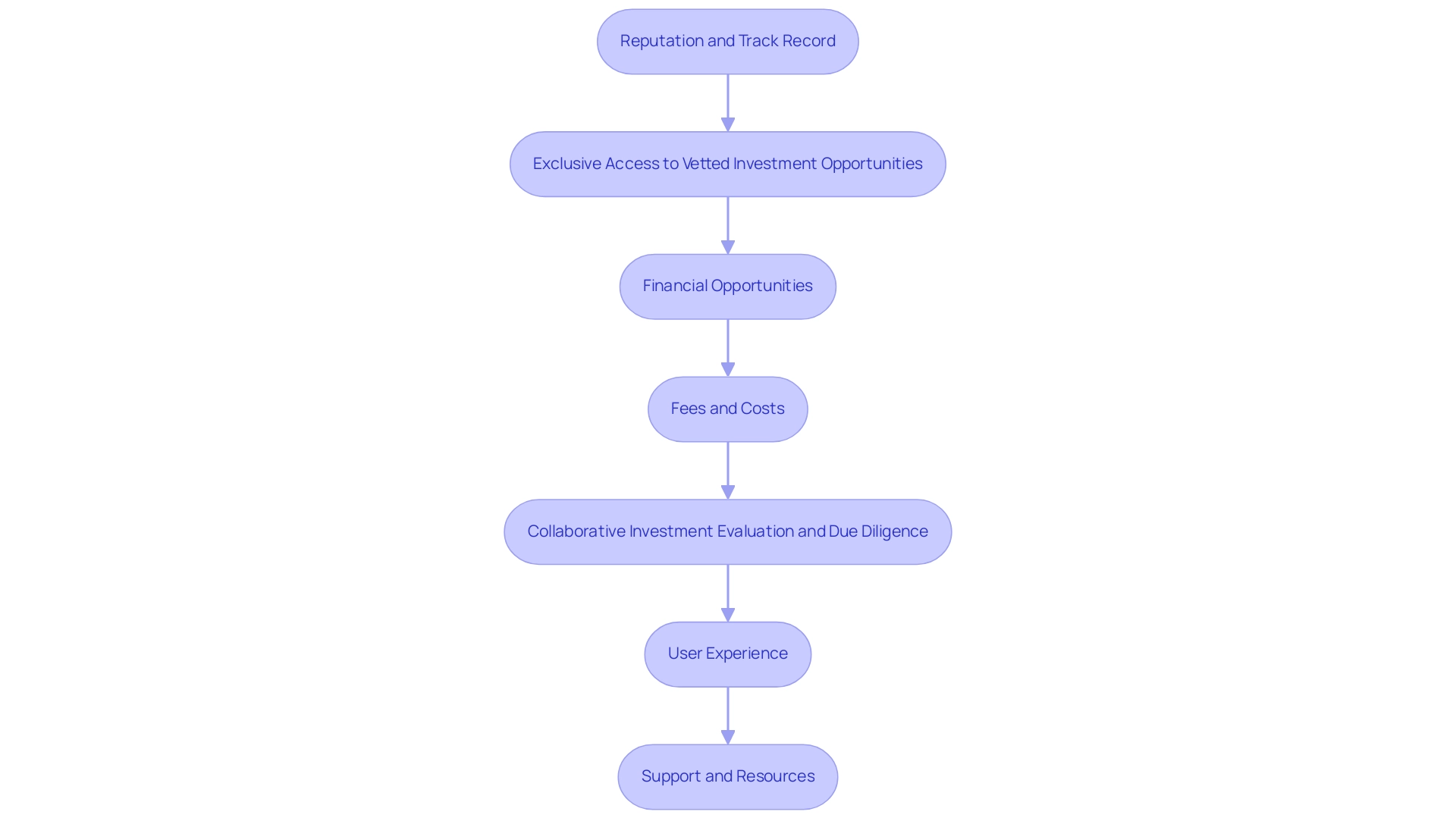

Reputation and Track Record - Explore the service's history and user reviews to evaluate its reliability and success rate. A strong reputation is crucial as it often correlates with successful funding outcomes on the best equity crowdfunding platforms. According to research, this is found to increase crowdfunding participation through the number of backers and funding amount, as noted by Block, Hornuf, and Moritz.

-

Exclusive Access to Vetted Investment Opportunities - Consider sites like fff.club, which provide exclusive access to high-grade deals in venture capital, private equity, real estate, and private credit. These vetted opportunities are critical for tech investors looking to enhance their portfolios with the best equity crowdfunding platforms that provide reliable options.

-

Financial Opportunities - Evaluate the range of financial opportunities provided by the platform. Ensure that these opportunities align with your investment goals and interests, as the best equity crowdfunding platforms can offer diverse options to enhance your portfolio. Notably, the primary backer in the SyndicateRoom model typically commits between 25% and 40% of the target capital before the campaign launches publicly. This strategy has been shown to increase overall crowdfunding participation, enhancing the number of investors and the total funding amount.

-

Fees and Costs - Acquire a comprehensive grasp of the system's fee arrangement, including any commissions or expenses that may be imposed on your capital. Transparent fee policies are vital on the best equity crowdfunding platforms, as they directly impact your overall returns.

-

Collaborative Investment Evaluation and Due Diligence - Seek venues that leverage community expertise, such as the best equity crowdfunding platforms like fff.club, where collaboration enhances deal evaluation. With over 300 members evaluating each deal, this community-driven method guarantees a thorough due diligence process, resulting in improved financial decisions. As one member noted, "The collective insights from the community make a significant difference in identifying high-grade deals."

-

User Experience - Evaluate the platform's interface and overall usability. A user-friendly experience can significantly enhance your investment journey, reducing friction and allowing for more effective decision-making. Recent research methodology covering 94 empirical studies highlights the critical role user experience plays in determining success on the best equity crowdfunding platforms.

-

Support and Resources - Seek platforms that provide educational resources and robust customer support. Access to the best equity crowdfunding platforms is essential for making well-informed investment decisions. Platforms with robust support systems can encourage greater participation from backers, as they assist users in navigating the intricacies of fundraising.

By thoughtfully evaluating these elements, including the distinct benefits provided by community-oriented platforms like fff.club, individuals can prepare themselves for success in the changing environment of equity funding.

Navigating the Regulatory Environment of Equity Crowdfunding

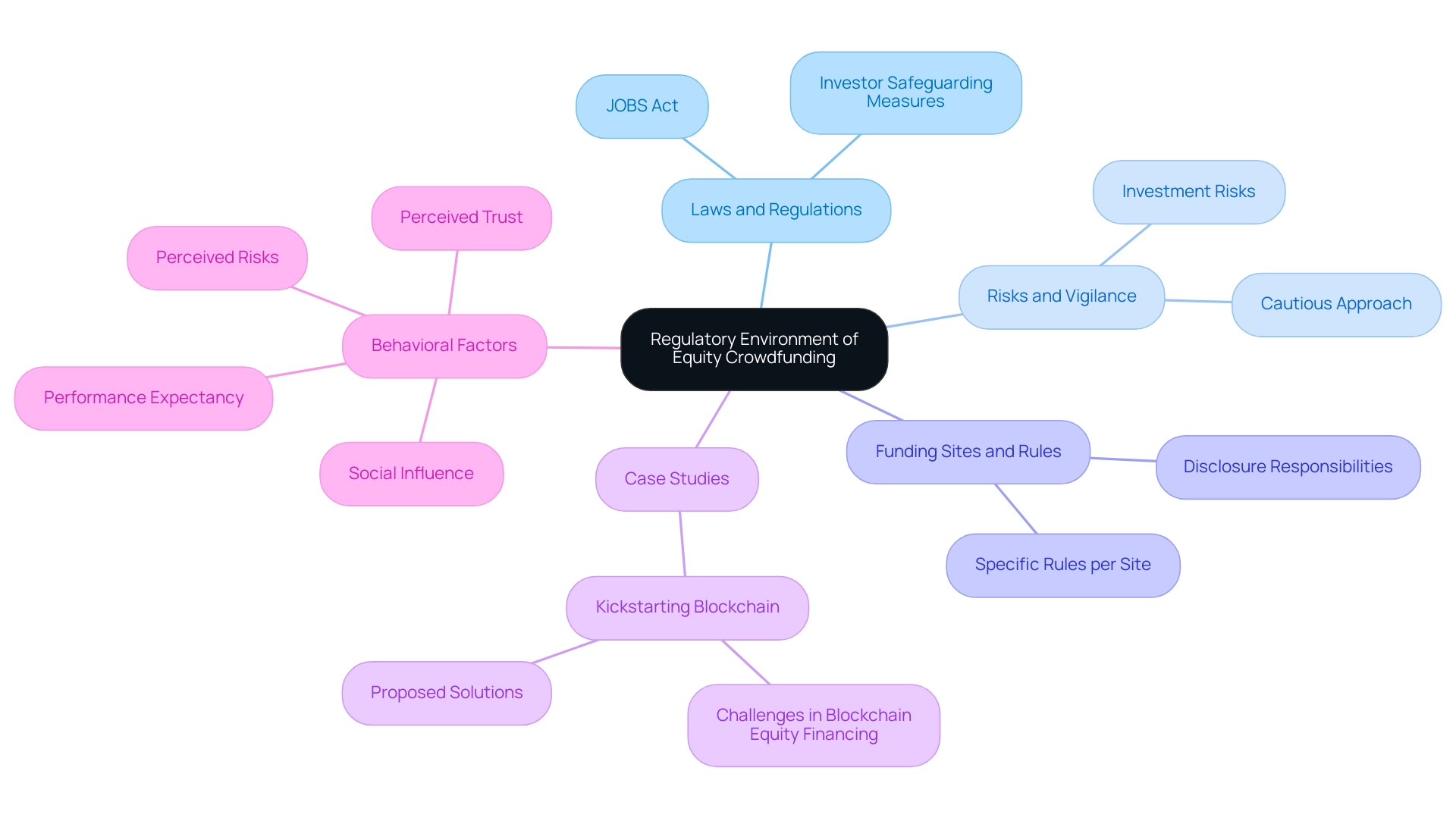

The regulatory framework overseeing equity fundraising is intricately influenced by a range of laws and regulations designed to protect participants. In the United States, the Jumpstart Our Business Startups (JOBS) Act has considerably changed the environment by permitting non-accredited individuals to engage in equity fundraising, thus democratizing funding opportunities. However, potential stakeholders must remain vigilant regarding the inherent risks associated with investing in startups, as these investments are often subject to less stringent regulations compared to traditional securities.

It is essential to become acquainted with the specific rules pertinent to your selected funding site, including disclosure responsibilities and investor safeguarding measures. As Kukuh Tondoyekti indicates, the improper use of funds on the Kitabisa.com website emphasizes significant issues in sustaining public confidence, accountability, and business ethics within Indonesia's FinTech ecosystem. This underscores the necessity for ongoing diligence in monitoring the evolving regulatory landscape.

Significantly, a case study titled 'Kickstarting Blockchain: Designing Blockchain-based Tokens for Equity Financing' addresses the challenges faced by early-stage companies in utilizing blockchain for equity financing and proposes innovative solutions that enhance efficiency and transparency. Moreover, a study on young Saudi entrepreneurs showed that performance expectancy, social influence, perceived trust, and perceived risks significantly predict behavioral intentions to utilize funding platforms, emphasizing the factors affecting participant behavior. As we approach 2024, anticipated regulatory changes may further impact equity crowdfunding, necessitating investors to stay informed about how these modifications could affect their investment strategies in this dynamic sector.

Conclusion

Equity crowdfunding represents a significant shift in the investment landscape, offering unprecedented access to capital for startups while democratizing opportunities for individual investors. This method not only empowers entrepreneurs to secure necessary funding but also allows a broader audience to participate in the growth of innovative businesses. Key platforms such as SeedInvest, CrowdCube, and Wefunder provide various investment opportunities, each with its unique strengths, enabling investors to make informed decisions based on their particular goals and risk tolerances.

While the benefits of equity crowdfunding are appealing—such as access to early-stage investments, potential for high returns, and diversification—investors must remain mindful of the inherent risks. The high failure rate of startups, liquidity challenges, and regulatory uncertainties necessitate thorough due diligence and a clear understanding of the platforms involved.

As the equity crowdfunding sector continues to evolve, staying informed about market trends and educational resources is essential. By selecting reputable platforms and leveraging community insights, investors can navigate this dynamic environment more effectively. Ultimately, equity crowdfunding not only fosters innovation and economic growth but also creates a collaborative investment ecosystem where both entrepreneurs and investors can thrive.