Overview

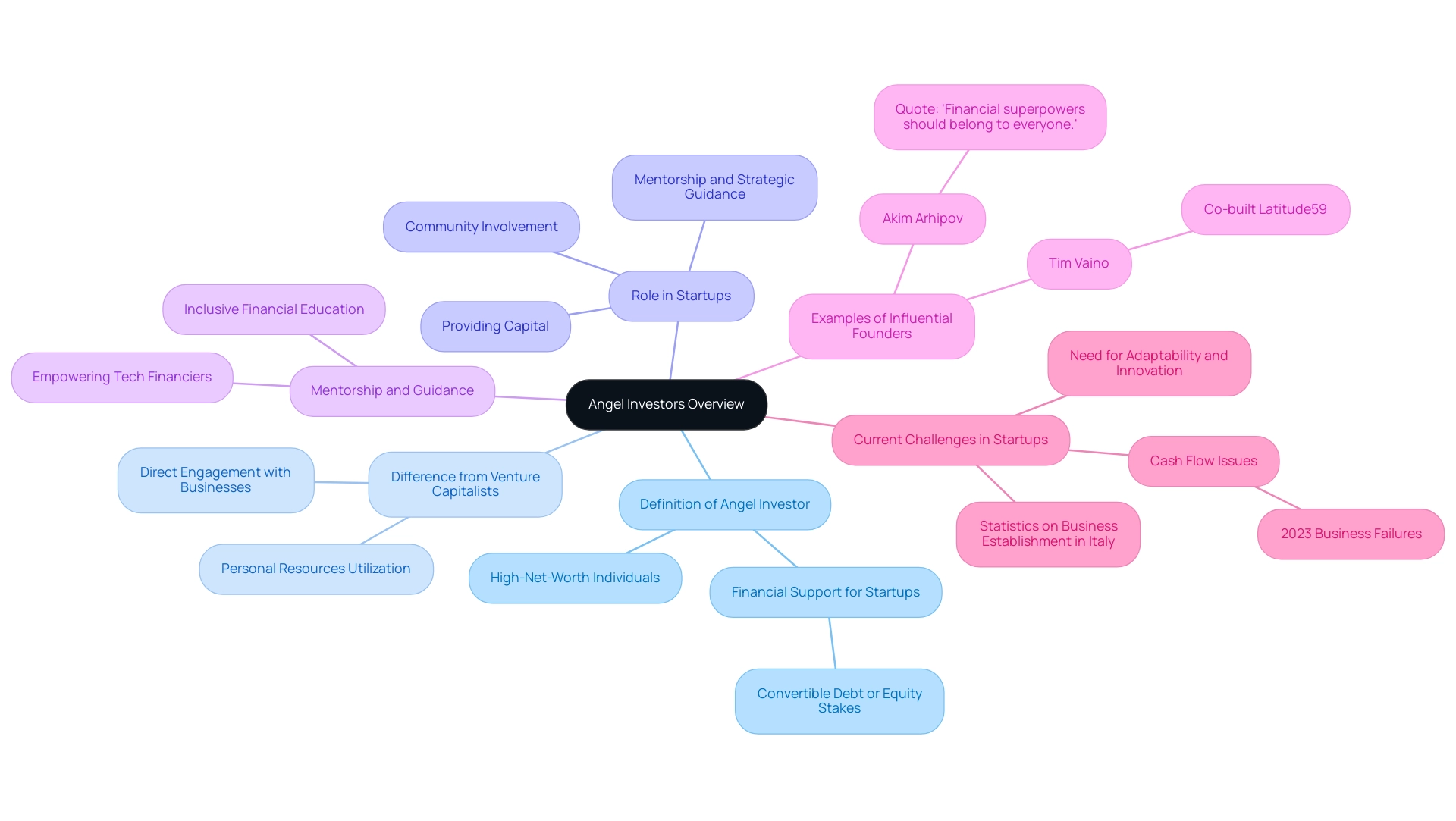

Angel investors are defined as high-net-worth individuals who provide essential financial support to startups or early-stage companies, often in exchange for equity stakes or convertible debt, while also offering mentorship and strategic guidance. The article emphasizes that their involvement is crucial for new ventures, as they not only supply capital but also foster connections and provide valuable insights that enhance the chances of success in a competitive market.

Introduction

Navigating the world of startup funding can be a daunting endeavor, especially for entrepreneurs seeking the right financial support to launch and grow their businesses. Angel investors have emerged as a vital source of capital, providing not only the necessary funds but also mentorship and strategic guidance that can significantly influence a startup's trajectory. Unlike venture capitalists, who operate with pooled resources, angel investors leverage their personal wealth to make independent decisions, often forming close relationships with the companies they support.

As the landscape of angel investing evolves, understanding the dynamics between these investors and startups is crucial for entrepreneurs aiming to harness the full potential of this funding avenue. This article delves into the intricacies of angel investing, comparing it to venture capital, outlining the investment process, and exploring the profiles and motivations of angel investors, ultimately equipping startups with the knowledge needed to navigate this critical financial landscape.

Defining Angel Investors: An Overview

To define angel investor, it refers to a high-net-worth individual who provides essential financial support to startups or early-stage companies, typically in exchange for convertible debt or equity stakes. Distinct from venture capitalists, who manage pooled funds from various sources, individual financiers utilize their personal resources and often engage more directly with the businesses they support, fostering vital connections within the community. This involvement can be invaluable, as angel backers not only provide capital but also mentorship and strategic guidance, empowering tech financiers through inclusive financial education and collaboration.

For instance, Akim Arhipov, a founder with multiple successful exits, emphasizes that 'financial superpowers should belong to everyone,' reflecting the founders' commitment to accessible investment opportunities. Their financial support plays a pivotal role in assisting new businesses refine their products and scale operations, establishing a solid foundation for future funding from larger backers. In Italy, the average number of days needed to establish a business from 2014 to 2029 underscores the evolving entrepreneurial landscape.

Additionally, the quote indicating that in 2023, numerous companies collapsed because of cash flow issues highlights the essential role of financial assistance from private backers. As startups are advised to remain adaptable and focus on innovation, backers facilitate these strategies through collaborative funding opportunities, making their role increasingly vital in the current market. Understanding the dynamics of angel investing, including how to define angel investor through the specific processes employed by founders like Tim Vaino, who co-built Latitude59, is critical for entrepreneurs seeking to leverage these resources effectively.

Angel Investors vs. Venture Capitalists: Key Differences

Angel backers typically allocate their own capital and often operate independently, making decisions based on personal judgment and experience. In contrast, venture capitalists oversee combined resources from various backers, enabling them to participate in larger funding rounds, particularly in high-potential industries where financing rounds have surpassed $100 million as we approach 2024. This trend highlights the growing magnitude of venture capital funding.

Notably, perspectives from prominent financiers such as Donatas Keras, a founding partner of Practica Capital, and Kristjan Tamla, Managing Director of ofTEN, illustrate diverse funding strategies within the Baltics. Keras' emphasis on early-stage ventures is illustrated by Practica Capital's backing of firms such as:

- Montonio

- Ovoko

- PvCase

- TransferGo

This helps to define angel investors as those who participate at the beginning of a company's lifecycle, offering not only capital but also mentorship and strategic advice—resources that can be crucial for emerging enterprises. Recently, Practica Capital announced their fund III, ready to deploy another 80 million euros into future success stories of the Baltics.

On the other hand, Tamla's knowledge in property acquisitions showcases the operational complexities of overseeing significant assets in more established sectors, especially via the Special Opportunity Fund that focuses on distinctive funding prospects.

It is vital for new ventures to comprehend the distinctions between these two categories of financiers when they define angel investor in their pursuit of capital. As one industry expert noted, "Investors are more discerning than ever with their capital, as a result of economic circumstances, but also the intrinsic high failure rate that is common with start-ups." This perspective emphasizes the significance of aligning with the appropriate type of investor based on a company's stage and needs.

Furthermore, recent successful IPOs, like Reddit and Astera Labs, illustrate the potential for significant returns on investment, rendering both private investing and venture capital attractive while requiring a clear comprehension of their distinct characteristics and operational styles. Furthermore, prompt engineering techniques such as iteration and ablation can enhance the effectiveness of investment-related queries, providing new ventures with valuable insights when navigating funding options. With India witnessing an extraordinary 1803% rise in funding rounds since 2013, now acknowledged as one of the fastest-growing economies, the knowledge acquired from contrasting private backers and venture capitalists is more relevant than ever for informed decision-making.

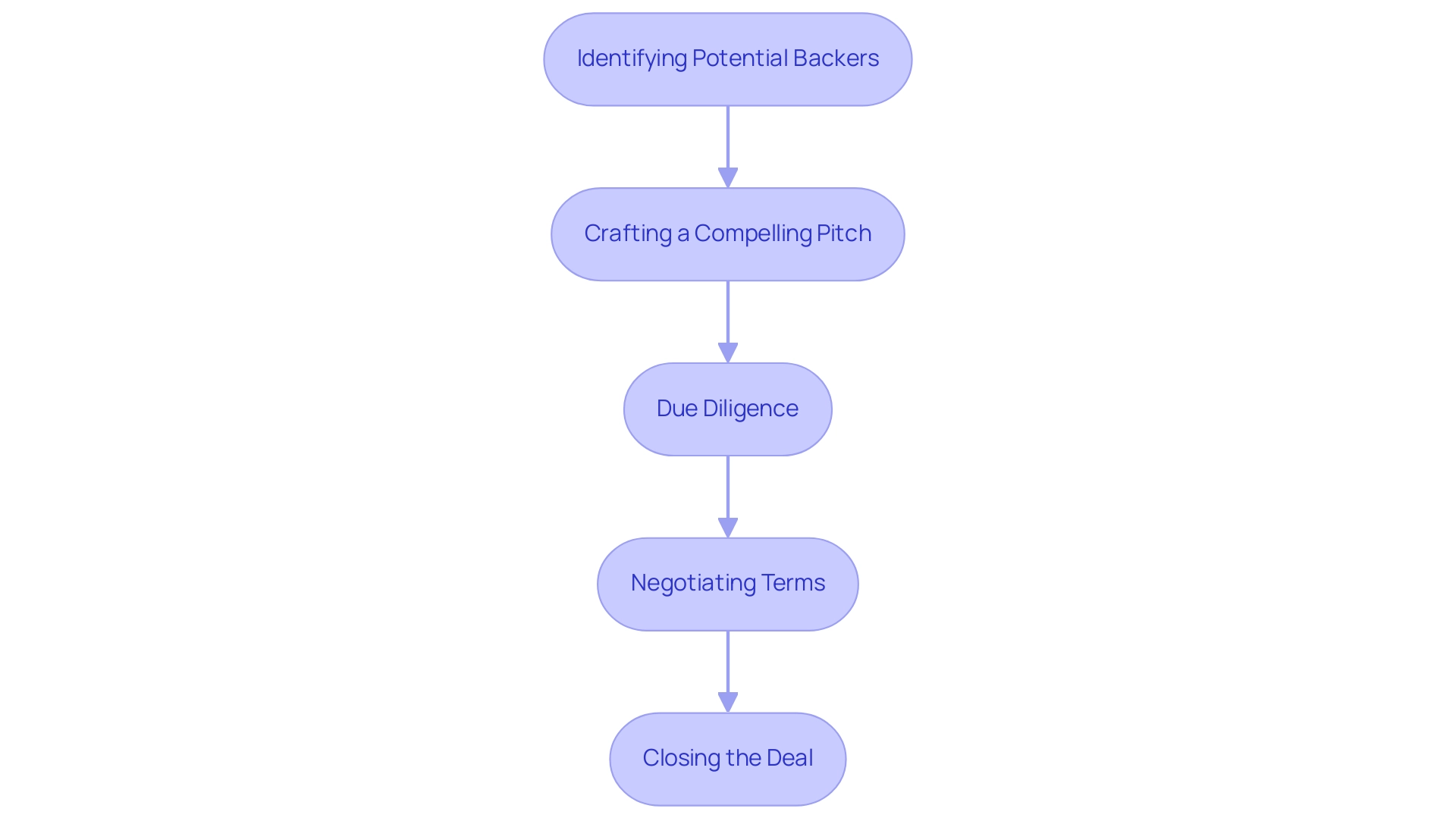

How Angel Investing Works: A Step-by-Step Process

-

Identifying Potential Backers: The first step in obtaining funding from private sources involves thorough research and networking to locate individuals with a proven history in your industry. Participating in pitch events, startup contests, and networking meetings can promote connections with potential backers, especially within the fff. Club community, which features over 400 tech supporters, including notable individuals like Akim Arhipov and Tim Vaino. This network emphasizes collaborative investment opportunities, allowing members to share insights and experiences. The terrain of early-stage funding is increasingly marked by co-investing across regions, highlighting the importance of fostering connections with backers receptive to collaboration. As Jenny Tooth, Executive Chair of the UK Business Angels Association, noted,

Yes, I think you’re absolutely right. There’s a lot more co-investing going on into the earlier-stage businesses between the US and UK.

This trend highlights the importance of networking within communities like fff. Club to foster connections with potential investors.

-

Crafting a Compelling Pitch: A well-structured pitch is essential for attracting interest. Your presentation should clearly articulate your business idea, market potential, and financial projections while also being engaging. Be prepared to address questions comprehensively, as stakeholders will seek detailed insights into your business model and strategy. Successful entrepreneurs emphasize that a solid pitch can significantly enhance your chances of securing funding, especially within a community that values collaborative insights and inclusive financial education.

-

Due Diligence: Following an angel backer's expression of interest, they will embark on a due diligence process. This crucial phase involves a meticulous review of your business plan, financial statements, and market analysis, which helps to define angel investor interest by assessing the viability and risks associated with your venture. Engaging with experienced investors from the fff. Club network can provide valuable feedback during this phase, particularly regarding deal flow opportunities.

-

Negotiating Terms: Should the due diligence phase yield favorable insights, the next step is negotiating the terms of the funding. This includes discussing the amount of funding, the equity stake—typically ranging from 20 to 30 percent—and any specific conditions or expectations linked to the funding. Grasping the nuances of these negotiations can play a pivotal role in establishing a fruitful partnership, particularly within a supportive community that encourages co-investing.

Closing the Deal: The final stage involves formalizing the funding through legal documentation that outlines the agreed-upon terms. It is imperative that both parties clearly understand their respective roles and expectations moving forward. This step is fundamental in fostering a successful partnership, as it sets the groundwork for future collaboration. Startups can expect to secure between $100,000 and $300,000 during a typical funding round involving several backers, with average contributions around $330,000. Significantly, prosperous firms such as Google, Tesla, Twitter, Dropbox, Uber, and Airbnb initially obtained angel funding to assist them in expanding, highlighting the essential function of angel backers in fostering early-stage company success and the assistance accessible through communities like fff.club.

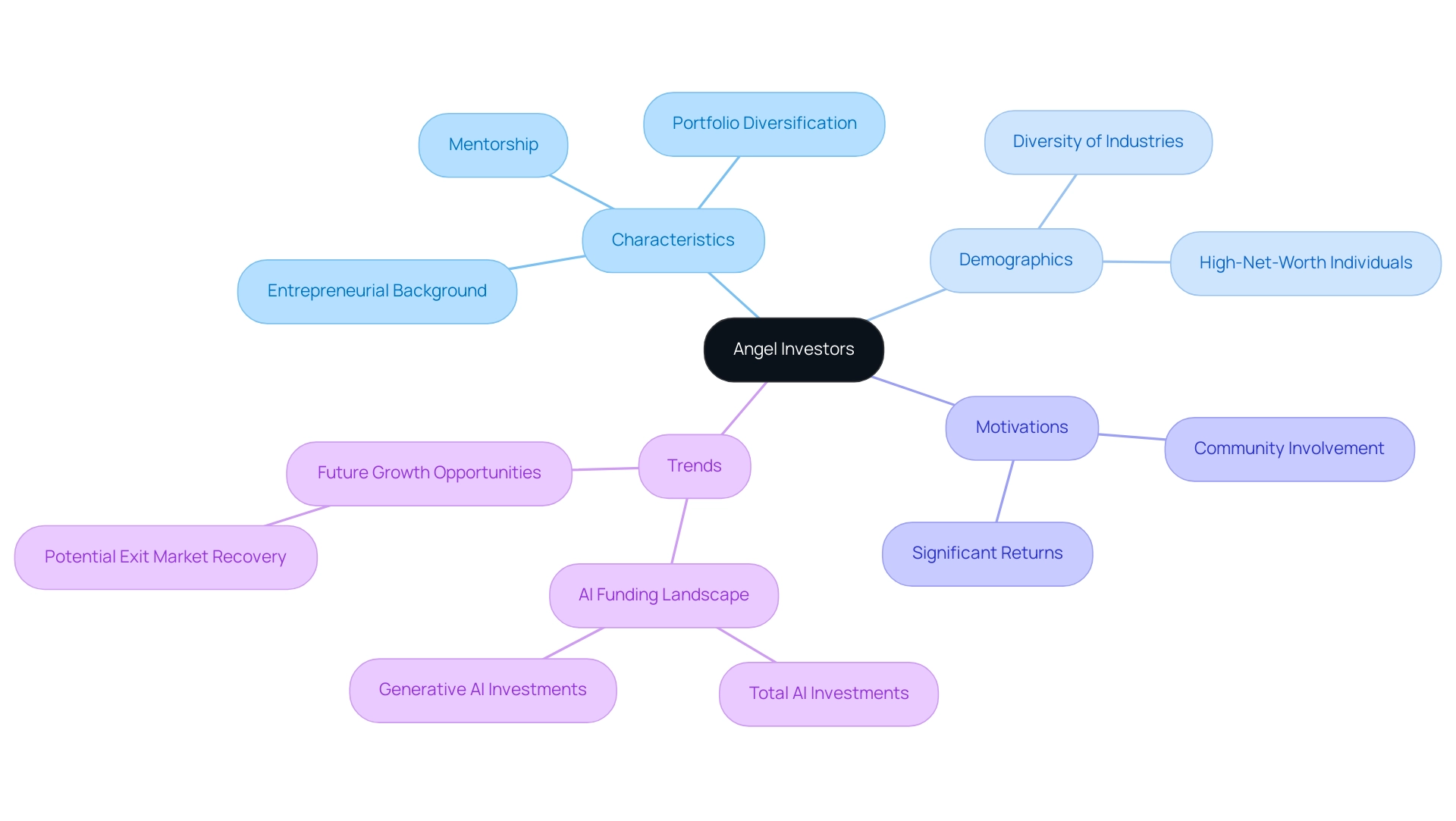

Understanding the Profile of Angel Investors

To define an angel investor, one can say that they are often characterized by their robust entrepreneurial backgrounds, frequently having founded or managed their own businesses. This experience not only equips them with valuable insights into the challenges faced by startups but also fuels their desire to support innovation and mentor emerging entrepreneurs. Driven by the possibility of significant returns, many backers are also predisposed to diversify their portfolios, pursuing opportunities that match their interests and expertise.

In 2024, the demographics of angel backers indicate a growing trend of individuals from varied industries stepping into this role, reflecting a shift towards a more diverse financial landscape. As noted by David A., 'Angel backers, who are typically high-net-worth individuals, help define angel investor contributions in seed funding.' The financial landscape is notably influenced by the surge in AI funding in the United States, which reached $67B in 2023, with generative AI alone accounting for $22B.

Insights into their motivations highlight the significance of community involvement, as platforms like fff. Club cultivate connections among over 400 tech financiers, thus creating collaborative wealth management opportunities. Moreover, fff. Club offers specific opportunities for deal flow, due diligence, and co-investing, empowering tech financiers with educational resources and exclusive funding opportunities.

Considering the potential recovery of the exit market in 2025, driven by strong corporate earnings and declining inflation, the landscape for early-stage backers is poised for growth, presenting increased opportunities for successful investment realization. For those seeking in-depth information, access to detailed statistics and reports requires a Statista account.

The Pros and Cons of Angel Investing

Pros:

- Access to Capital: Angel backers play a crucial role in providing essential funding for new ventures that often struggle to secure traditional financing options. With a minimum of 30 new investment groups appearing in the past two years, the environment is more dynamic than ever, greatly improving funding prospects for new ventures and enabling them to access a varied range of financial resources. Influential figures like Sten Tamkivi, a veteran in the Estonian tech scene and former General Manager at Skype, exemplify how early-stage investors leverage their extensive networks to create substantial deal flow, especially in the climate tech sector.

- Mentorship and Guidance: To define angel investor, it's important to note that beyond capital, many early-stage investors offer invaluable mentorship and guidance. Their extensive experience in the industry can assist new enterprises in navigating challenges and refining their business strategies, ultimately increasing their chances of success. Kristjan Vilosius, who balances his role as a new business founder with private equity, provides insights that help emerging companies succeed in a competitive market, drawing from his own experiences in securing significant funding for his enterprise, Katana MRP.

- Flexible Terms: Unlike venture capitalists, private equity frequently comes with more accommodating terms. This flexibility can be instrumental for startups looking to maintain control while seeking growth.

Cons:

- Equity Dilution: One of the significant drawbacks of accepting investment from early-stage investors is equity dilution. Startups may need to relinquish a substantial share of ownership in exchange for funding, which can impact long-term control and profitability.

- Potential for Conflict: Differences in vision between entrepreneurs and financiers can lead to conflicts regarding the direction of the business. Such disagreements can hinder progress and create tension within the partnership. Insights from community-driven platforms like fff. Club emphasize the significance of aligning funders and entrepreneurs to address these challenges and promote collaborative relationships.

- Limited Resources: While early-stage backers provide essential funding and guidance, to define angel investor, it is important to note that they may lack the extensive networks and resources that venture capitalists usually offer. This limitation can restrict growth opportunities and market entry for new ventures.

The current state of the funding market for emerging companies, which reached $400 billion in total funding across all stages in 2023, emphasizes the evolving dynamics of private investing. This substantial funding illustrates the broader environment in which private backers operate, showcasing the increasing opportunities available. As Jenny Tooth, Executive Chair of the UK Business Angels Association, observes, “There’s a lot more co-investing happening in the earlier-stage companies between the US and UK.” This trend is especially clear in the AI sector, suggesting a strengthening of the funding ecosystem that benefits both funders and emerging enterprises alike.

Furthermore, engaging with angel investors often requires navigating complex legal frameworks, making services like those offered by LegalVision—providing membership for unlimited access to experienced lawyers for legal assistance—crucial for startups to ensure they are well-supported in their investment journeys and can effectively navigate the legal landscape.

Conclusion

Angel investors play an indispensable role in the startup ecosystem, providing not only essential funding but also mentorship and strategic guidance that can significantly influence a company's trajectory. Understanding the unique characteristics that differentiate angel investors from venture capitalists is crucial for entrepreneurs seeking the right financial partners. While angel investors offer flexibility and personalized support, they also require careful consideration of the potential drawbacks, such as equity dilution and the possibility of conflicts over business direction.

The process of securing angel investment involves several key steps:

- Identifying potential investors

- Crafting compelling pitches

- Negotiating favorable terms

Entrepreneurs must navigate this landscape with a clear understanding of their needs and the specific dynamics of angel investing. Engaging with networks, such as the fff.club, can enhance opportunities for collaboration and provide invaluable resources that support startups through various stages of development.

As the investment landscape continues to evolve, the growing diversity among angel investors presents new opportunities for startups. With the surge in funding and the increasing focus on community-driven investment approaches, now is a pivotal moment for entrepreneurs to leverage the expertise and resources provided by angel investors. By fostering strong relationships and aligning visions, startups can position themselves for success, ultimately contributing to a vibrant and thriving entrepreneurial ecosystem.