Overview

In this article, we aim to address the concerns of potential investors by identifying and evaluating the top crowdfunding platforms available in 2025. We understand that navigating these options can be overwhelming, and we want to provide you with insights into their unique offerings that truly matter to you. By detailing various crowdfunding models—such as rewards-based, equity-based, and donation-based—we hope to illuminate the choices available.

We’ll also highlight specific platforms like:

- Kickstarter

- Indiegogo

- Crowdcube

showcasing their distinct features and how they cater to different investor needs and project types. As many of our members have experienced, finding the right platform can significantly impact your investment journey. We’re here to support you in making informed decisions that align with your goals and aspirations.

Introduction

In recent years, crowdfunding has emerged as a revolutionary approach to capital raising, democratizing access to financial resources for entrepreneurs and creators alike. We understand that navigating this new landscape can feel overwhelming, especially for tech investors seeking to make informed decisions. By tapping into the collective support of individuals through online platforms, this innovative funding model not only empowers startups but also offers diverse investment opportunities.

Each category—rewards-based, equity-based, and donation-based—caters to different project types and investor interests, making it essential to grasp the intricacies of this ecosystem. As many of our members have experienced, recognizing both the potential benefits and inherent risks of crowdfunding is crucial for those looking to engage with this dynamic landscape effectively.

Together, we can explore these opportunities and support one another in this exciting journey.

Understanding Crowdfunding: An Overview

Crowdfunding, particularly through the best crowdfunding platforms of 2023, embodies a transformative approach to capital raising that harnesses the collective efforts of many individuals. This innovative method empowers entrepreneurs, startups, and established businesses to tap into a diverse pool of investors, thereby democratizing the funding landscape. By allowing anyone with a compelling idea to seek financial support, this approach reduces reliance on traditional funding sources like banks and venture capitalists.

The funding ecosystem includes several distinct models, each catering to different project types and investor interests. As many of our members have experienced, rewards-based crowdfunding allows backers to contribute to a project in exchange for non-financial rewards, such as products or services, making it particularly popular among creative ventures and product launches. Equity-based funding enables investors to acquire shares in a company, aligning their financial interests with the success of the business. This model has gained traction as startups seek alternative funding avenues. Meanwhile, donation-based fundraising is often utilized for charitable and educational projects, where contributors do not expect monetary returns. This model fosters community support and engagement, exemplified by initiatives like the Molly Huggins Foundation, which aims to invest £75 million in community impact projects over the next decade.

As we look toward 2025, the fundraising market continues to experience significant growth, driven by technological advancements and an increasing number of platforms catering to various niches. We understand that recent trends indicate a shift towards more inclusive funding practices, reflecting a broader movement towards democratization in finance. This evolution not only enhances access to capital for startups but also empowers individuals to participate in funding opportunities that resonate with their values and interests.

Grasping the subtleties of collective funding is crucial for technology financiers navigating this dynamic landscape. By recognizing the distinctions between different crowdfunding models and their respective impacts on startup funding, investors can make informed decisions that contribute to their overall financial strategies. Insights from Baltic leaders in finance like Sten Tamkivi and Kristjan Vilosius highlight the importance of community in fostering collaboration and overcoming challenges in the field.

As Marlene Greenfield, Vice President of Hearst Magazines, noted, "Statista has been my savior on several occasions. The site is easy to maneuver and the data is in a format that can go right into a report or presentation." This underscores the significance of data in making informed financial decisions.

The ongoing growth of the crowdfunding market emphasizes the potential of the best crowdfunding platforms of 2025 to transform the future of financing, making it a crucial area of focus for those involved in the tech funding sector. The insights and values expressed by Finance, Freedom, Fellows—especially concerning community engagement and education—strengthen the belief that financial superpowers should be available to all, further enhancing the experience for its members. Additionally, fff. Club offers various initiatives aimed at empowering tech stakeholders through educational resources and community-driven investment opportunities.

Exploring Different Types of Crowdfunding Platforms

Funding platforms can be categorized into several unique types, each addressing various needs and contributor profiles, reflecting the diverse motivations of investors and the evolving dynamics of funding in 2025.

-

Rewards-based funding: In this model, supporters obtain non-financial rewards, such as products or services, in return for their contributions. Platforms like Kickstarter and Indiegogo exemplify this approach, allowing creators to fund their projects while offering tangible incentives to supporters. We understand that many individuals seek meaningful ways to contribute, and this model provides a fulfilling avenue for involvement.

-

Equity funding: This type enables investors to acquire shares in a company, granting them a stake in its future success. Platforms like Crowdcube and Seedrs have gained traction, especially as the rise of equity-based funding continues to reshape investment landscapes in 2025. As many of our members have experienced, this model can create a sense of ownership and connection to the projects they support.

-

Donation-based funding: Contributors donate funds to support a cause or project without expecting any financial return. GoFundMe is a prominent example, receiving over 38.61 million visits monthly, highlighting the increasing reliance on this model for charitable and community-driven initiatives. UK Prime Minister Rishi Sunak has requested additional financial assistance for charities and the voluntary sector, emphasizing the significance of donation-based fundraising in today's economic climate. Moreover, the percentage of individuals contributing through conventional methods such as street collections and workplace requests has diminished, further underscoring the importance of funding platforms. We recognize the emotional weight behind these contributions, as they often stem from a desire to make a difference.

-

Debt funding: Also referred to as peer-to-peer lending, this model enables individuals to lend money to others or businesses with the anticipation of repayment with interest. Platforms like Funding Circle are considered some of the best crowdfunding platforms in 2025, facilitating these transactions and providing an alternative financing route for borrowers. Each type of crowdfunding serves unique purposes, reflecting the diverse motivations of investors and the evolving dynamics of funding in 2025. For example, recent grant funding advancements, such as the Molly Huggins Foundation's £75 million contribution to community projects, illustrate how funding initiatives are adapting to current economic conditions. As the landscape continues to grow, understanding these categories becomes essential for making informed investment decisions. We hope this insight empowers you to navigate the funding landscape with confidence and compassion.

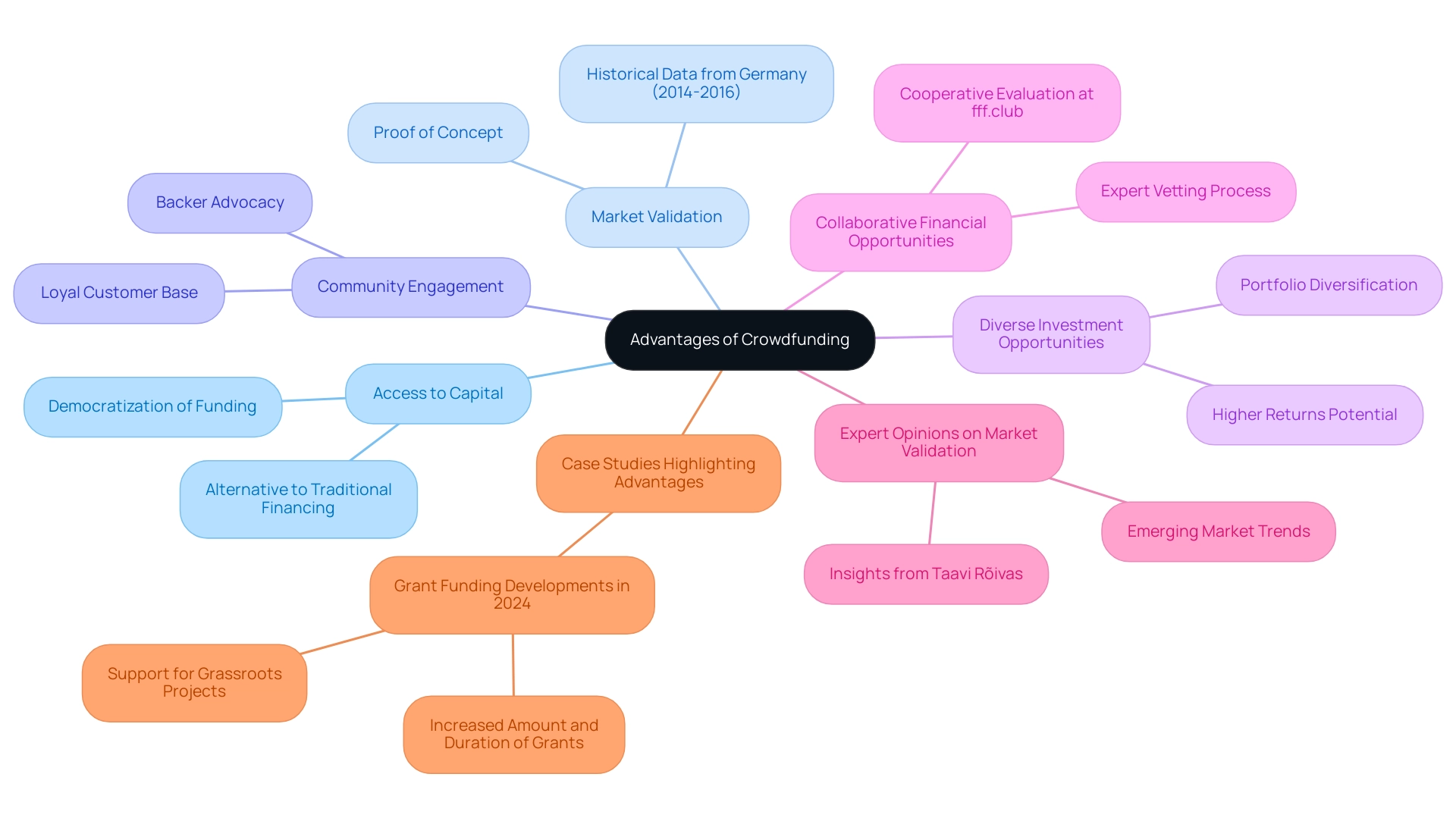

The Advantages of Crowdfunding for Investors and Creators

Crowdfunding presents a multitude of advantages for investors in 2025, making it an increasingly attractive option in the financial landscape. We understand that many startups and small businesses face significant hurdles in accessing capital.

-

Access to Capital: Collective funding serves as a viable alternative to traditional financing methods, allowing these businesses to raise funds without the burdensome requirements often associated with banks and venture capitalists. This democratization of funding is especially vital in an environment where access to capital can be restricted.

-

Market Validation: One of the most important advantages of collective funding is its capacity to validate business ideas. Successful campaigns not only demonstrate demand but also provide tangible proof of concept before a product launch. This validation can significantly reduce the risks associated with new ventures, as evidenced by numerous campaigns that have successfully transitioned from fundraising to market success. As many have seen, historical data shows that from 2014 to 2016, Germany experienced a substantial increase in crowdfunding campaigns, highlighting the growing acceptance and effectiveness of this funding model.

-

Community Engagement: Crowdfunding fosters a strong sense of community among backers, who often become passionate advocates for the projects they support. This engagement not only enhances the visibility of the campaign but also creates a loyal customer base that can be invaluable for future growth. In 2025, statistics indicate that 52% of charities are prioritizing digital fundraising, reflecting a broader trend towards innovative funding solutions that attract a variety of funding interests.

-

Diverse Investment Opportunities: Supporters can diversify their portfolios by backing a wide array of projects across various sectors. This diversification can lead to higher returns, as it allows investors to spread their risk across multiple ventures. The growing emphasis on digital fundraising among charities further demonstrates the broadening scope of crowdfunding possibilities.

-

Collaborative Financial Opportunities at fff.club: At Finance, Freedom, Fellows, we highlight the significance of cooperative financial evaluation. Our platform screens high-grade deals and performs thorough due diligence, leveraging the expertise of over 300 members to ensure that each opportunity is meticulously vetted. This collective approach empowers our members, providing them with access to high-quality deals that might otherwise be overlooked. As one pleased participant observed, 'The thorough vetting process at fff. Club gave me confidence in my investments, knowing that they were backed by a community of experts.'

-

Expert Opinions on Market Validation: Industry leaders emphasize the importance of collective funding as a tool for market validation. For example, Taavi Roivas, former Prime Minister of Estonia, has observed that collective funding not only empowers entrepreneurs but also offers backers insights into emerging market trends and consumer preferences, reinforcing the value of investing in validated ideas.

-

Case Studies Highlighting Advantages: Recent developments in grant funding, such as those from the National Lottery Community Fund, illustrate how adaptive funding strategies can support grassroots projects. These alterations demonstrate a proactive strategy for financing that aligns with the fundraising model, highlighting its ability to tackle urgent social concerns while affirming business concepts.

In summary, the benefits of collective funding for investors in 2025 are evident: it grants access to capital, confirms business concepts, encourages community involvement, and offers varied funding opportunities, all of which enhance a more dynamic and inclusive financial landscape. If you're interested in exploring these opportunities, we warmly invite you to apply now to join our community at fff.club.

Understanding the Risks of Crowdfunding

While crowdfunding opens up a world of opportunities, it's important to acknowledge the inherent risks that come along with it:

- Investment Loss: We understand that the thought of losing your entire investment can be daunting, especially if a project falls short of its goals. In 2025, investment loss rates in collective financing have raised significant concerns, with many projects failing to deliver the returns they promised.

- Lack of Regulation: The crowdfunding landscape often lacks robust regulatory oversight, which can increase the risk of fraud. This minimal control means that you must proceed with caution and conduct thorough due diligence before committing your funds. At Finance, Freedom, Fellows (fff.club), we prioritize high-grade deal screening and perform extensive due diligence, ensuring that you are well-informed and protected.

- Intellectual Property Risks: Sharing your ideas on funding platforms can expose you to the risk of intellectual property theft. This reality calls for careful consideration regarding how much information to disclose during your campaign.

- Reputational Damage: We recognize that failed campaigns can harm the reputation of project creators, making future fundraising efforts more complicated. The fallout from unsuccessful projects can deter potential backers and erode trust within the community.

- Funding Fraud: Recent reports have brought to light instances of funding fraud, underscoring the need for vigilance. It’s crucial to be aware of red flags and conduct background checks on projects and their creators. At fff.club, we leverage the expertise of over 300 evaluators to assess deals, making the investment process smoother and more secure for you.

- Case Studies on Risks: Reflecting on past funding failures reveals critical lessons. For instance, projects that lacked clear communication or realistic funding goals often struggled to gain traction. Understanding these pitfalls can empower you to make more informed decisions. Specific examples include campaigns that faltered due to overambitious targets or inadequate marketing strategies.

- Expert Insights: Industry specialists emphasize the importance of diversifying your investment portfolio to mitigate risks associated with collective funding. As consultant Ammina Hamed notes, "Innovation remains tough, particularly in the current climate. But diversifying income portfolios is essential." This highlights the importance of not putting all your resources into a single fundraising initiative.

- Statistics on Risks: In 2024, a significant percentage of fundraising projects encountered challenges, with many failing to meet their funding targets. This statistic illustrates the competitive nature of the fundraising space and the necessity for strategic planning. Additionally, it's noteworthy that 70% of charities planned to fundraise through mass physical events, signaling a shift in fundraising strategies that could influence donation dynamics.

- Successful Examples: On a brighter note, dance projects on Kickstarter have collectively raised $16.28 million, benefiting from smaller funding targets. This success story contrasts with the risks discussed and shows that with the right approach, collective funding can lead to significant achievements.

- Demographics of Backers: Understanding the demographics of Kickstarter backers is vital for crafting campaigns that resonate. The majority of backers are male (64%) and college-educated, with the largest age group being 25 to 34 years old. This insight can help you create targeted campaigns that engage potential backers, ultimately improving your chances of funding success.

By understanding these risks and learning from previous experiences, you can navigate the fundraising environment more effectively, making informed choices that align with your financial objectives. At fff.club, our collaborative investment evaluation process ensures that you have the support and insights needed to identify high-grade deal opportunities. We invite you to join us and discover the potential of collective funding with the backing of our expert evaluators.

Top 10 Crowdfunding Platforms to Consider in 2025

In 2023, navigating the funding landscape can be challenging for tech investors, especially those who value community-driven initiatives like Finance, Freedom, Fellows. Here are ten funding sites to consider, each offering unique opportunities that could resonate with your journey:

- Kickstarter: This platform is well-known for its focus on creative projects, operating on a rewards-based funding model that can breathe life into your innovative ideas. Many creators have shared their success stories, showcasing how collective financing can foster community connections among backers and creators.

- Indiegogo: With its flexible funding options, Indiegogo caters to a diverse range of projects, including technology and creative endeavors. This flexibility allows project developers to choose between fixed and flexible funding objectives, reflecting the growing trend of equity financing, which is expanding at a pace that surpasses traditional lending. This aligns beautifully with the collaborative investment strategies that our fff.club community champions.

- Crowdcube: As a leading equity raising platform in the UK, Crowdcube empowers individuals to invest in startups, making it a top choice for those eager to support innovative companies at their early stages. This approach mirrors the community-driven ethos of fff.club, emphasizing inclusivity and collaboration among technology supporters, fostering a space where members can connect and share insights.

- Seedrs: Similar to Crowdcube, Seedrs focuses on equity crowdfunding, providing opportunities to support early-stage companies. Its user-friendly interface and rigorous due diligence process enhance investor confidence, reflecting our commitment to informed decision-making within the fff.club community, where financial education is prioritized.

- GoFundMe: Widely recognized for personal causes and charitable projects, GoFundMe operates on a donation-based model, making it a go-to for individuals looking to fund community initiatives or personal emergencies. The landscape of fundraising has evolved, with social media now accounting for 23% of contributions, illustrating how these platforms adapt to changing donor behaviors post-COVID-19, resonating with the community engagement that fff.club advocates.

- Patreon: This subscription-based platform allows creators to receive ongoing support from their fans, a model that is particularly beneficial for artists, podcasters, and content creators who thrive on consistent funding. This reflects the ongoing collaboration that fff.club promotes, emphasizing the importance of community support.

- Fundable: Serving startups, Fundable offers both rewards and equity funding options, allowing entrepreneurs to choose the best strategy for their business model. This dual approach fosters a collaborative atmosphere for tech investors, similar to the various funding strategies celebrated within the fff.club community.

- Funding Circle: Specializing in debt financing, Funding Circle connects businesses with investors looking to provide loans. This platform is ideal for those interested in supporting small businesses while earning interest, aligning with the broader trend of community-focused investment that fff.club promotes.

- Crowdfunder: Based in the UK, Crowdfunder supports various forms of collective funding, including community projects. Its focus on social impact initiatives resonates with individuals who wish to make a difference, echoing the inclusivity philosophy championed by fff.club's founder, Akim Arhipov, who believes in empowering everyone.

- Republic: A rapidly growing equity investment service, Republic democratizes access to investment opportunities, allowing anyone to invest in startups. Its commitment to inclusivity aligns with the movement toward ensuring financial empowerment is accessible to all, a core principle embraced by the fff.club community.

As we observe the funding landscape shift, with equity-based fundraising expanding at a remarkable rate compared to lending, there's an opportunity for tech investors to leverage these platforms. By engaging with the best crowdfunding options of 2025, you can enhance your investment portfolio while building meaningful connections and gaining valuable insights within the vibrant community at fff.club.

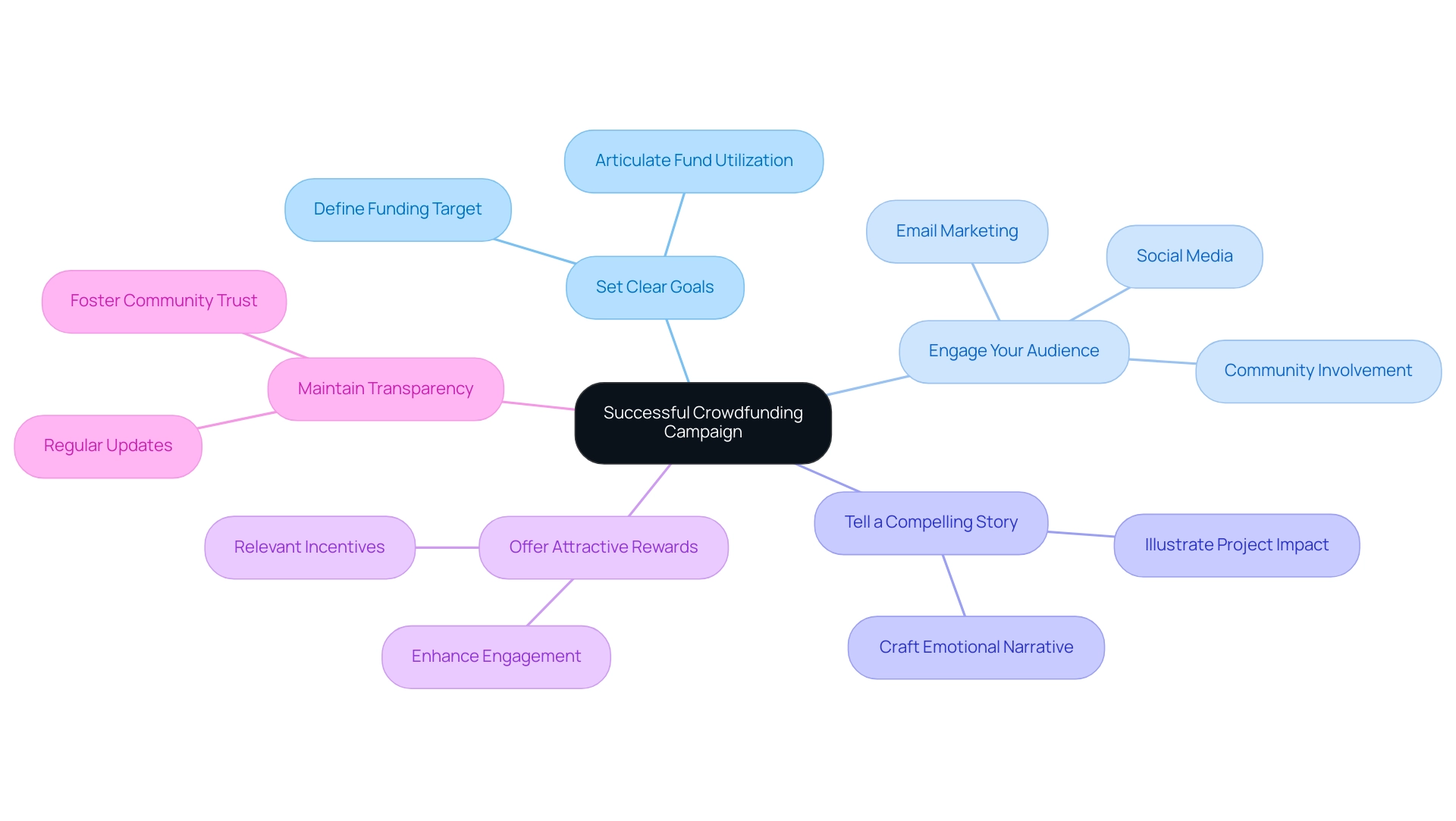

Tips for Running a Successful Crowdfunding Campaign

To run a successful fundraising campaign, it's essential to consider several nurturing strategies:

-

Set Clear Goals: Clearly defining your funding target and articulating how the funds will be utilized is crucial. This transparency not only builds trust but also helps potential backers understand the significance of their contributions.

-

Engage Your Audience: Before launching your campaign, it's important to cultivate a community around your project. By leveraging social media platforms and email marketing, you can generate excitement and anticipation, ensuring that your audience feels involved from the outset. At fff.club, we truly emphasize the significance of community involvement, connecting over 400 tech investors who collaborate and share insights to enhance their funding efforts.

-

Tell a Compelling Story: Crafting a narrative that resonates emotionally with potential backers is vital. Sharing your vision and illustrating the impact of your project makes it relatable and inspiring, encouraging support.

-

Offer Attractive Rewards: In rewards-based campaigns, ensure that the incentives you provide are not only appealing but also relevant to your target audience. Thoughtfully designed rewards can significantly enhance backer engagement and motivation.

-

Maintain Transparency: Keeping your backers informed throughout the campaign is essential. Regular updates about your progress, challenges, and milestones foster a sense of community and trust, encouraging continued support. This aligns with fff.club's commitment to inclusivity and transparency, as articulated by founder Akim Arhipov, who believes that financial superpowers should belong to everyone.

In 2025, successful fundraising campaigns have demonstrated a notable success rate, particularly in niche areas such as dance projects, which boast a 61.05% success rate. This statistic underscores the importance of strategic planning and community involvement in achieving funding goals. As many of our members have expressed, there are persistent worries regarding local government financing for charities, highlighting the necessity for innovative funding strategies such as community funding.

The case study of Finance, Freedom, Fellows (fff.club) illustrates how community involvement and cooperation can lead to successful community funding campaigns. By nurturing relationships among technology backers, fff.club enables its members to exchange insights and strategies, improving their fundraising efforts. We invite you to join us at fff.club and become a member to leverage these opportunities, creating a more engaging experience for your backers.

Future Trends in Crowdfunding: What to Watch For

As collective funding continues to advance, we recognize that several key trends are emerging, influencing the environment for stakeholders and services alike:

-

Increased Regulation: We understand that the collective funding sector is undergoing a significant transformation toward stricter regulatory structures. These changes are designed to ensure participant protection and enhance service accountability. This trend is expected to gain momentum in 2025, as regulators strive to create a more secure environment for both backers and entrepreneurs.

-

Increase of Equity Funding: Many of our members have experienced the rise of equity funding, which increasingly enables everyday backers to participate in startup financing. This democratization of financial opportunities is reshaping the funding landscape, allowing a broader array of participants to connect with innovative companies right from their inception.

-

Integration of Technology: As we navigate this changing landscape, the incorporation of advanced technologies like blockchain and artificial intelligence is transforming funding platforms. These innovations enhance security, streamline processes, and improve user experiences, making it easier for investors to explore their options and for entrepreneurs to achieve their funding goals.

-

Focus on Impact Investing: There is a growing trend toward impact investing within the crowdfunding space, where projects aimed at social and environmental benefits are gaining traction. Influential figures like Train Hartmann, co-founder of Grünfin, exemplify this shift by helping individuals invest in sustainable funds that prioritize positive societal impacts. Triin's efforts in promoting sustainable financial choices have inspired many to reflect on the broader implications of their monetary decisions. Similarly, Sten Tamkivi's extensive experience in tech investment, including his role as General Manager at Skype and his recent venture Plural, highlights the importance of community-driven initiatives in fostering innovation and sustainability. Sten's insights into the tech landscape emphasize the need for collaborative efforts to address pressing global challenges. This shift draws financial backers who seek not only monetary gains but also wish to make a positive impact on society and the environment.

-

Case Studies on Future Trends: For instance, Soteria's recent public fundraising initiative to develop safe lithium-ion batteries illustrates how collaboration with over 125 top companies can drive innovation in critical sectors. This case emphasizes the possibilities of collective funding to support initiatives that tackle urgent global issues.

-

Expert Predictions for 2025: Industry specialists forecast that the collective funding market will continue to grow, with additional services emerging to meet niche markets and specific investor interests. This diversification is expected to enhance competition and drive innovation across the sector.

-

Impact of Regulation on Crowdfunding Platforms: As regulatory changes take effect, platforms will need to adapt their business models to comply with new standards. While this may lead to increased operational costs, it ultimately aims to foster greater trust among investors. We encourage you to stay informed about these trends, particularly the popularity of crowdfunding and the best crowdfunding platforms in 2023, to make strategic decisions in your investment journeys. In 2023, GoFundMe demonstrated its status as one of the best crowdfunding platforms by raising $106 million for natural disaster relief efforts, highlighting the service's impact. Furthermore, GoFundMe averages 38.61 million visits monthly, with a substantial part of its user base originating from the United States, emphasizing the reach and importance of funding platforms. This analysis is brought to you by Finance, Freedom, Fellows.

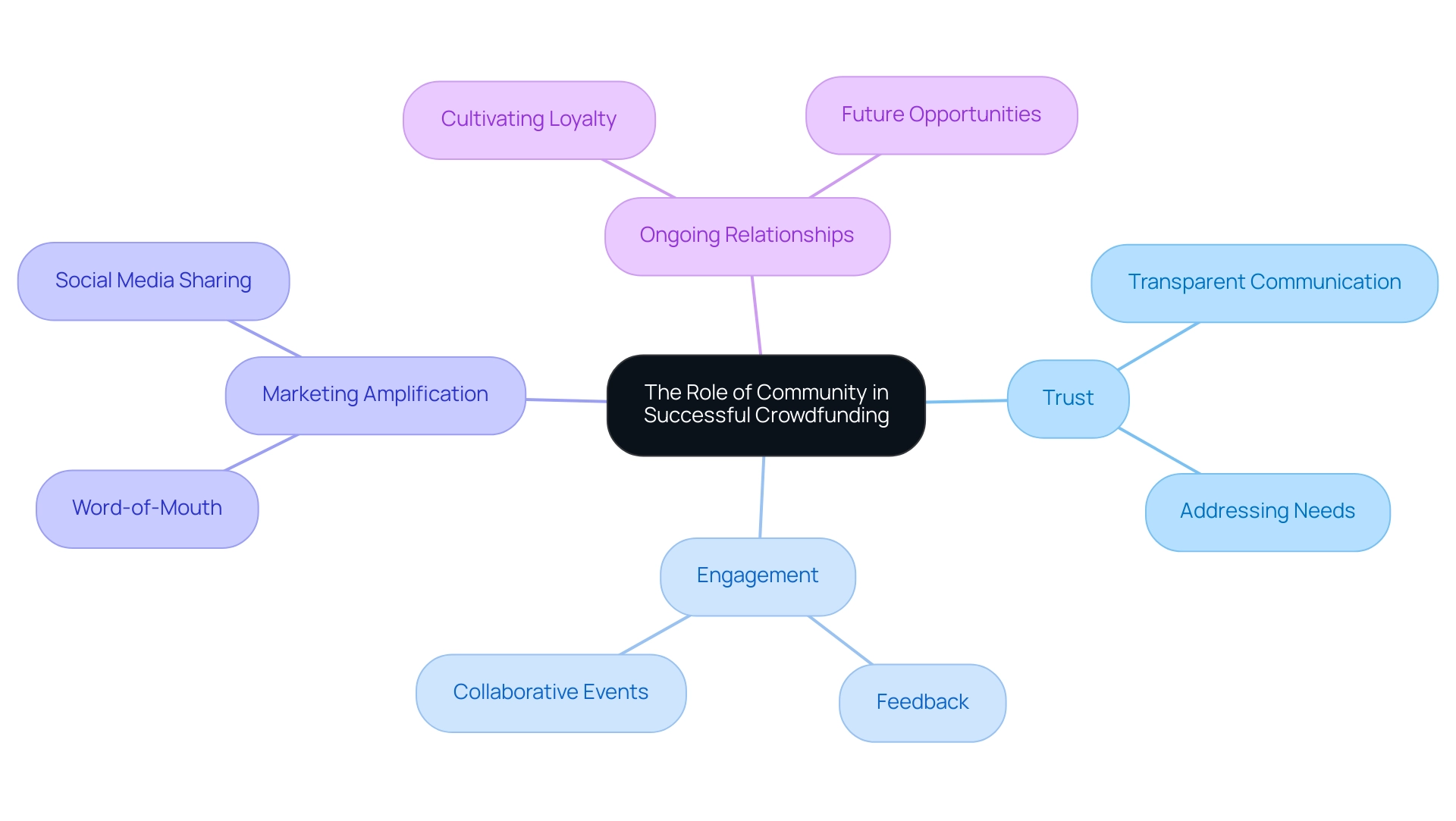

The Role of Community in Successful Crowdfunding

Community stands as a cornerstone of funding success, profoundly influencing various aspects of campaign effectiveness in 2025. A supportive community nurtures trust, an essential element for encouraging individuals to contribute to campaigns. When backers feel a genuine connection to a project and its creator, they are more likely to invest their resources, confident that their contributions are valued and impactful.

This sentiment rings particularly true within the fff. Club community, where tech investors can forge valuable connections, gain insights into investment opportunities, and access weekly tech and economic updates, alongside participating in engaging events.

Engagement with the community also offers creators invaluable feedback, enabling them to refine their projects based on real-time insights. This iterative process not only enhances the quality of the campaign but also demonstrates to potential backers that their opinions matter, thereby further solidifying trust. Moreover, the accessibility of crowdfunding shines through, as campaign owners are not required to undergo credit checks or pitch to venture capitalists, simplifying the path for diverse projects to gain support.

A robust community amplifies marketing efforts through organic sharing and advocacy. Word-of-mouth promotion can significantly elevate a campaign's visibility, leading to greater funding potential. Many successful campaigns often witness their reach grow exponentially as community members share their enthusiasm across social media channels and personal networks.

The fff. Club site exemplifies this dynamic by engaging over 400 tech investors for collaborative wealth management, fostering a culture of shared success.

Sustained engagement with backers after the campaign concludes is equally vital. By nurturing relationships with supporters, creators can cultivate a loyal base that is more inclined to contribute to future projects. This ongoing connection not only fosters a sense of belonging but also opens doors to additional funding opportunities.

Insights from Baltic investment leaders like Sten Tamkivi and Kristjan Vilosius further highlight the role of community in navigating challenges and fostering collaboration in investment, particularly through deal flow, due diligence, and co-investing opportunities.

Statistics underscore the significance of community in collective funding; for instance, projects on platforms such as Indiegogo have garnered an average of $41,634 each, showcasing the potential financial influence of a well-engaged community. Additionally, case studies like Mercado Bitcoin's successful fundraising of USD 200 million from the SoftBank Latin America Fund illustrate how community-driven initiatives can significantly enhance market presence and instill confidence among backers.

In summary, establishing trust within funding communities is paramount. Trust can be cultivated through transparent communication, consistent engagement, and a genuine commitment to addressing backers' needs. As Akim Arhipov, founder of fff.club, aptly states, "Financial superpowers should be accessible to everyone," reinforcing the belief that a strong community can empower individuals to achieve their financial goals through collaborative efforts.

Navigating Crowdfunding Regulations and Compliance

Navigating the regulatory landscape of collective funding can feel daunting, but understanding key compliance issues is essential for both services and investors. We recognize that:

-

Know Your Customer (KYC): Collective funding services are required to verify the identities of their users. This process is crucial, not only for preventing fraud but also for ensuring compliance with financial regulations. As many of our members have experienced, KYC requirements have become increasingly stringent in 2025, necessitating robust verification processes to protect against identity theft and fraudulent activities.

-

Anti-Money Laundering (AML): To combat money laundering effectively, fundraising services must adopt comprehensive AML measures. These regulations demand that services monitor transactions and report any suspicious activities, protecting the integrity of our financial system. We understand that the focus on AML compliance has intensified, with organizations acknowledging the importance of leveraging technology to enhance efficiency and effectiveness in these efforts.

-

Securities Regulations: Equity fundraising is governed by securities laws, imposing specific obligations on systems regarding disclosures and reporting. In 2025, compliance with these regulations is vital, as they ensure that stakeholders are sufficiently informed about the risks tied to their assets. Services must provide transparent information to foster trust and confidence among their users, as many of you have shared concerns about the clarity of information.

-

Consumer Protection Laws: It is imperative for crowdfunding services to adhere to consumer protection laws that require clear communication about risks and rights. This clarity is essential for safeguarding stakeholders and ensuring they are fully informed about the potential risks of their financial commitments. Recently, the emphasis on consumer safeguarding has grown, with services striving to create a more secure financial environment for everyone involved.

A notable case study reveals the impact of video presentations on fundraising success. Campaigns incorporating a video pitch raise 105% more funds than those without, highlighting the importance of storytelling and visual engagement in attracting backers. This trend illustrates how platforms can enhance their compliance and fundraising strategies by integrating effective communication tools.

As the fundraising landscape continues to evolve, staying informed about KYC and AML requirements, along with other regulatory compliance issues, is essential for both platforms and investors. Engaging with expert advice on navigating these regulations can significantly enhance your investment experience and ensure adherence to the latest standards. Notably, 77% of corporate risk and compliance professionals consider it crucial to remain informed about ESG developments, underscoring the growing significance of these matters in our financial sector.

Furthermore, as Marcus Schwarz observed, donations totaling $106 million were collected for natural disaster relief in 2025, illustrating the profound impact of funding initiatives. Leveraging technology to boost compliance efficiency is vital for organizations to navigate this complex landscape effectively, ensuring that we all move forward together.

Taking the Next Steps in Your Crowdfunding Journey

As you embark on your crowdfunding journey, we understand that navigating this landscape can feel overwhelming. Here are some essential steps to help you maximize your success:

- Research Platforms: Start by exploring which crowdfunding platform aligns best with your project or investment goals. The fundraising landscape is constantly evolving, and understanding the unique features and offerings of the best crowdfunding platforms in 2023 is vital. Remember, statistics show that 37.86% of funding campaigns manage to raise at least some money, highlighting your potential for success.

- Engage with Communities: Actively participating in forums and groups dedicated to crowdfunding can be incredibly beneficial. Engaging with these communities allows you to learn from the experiences of others, gain invaluable insights, and build connections that can support your campaign. As many of our members have experienced, the community-driven approach of fff.club emphasizes that collaboration is key to enhancing your financial strategies. Here, you can connect with over 400 tech fellows, gain investment insights, and access exclusive deal flow opportunities in private markets, including co-investing options that empower you to make informed decisions.

- Prepare Your Campaign: If you're planning to launch a campaign, developing a comprehensive strategy is crucial. This should include setting clear funding goals, crafting a compelling marketing approach, and outlining community engagement tactics to attract backers. We understand that challenges can arise, as Luke Lang, co-founder of Crowdcube, noted, "The regulatory environment was another challenge that the new platform had to overcome," which underscores the importance of being well-prepared.

- Stay Informed: Continuously monitoring trends and changes within the funding landscape is essential. Staying updated will enable you to adapt your strategies effectively, ensuring that you remain competitive in this dynamic market. The case study titled "Crowdfunding Growth Dynamics" indicates a notable shift from lending to equity financing, which is growing at a faster rate, suggesting that understanding these trends is vital for your success. Additionally, by participating in events and receiving weekly tech and economic updates through fff.club, you can stay ahead of market trends and enhance your strategic wealth management.

By following these steps and leveraging the resources available at fff.club, including exclusive investment opportunities and community support, you can enhance your crowdfunding experience and increase the likelihood of achieving your funding objectives. Join fff.club today to access these valuable resources and connect with fellow tech investors.

Conclusion

Crowdfunding has undeniably transformed the landscape of capital raising, offering diverse opportunities for both investors and creators. We understand that navigating this new ecosystem can be daunting, but by familiarizing oneself with the different models—rewards-based, equity-based, and donation-based—individuals can approach it with greater confidence. Each model serves unique purposes, catering to various project types and aligning with investor interests, thereby democratizing access to funding.

However, it is crucial to recognize the inherent risks associated with crowdfunding. Many investors have faced potential losses, fraud, and the lack of regulatory oversight, which can be concerning. We encourage you to remain vigilant and conduct thorough due diligence. Engaging with credible platforms can significantly mitigate these risks, as emphasized by community-driven initiatives like fff.club, which prioritize transparency and informed decision-making.

Looking ahead, the future of crowdfunding is marked by exciting trends, including increased regulation, technological integration, and a growing focus on impact investing. These developments not only enhance investor protection but also encourage a broader range of participants to engage in funding innovative projects with social and environmental benefits. As many of our members have experienced, these changes can create a more secure and rewarding environment for everyone involved.

Ultimately, fostering a strong sense of community is key to successful crowdfunding campaigns. By building trust, engaging backers, and maintaining relationships beyond the funding phase, creators can cultivate loyal supporters who are invested in their long-term success. As the crowdfunding landscape continues to evolve, leveraging community insights and resources will empower both investors and creators to thrive in this dynamic environment. Together, we can navigate these challenges and celebrate the opportunities that crowdfunding presents.